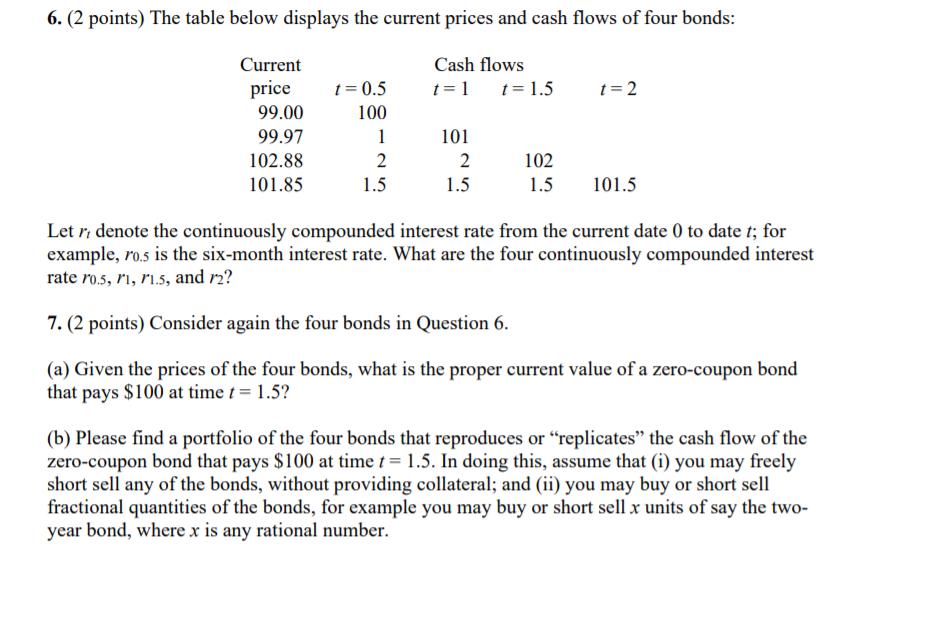

6. (2 points) The table below displays the current prices and cash flows of four bonds: Cash flows Current price 99.00 t = 1

6. (2 points) The table below displays the current prices and cash flows of four bonds: Cash flows Current price 99.00 t = 1 99.97 102.88 101.85 t = 0.5 100 1 2 1.5 101 2 1.5 t = 1.5 t=2 102 1.5 101.5 Letri denote the continuously compounded interest rate from the current date 0 to date t; for example, ro.s is the six-month interest rate. What are the four continuously compounded interest rate ro.5, ri, r1.5, and 12? 7. (2 points) Consider again the four bonds in Question 6. (a) Given the prices of the four bonds, what is the proper current value of a zero-coupon bond that pays $100 at time t = 1.5? (b) Please find a portfolio of the four bonds that reproduces or "replicates" the cash flow of the zero-coupon bond that pays $100 at time t = 1.5. In doing this, assume that (i) you may freely short sell any of the bonds, without providing collateral; and (ii) you may buy or short sell fractional quantities of the bonds, for example you may buy or short sell x units of say the two- year bond, where x is any rational number.

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations 6 Bond 1 r05 l...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started