Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CPA Yolanda is the Best & Co engagement partner on the Casa Construction Company ( CCC ) audit supervised from the Santa Fe office of

CPA Yolanda is the Best & Co engagement partner on the Casa Construction Company CCC audit supervised from the Santa Fe office of the firm. Yolanda owns shares of CCCYesb. CPA Yolanda sold the CCC shares to CPA Javier, who is another partner in the Santa Fe office but who is not involved in the CCC audit.YesC. CPA Javier transferred ownership of the CCC shares to his wife.Yesd. CPA Javier's wife gave the shares to their yearold son.Yese. CPA Javier's son sold the shares to Javier's father.Nof. CPA Javier's father was happy to combine the CCC shares with shares he already owned because now he owns percent of CCC and can control many decisions of the board of directors.Yesg. CPA Javier's father declared personal bankruptcy and sold his CCC stock. CCC then hired him to fill the newly created position of director of financial reporting.When a CPA knows that a tax client has skimmed cash receipts and not reported the income in the federal income tax return but signs the return as a CPA who prepared the return, the CPA has violated which of the following AICPA Rules of Conduct?

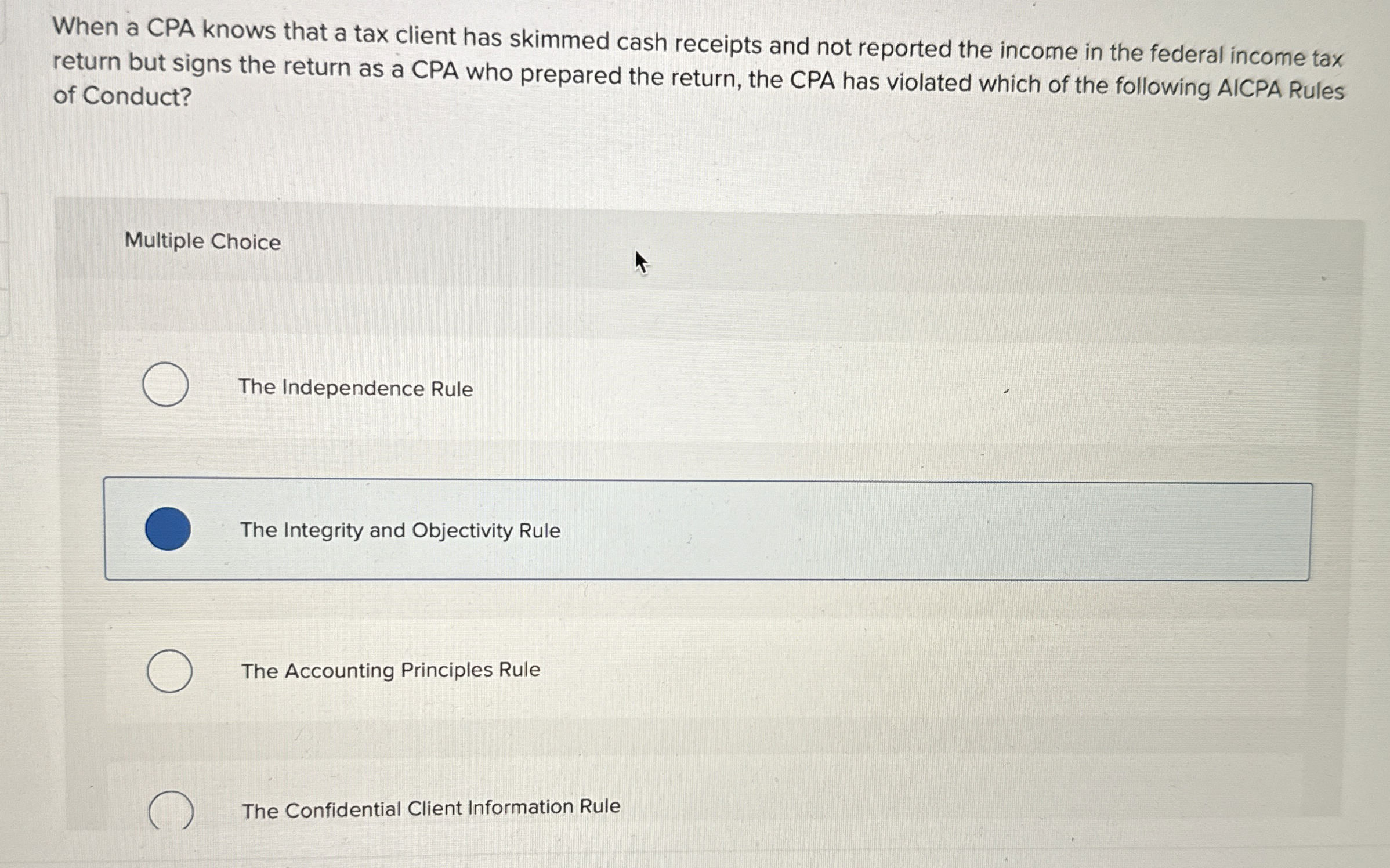

Multiple Choice

The Independence Rule

The Integrity and Objectivity Rule

The Accounting Principles Rule

The Confidential Client Information Rule

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started