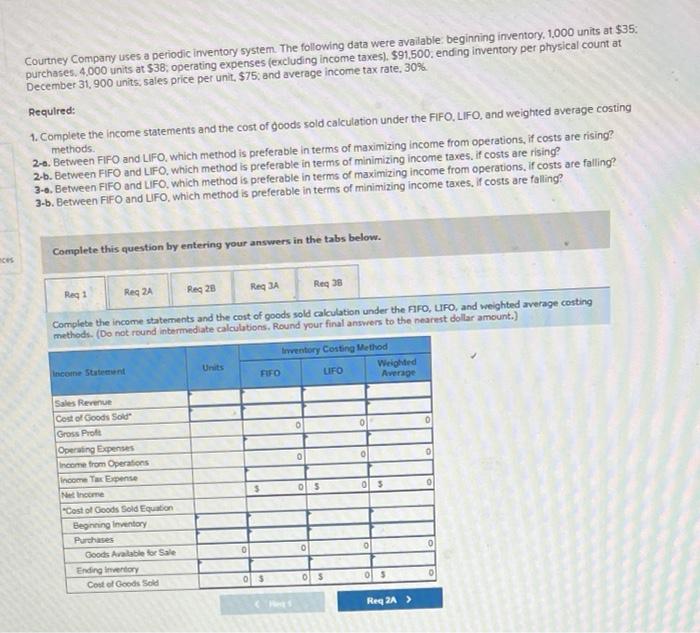

Courtney Company uses a periodic inventory system. The following data were available, beginning inventory, 1,000 units at $35 : purchases. 4,000 units at $38; operating expenses (excluding income taxes), $91,500, ending inventory per physical count at December 31,900 units, sales price per unit, $75; and average income tax rate, 30%. 1. Complete the income statements and the cost of goods sold calculation under the FIFO. LIFO, and weighted average costing Requlred: 2-0. Between FIFO and LIFO, which method is preferable in terms of maximizing income from operations, if costs are rising? methods. 2.b. Between FIFO and LIFO, which method is preferable in terms of minimizing income taxes, if costs are rising? 3-6. Between FIFO and UFO, which method is preferable in terms of maximizing income from operations, if costs are falling? 3-b. Between FIFO and LFO, which method is preferable in terms of minimizing income taxes, if costs are falling? Complete this question by entering your answers in the tabs below. Complete the income statements and the cort of goods sold cakulation under the FFO, LFO, and weighted average costing hedete ine notround intermediate calculutions. Round your final answers to the nearest dollar amount.) Courtney Company uses a periodic inventory system. The following data were available, beginning inventory, 1,000 units at $35 : purchases. 4,000 units at $38; operating expenses (excluding income taxes), $91,500, ending inventory per physical count at December 31,900 units, sales price per unit, $75; and average income tax rate, 30%. 1. Complete the income statements and the cost of goods sold calculation under the FIFO. LIFO, and weighted average costing Requlred: 2-0. Between FIFO and LIFO, which method is preferable in terms of maximizing income from operations, if costs are rising? methods. 2.b. Between FIFO and LIFO, which method is preferable in terms of minimizing income taxes, if costs are rising? 3-6. Between FIFO and UFO, which method is preferable in terms of maximizing income from operations, if costs are falling? 3-b. Between FIFO and LFO, which method is preferable in terms of minimizing income taxes, if costs are falling? Complete this question by entering your answers in the tabs below. Complete the income statements and the cort of goods sold cakulation under the FFO, LFO, and weighted average costing hedete ine notround intermediate calculutions. Round your final answers to the nearest dollar amount.)