Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are an analyst covering Bartlett Industries. Bartlett currently has 60 million outstanding shares, $120 million in debt, and $40 million in cash. Based

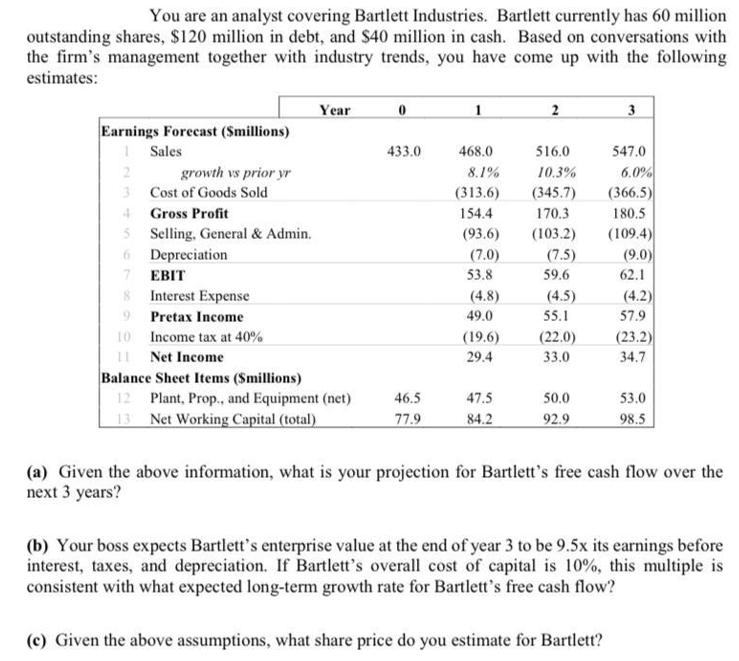

You are an analyst covering Bartlett Industries. Bartlett currently has 60 million outstanding shares, $120 million in debt, and $40 million in cash. Based on conversations with the firm's management together with industry trends, you have come up with the following estimates: Earnings Forecast (Smillions) 1 Sales 2 3 growth vs prior yr Cost of Goods Sold 4 Gross Profit 5 Selling, General & Admin. 6 Depreciation 7 EBIT 8 Interest Expense 19 Pretax Income 10 11 Net Income Income tax at 40% Year Balance Sheet Items (Smillions) 12 Plant, Prop., and Equipment (net) Net Working Capital (total) 13 0 433.0 46.5 77.9 1 468.0 8.1% (313.6) 154.4 (93.6) (7.0) 53.8 (4.8) 49.0 (19.6) 29.4 47.5 84.2 2 516.0 10.3% (345.7) 170.3 (103.2) (7.5) 59.6 (4.5) 55.1 (22.0) 33.0 50.0 92.9 3 547.0 (c) Given the above assumptions, what share price do you estimate for Bartlett? 6.0% (366.5) 180.5 (109.4) (9.0) 62.1 (4.2) 57.9 (23.2) 34.7 53.0 98.5 (a) Given the above information, what is your projection for Bartlett's free cash flow over the next 3 years? (b) Your boss expects Bartlett's enterprise value at the end of year 3 to be 9.5x its earnings before interest, taxes, and depreciation. If Bartlett's overall cost of capital is 10%, this multiple is consistent with what expected long-term growth rate for Bartlett's free cash flow?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started