Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cowboy Company's bank statement for June 30 showed a cash balance of $45,870. The company's general ledger Cash account showed a $34,665 debit balance.

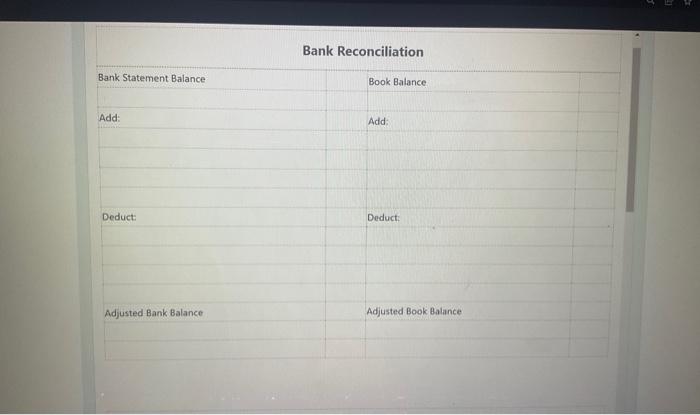

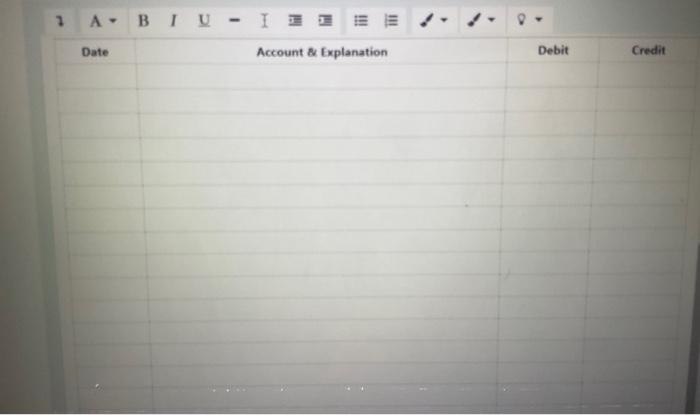

Cowboy Company's bank statement for June 30 showed a cash balance of $45,870. The company's general ledger Cash account showed a $34,665 debit balance. The following information was also available as of June 30: 1. A debit memo included in the bank statement shows a $980 NSF check from a customer, J. Doe. 2. Included with the bank statement was a credit memorandum in the amount of $40 for interest deposited into Cowboy Company's bank account. 3. Outstanding checks as of June 30 totaled $9,870 4. A customer's note for $8,500 was collected by the bank. 5. Included in the bank statement was a debit memorandum in the amount of $25 for bank service charges. These charges had not been recorded on the company's books. D 6. Examination of the checks on the bank statement with the entries on the accounting records reveals the check #345 for the payment of an rent expense was correctly written and drawn for $1000, but was recorded in the accounting records as $1,100 7. A deposit placed in the bank's night depository on June 30 totaled $6,300. The deposit did not appear on the bank statement Based on the above information, prepare the June bank reconciliation and necessary adjusting journal entries for Cowboy Company. A - BIU 11 Bank Statement Balance Add: Deduct: Adjusted Bank Balance Bank Reconciliation Book Balance Add: Deduct: Adjusted Book Balance 1 A B IU - IE Date Account & Explanation Debit Credit

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started