Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Course: Financial derivatives Those are two questions whose answers are based on the data below. 400-500 words required Thanks!:-) let me know if need additional

Course: Financial derivatives

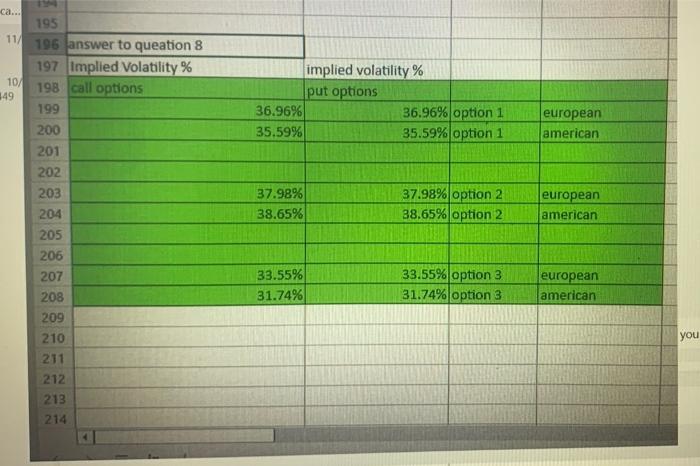

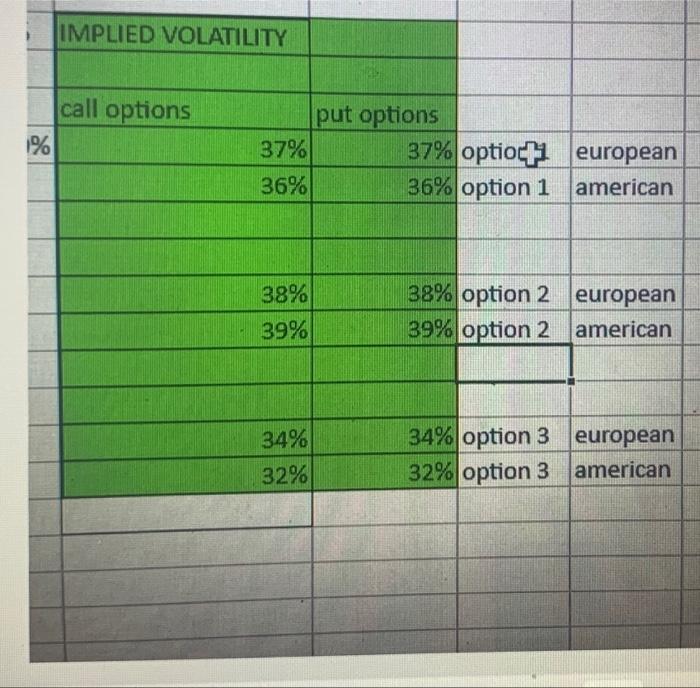

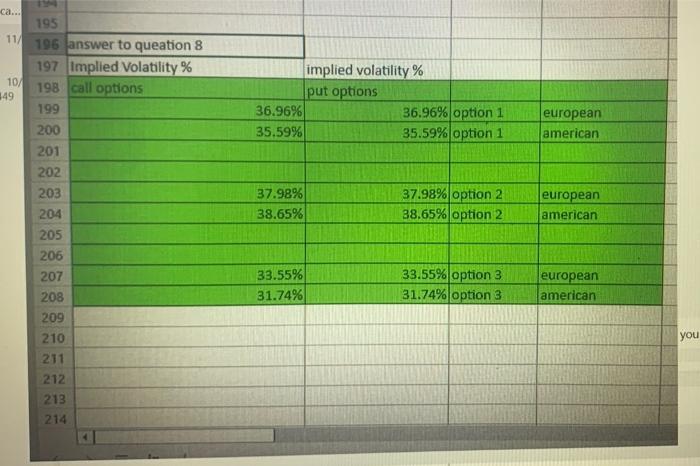

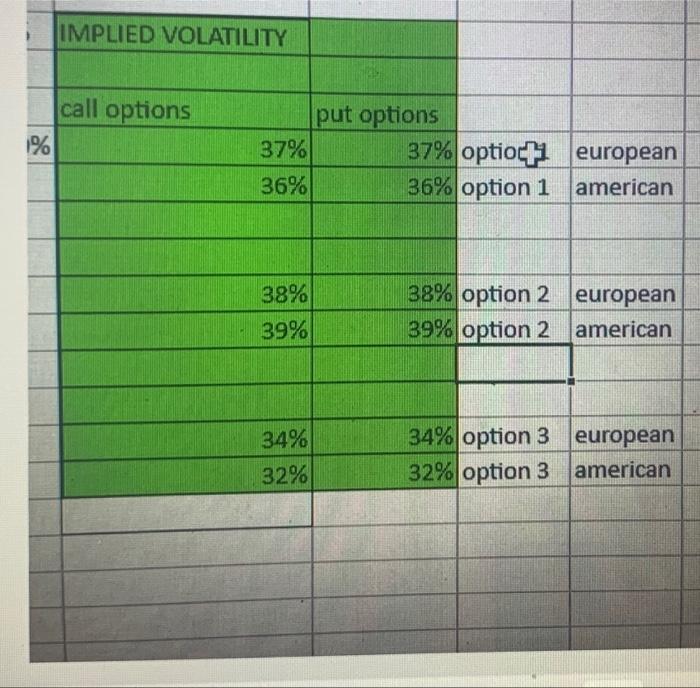

9. Discussion of the plot of implied volatility against moneyness or exercise price X. (10) 10. Compare implied vol with each other and with VXO or VXN - interpret differences (10) implied volatility % put options 36.9696 36.96% option 1 35.59% 35.59% option 1 european american ca... 195 11/ 196 answer to queation 8 197 Implied Volatility % 10/ 198 call options 349 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 37.98% 38.65% 37.98% option 2 38.65% option 2 european american 33.55% 31.74% 33.55% option 3 31.74% option 3 european american you IMPLIED VOLATILITY call options % put options 37% 37% optiocf european 36% 36% option 1 american 38% 39% 38% option 2 european 39% option 2 american 34% 32% 34% option 3 european 32% option 3 american 9. Discussion of the plot of implied volatility against moneyness or exercise price X. (10) 10. Compare implied vol with each other and with VXO or VXN - interpret differences (10) implied volatility % put options 36.9696 36.96% option 1 35.59% 35.59% option 1 european american ca... 195 11/ 196 answer to queation 8 197 Implied Volatility % 10/ 198 call options 349 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 37.98% 38.65% 37.98% option 2 38.65% option 2 european american 33.55% 31.74% 33.55% option 3 31.74% option 3 european american you IMPLIED VOLATILITY call options % put options 37% 37% optiocf european 36% 36% option 1 american 38% 39% 38% option 2 european 39% option 2 american 34% 32% 34% option 3 european 32% option 3 american Those are two questions whose answers are based on the data below. 400-500 words required

Thanks!:-)

let me know if need additional information

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started