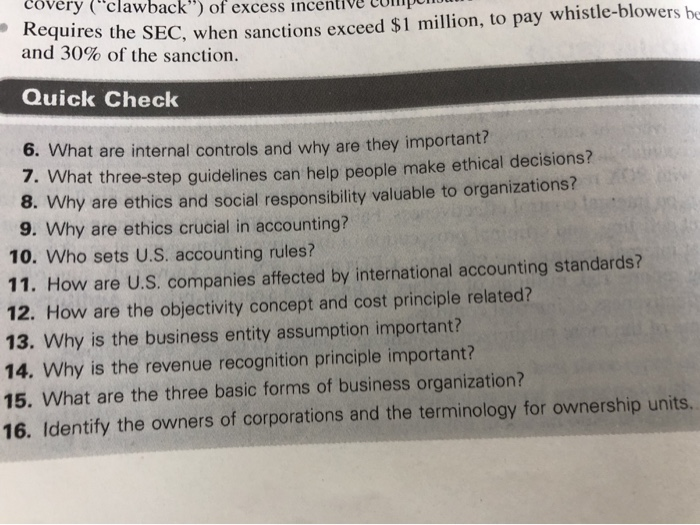

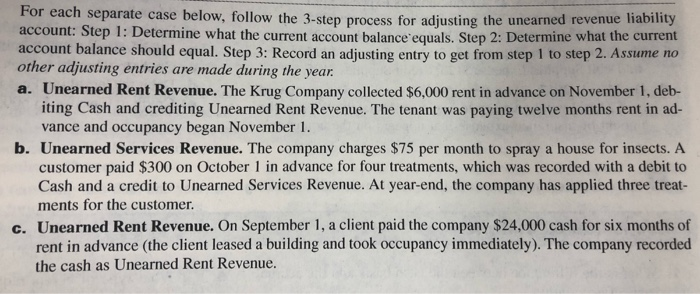

covery (clawback") of excess ince Requires the SEC, when sanctions exceed $1 million, to pay whistle-blowers be and 30% of the sanction. Quick Check 6. What are internal controls and why are they important? 7. What three-step guidelines can help people make ethical decisions? 8. Why are ethics and social responsibility valuable to organizations? 9. Why are ethics crucial in accounting? 10. Who sets U.S. accounting rules? 11. How are U.S. companies affected by international accounting standards? 12. How are the objectivity concept and cost principle related? 13. Why is the business entity assumption important? 14. Why is the revenue recognition principle important? 15. What are the three basic forms of business organization? 16. Identify the owners of corporations and the terminology for ownership units. For each separate case below, follow the 3-step process for adjusting the unearned revenue liability account: Step 1: Determine what the current account balance'equals. Step 2: Determine what the current account balance should equal. Step 3: Record an adjusting entry to get from step 1 to step 2. Assume no other adjusting entries are made during the year. a. Unearned Rent Revenue. The Krug Company collected $6,000 rent in ad vance on November 1, deb- iting Cash and crediting Unearned Rent Revenue. The tenant was paying twelve months rent in ad- vance and occupancy began November 1. b. Unearned Services Revenue. The company charges $75 per month to spray a house for insects. A customer paid $300 on October 1 in advance for four treatments, which was recorded with a debit to Cash and a credit to Unearned Services Revenue. At year-end, the company has applied three treat- ments for the customer. c. Unearned Rent Revenue. On September 1, a client paid the company $24,000 cash for six months of rent in advance (the client leased a building and took occupancy immediately). The company recorded the cash as Unearned Rent Revenue. covery (clawback") of excess ince Requires the SEC, when sanctions exceed $1 million, to pay whistle-blowers be and 30% of the sanction. Quick Check 6. What are internal controls and why are they important? 7. What three-step guidelines can help people make ethical decisions? 8. Why are ethics and social responsibility valuable to organizations? 9. Why are ethics crucial in accounting? 10. Who sets U.S. accounting rules? 11. How are U.S. companies affected by international accounting standards? 12. How are the objectivity concept and cost principle related? 13. Why is the business entity assumption important? 14. Why is the revenue recognition principle important? 15. What are the three basic forms of business organization? 16. Identify the owners of corporations and the terminology for ownership units. For each separate case below, follow the 3-step process for adjusting the unearned revenue liability account: Step 1: Determine what the current account balance'equals. Step 2: Determine what the current account balance should equal. Step 3: Record an adjusting entry to get from step 1 to step 2. Assume no other adjusting entries are made during the year. a. Unearned Rent Revenue. The Krug Company collected $6,000 rent in ad vance on November 1, deb- iting Cash and crediting Unearned Rent Revenue. The tenant was paying twelve months rent in ad- vance and occupancy began November 1. b. Unearned Services Revenue. The company charges $75 per month to spray a house for insects. A customer paid $300 on October 1 in advance for four treatments, which was recorded with a debit to Cash and a credit to Unearned Services Revenue. At year-end, the company has applied three treat- ments for the customer. c. Unearned Rent Revenue. On September 1, a client paid the company $24,000 cash for six months of rent in advance (the client leased a building and took occupancy immediately). The company recorded the cash as Unearned Rent Revenue