Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Coursework 1 You work as an economist in a big US MNC that has global operations in Australia, Brazil, Europe, UK, Japan and South Africa.

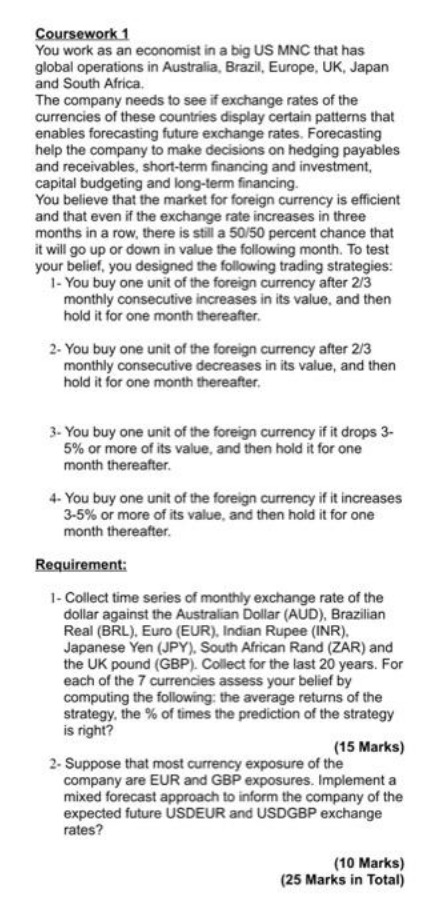

Coursework 1 You work as an economist in a big US MNC that has global operations in Australia, Brazil, Europe, UK, Japan and South Africa. The company needs to see if exchange rates of the currencies of these countries display certain patterns that enables forecasting future exchange rates. Forecasting help the company to make decisions on hedging payables and receivables, short-term financing and investment, capital budgeting and long-term financing. You believe that the market for foreign currency is efficient and that even if the exchange rate increases in three months in a row, there is still a 50/50 percent chance that it will go up or down in value the following month. To test your belief, you designed the following trading strategies: 1- You buy one unit of the foreign currency after 2/3 monthly consecutive increases in its value, and then hold it for one month thereafter. 2- You buy one unit of the foreign currency after 2/3 monthly consecutive decreases in its value, and then hold it for one month thereafter. 3. You buy one unit of the foreign currency if it drops 3 . 5% or more of its value, and then hold it for one month thereafter. 4- You buy one unit of the foreign currency if it increases 35% or more of its value, and then hold it for one month thereafter. Requirement: 1- Collect time series of monthly exchange rate of the dollar against the Australian Dollar (AUD), Brazilian Real (BRL), Euro (EUR), Indian Rupee (INR), Japanese Yen (JPY), South African Rand (ZAR) and the UK pound (GBP). Collect for the last 20 years. For each of the 7 currencies assess your belief by computing the following: the average returns of the strategy, the % of times the prediction of the strategy is right? (15 Marks) 2- Suppose that most currency exposure of the company are EUR and GBP exposures. Implement a mixed forecast approach to inform the company of the expected future USDEUR and USDGBP exchange rates? (10 Marks) (25 Marks in Total)

Coursework 1 You work as an economist in a big US MNC that has global operations in Australia, Brazil, Europe, UK, Japan and South Africa. The company needs to see if exchange rates of the currencies of these countries display certain patterns that enables forecasting future exchange rates. Forecasting help the company to make decisions on hedging payables and receivables, short-term financing and investment, capital budgeting and long-term financing. You believe that the market for foreign currency is efficient and that even if the exchange rate increases in three months in a row, there is still a 50/50 percent chance that it will go up or down in value the following month. To test your belief, you designed the following trading strategies: 1- You buy one unit of the foreign currency after 2/3 monthly consecutive increases in its value, and then hold it for one month thereafter. 2- You buy one unit of the foreign currency after 2/3 monthly consecutive decreases in its value, and then hold it for one month thereafter. 3. You buy one unit of the foreign currency if it drops 3 . 5% or more of its value, and then hold it for one month thereafter. 4- You buy one unit of the foreign currency if it increases 35% or more of its value, and then hold it for one month thereafter. Requirement: 1- Collect time series of monthly exchange rate of the dollar against the Australian Dollar (AUD), Brazilian Real (BRL), Euro (EUR), Indian Rupee (INR), Japanese Yen (JPY), South African Rand (ZAR) and the UK pound (GBP). Collect for the last 20 years. For each of the 7 currencies assess your belief by computing the following: the average returns of the strategy, the % of times the prediction of the strategy is right? (15 Marks) 2- Suppose that most currency exposure of the company are EUR and GBP exposures. Implement a mixed forecast approach to inform the company of the expected future USDEUR and USDGBP exchange rates? (10 Marks) (25 Marks in Total) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started