Question

course: financial management & Application I need urgent plz due to 1 hour because there time limit Q.No. 3 Instruction: Use the table below to

course: financial management & Application

I need urgent plz due to 1 hour because there time limit

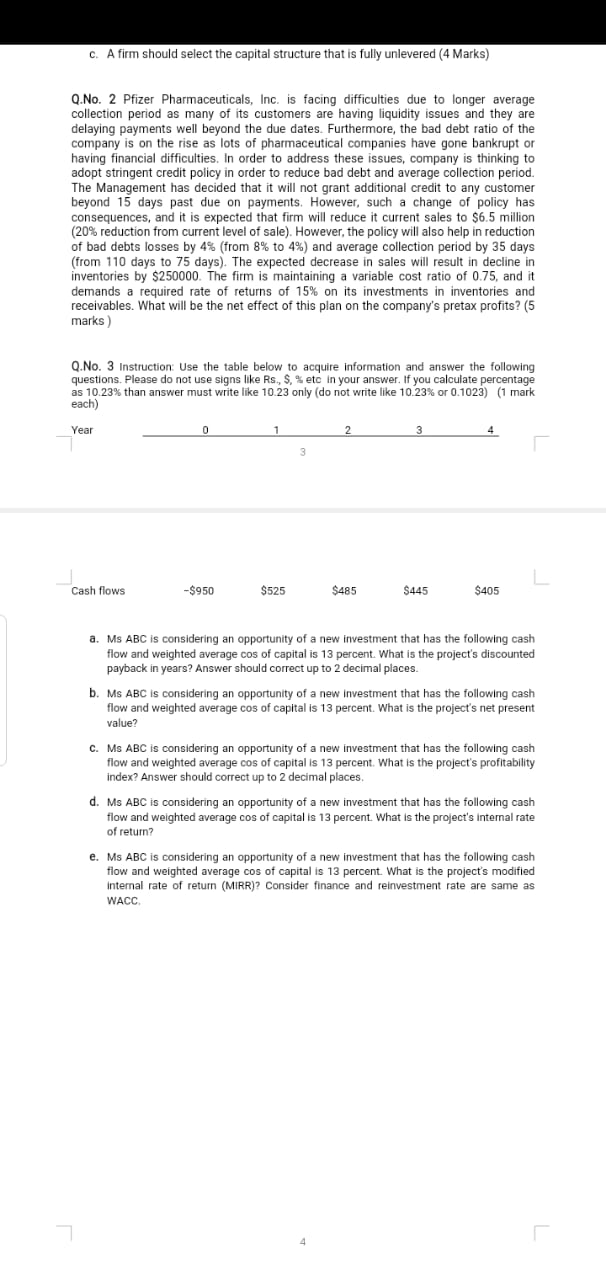

Q.No. 3 Instruction: Use the table below to acquire information and answer the following questions. Please do not use signs like Rs., $, % etc in your answer. If you calculate percentage as 10.23% than answer must write like 10.23 only (do not write like 10.23% or 0.1023) (1 mark each)

| Year | 0 | 1 | 2 | 3 | 4 |

| Cash flows | $950 | $525 | $485 | $445 | $405 |

- Ms ABC is considering an opportunity of a new investment that has the following cash flow and weighted average cos of capital is 13 percent. What is the project's discounted payback in years? Answer should correct up to 2 decimal places.

- Ms ABC is considering an opportunity of a new investment that has the following cash flow and weighted average cos of capital is 13 percent. What is the project's net present value?

- Ms ABC is considering an opportunity of a new investment that has the following cash flow and weighted average cos of capital is 13 percent. What is the project's profitability index? Answer should correct up to 2 decimal places.

- Ms ABC is considering an opportunity of a new investment that has the following cash flow and weighted average cos of capital is 13 percent. What is the project's internal rate of return?

- Ms ABC is considering an opportunity of a new investment that has the following cash flow and weighted average cos of capital is 13 percent. What is the project's modified internal rate of return (MIRR)? Consider finance and reinvestment rate are same as WACC.

Q.No. 2 Pfizer Pharmaceuticals, Inc. is facing difficulties due to longer average collection period as many of its customers are having liquidity issues and they are delaying payments well beyond the due dates. Furthermore, the bad debt ratio of the company is on the rise as lots of pharmaceutical companies have gone bankrupt or having financial difficulties. In order to address these issues, company is thinking to adopt stringent credit policy in order to reduce bad debt and average collection period. The Management has decided that it will not grant additional credit to any customer beyond 15 days past due on payments. However, such a change of policy has consequences, and it is expected that firm will reduce it current sales to $6.5 million (20% reduction from current level of sale). However, the policy will also help in reduction of bad debts losses by 4% (from 8% to 4%) and average collection period by 35 days (from 110 days to 75 days). The expected decrease in sales will result in decline in inventories by $250000. The firm is maintaining a variable cost ratio of 0.75, and it demands a required rate of returns of 15% on its investments in inventories and receivables. What will be the net effect of this plan on the companys pretax profits? (5 marks )

sir this is information infile plz doASAPANSWER i havent much time

C. A firm should select the capital structure that is fully unlevered (4 Marks) Q.No. 2 Pfizer Pharmaceuticals, Inc. is facing difficulties due to longer average collection period as many of its customers are having liquidity issues and they are delaying payments well beyond the due dates. Furthermore, the bad debt ratio of the company is on the rise as lots of pharmaceutical companies have gone bankrupt or having financial difficulties. In order to address these issues, company is thinking to adopt stringent credit policy in order to reduce bad debt and average collection period. The Management has decided that it will not grant additional credit to any customer beyond 15 days past due on payments. However, such a change of policy has consequences, and it is expected that firm will reduce it current sales to $6.5 million (20% reduction from current level of sale). However, the policy will also help in reduction of bad debts losses by 4% (from 8% to 4%) and average collection period by 35 days (from 110 days to 75 days). The expected decrease in sales will result in decline in inventories by $250000. The firm is maintaining a variable cost ratio of 0.75, and it demands a required rate of returns of 15% on its investments in inventories and receivables. What will be the net effect of this plan on the company's pretax profits? (5 marks Q.No. 3 Instruction: Use the table below to acquire information and answer the following questions. Please do not use signs like Rs., S. % etc in your answer. If you calculate percentage as 10.23% than answer must write like 10.23 only do not write like 10.23% or 0.1023) (1 mark each) Year 0 1 3 Cash flows -$950 $525 $485 $445 $405 a. Ms ABC is considering an opportunity of a new investment that has the following cash flow and weighted average cos of capital is 13 percent. What is the project's discounted payback in years? Answer should correct up to 2 decimal places. b. Ms ABC is considering an opportunity of a new Investment that has the following cash flow and weighted average cos of capital is 13 percent. What is the project's net present value? C. Ms ABC is considering an opportunity of a new investment that has the following cash flow and weighted average cos of capital is 13 percent. What is the project's profitability index? Answer should correct up to 2 decimal places d. Ms ABC is considering an opportunity of a new investment that has the following cash flow and weighted average cos of capital is 13 percent. What is the project's internal rate of return? e. Ms ABC is considering an opportunity of a new investment that has the following cash flow and weighted average cos of capital is 13 percent. What is the project's modified Internal rate of return (MIRR)? Consider finance and reinvestment rate are same as WACC C. A firm should select the capital structure that is fully unlevered (4 Marks) Q.No. 2 Pfizer Pharmaceuticals, Inc. is facing difficulties due to longer average collection period as many of its customers are having liquidity issues and they are delaying payments well beyond the due dates. Furthermore, the bad debt ratio of the company is on the rise as lots of pharmaceutical companies have gone bankrupt or having financial difficulties. In order to address these issues, company is thinking to adopt stringent credit policy in order to reduce bad debt and average collection period. The Management has decided that it will not grant additional credit to any customer beyond 15 days past due on payments. However, such a change of policy has consequences, and it is expected that firm will reduce it current sales to $6.5 million (20% reduction from current level of sale). However, the policy will also help in reduction of bad debts losses by 4% (from 8% to 4%) and average collection period by 35 days (from 110 days to 75 days). The expected decrease in sales will result in decline in inventories by $250000. The firm is maintaining a variable cost ratio of 0.75, and it demands a required rate of returns of 15% on its investments in inventories and receivables. What will be the net effect of this plan on the company's pretax profits? (5 marks Q.No. 3 Instruction: Use the table below to acquire information and answer the following questions. Please do not use signs like Rs., S. % etc in your answer. If you calculate percentage as 10.23% than answer must write like 10.23 only do not write like 10.23% or 0.1023) (1 mark each) Year 0 1 3 Cash flows -$950 $525 $485 $445 $405 a. Ms ABC is considering an opportunity of a new investment that has the following cash flow and weighted average cos of capital is 13 percent. What is the project's discounted payback in years? Answer should correct up to 2 decimal places. b. Ms ABC is considering an opportunity of a new Investment that has the following cash flow and weighted average cos of capital is 13 percent. What is the project's net present value? C. Ms ABC is considering an opportunity of a new investment that has the following cash flow and weighted average cos of capital is 13 percent. What is the project's profitability index? Answer should correct up to 2 decimal places d. Ms ABC is considering an opportunity of a new investment that has the following cash flow and weighted average cos of capital is 13 percent. What is the project's internal rate of return? e. Ms ABC is considering an opportunity of a new investment that has the following cash flow and weighted average cos of capital is 13 percent. What is the project's modified Internal rate of return (MIRR)? Consider finance and reinvestment rate are same as WACC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started