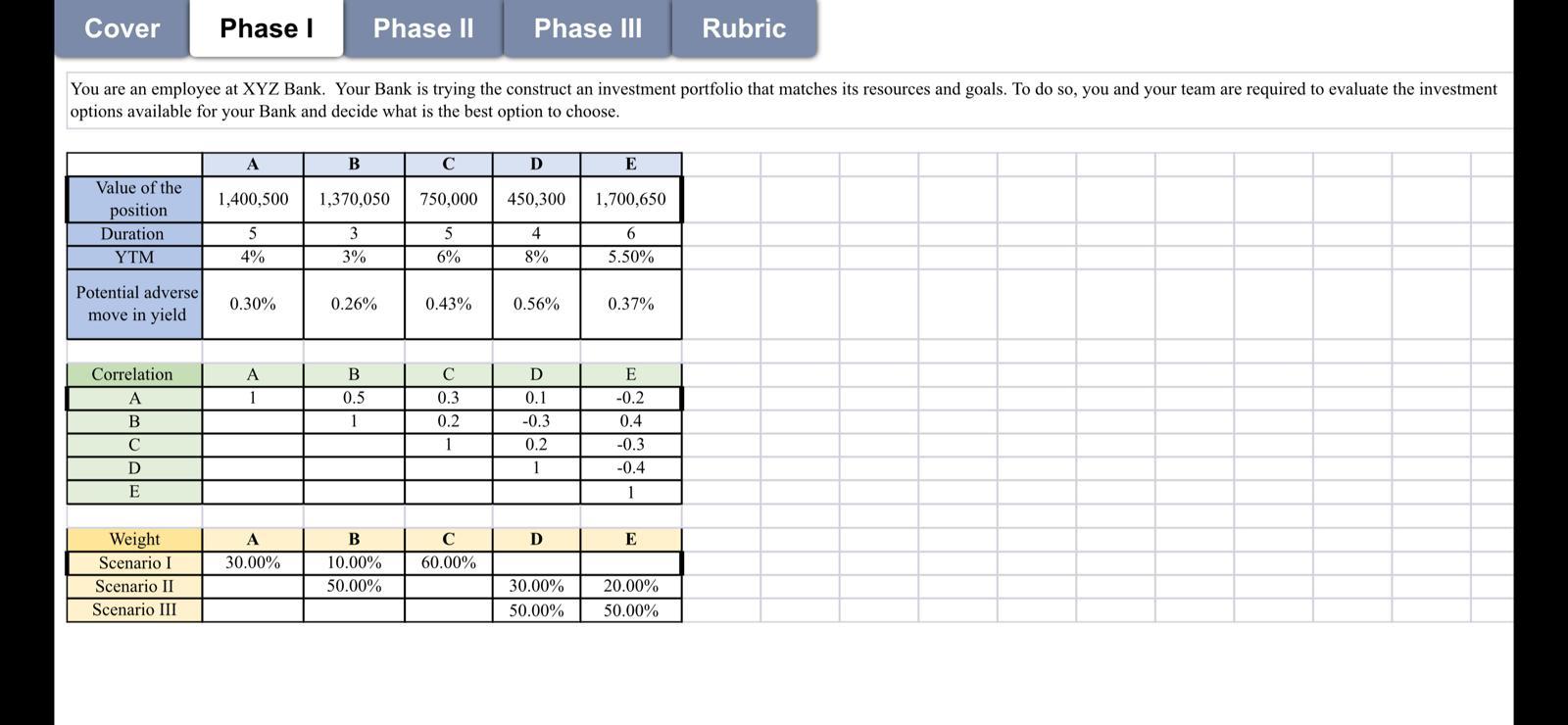

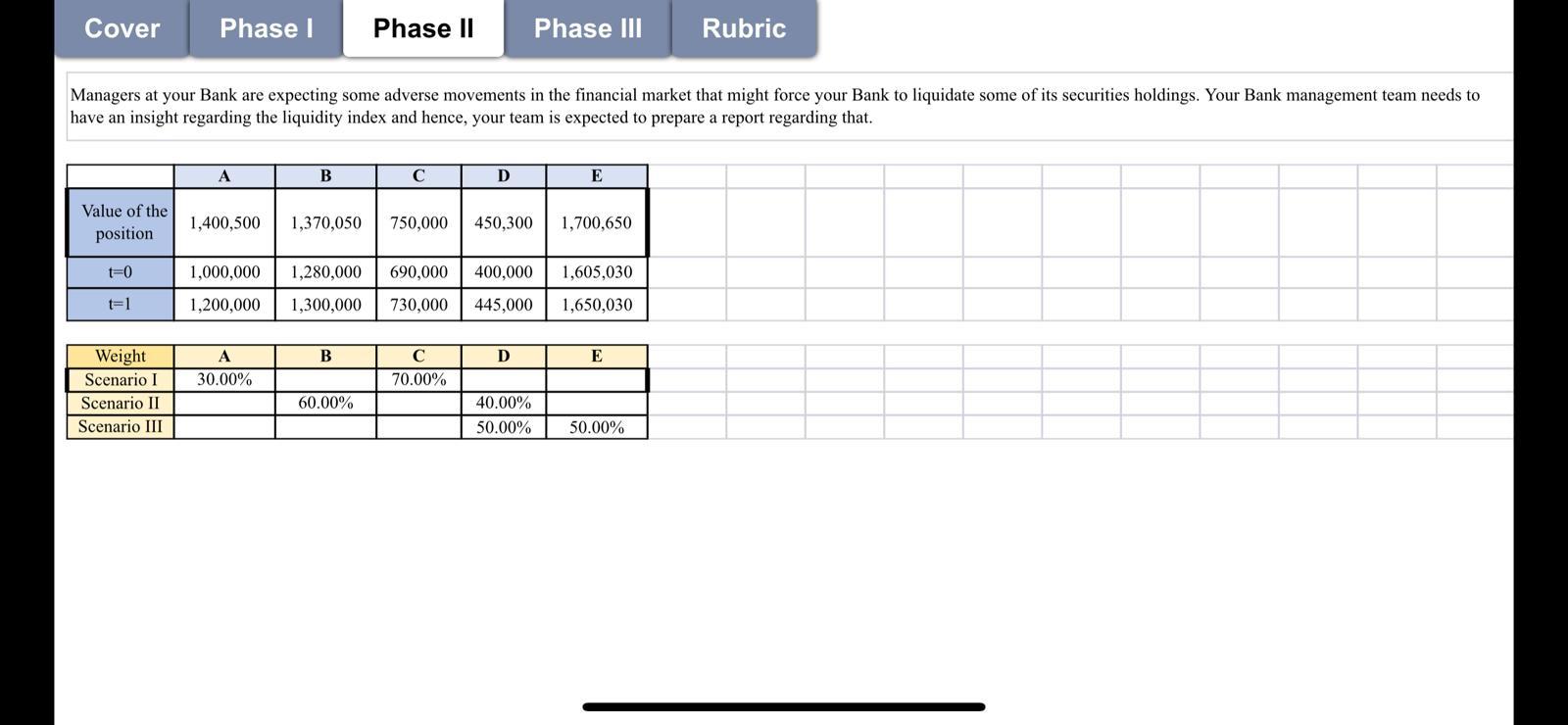

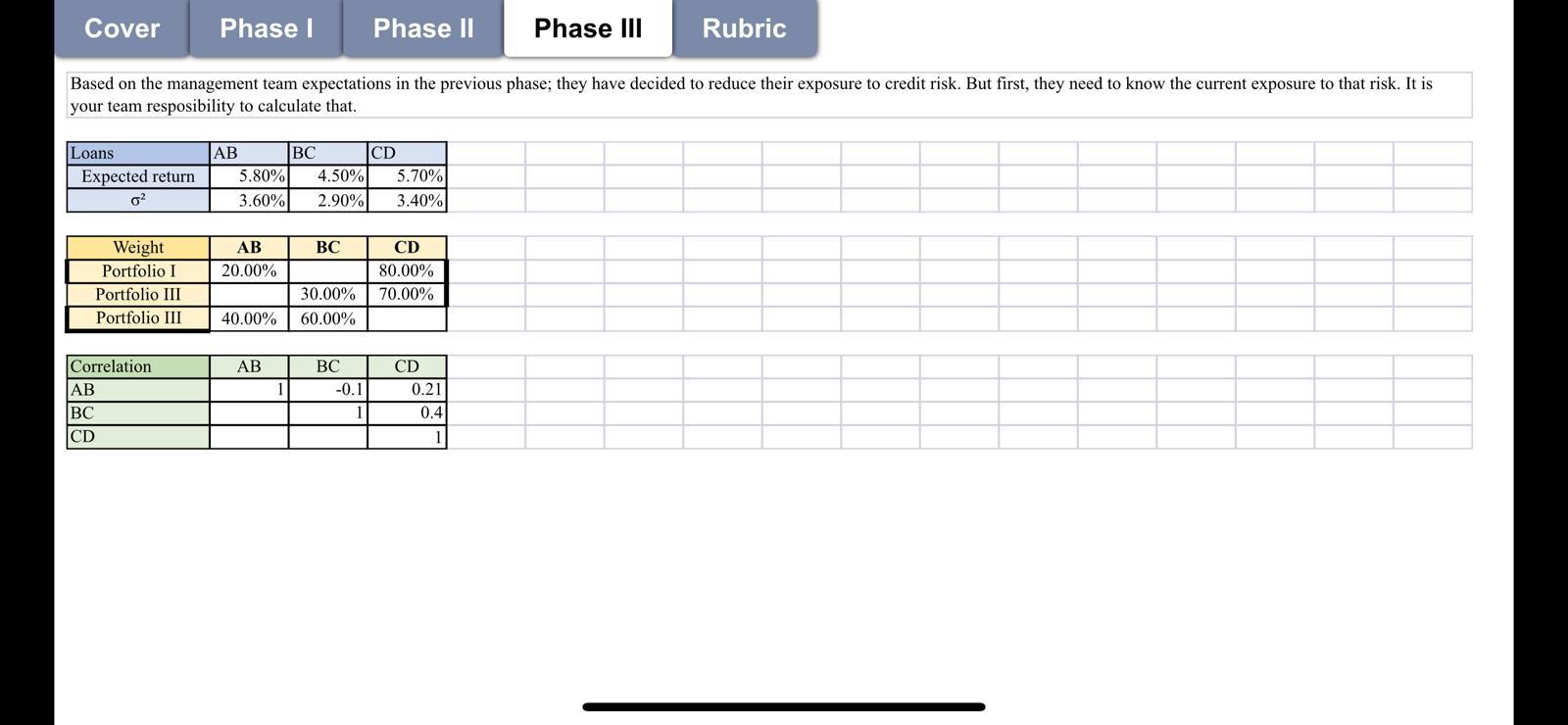

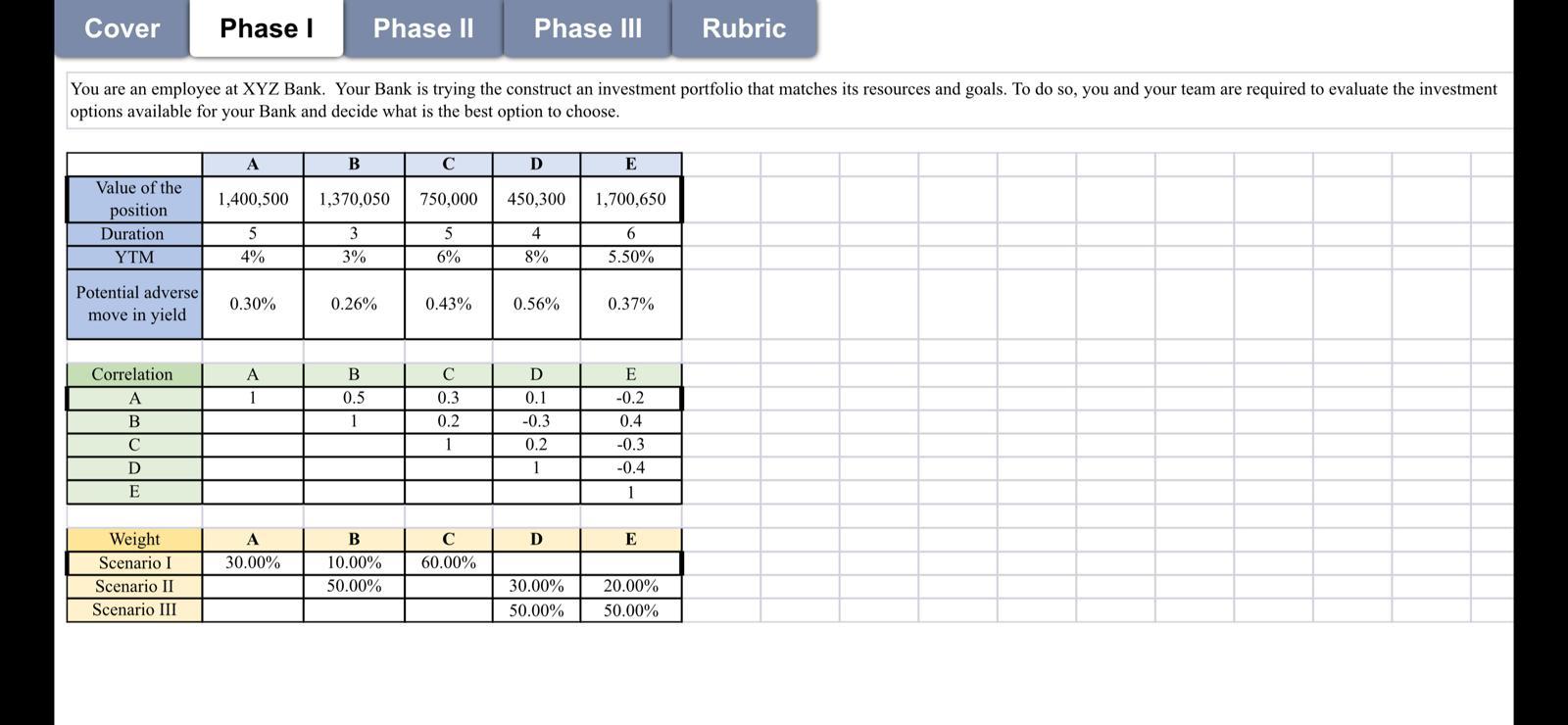

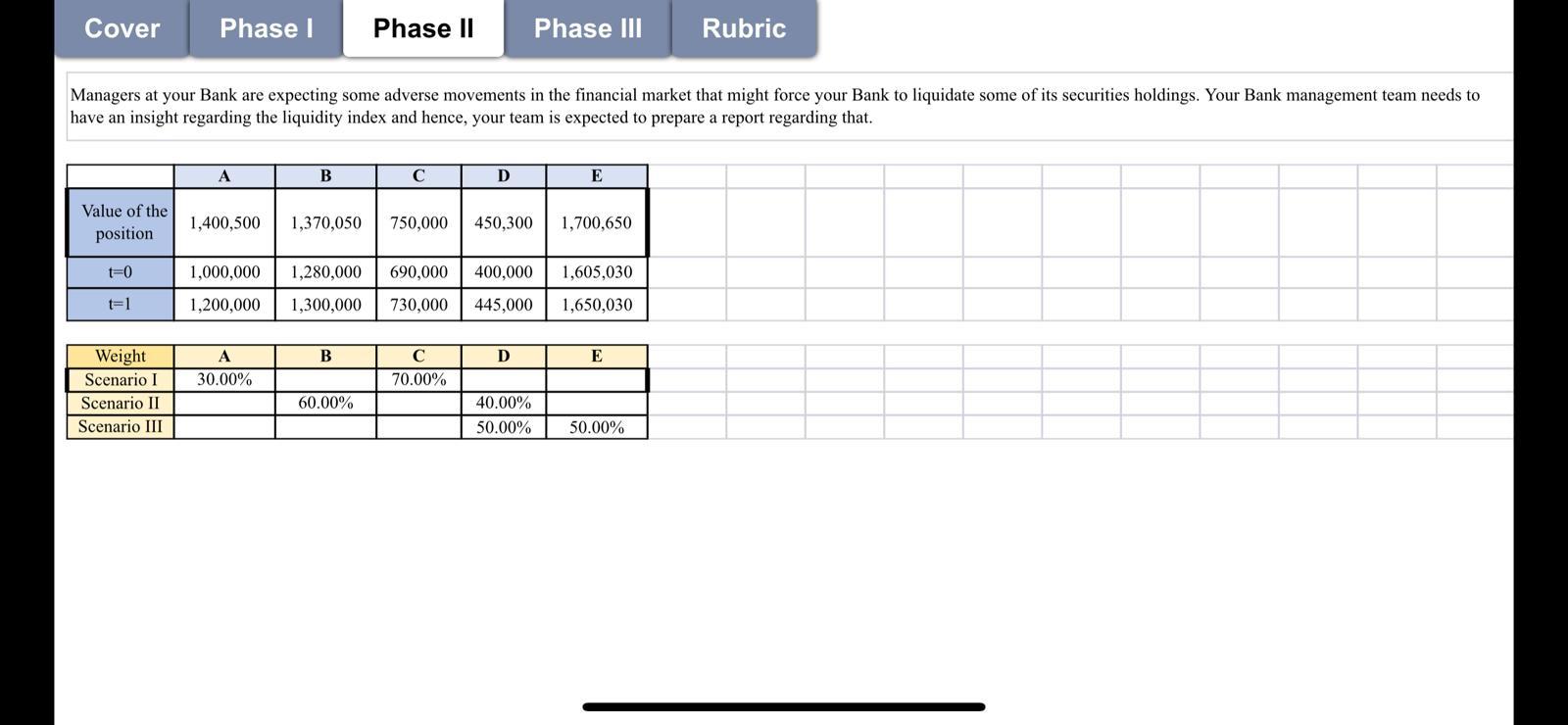

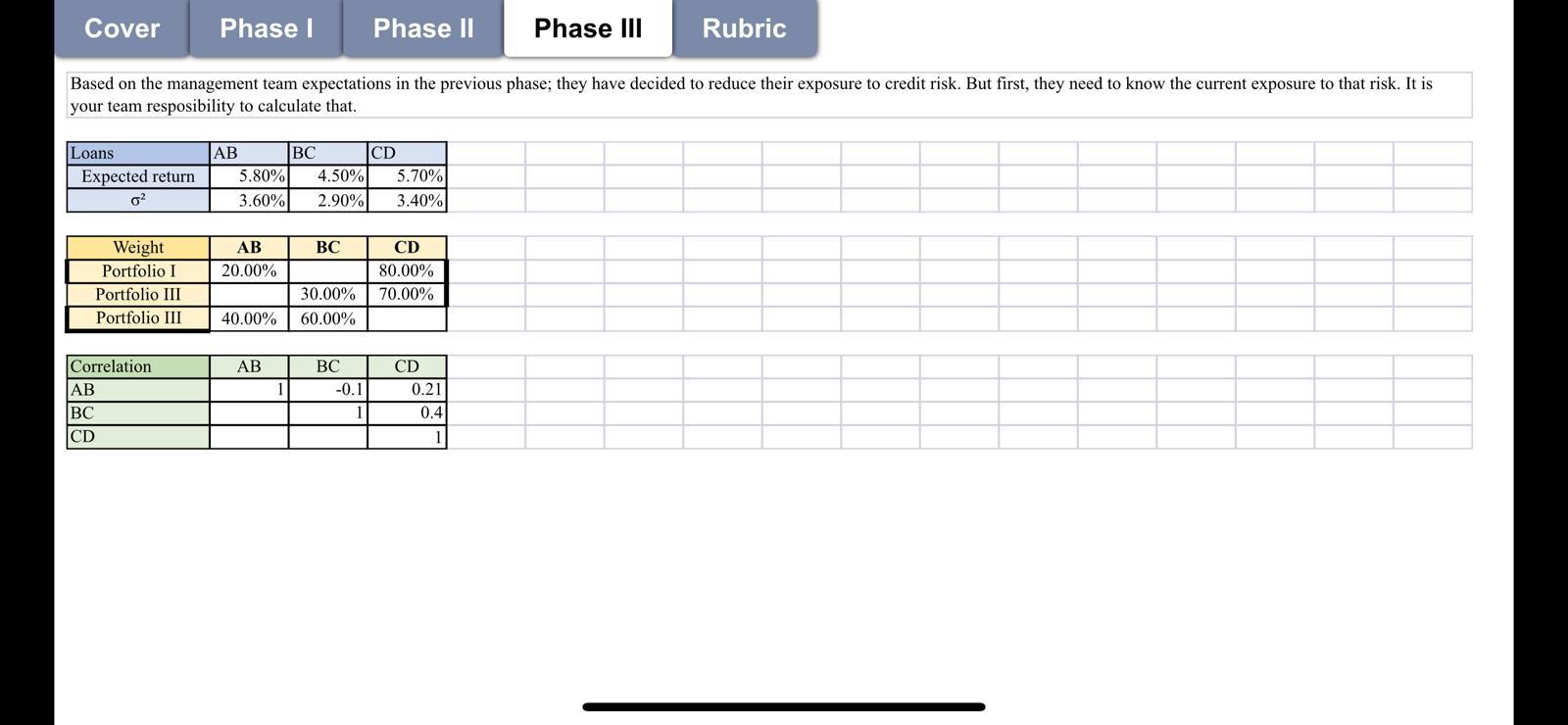

Cover Phasel Phase II Phase III Rubric You are an employee at XYZ Bank. Your Bank is trying the construct an investment portfolio that matches its resources and goals. To do so, you and your team are required to evaluate the investment options available for your Bank and decide what is the best option to choose. A B D E 1,400,500 1,370,050 750,000 450,300 1,700,650 Value of the position Duration YTM 6 5 4% 3 3% 5 6% 4 8% 5.50% Potential adverse move in yield 0.30% 0.26% 0.43% 0.56% 0.37% A B 0.5 1 Correlation A B D E 0.3 0.2 1 1 D 0.1 -0.3 0.2 1 E -0.2 0.4 -0.3 -0.4 1 D E 30.00% Weight Scenario I Scenario II Scenario III B 10.00% 50.00% 60.00% 30.00% 50.00% 20.00% 50.00% Cover Phase 1 Phase II Phase III Rubric Managers at your Bank are expecting some adverse movements in the financial market that might force your Bank to liquidate some of its securities holdings. Your Bank management team needs to have an insight regarding the liquidity index and hence, your team is expected to prepare a report regarding that. A B C D E Value of the position 1,400,500 1,370,050 750,000 450,300 1,700,650 t=0 1,000,000 1,280,000 690,000 400,000 1,605,030 1,650,030 t=1 1,200,000 1,300,000 730,000 445,000 A B C D E 30.00% 70.00% Weight Scenario I Scenario II Scenario III 60.00% 40.00% 50.00% 50.00% Cover Phase 1 Phase II Phase III Rubric Based on the management team expectations in the previous phase; they have decided to reduce their exposure to credit risk. But first, they need to know the current exposure to that risk. It is your team resposibility to calculate that. Loans Expected return AB BC CD 5.80% 4.50% 5.70% 3.60% 2.90% 3.40% BC AB 20.00% Weight Portfolio I Portfolio III Portfolio III CD 80.00% 70.00% 30.00% 60.00% 40.00% AB BC -0.1 1 Correlation AB BC CD CD 0.21 0.4 1 Cover Phasel Phase II Phase III Rubric You are an employee at XYZ Bank. Your Bank is trying the construct an investment portfolio that matches its resources and goals. To do so, you and your team are required to evaluate the investment options available for your Bank and decide what is the best option to choose. A B D E 1,400,500 1,370,050 750,000 450,300 1,700,650 Value of the position Duration YTM 6 5 4% 3 3% 5 6% 4 8% 5.50% Potential adverse move in yield 0.30% 0.26% 0.43% 0.56% 0.37% A B 0.5 1 Correlation A B D E 0.3 0.2 1 1 D 0.1 -0.3 0.2 1 E -0.2 0.4 -0.3 -0.4 1 D E 30.00% Weight Scenario I Scenario II Scenario III B 10.00% 50.00% 60.00% 30.00% 50.00% 20.00% 50.00% Cover Phase 1 Phase II Phase III Rubric Managers at your Bank are expecting some adverse movements in the financial market that might force your Bank to liquidate some of its securities holdings. Your Bank management team needs to have an insight regarding the liquidity index and hence, your team is expected to prepare a report regarding that. A B C D E Value of the position 1,400,500 1,370,050 750,000 450,300 1,700,650 t=0 1,000,000 1,280,000 690,000 400,000 1,605,030 1,650,030 t=1 1,200,000 1,300,000 730,000 445,000 A B C D E 30.00% 70.00% Weight Scenario I Scenario II Scenario III 60.00% 40.00% 50.00% 50.00% Cover Phase 1 Phase II Phase III Rubric Based on the management team expectations in the previous phase; they have decided to reduce their exposure to credit risk. But first, they need to know the current exposure to that risk. It is your team resposibility to calculate that. Loans Expected return AB BC CD 5.80% 4.50% 5.70% 3.60% 2.90% 3.40% BC AB 20.00% Weight Portfolio I Portfolio III Portfolio III CD 80.00% 70.00% 30.00% 60.00% 40.00% AB BC -0.1 1 Correlation AB BC CD CD 0.21 0.4 1