Answered step by step

Verified Expert Solution

Question

1 Approved Answer

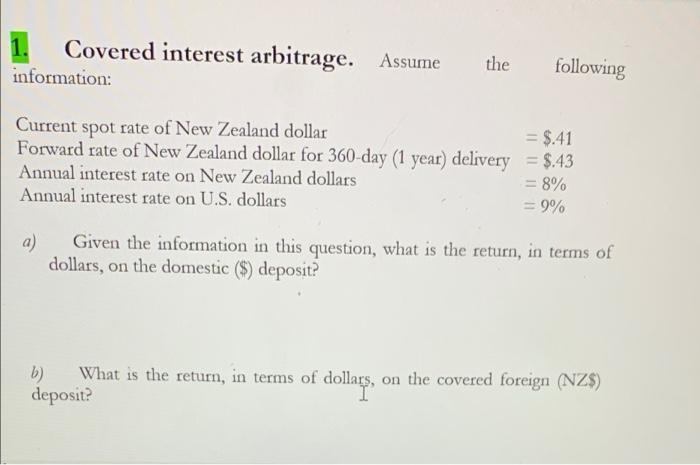

Covered interest arbitrage. Assume information: a) the following Current spot rate of New Zealand dollar = $.41 Forward rate of New Zealand dollar for

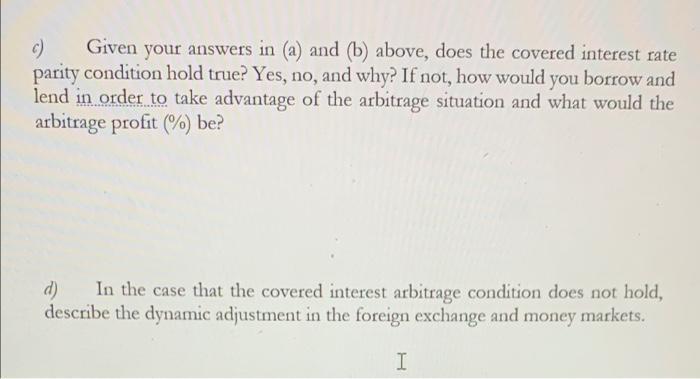

Covered interest arbitrage. Assume information: a) the following Current spot rate of New Zealand dollar = $.41 Forward rate of New Zealand dollar for 360-day (1 year) delivery = $.43 Annual interest rate on New Zealand dollars Annual interest rate on U.S. dollars = 8% = 9% Given the information in this question, what is the return, in terms of dollars, on the domestic ($) deposit? b) What is the return, in terms of dollars, lars, on the covered foreign (NZ$) deposit? c) Given your answers in (a) and (b) above, does the covered interest rate parity condition hold true? Yes, no, and why? If not, how would you borrow and lend in order to take advantage of the arbitrage situation and what would the arbitrage profit (%) be? In the case that the covered interest arbitrage condition does not hold, describe the dynamic adjustment in the foreign exchange and money markets. I

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To determine the returns and assess the covered interest rate parity condition we will follow the given information a Return on the domestic deposit T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started