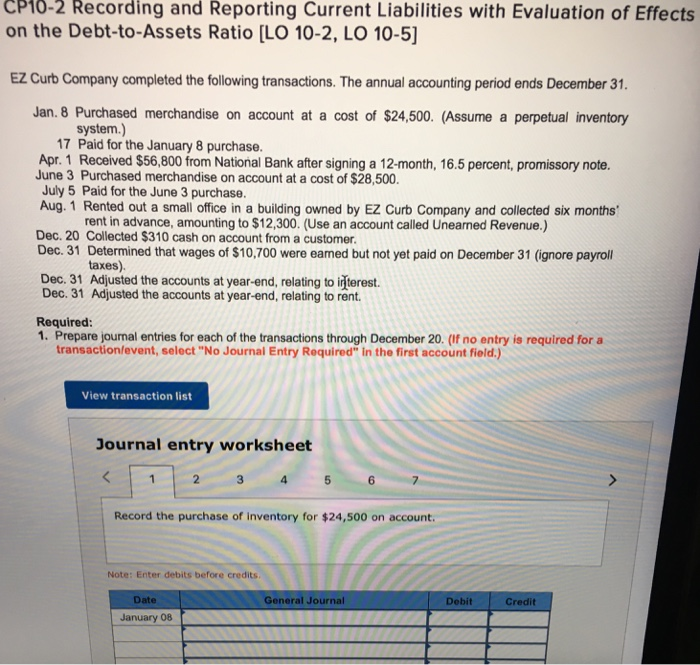

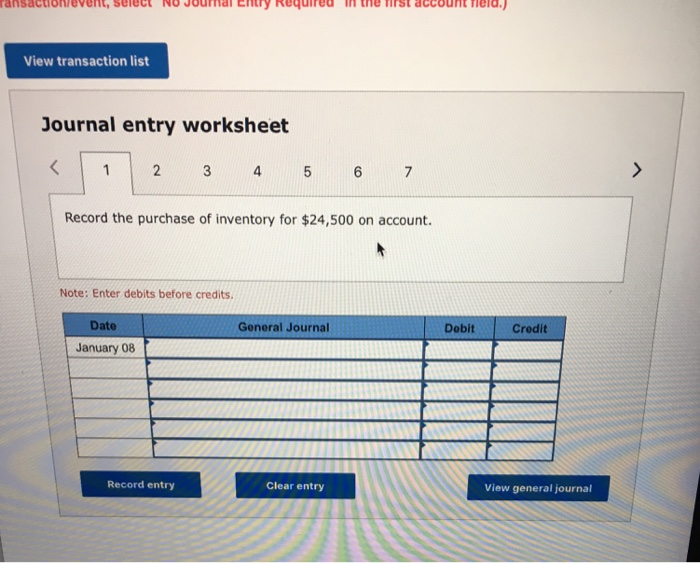

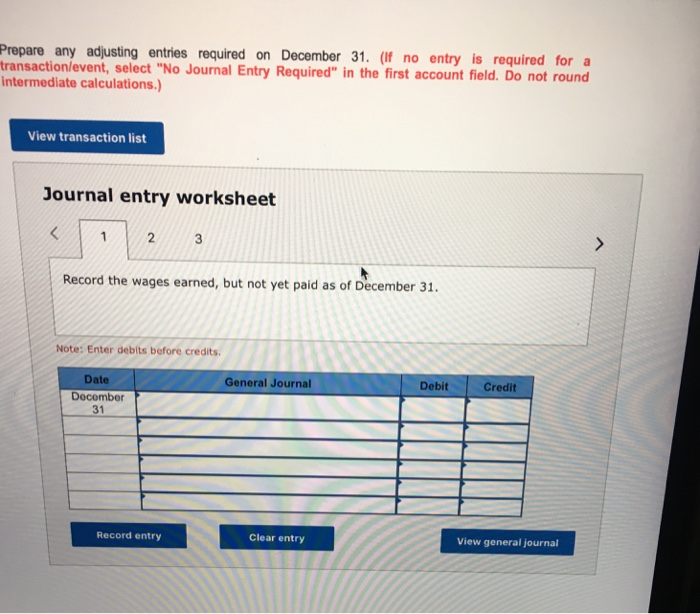

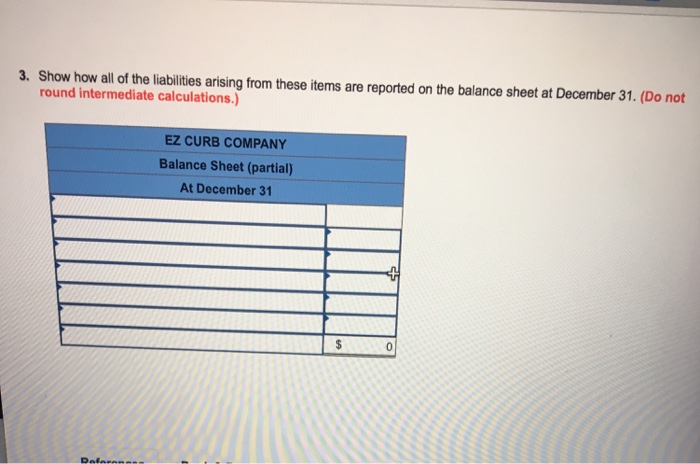

CP10-2 Recording and Reporting Current Liabilities with Evaluation of Effects on the Debt-to-Assets Ratio [LO 10-2, LO 10-5] EZ Curb Company completed the following transactions. The annual accounting period ends December 31. Jan. 8 Purchased merchandise on account at a cost of $24,500. (Assume a perpetual inventory system.) 17 Paid for the January 8 purchase. Apr. 1 Received $56,800 from National Bank after signing a 12-month, 16.5 percent, promissory note. June 3 Purchased merchandise on account at a cost of $28,500 July 5 Paid for the June 3 purchase. Aug. 1 Rented out a small office in a building owned by EZ Curb Company and collected six months rent in advance, amounting to $12,300. (Use an account called Unearned Revenue.) Dec. 20 Collected $310 cash on account from a customer Dec. 31 Determined that wages of $10,700 were eamed but not yet paid on December 31 (ignore payrll taxes). Dec. 31 Adjusted the accounts at year-end, relating to iterest. Dec. 31 Adjusted the accounts at year-end, relating to rent. Required: 1. Prepare journal entries for each of the transactions through December 20. (If no entry is required fora transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the purchase of inventory for $24,500 on account. Note: Enter debits before credits Date General Journal Debit Credit January 08 ransactionevent, seleCL NO Journal Entry Required in the irst account Heid.) View transaction list Journal entry worksheet 2 4 Record the purchase of inventory for $24,500 on account. Note: Enter debits before credits. Date January 08 General Journal Credit Record entry Clear entry View general journal Prepare any adjusting entries required on December 31. (lf no entry is required for a ransactionlevent, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.) View transaction list Journal entry worksheet 3 Record the wages earned, but not yet paid as of December 31. Note: Enter debits before credits Date General Journal Debit Credit Docember 31 Record entry Clear entry View general journal 3. Show how all of the liabilities arising from these items are reported on the balance sheet at December 31. (Do not round intermediate calculations.) EZ CURB COMPANY Balance Sheet (partial) At December 31