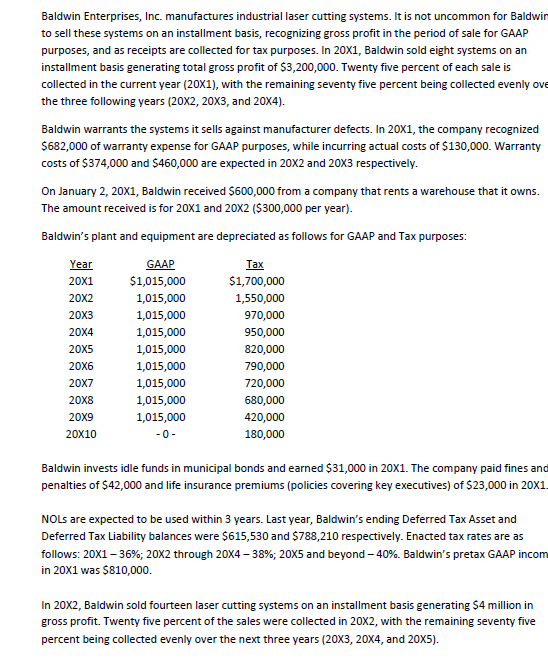

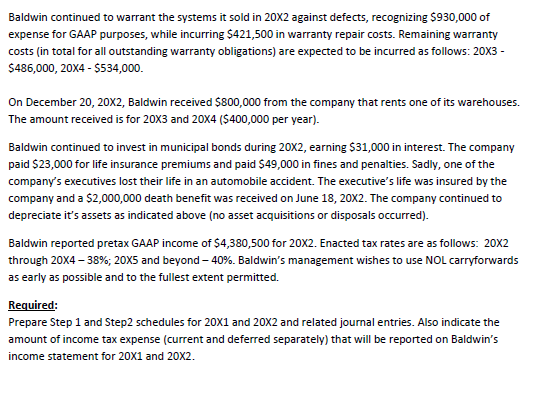

CoursHeroTranscribedText: Baldwin Enterprises, Inc. manufactures industrial laser cutting systems. It is not uncommon for Baldwin to sell these systems on an installment basis, recognizing gross profit in the period of sale for GAAP purposes, and as receipts are collected for tax purposes. In 20X1, Baldwin sold eight systems on an installment basis generating total gross profit of $3,200,000. Twenty five percent of each sale is collected in the current year (20X1), with the remaining seventy five percent being collected evenly ov the three following years (20X2, 20X3, and 20X4). Baldwin warrants the systems it sells against manufacturer defects. In 20X1, the company recognized 5682,000 of warranty expense for GAAP purposes, while incurring actual costs of $130,000. Warranty costs of $374,000 and $460,000 are expected in 20X2 and 20X3 respectively. On January 2, 20X1, Baldwin received $600,000 from a company that rents a warehouse that it owns. The amount received is for 20X1 and 20X2 ($300,000 per year). Baldwin's plant and equipment are depreciated as follows for GAAP and Tax purposes: Year GAAP Tax 20X1 $1,015,000 $1,700,000 20X2 1,015,000 1,550,000 20X3 1,015,000 970,000 20X4 1,015,000 950,000 20X5 1,015,000 820,000 20X6 1,015,000 790,000 20X7 1,015,000 720,000 20X8 1,015,000 680,000 20X9 1,015,000 420,000 20X10 - 0 - 180,000 Baldwin invests idle funds in municipal bonds and earned $31,000 in 20X1. The company paid fines and penalties of $42,000 and life insurance premiums (policies covering key executives) of $23,000 in 20X1 NOL are expected to be used within 3 years. Last year, Baldwin's ending Deferred Tax Asset and Deferred Tax Liability balances were $615,530 and $788,210 respectively. Enacted tax rates are as follows: 20X1 - 36%; 20X2 through 20X4 - 38%; 20X5 and beyond - 40%. Baldwin's pretax GAAP incom in 20X1 was $810,000. In 20X2, Baldwin sold fourteen laser cutting systems on an installment basis generating $4 million in gross profit. Twenty five percent of the sales were collected in 20X2, with the remaining seventy five percent being collected evenly over the next three years (20X3, 20X4, and 20X5).Baldwin continued to warrant the systems it sold in 20X2 against defects, recognizing $930,000 of expense for GAAP purposes, while incurring $421,500 in warranty repair costs. Remaining warranty costs (in total for all outstanding warranty obligations) are expected to be incurred as follows: 20X3 - $486,000, 20X4 - $534,000. On December 20, 20X2, Baldwin received $800,000 from the company that rents one of its warehouses. The amount received is for 20X3 and 20X4 ($400,000 per year). Baldwin continued to invest in municipal bonds during 20X2, earning $31,000 in interest. The company paid $23,000 for life insurance premiums and paid $49,000 in fines and penalties. Sadly, one of the company's executives lost their life in an automobile accident. The executive's life was insured by the company and a $2,000,000 death benefit was received on June 18, 20X2. The company continued to depreciate it's assets as indicated above (no asset acquisitions or disposals occurred). Baldwin reported pretax GAAP income of $4,380,500 for 20X2. Enacted tax rates are as follows: 20X2 through 20X4 -38%; 20X5 and beyond - 40%. Baldwin's management wishes to use NOL carryforwards as early as possible and to the fullest extent permitted. Required: Prepare Step 1 and Step2 schedules for 20X1 and 20X2 and related journal entries. Also indicate the amount of income tax expense (current and deferred separately) that will be reported on Baldwin's income statement for 20X1 and 20X2