Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Covered versus uncovered interest arbitrage On May 3 1 , Maria, an American investor, decided to buy three - month Treasury bills. She found that

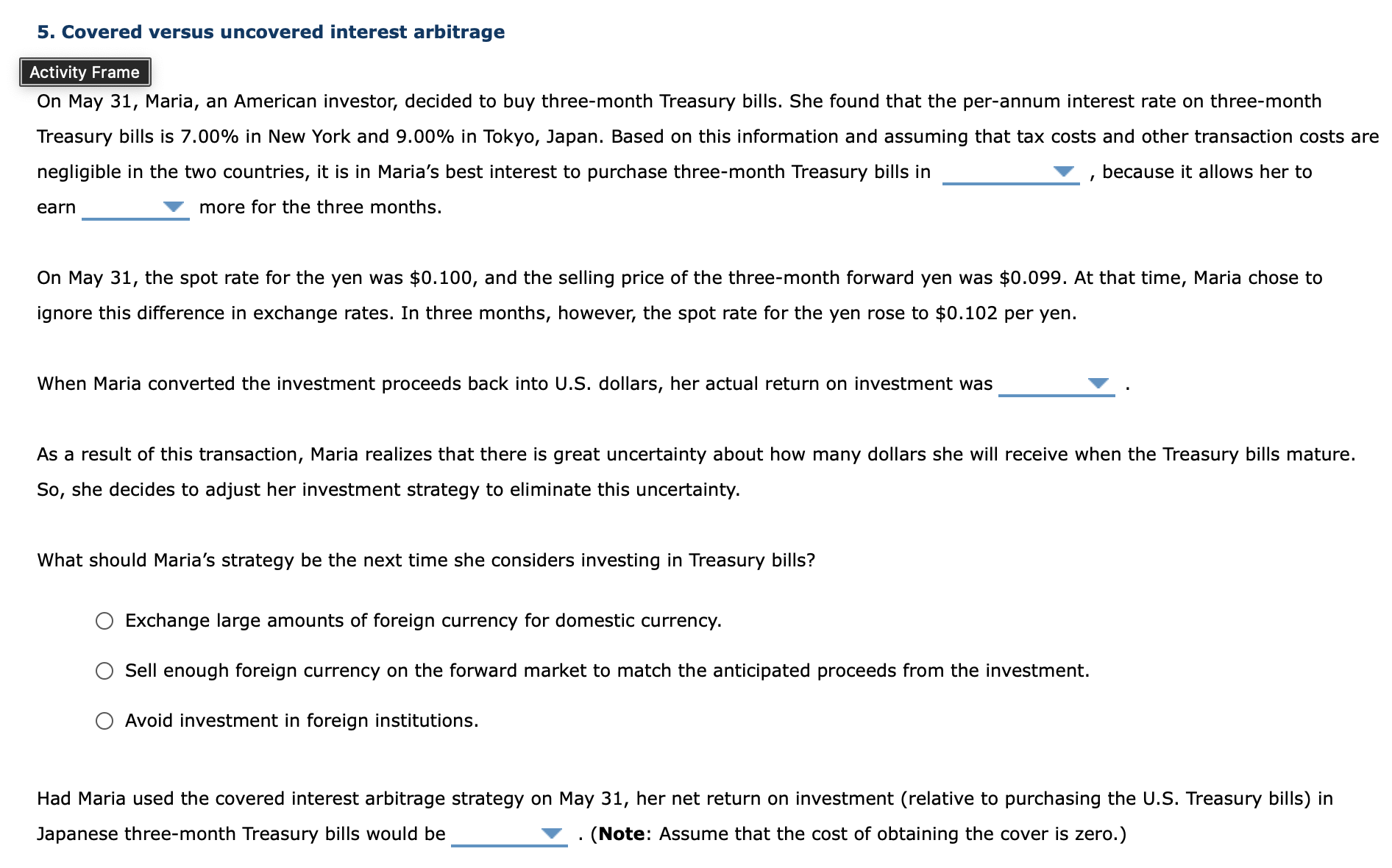

Covered versus uncovered interest arbitrage

On May Maria, an American investor, decided to buy threemonth Treasury bills. She found that the perannum interest rate on threemonth

Treasury bills is in New York and in Tokyo, Japan. Based on this information and assuming that tax costs and other transaction costs are

negligible in the two countries, it is in Maria's best interest to purchase threemonth Treasury bills in

because it allows her to

earn

more for the three months.

On May the spot rate for the yen was $ and the selling price of the threemonth forward yen was $ At that time, Maria chose to

ignore this difference in exchange rates. In three months, however, the spot rate for the yen rose to $ per yen.

When Maria converted the investment proceeds back into US dollars, her actual return on investment was

As a result of this transaction, Maria realizes that there is great uncertainty about how many dollars she will receive when the Treasury bills mature.

So she decides to adjust her investment strategy to eliminate this uncertainty.

What should Maria's strategy be the next time she considers investing in Treasury bills?

Exchange large amounts of foreign currency for domestic currency.

Sell enough foreign currency on the forward market to match the anticipated proceeds from the investment.

Avoid investment in foreign institutions.

Had Maria used the covered interest arbitrage strategy on May her net return on investment relative to purchasing the US Treasury bills in

Japanese threemonth Treasury bills would be

Note: Assume that the cost of obtaining the cover is zero.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started