Answered step by step

Verified Expert Solution

Question

1 Approved Answer

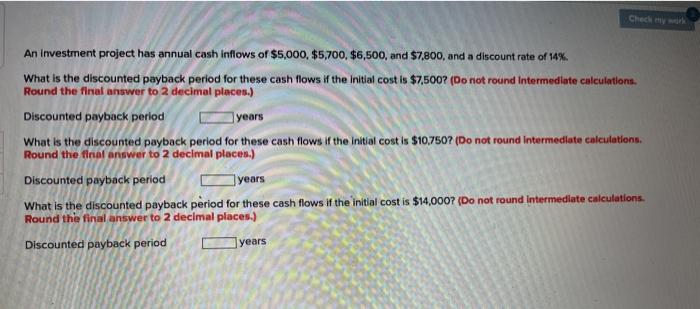

course : financial mangement hmm Check my work years An Investment project has annual cash inflows of $5,000 $5,700, $6,500, and $7,800, and a discount

course : financial mangement

hmm

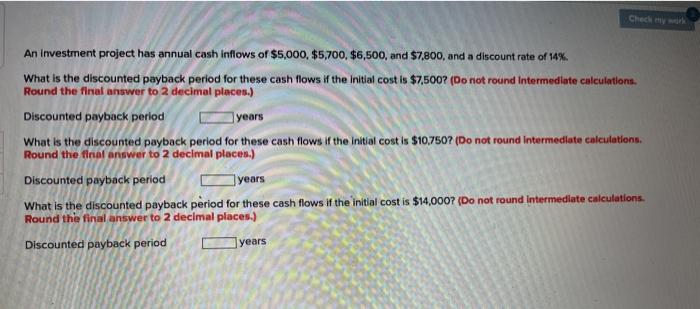

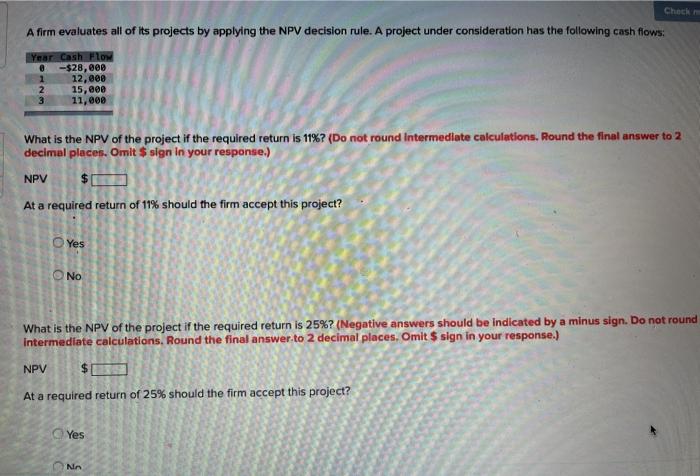

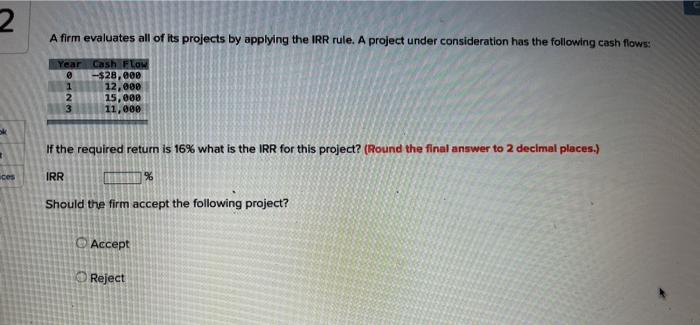

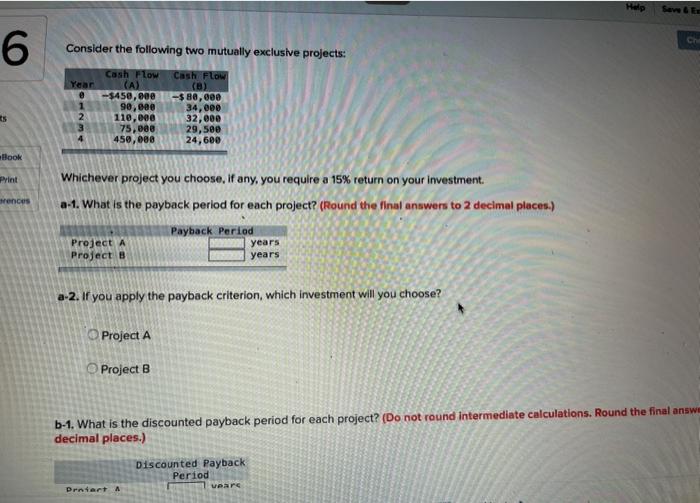

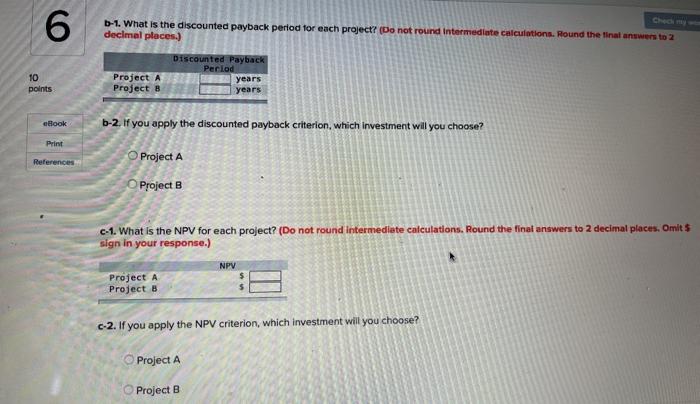

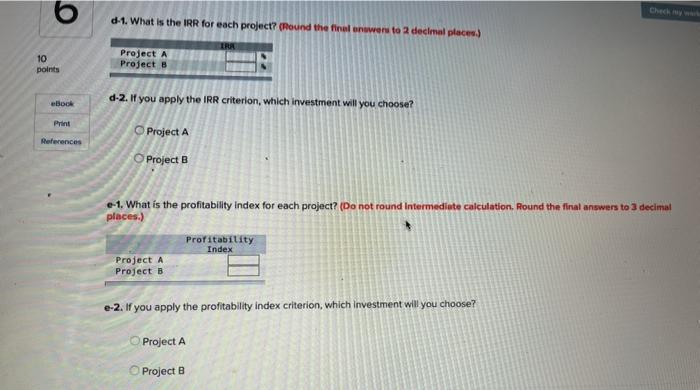

Check my work years An Investment project has annual cash inflows of $5,000 $5,700, $6,500, and $7,800, and a discount rate of 14%. What is the discounted payback period for these cash flows if the initial cost is $7,500? (Do not round Intermediate calculations. Round the final answer to 2 decimal places.) Discounted payback period What is the discounted payback period for these cash flows if the initial cost is $10,750? (Do not round Intermediate calculations. Round the final answer to 2 decimal places.) Discounted payback period years What is the discounted payback period for these cash flows if the initial cost is $14,000? (Do not round Intermediate calculations Round the final answer to 2 decimal places.) Discounted payback period years Cheche A firm evaluates all of its projects by applying the NPV decision rule. A project under consideration has the following cash flows: Year Cash Flow @ -$28,000 1 12,000 2 15,000 11,000 What is the NPV of the project if the required return is 11%? (Do not round Intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) NPV At a required return of 11% should the firm accept this project? Yes No What is the NPV of the project if the required return is 25%? (Negative answers should be indicated by a minus sign. Do not round Intermediate calculations. Round the final answer to 2 decimal places, Omit S sign in your response.) NPV At a required return of 25% should the firm accept this project? Yes NA 2 A firm evaluates all of its projects by applying the IRR rule. A project under consideration has the following cash flows: Year WNE Cash Flow -$28.000 12,000 15,000 11,000 If the required return is 16% what is the IRR for this project? (Round the final answer to 2 decimal places.) 3 ces IRR % Should the firm accept the following project? Accept Reject 6 Consider the following two mutually exclusive projects: Year @ Cash Flow (A) - $450,000 90,000 110,000 75,000 450,000 Cash Flow (B) -$80,000 34,000 32,000 29,500 24,600 Book Print Whichever project you choose, if any, you require a 15% return on your investment a-1. What is the payback period for each project? (Round the final answers to 2 decimal places.) Mences Project Project B Payback Period years years a-2. If you apply the payback criterion, which investment will you choose? Project A Project B b-1. What is the discounted payback period for each project? (Do not round intermediate calculations. Round the final answm decimal places.) Discounted Payback Period vears Drniert 6 b-1. What is the discounted payback period for each project? (Do not round Intermediate calculations. Round the final answers to 2 decimal places.) Discounted Payback Period Project A Project B 10 points years years etlook b-2. If you apply the discounted payback criterion, which investment will you choose? Print Project A References Project B c-1. What is the NPV for each sign in your response.) ect? (Do not round Intermediate calculations. Round the final answers to 2 decimal places. Omits NPV Project A Project B c-2. If you apply the NPV criterion, which investment will you choose? Project A Project B -1. What is the IRR for each project? (Round the finalenwers to 2 decimal places) 10 points Project A Project d-2. If you apply the IRR criterion, which investment will you choose? Bock Project A References Project B e-1. What is the profitability Index for each project? (Do not round Intermediate calculation. Round the final answers to decimal places.) Profitability Index Project A Project B e-2. If you apply the profitability index criterion, which investment will you choose? Project A Project B Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started