Course Number and Title: FI300-61 FINANCE

From Book: Ross Westerfield Jordan Essentials of Corporart Financials Eleventh Edition

Assignment #1

Please upload your answers to the Blackboard. More detailed answers could increase your chances to earn better grades. Assignment #1 is 50 points out of your total 1,000 points grade.

Good luck!

[Chapter 1]

1. Explain how agency problems interfere with a managers ability to achieve the primary goal of financial management.

2. Explain what types of issues are related to the capital structure of a firm.

3. Describe the primary advantages and disadvantages of each of the following types of business organizations: sole proprietorship, partnership, and corporation.

[Chapter 2]

4. How is liquidity both beneficial and harmful to a firm?

5. What does the term financial leverage mean, and is it beneficial or harmful to a firms stockholders?

6. Explain the difference between accounting value and market value. Which is more important to the financial manager? Why?

7. Why is accounting income not the same as cash flow?

8. What is the difference between a marginal and an average tax rate?

9. What are the components of operating cash flow?

10. Why is interest paid not a component of operating cash flow?

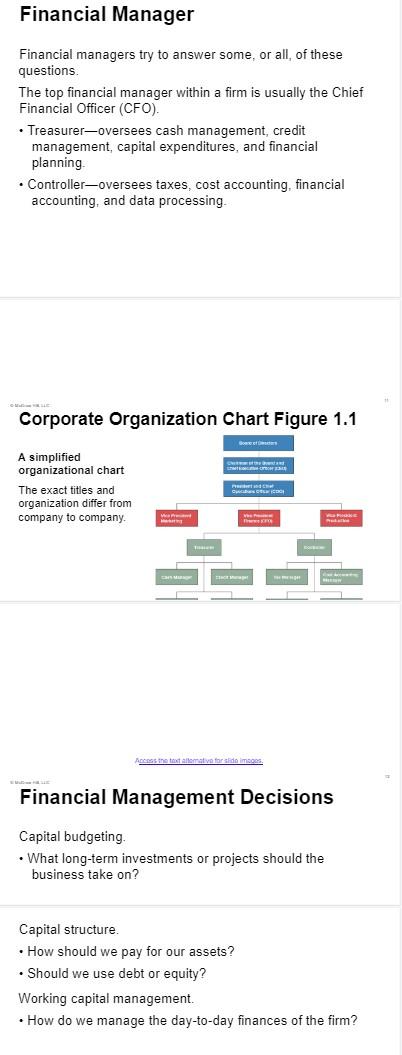

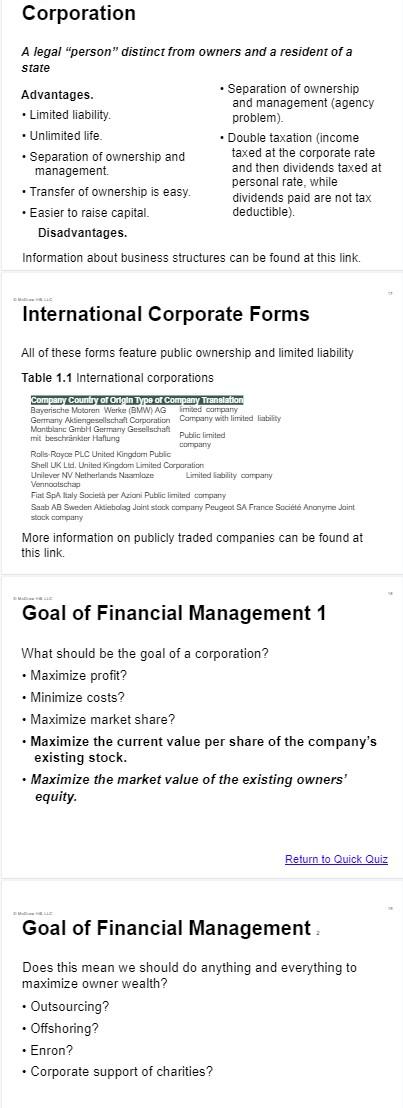

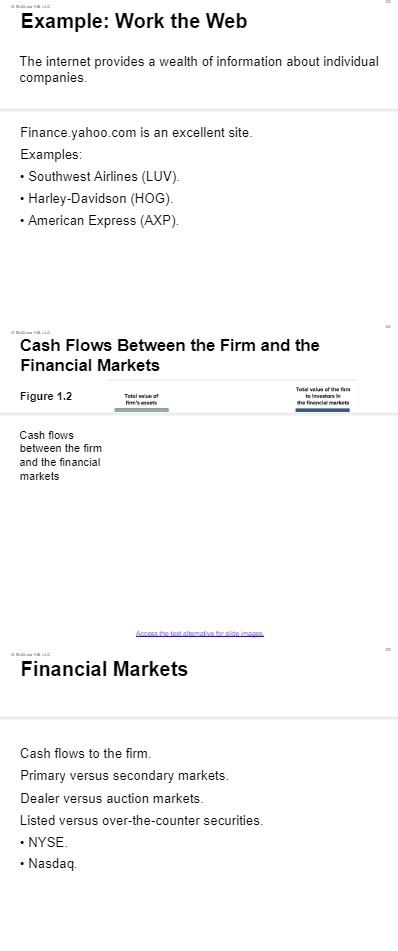

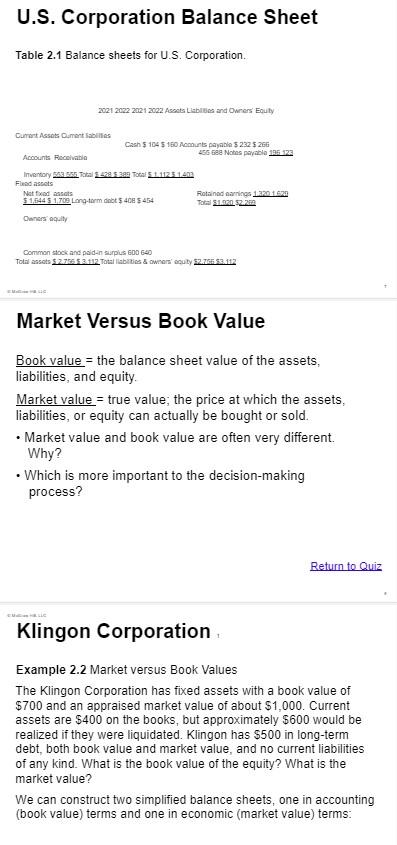

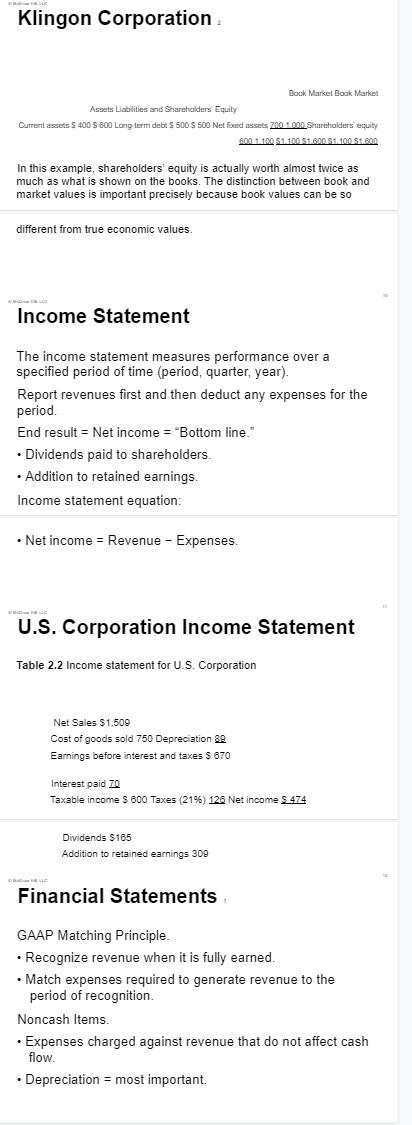

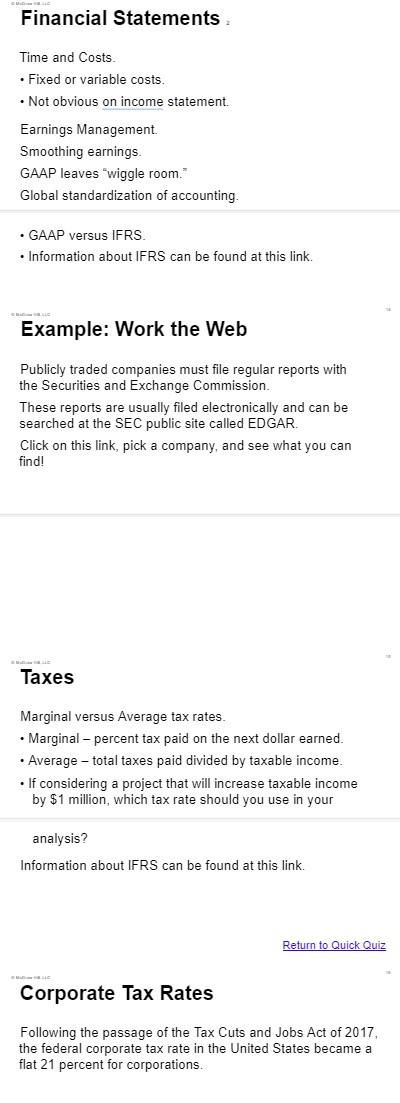

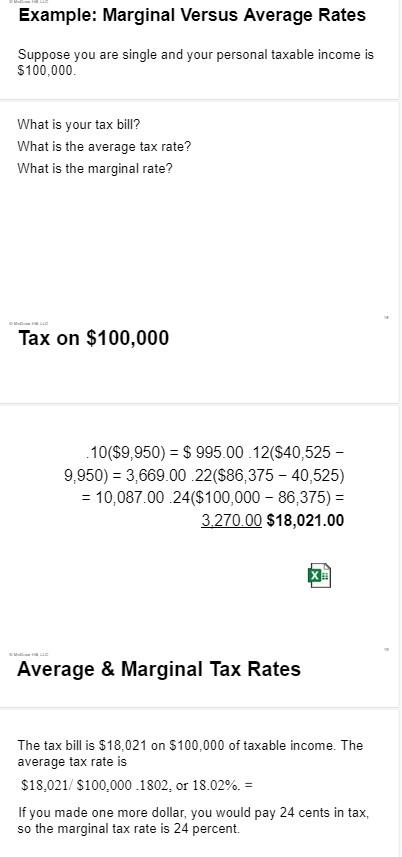

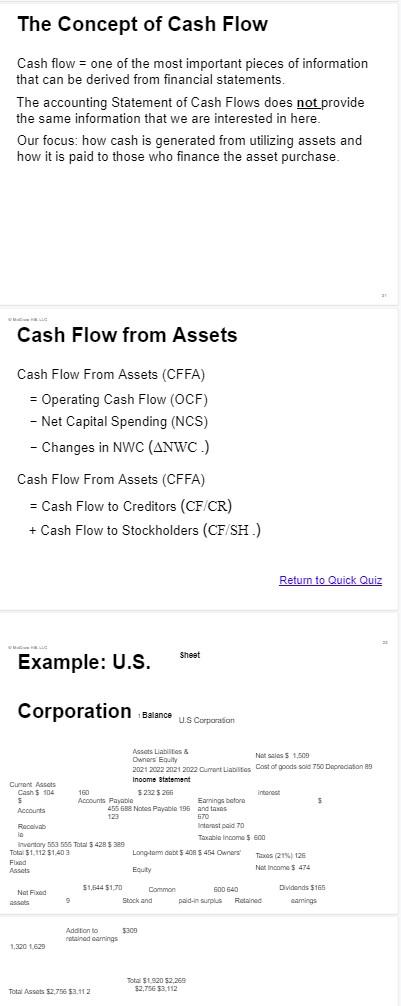

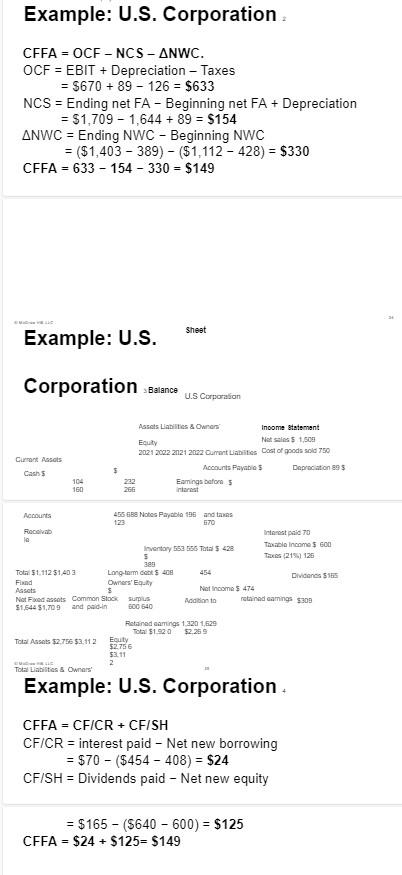

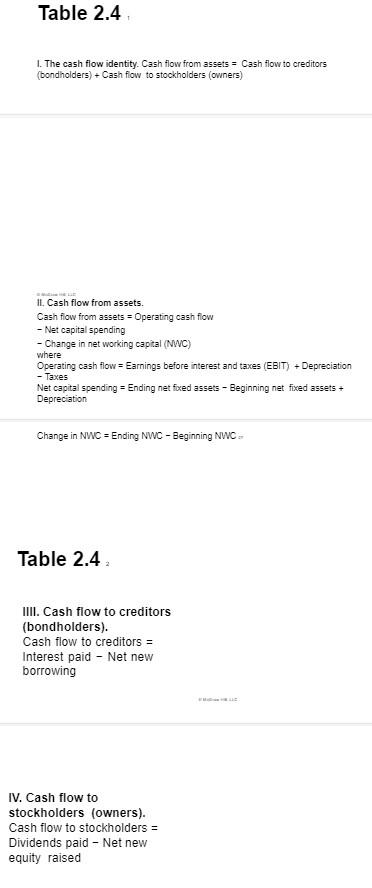

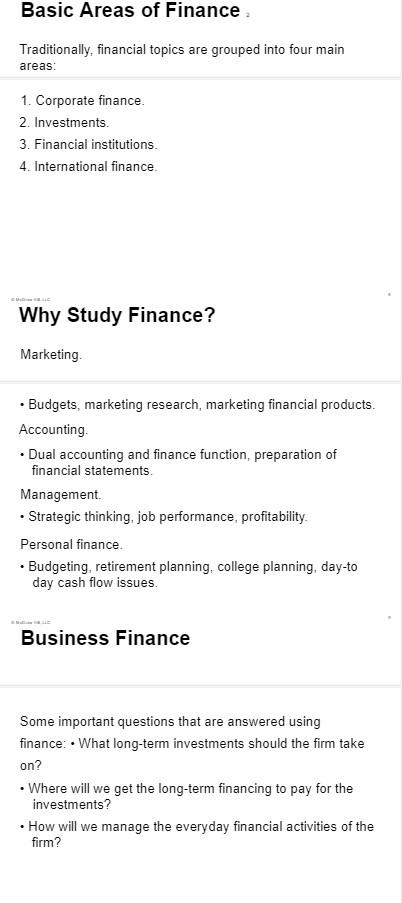

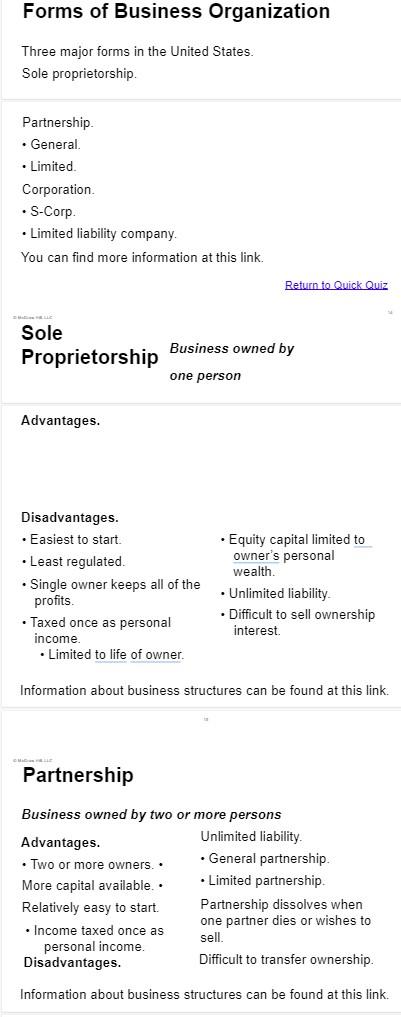

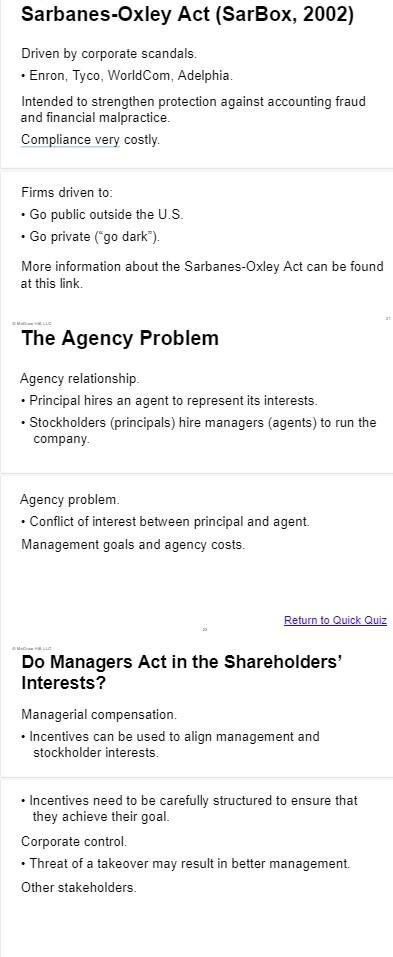

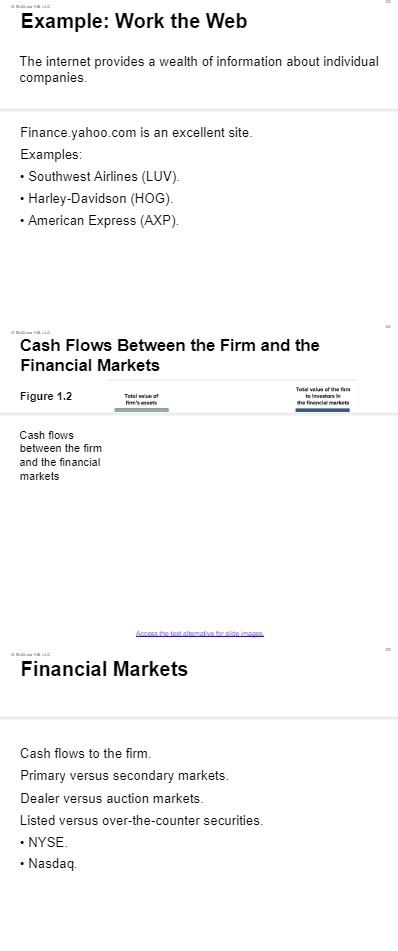

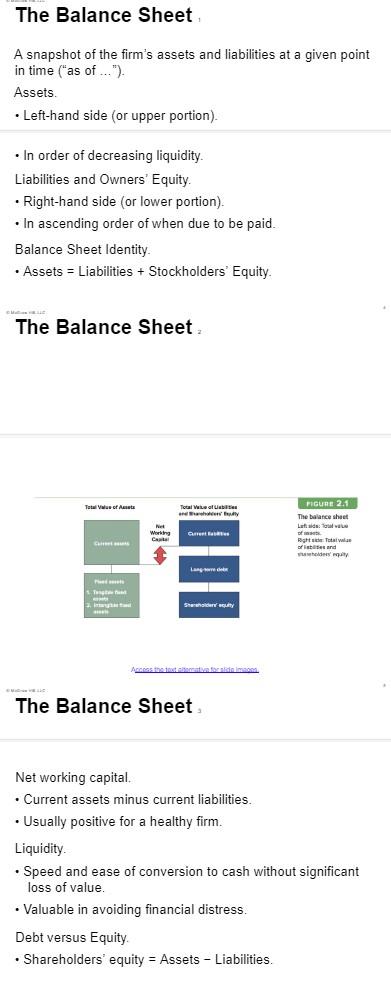

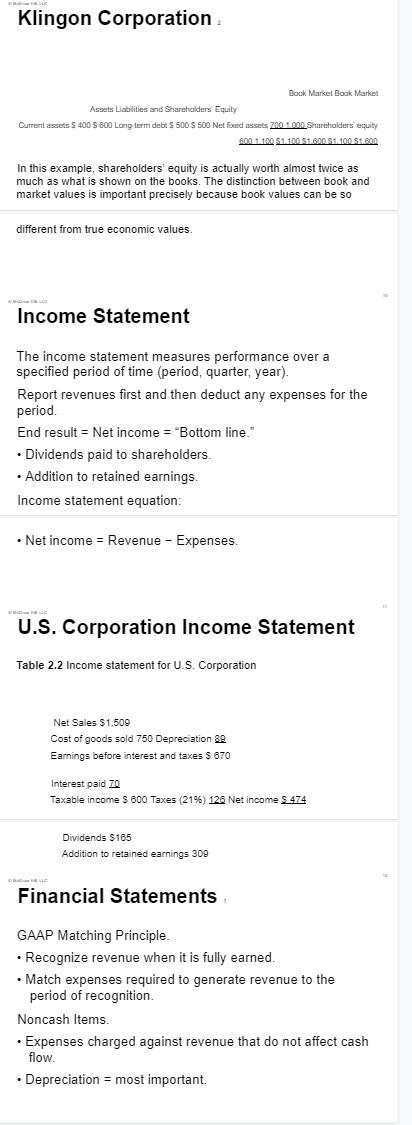

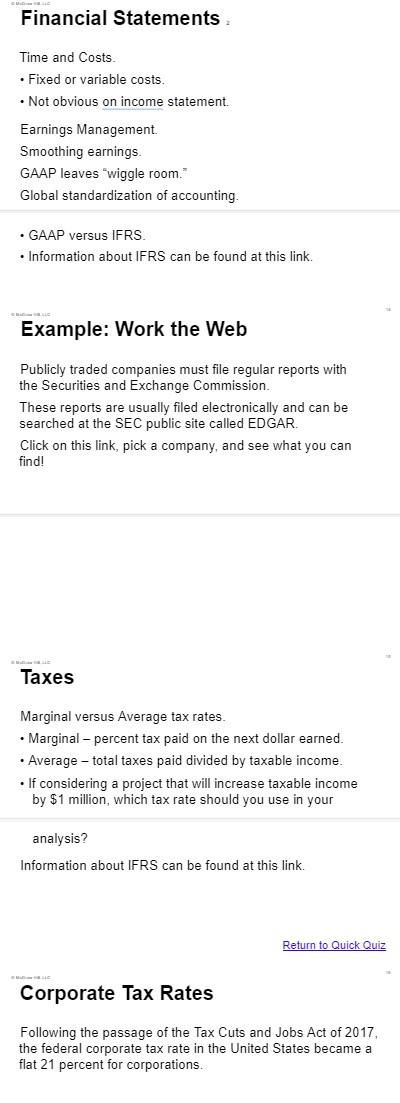

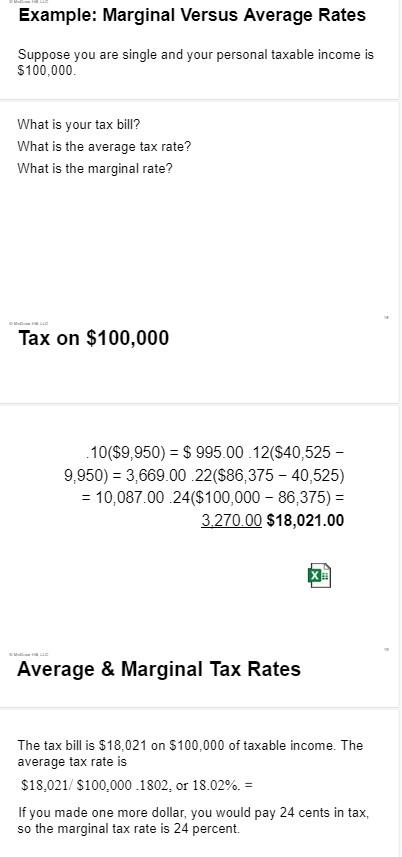

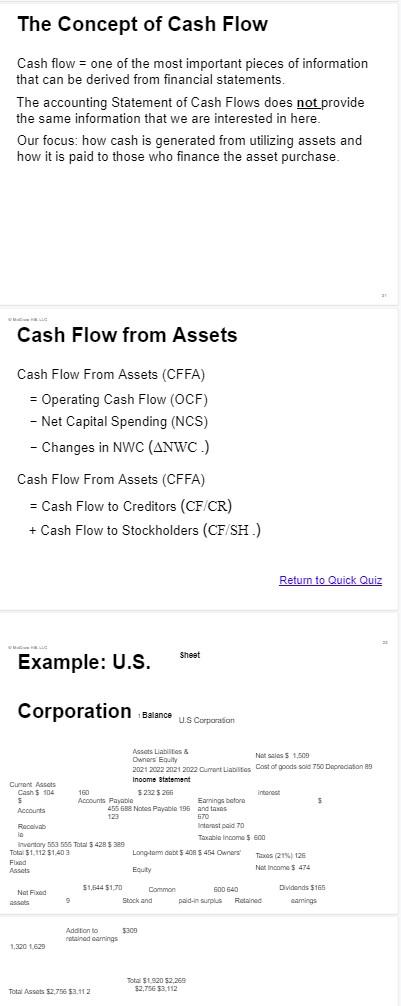

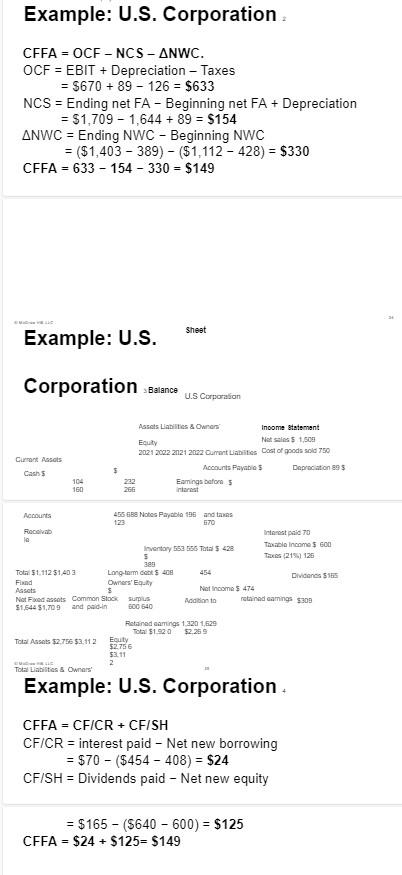

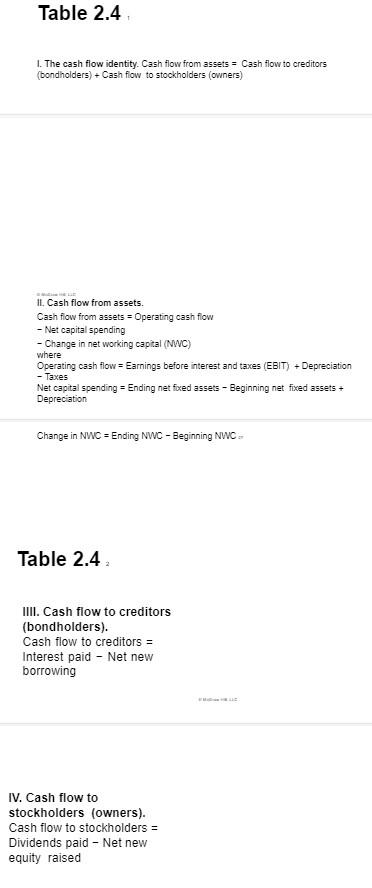

Investments Work with financial assets such as stocks and bonds. Value of financial assets, risk versus return, and asset allocation. Job opportunities. - Stockbroker or financial advisor. - Portfolio manager. - Security analyst. Financial Institutions Companies that specialize in financial matters. - Banks-commercial and investment, credit unions, savings and loans. - Insurance companies. - Brokerage firms. Job opportunities. International Finance An area of specialization within each of the areas discussed so far. May allow you to work in other countries or at least travel on a regular basis. Need to be familiar with exchange rates and political risk. Need to understand the customs of other countries; speaking a foreign language fluently is also helpful. Basic Areas of Finance Traditionally, financial topics are grouped into four main areas: 1. Corporate finance. 2. Investments. 3. Financial institutions. 4. International finance. Why Study Finance? Marketing. - Budgets, marketing research, marketing financial products. Accounting. - Dual accounting and finance function, preparation of financial statements. Management. - Strategic thinking, job performance, profitability. Personal finance. - Budgeting, retirement planning, college planning, day-to day cash flow issues. Business Finance Some important questions that are answered using finance: What long-term investments should the firm take on? - Where will we get the long-term financing to pay for the investments? - How will we manage the everyday financial activities of the firm? Financial Manager Financial managers try to answer some, or all, of these questions. The top financial manager within a firm is usually the Chief Financial Officer (CFO). - Treasurer-oversees cash management, credit management, capital expenditures, and financial planning. - Controller-oversees taxes, cost accounting, financial accounting, and data processing. Corporate Organization Chart Figure 1.1 A simplified organizational chart The exact titles and organization differ from company to company. Financial Management Decisions Capital budgeting. - What long-term investments or projects should the business take on? Capital structure. - How should we pay for our assets? - Should we use debt or equity? Working capital management. - How do we manage the day-to-day finances of the firm? Advantages. Information about business structures can be found at this link. Partnership Rucinace numbel hutwh nr mopa narenne Information about business structures can be found at this link. International Corporate Forms All of these forms feature public ownership and limited liability Table 1.1 International corporations Gerranty Aktiengesellschast Carporation Company with limited liabiityy Mantblant GmbH Grrranty Gusellschafl mit beschriniker Haftury Public limiled Rolls:Rayce PLC United Kingdem Public Shetl UK Lid. United Kirgdam Limited Corparation Urilever NV Netherlarids Naranloae Vernoatschap Fiat SpA laaly Societa per Azioni Public limited cartpany Saab AB Sweden Abdiabolag Joint stuck corrparry Peugeot SA France Socit Anonymre Jaint stack corrparry More information on publicly traded companies can be found at this link. Goal of Financial Management 1 What should be the goal of a corporation? - Maximize profit? - Minimize costs? - Maximize market share? - Maximize the current value per share of the company's existing stock. - Maximize the market value of the existing owners' equity. Goal of Financial Management : Does this mean we should do anything and everything to maximize owner wealth? - Outsourcing? - Offshoring? - Enron? - Corporate support of charities? Sarbanes-Oxley Act (SarBox, 2002) Driven by corporate scandals. - Enron, Tyco, WorldCom, Adelphia. Intended to strengthen protection against accounting fraud and financial malpractice. Compliance very costly. Firms driven to: - Go public outside the U.S. - Go private ("go dark"). More information about the Sarbanes-Oxley Act can be found at this link. The Agency Problem Agency relationship. - Principal hires an agent to represent its interests. - Stockholders (principals) hire managers (agents) to run the company. Agency problem. - Conflict of interest between principal and agent. Management goals and agency costs. Do Managers Act in the Shareholders' Interests? Managerial compensation. - Incentives can be used to align management and stockholder interests. - Incentives need to be carefully structured to ensure that they achieve their goal. Corporate control. - Threat of a takeover may result in better management. Other stakeholders. Example: Work the Web The internet provides a wealth of information about individual companies. Finance.yahoo.com is an excellent site. Examples: - Southwest Airlines (LUV). - Harley-Davidson (HOG). - American Express (AXP). Cash Flows Between the Firm and the Financial Markets Financial Markets Cash flows to the firm. Primary versus secondary markets. Dealer versus auction markets. Listed versus over-the-counter securities. - NYSE. - Nasdaq. The Balance Sheet A snapshot of the firm's assets and liabilities at a given point in time ("as of ..."). Assets. - Left-hand side (or upper portion). - In order of decreasing liquidity. Liabilities and Owners' Equity. - Right-hand side (or lower portion). - In ascending order of when due to be paid. Balance Sheet Identity. - Assets = Liabilities + Stockholders' Equity. The Balance Sheet The Balance Sheet Net working capital. - Current assets minus current liabilities. - Usually positive for a healthy firm. Liquidity. - Speed and ease of conversion to cash without significant loss of value. - Valuable in avoiding financial distress. Debt versus Equity. - Shareholders' equity = Assets Liabilities. Table 2.1 Balance sheets for U.S. Corporation. 2021202220212002 , peosts Llabilica and Owners' Equty. Common stock and paid-n eurpiss 600640 Market Versus Book Value Book value = the balance sheet value of the assets, liabilities, and equity. Market value = true value; the price at which the assets, liabilities, or equity can actually be bought or sold. - Market value and book value are often very different. Why? - Which is more important to the decision-making process? Klingon Corporation Example 2.2 Market versus Book Values The Klingon Corporation has fixed assets with a book value of $700 and an appraised market value of about $1,000. Current assets are $400 on the books, but approximately $600 would be realized if they were liquidated. Klingon has $500 in long-term debt, both book value and market value, and no current liabilities of any kind. What is the book value of the equity? What is the market value? We can construct two simplified balance sheets, one in accounting (book value) terms and one in economic (market value) terms: Book Market Doak Market Assets Liablities and Sharehalders Enuity Cument assets $400 S 600 Lang term debt S600$500 Net fixed assets 7001,000 Shareholders equity 6001.100.51.100.51.600$81.100$1.600 In this example, shareholders' equity is actually worth almost twice as much as what is shown on the books. The distinction between book and market values is important precisely because book values can be so different from true economic values. Income Statement The income statement measures performance over a specified period of time (period, quarter, year). Report revenues first and then deduct any expenses for the period. End result = Net income = "Bottom line. . - Dividends paid to shareholders. - Addition to retained earnings. Income statement equation: - Net income = Revenue Expenses. U.S. Corporation Income Statement Table 2.2 Income statement for U.S. Corporation Net Sales \$1,509 Cost of goods sold 750 Depreciation 39 Earnings before interest and taxes $670 Interest paid 70 Taxable income S 600 Taxes (21\%) 126 Net income $474 Dividends $165 Addition to retained earnings 309 Financial Statements GAAP Matching Principle. - Recognize revenue when it is fully earned. - Match expenses required to generate revenue to the period of recognition. Noncash Items. - Expenses charged against revenue that do not affect cash flow. - Depreciation = most important. Financial Statements Time and Costs. - Fixed or variable costs. - Not obvious on income statement. Earnings Management. Smoothing earnings. GAAP leaves "wiggle room." Global standardization of accounting. - GAAP versus IFRS. - Information about IFRS can be found at this link. Example: Work the Web Publicly traded companies must file regular reports with the Securities and Exchange Commission. These reports are usually filed electronically and can be searched at the SEC public site called EDGAR. Click on this link, pick a company, and see what you can find! Taxes Marginal versus Average tax rates. - Marginal - percent tax paid on the next dollar earned. - Average - total taxes paid divided by taxable income. - If considering a project that will increase taxable income by $1 million, which tax rate should you use in your analysis? Information about IFRS can be found at this link. Return to Quick Quiz Corporate Tax Rates Following the passage of the Tax Cuts and Jobs Act of 2017. the federal corporate tax rate in the United States became a flat 21 percent for corporations. Example: Marginal Versus Average Rates Suppose you are single and your personal taxable income is $100,000. What is your tax bill? What is the average tax rate? What is the marginal rate? Tax on $100,000 10($9,950)=$995.00.12($40,5259,950)=3,669.00.22($86,37540,525)=10,087.00.24($100,00086,375)=3,270.00$18,021.00 Average \& Marginal Tax Rates The tax bill is $18,021 on $100,000 of taxable income. The average tax rate is $18,021/$100,000.1802,or18.02%= If you made one more dollar, you would pay 24 cents in tax, so the marginal tax rate is 24 percent. The Concept of Cash Flow Cash flow = one of the most important pieces of information that can be derived from financial statements. The accounting Statement of Cash Flows does not provide the same information that we are interested in here. Our focus: how cash is generated from utilizing assets and how it is paid to those who finance the asset purchase. Cash Flow from Assets Cash Flow From Assets (CFFA) = Operating Cash Flow (OCF) - Net Capital Spending (NCS) - Changes in NWC ( NWC.) Cash Flow From Assets (CFFA) = Cash Flow to Creditors (CF/CR) + Cash Flow to Stockholders (CF/SH .) Example: U.S. Shest Corporation Balance U.S Corparafon. Example: U.S. Corporation CFFA = OCF - NCS NWC. OCF = EBIT + Depreciation - Taxes =$670+89126=$633 NCS=EndingnetFABeginningnetFA+Depreciation=$1,7091,644+89=$154NWC=EndingNWCBeginningNWC=($1,403389)($1,112428)=$330CFFA=633154330=$149 Example: U.S. Corporation sasance Sheet Example: U.S. Corporation . CFFA=CF/CR+CF/SH CF/CR= interest paid Net new borrowing =$70($454408)=$24 CF/SH= Dividends paid Net new equity =CFFA$165($640600)=$125=$24+$125=$149 1. The cash flow identity. Cash flow from assets = Cash flow to creditors (bondholders) + Cash flow to stockholders (owners) II. Cash flow from assets. Cash flow from assets = Operating cash flow - Net capital spending - Change in net working capital (NWC) where Operating cash flow = Earnings before interest and taxes (EBIT) + Depreciation - Taxes Net capital spending = Ending net fuxed assets - Beginning net fixed assets + Depreciation Change in NWC = Ending NWC - Beginning NWC :r Table 2.4 IIII. Cash flow to creditors (bondholders). Cash flow to creditors = Interest paid - Net new borrowing IV. Cash flow to stockholders (owners). Cash flow to stockholders = Dividends paid - Net new equity raised