Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CoursHeroTranscribedText: Complete the following personal tax case using CanTax 2021 T1 software available in Seneca MyApps: Jessie Pinkman is 40 years old, married and has

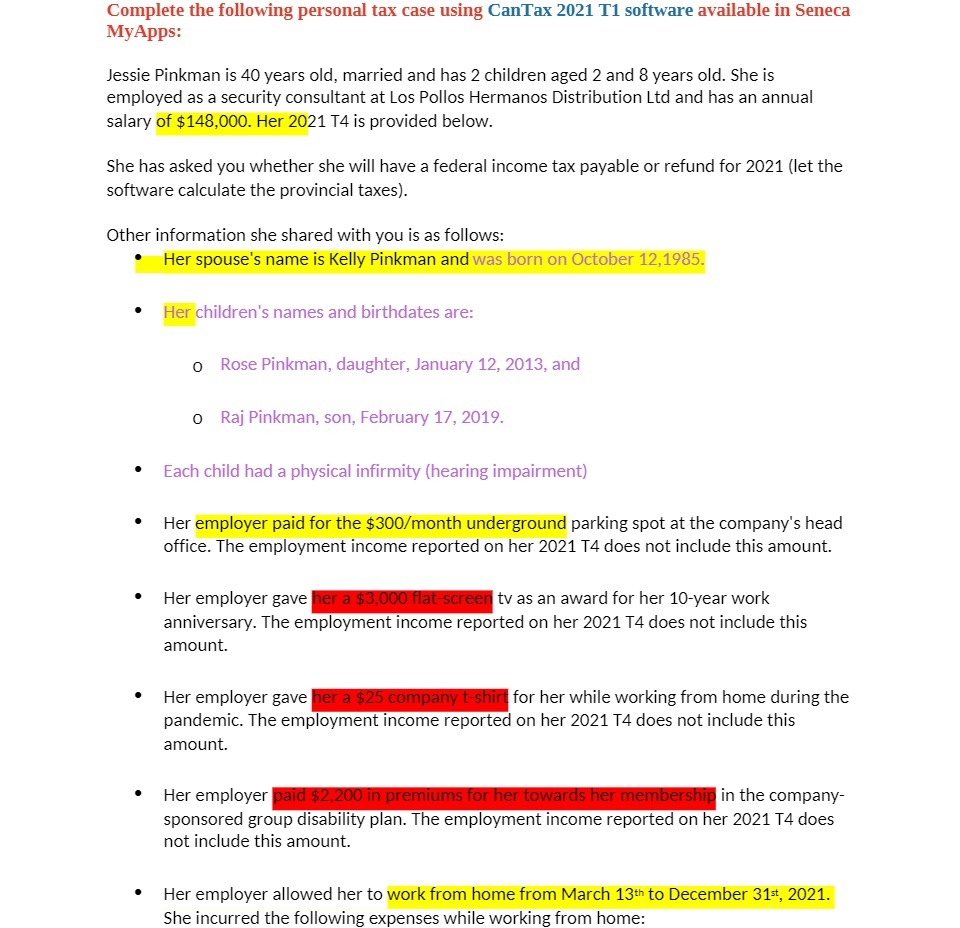

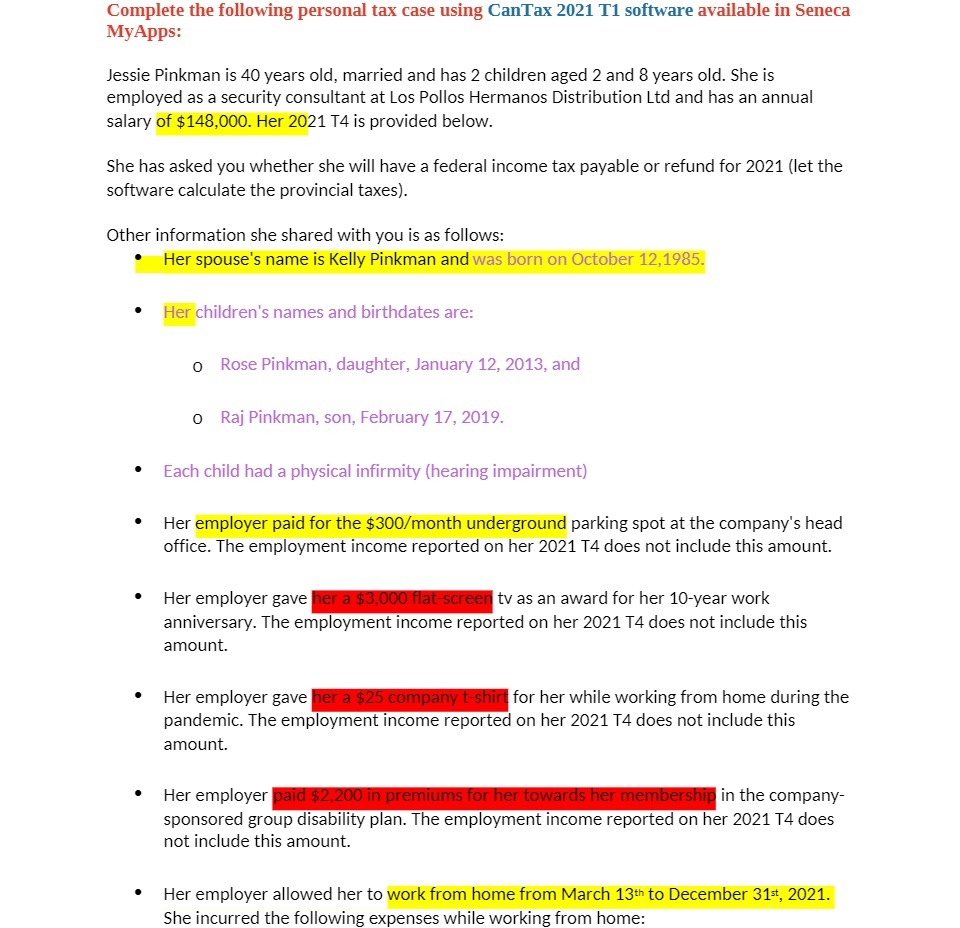

CoursHeroTranscribedText: Complete the following personal tax case using CanTax 2021 T1 software available in Seneca MyApps: Jessie Pinkman is 40 years old, married and has 2 children aged 2 and 8 years old. She is employed as a security consultant at Los Pollos Hermanos Distribution Ltd and has an annual salary of $148,000. Her 2021 14 is provided below. She has asked you whether she will have a federal income tax payable or refund for 2021 (let the software calculate the provincial taxes). Other information she shared with you is as follows: . Her spouse's name is Kelly Pinkman and was born on October 12,1985. Her children's names and birthdates are: o Rose Pinkman, daughter, January 12, 2013, and o Raj Pinkman, son, February 17, 2019. . Each child had a physical infirmity (hearing impairment) Her employer paid for the $300/month underground parking spot at the company's head office. The employment income reported on her 2021 14 does not include this amount. Her employer gave her a $3,000 flat screen tv as an award for her 10-year work anniversary. The employment income reported on her 2021 14 does not include this amount. Her employer gave her a $25 company t-shirt for her while working from home during the pandemic. The employment income reported on her 2021 74 does not include this amount. Her employer paid $2,200 in premiums for her towards her membership in the company- sponsored group disability plan. The employment income reported on her 2021 14 does not include this amount. Her employer allowed her to work from home from March 13th to December 31st, 2021. She incurred the following expenses while working from home

CoursHeroTranscribedText: Complete the following personal tax case using CanTax 2021 T1 software available in Seneca MyApps: Jessie Pinkman is 40 years old, married and has 2 children aged 2 and 8 years old. She is employed as a security consultant at Los Pollos Hermanos Distribution Ltd and has an annual salary of $148,000. Her 2021 14 is provided below. She has asked you whether she will have a federal income tax payable or refund for 2021 (let the software calculate the provincial taxes). Other information she shared with you is as follows: . Her spouse's name is Kelly Pinkman and was born on October 12,1985. Her children's names and birthdates are: o Rose Pinkman, daughter, January 12, 2013, and o Raj Pinkman, son, February 17, 2019. . Each child had a physical infirmity (hearing impairment) Her employer paid for the $300/month underground parking spot at the company's head office. The employment income reported on her 2021 14 does not include this amount. Her employer gave her a $3,000 flat screen tv as an award for her 10-year work anniversary. The employment income reported on her 2021 14 does not include this amount. Her employer gave her a $25 company t-shirt for her while working from home during the pandemic. The employment income reported on her 2021 74 does not include this amount. Her employer paid $2,200 in premiums for her towards her membership in the company- sponsored group disability plan. The employment income reported on her 2021 14 does not include this amount. Her employer allowed her to work from home from March 13th to December 31st, 2021. She incurred the following expenses while working from home

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started