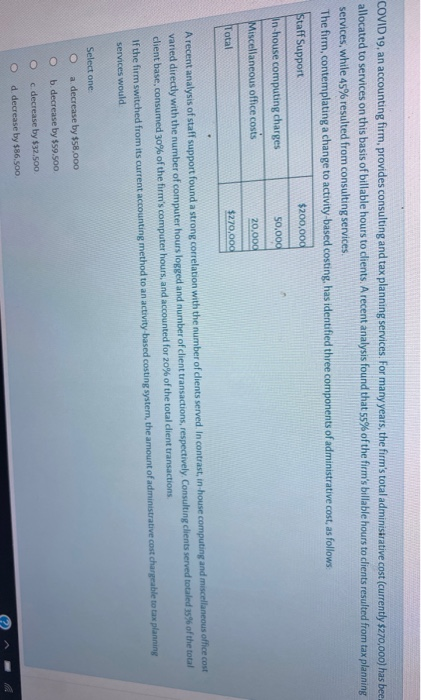

COVID 19. an accounting firm, provides consulting and tax planning services. For many years, the firm's total administrative cost (currently $270,000) has bee allocated to services on this basis of billable hours to clients. A recent analysis found that 5% of the firm's billable hours to clients resulted from tax planning services, while 45% resulted from consulting services The firm,contemplating a change to activity based costing, has identified three components of administrative cost, as follows: Staff Support $200,000 In-house computing charges 50,000 Miscellaneous office costs 20.000 Total $270,000 A recent analysis of staff support found a strong correlation with the number of clients served in contrast, in-house computing and miscellaneous office cost varied directly with the number of computer hours logged and number of client transactions, respectively. Consulting clients served totaled 35% of the total client base, consumed 30% of the firm's computer hours, and accounted for 20% of the total client transactions If the firm switched from its current accounting method to an activity based costing system, the amount of administrative cost chargeable to tax planning services would Select one a decrease by $58,000 b. decrease by $59.500 c decrease by $32.500 d. decrease by $86,500 COVID 19. an accounting firm, provides consulting and tax planning services. For many years, the firm's total administrative cost (currently $270,000) has bee allocated to services on this basis of billable hours to clients. A recent analysis found that 5% of the firm's billable hours to clients resulted from tax planning services, while 45% resulted from consulting services The firm,contemplating a change to activity based costing, has identified three components of administrative cost, as follows: Staff Support $200,000 In-house computing charges 50,000 Miscellaneous office costs 20.000 Total $270,000 A recent analysis of staff support found a strong correlation with the number of clients served in contrast, in-house computing and miscellaneous office cost varied directly with the number of computer hours logged and number of client transactions, respectively. Consulting clients served totaled 35% of the total client base, consumed 30% of the firm's computer hours, and accounted for 20% of the total client transactions If the firm switched from its current accounting method to an activity based costing system, the amount of administrative cost chargeable to tax planning services would Select one a decrease by $58,000 b. decrease by $59.500 c decrease by $32.500 d. decrease by $86,500