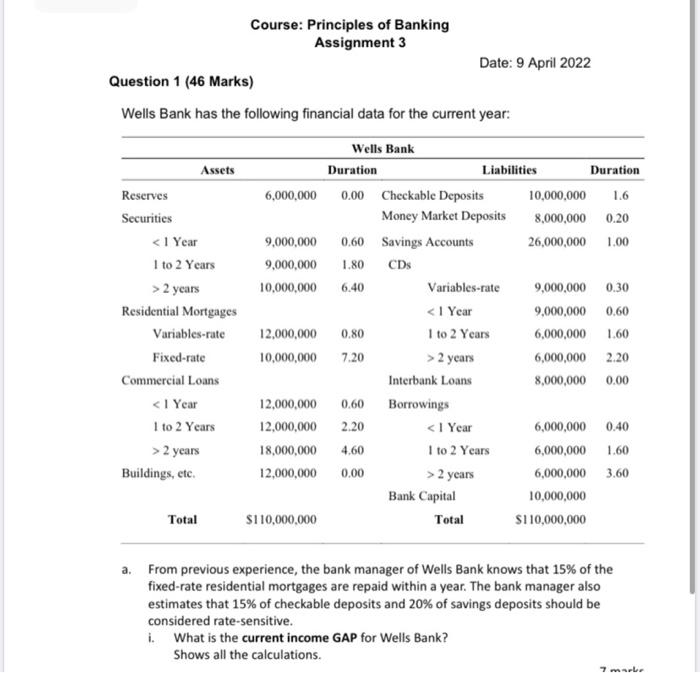

Course: Principles of Banking Assignment 3 Question 1 (46 Marks) Wells Bank has the following financial data for the current year: Wells Bank Assets Duration Liabilities Reserves 6,000,000 0.00 Checkable Deposits Securities 2 years 10,000,000 6.40 Residential Mortgages Variables-rate 12,000,000 0.80 Fixed-rate 10,000,000 7.20 Commercial Loans 2 years 18,000,000 4.60 Buildings, etc. 12,000,000 0.00 Bank Capital Total $110,000,000 Total $110,000,000 a. From previous experience, the bank manager of Wells Bank knows that 15% of the fixed-rate residential mortgages are repaid within a year. The bank manager also estimates that 15% of checkable deposits and 20% of savings deposits should be considered rate-sensitive. i. What is the current income GAP for Wells Bank? Shows all the calculations. 7 marke Date: 9 April 2022 Money Market Deposits Variables-rate 2 years Interbank Loans Borrowings 2 years Duration 1.6 10,000,000 8,000,000 0.20 26,000,000 1.00 9,000,000 0.30 9,000,000 0.60 6,000,000 1.60 6,000,000 2.20 8,000,000 0.00 6,000,000 0.40 6,000,000 1.60 6,000,000 3.60 10,000,000 Course: Principles of Banking Assignment 3 Question 1 (46 Marks) Wells Bank has the following financial data for the current year: Wells Bank Assets Duration Liabilities Reserves 6,000,000 0.00 Checkable Deposits Securities 2 years 10,000,000 6.40 Residential Mortgages Variables-rate 12,000,000 0.80 Fixed-rate 10,000,000 7.20 Commercial Loans 2 years 18,000,000 4.60 Buildings, etc. 12,000,000 0.00 Bank Capital Total $110,000,000 Total $110,000,000 a. From previous experience, the bank manager of Wells Bank knows that 15% of the fixed-rate residential mortgages are repaid within a year. The bank manager also estimates that 15% of checkable deposits and 20% of savings deposits should be considered rate-sensitive. i. What is the current income GAP for Wells Bank? Shows all the calculations. 7 marke Date: 9 April 2022 Money Market Deposits Variables-rate 2 years Interbank Loans Borrowings 2 years Duration 1.6 10,000,000 8,000,000 0.20 26,000,000 1.00 9,000,000 0.30 9,000,000 0.60 6,000,000 1.60 6,000,000 2.20 8,000,000 0.00 6,000,000 0.40 6,000,000 1.60 6,000,000 3.60 10,000,000