Answered step by step

Verified Expert Solution

Question

1 Approved Answer

course is corporate finance.. both steps should be solved in detail with formula Cash Management at SR Corporation SR Corporation was found 5 years ago.

course is corporate finance..

both steps should be solved in detail with formula

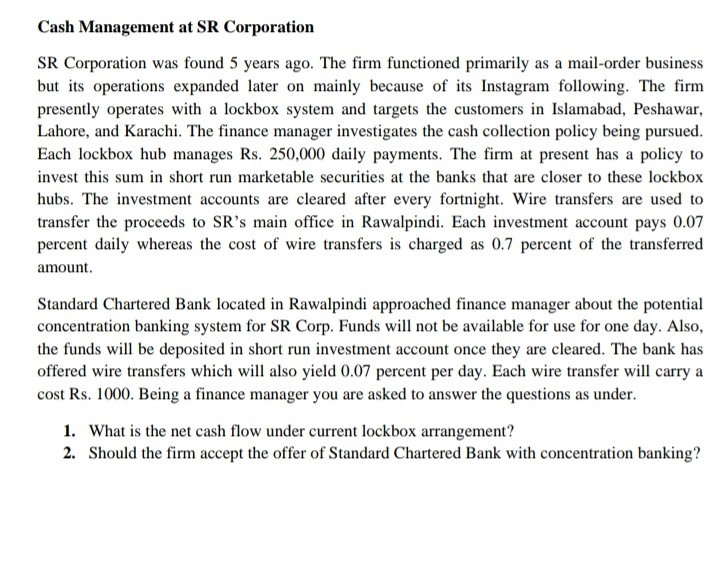

Cash Management at SR Corporation SR Corporation was found 5 years ago. The firm functioned primarily as a mail-order business but its operations expanded later on mainly because of its Instagram following. The firm presently operates with a lockbox system and targets the customers in Islamabad, Peshawar, Lahore, and Karachi. The finance manager investigates the cash collection policy being pursued. Each lockbox hub manages Rs. 250,000 daily payments. The firm at present has a policy to invest this sum in short run marketable securities at the banks that are closer to these lockbox hubs. The investment accounts are cleared after every fortnight. Wire transfers are used to transfer the proceeds to SR's main office in Rawalpindi. Each investment account pays 0.07 percent daily whereas the cost of wire transfers is charged as 0.7 percent of the transferred amount. Standard Chartered Bank located in Rawalpindi approached finance manager about the potential concentration banking system for SR Corp. Funds will not be available for use for one day. Also, the funds will be deposited in short run investment account once they are cleared. The bank has offered wire transfers which will also yield 0.07 percent per day. Each wire transfer will carry a cost Rs. 1000. Being a finance manager you are asked to answer the questions as under. 1. What is the net cash flow under current lockbox arrangement? 2. Should the firm accept the offer of Standard Chartered Bank with concentration bankingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started