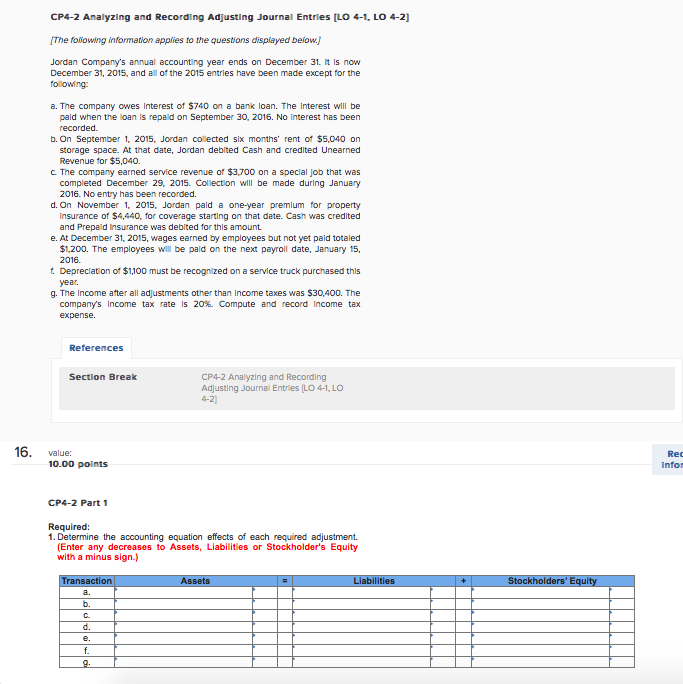

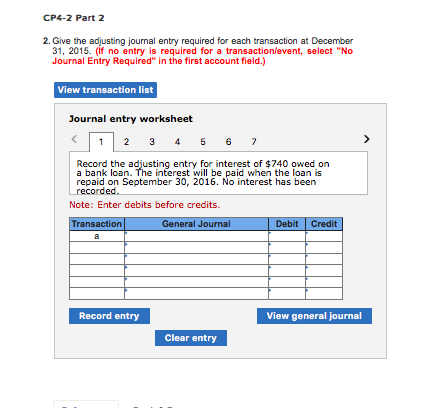

CP4-2 Analyzing and Recording Adjusting Journal Entries LO 4-1, LO 4-2] The tolowing information applies to the questions displayed below. Jordan Company's annual accounting year ends on December 31. It is now December 31, 2015, and al of the 2015 entries have been made except for the a. The company owes Interest of $740 on a bank loan. The Interest will be paid when the loan is repaid on September 30, 2016. No Interest has been b. On September 1, 2015, Jordan collected six months rent of $5,040 on storage space. At that date, Jordan debited Cash and credited Unearned Revenue for $5,040. C. The company earned service revenue of $3,700 on a special job that was completed December 29, 2015. Collection will be made during January 2016. No entry has been recorded. d. On Nowember , 2015, Jordan paid a one-year premium for property Insurance of $4,440, for coverage starting on that date. Cash was credited and Prepaid Insurance was debited for this amount e. At December 31, 2015, wages earned by employees but not yet paid totaled $1,200. The employees will be paid on the next payroll date, January 15, t. Depreclation of $1,100 must be recognized on a service truck purchased this g. The Income after all adjustments other than Income taxes was $30,400. The company's income tax rate is 20%. Compute and record income tax Section Break CP4-2 Analyzing and Recording Adjusting Journal Entries [LO 4-1, LO 4-2) 6 10.00 points CP4-2 Part 1 Required: 1. Determine the accounting equation effects of each required adjustment (Enter any decreases to Assets, Liabilities or Stockholder's Equity with a minus sign.) CP4-2 Part 2 2. Give the adjusting journal entry required for each transaction at December 31, 2015. ( no entry is required for a transaction event, select "No Journal Entry Required in the first account field.) View transaction list Journal entry worksheet 1 2345 6 7 Record the adjusting entry for interest of $740 owed on a bank loan. The interest will be paid when the loan is repaid on September 30, 2016. No interest has been recorded cuie. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry View general journal Clear entry