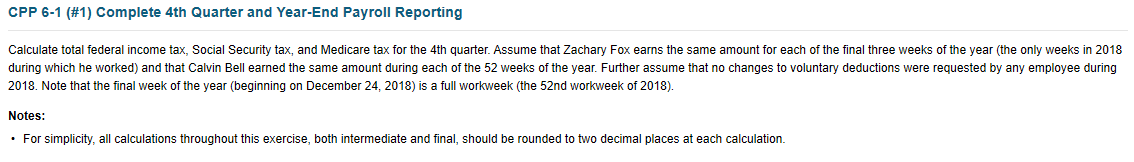

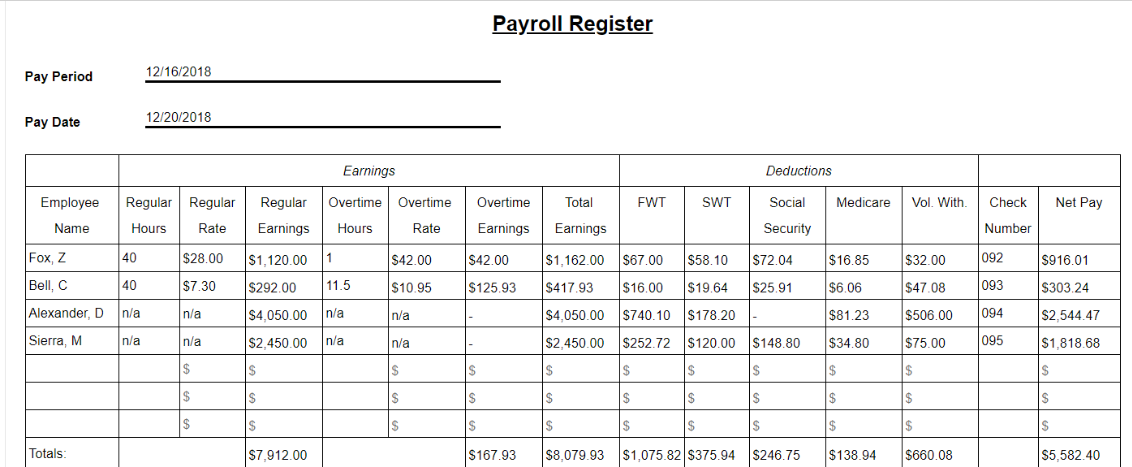

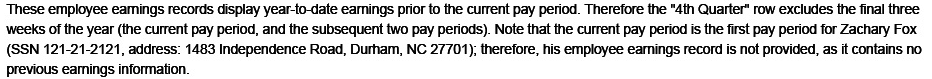

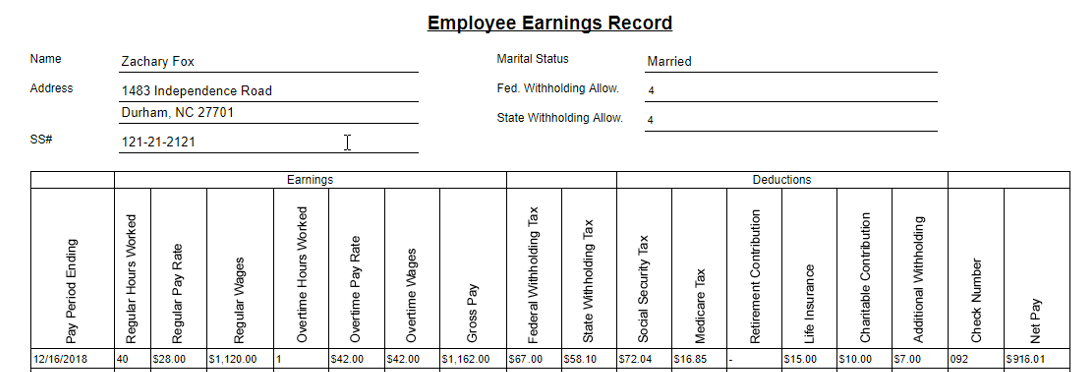

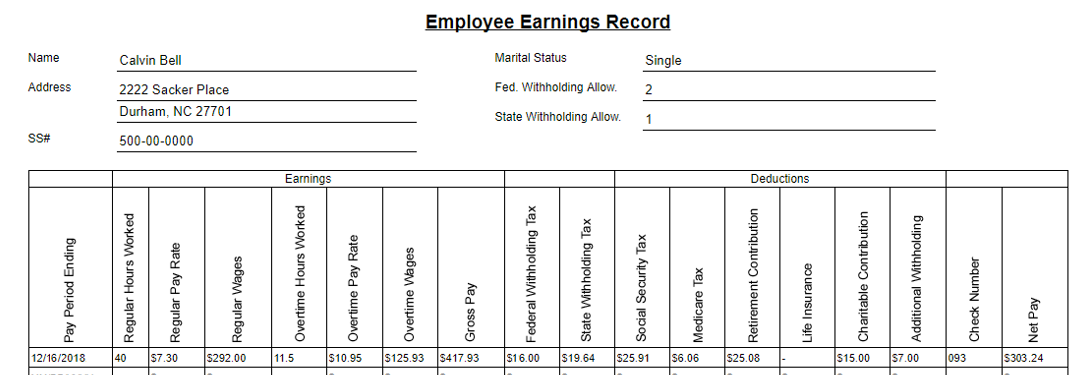

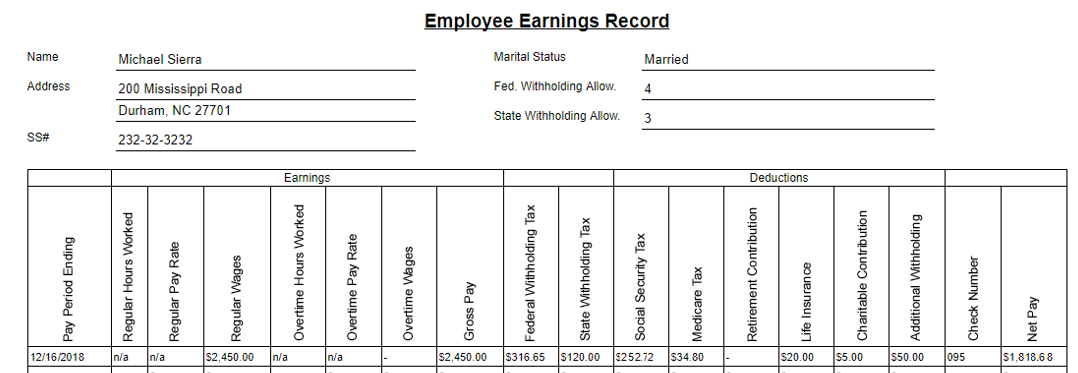

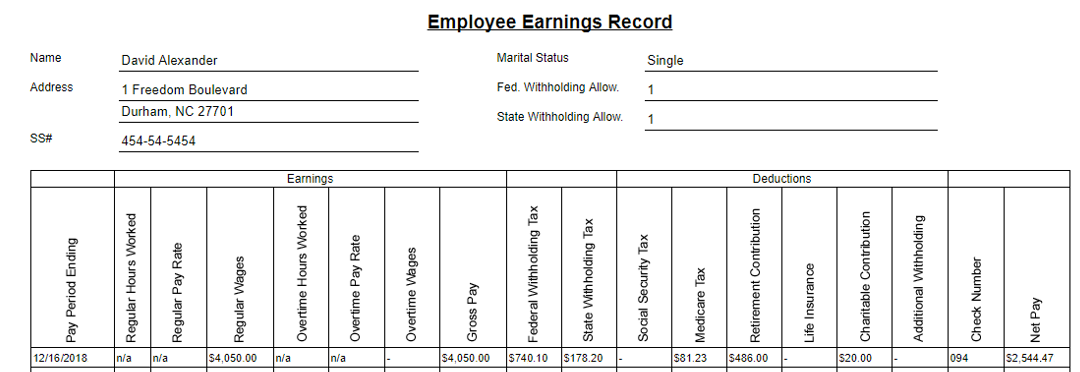

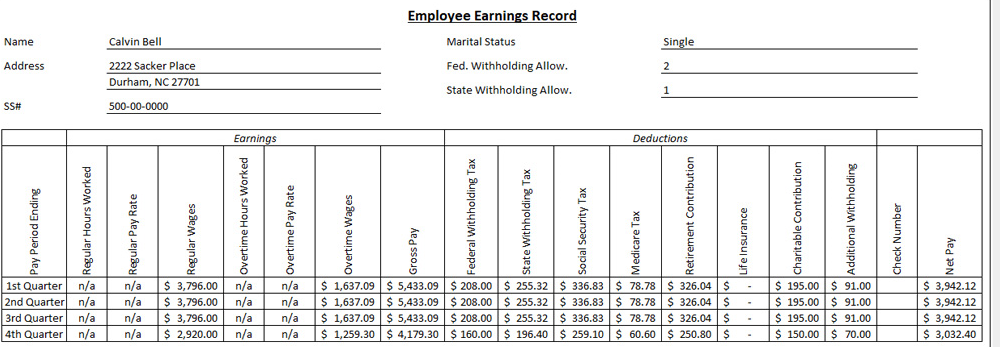

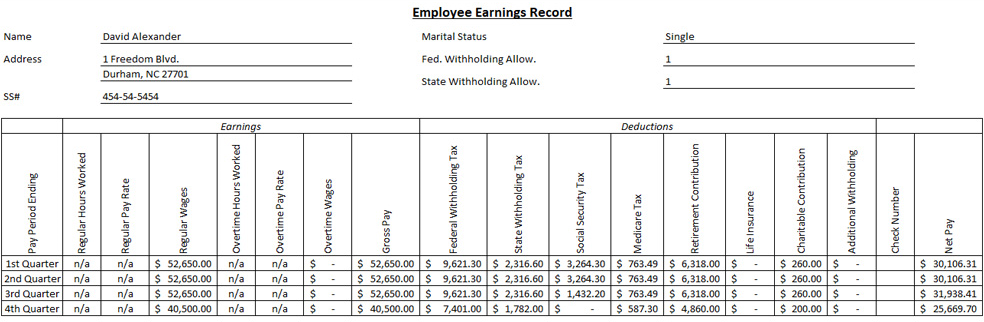

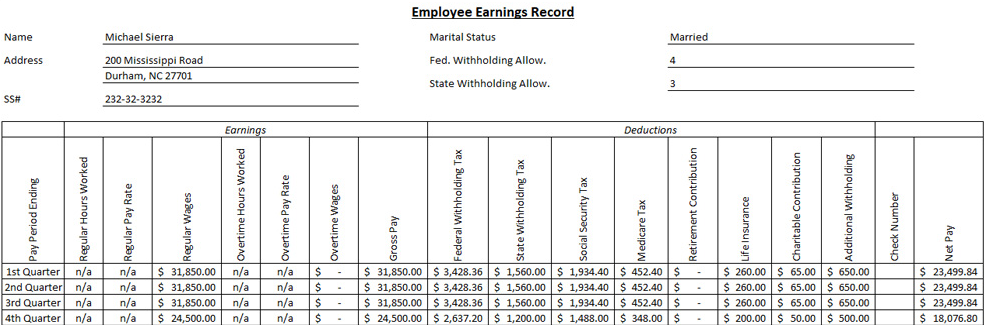

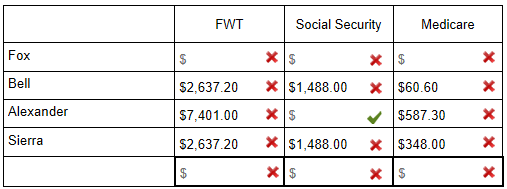

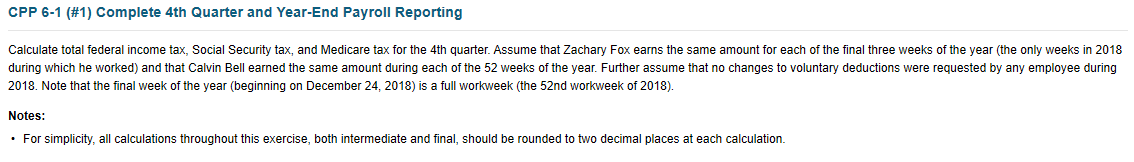

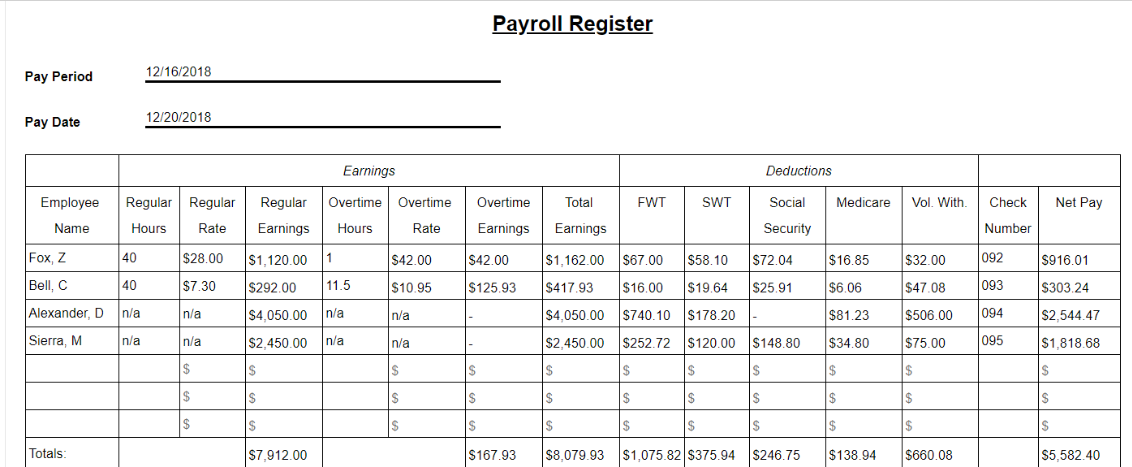

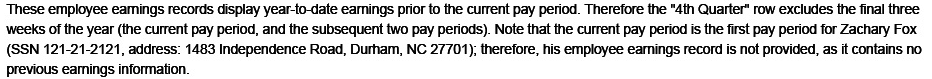

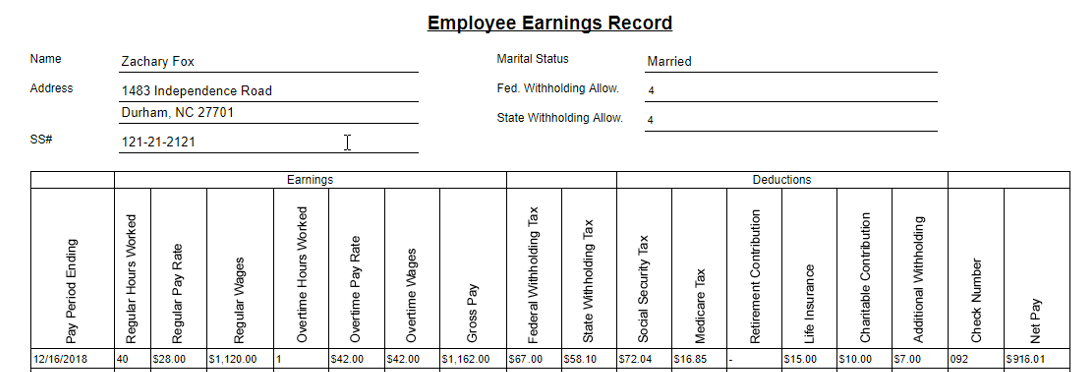

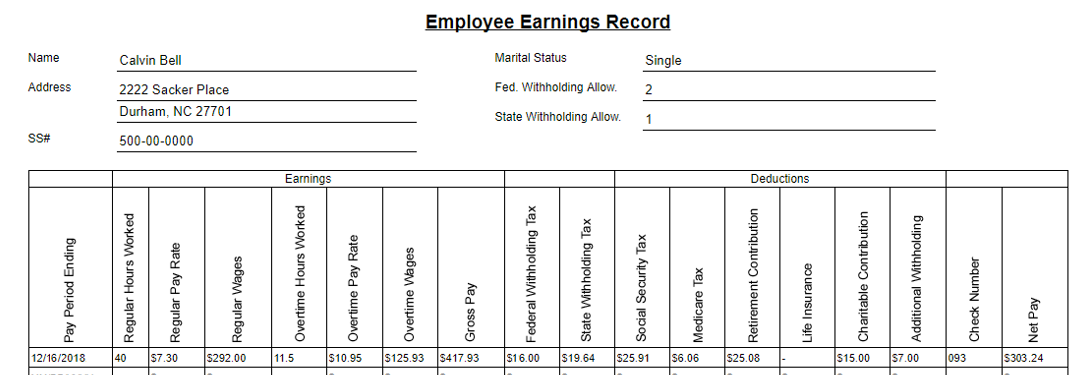

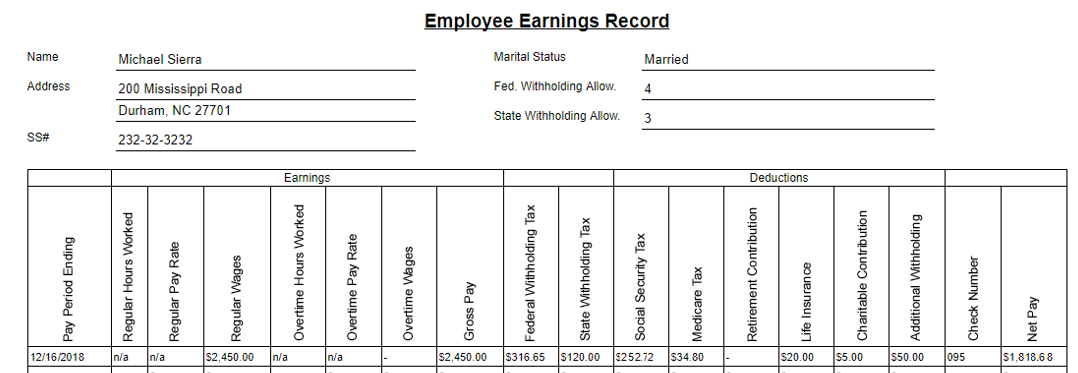

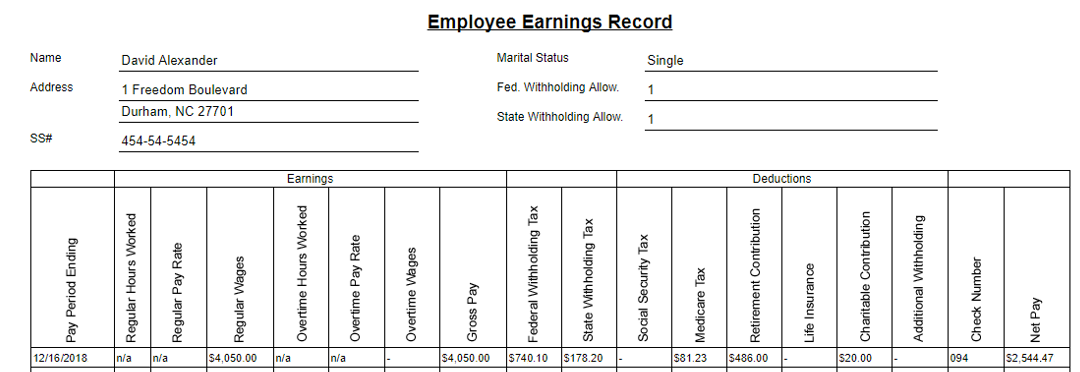

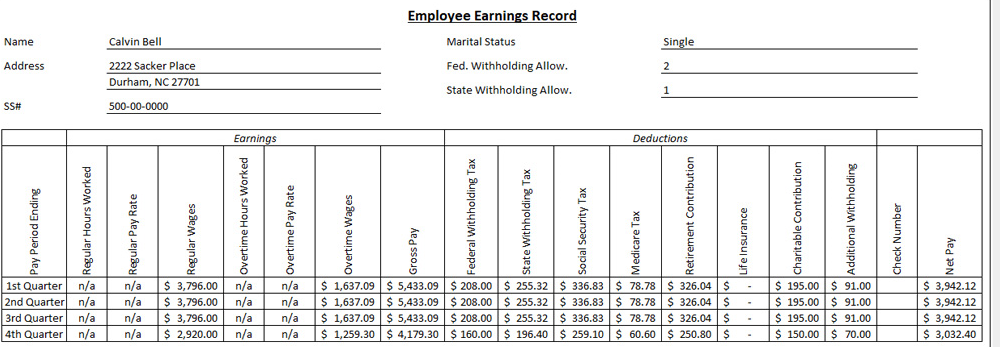

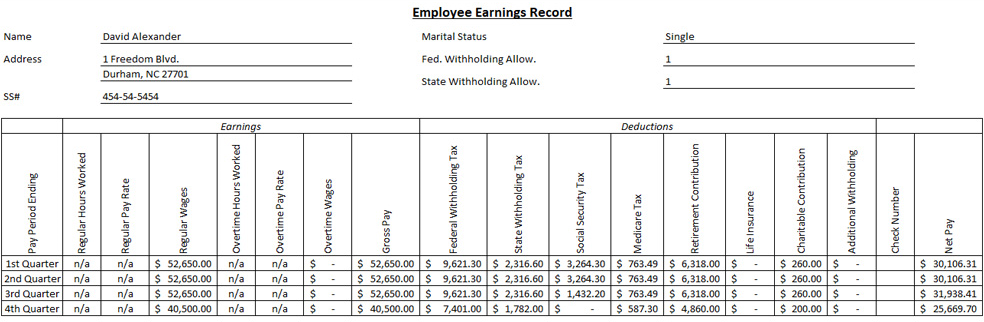

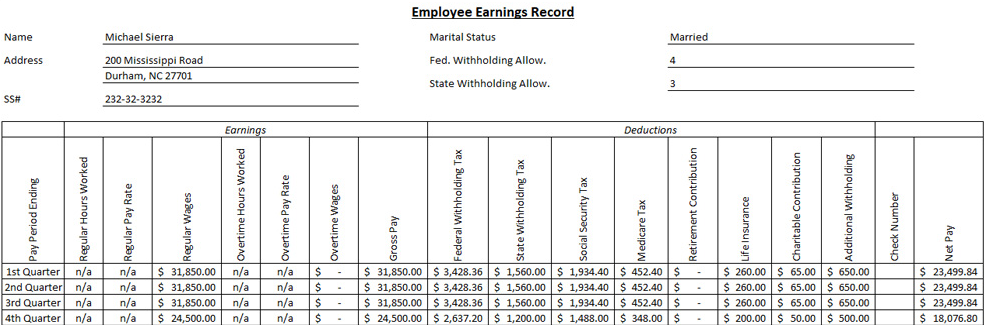

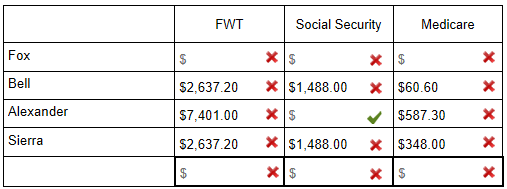

CPP 6-1 (#1) Complete 4th Quarter and Year-End Payroll Reporting Calculate total federal income tax, Social Security tax, and Medicare tax for the 4th quarter. Assume that Zachary Fox earns the same amount for each of the final three weeks of the year (the only weeks in 2018 during which he worked) and that Calvin Bell earned the same amount during each of the 52 weeks of the year. Further assume that no changes to voluntary deductions were requested by any employee during 2018. Note that the final week of the year (beginning on December 24, 2018) is a full workweek (the 52nd workweek of 2018). Notes: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. Payroll Register 12/16/2018 Pay Period 12/20/2018 Pay Date Earnings Deductions Regular Regular Vol. With Net Pay Employee Overtime Regular Overtime Overtime Total FWT SWT Social Medicare Check Security Name Hours Rate Earnings Hours Rate Earnings Earnings Number $1,162.00 $67.00 Fox, Z 40 $1,120.00 092 $28.00 1 $42.00 $42.00 $32.00 $16.85 $916.01 $58.10 $72.04 40 $7.30 093 $6.06 $303.24 Bell, C 11.5 $19.64 $47.08 $292.00 $10.95 $125.93 $417.93 $16,00 $25.91 Alexander, D n/a $4,050.00 S740.10 $178.20 $506.00 $81.23 n/a $4,050.00 n/a n/a 094 $2,544.47 $2,450.00 $252.72 $120.00 $75.00 Sierra, M n/a n/a 095 $2.450.00 n/a n/a $148.80 $34.80 $1.818.68 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $7,912.00 $167.93 $8,079.93$1,075.82 $375.94 $138.94 Totals: $660.08 S5,582.40 $246.75 These employee eamings records display year-to-date earnings prior to the current pay period. Therefore the "4th Quarter" row excludes the final three weeks of the year (the current pay period, and the subsequent two pay periods). Note that the current pay period is the first pay period for Zachary Fox (SSN 121-21-2121, address: 1483 Independence Road, Durham, NC 27701); therefore, his employee earnings record is not provided, as it contains no previous earnings information. Employee Earnings Record Marital Status Name Zachary Fox Married Fed. Withholding Allow. Address 1483 Independence Road Durham, NC 27701 State Withholding Allow. 4 sS# I 121-21-2121 Earnings Deductions $42.00 S1,162.00 s67.00 s58.10 S72.04 $16.85 S15.00 $10.00 40 $28.00 S1,120.00 S7.00 092 $42.00 $916.01 2/16/2018 Pay Period Ending Regular Hours Worked 8 Regular Pay Rate Regular Wages Overtime Hours Worked Overtime Pay Rate 8 Overtime Wages Gross Pay Federal Withh olding Tax State Withholding Tax Social Security Tax Medicare Tax Retirement Contribution Life Insurance Charitable Additional Withholding Check Number Net Pay Employee Earnings Record Marital Status Name Calvin Bell Single Address 2222 Sacker Place Fed. Withholding Allow. Durham, NC 27701 1 State Withholding Allow. sS# 500-00-0000 Earning Deductions $125.93 $417.93 11.5 $19.64 $25.91$6.06 12/16/2018 $7.3 $16.00 $25.08 S303.24 $10.95 Pay Period Ending Regular Hours Worked Regular Pay Rate 8 Regular Wages Overtime Hours Worked Overtime Pay Rate Overtime Wages Gross Pay 8Federal Withh olding Tax State Withholding Tax Social Security Tax Medicare Tax Retirement Contribution Life Insurance Charitable Contribution 8Additional Withholding Check Number Net Pay Employee Earnings Record Marital Status Name Michael Sierra Married Fed. Withholding Allow. Address 200 Mississippi Road Durham, NC 27701 State Withholding Allow. 3 SS# 232-32-3232 Deductions Earning: |$2,450.00 S316.65 $2,450.00 n/a $1,818.6 8 $120.00 252.72 20.00 Pay Period Ending Regular Hours Worked Regular Pay Rate Regular Wages Overtime Hours Worked Overtime Pay Rate Overtime Wages Gross Pay Federal Withholding Tax State Withholding Tax Social Security Tax Medicare Tax Retirement Contribution 520 Life Insurance Charitable Con trib ution 8Additional Withholding Check Number Net Pay Employee Earnings Record Marital Status Name David Alexander Single Address Fed. Withholding Allow. 1 Freedom Boulevard Durham. NC 27701 State Withholding Allow. 1 454-54-5454 Earnings Deductions $81.23 S486.00 $2,544,47 12/16/2018 $4,050.00 n/a S4,050.00 $740.10 S178.20 Pay Period Ending co Regular Hours Worked Regular Pay Rate Regular Wages Overtime Hours Worked Overtime Pay Rate Overtime Wages Gross Pay Federal Withh olding Tax State Withholding Tax Social Security Tax Medicare Tax Retirement Contribution Life Insurance 8Charitabl Additional Withholding 9 Check Number Net Pay Employee Earnings Record Calvin Bell Marital Status Single Name Address 2222 Sacker Place Fed. Withholding Allow. 2 Durham, NC 27701 State Withholding Allow. 1 SS# 500-00-0000 Earnings Deductions $ 3,796.00 $ 195.00 $ 91.00 $ 195.00 $ 91.00 $ 195.00 $ 91.00 $1,637.09 $ 5,433.09 $ 208.00 255.32 $336.83 78.78 326.04 $1,637.09 $ 5,433.09 $ 208.00 255.32 $336.83| $ 78.78 326.04 $ 1,637.09 $ 5,433.09 $208.00 255.32 336.83 $ 78.78 326.04 $ $ 1,259.30 $ 4,179.30 $160.00 196.40 259.10 $60.60 250.80 $ $ 3,942.12 $ 3,942.12 3,942.12 n/a 2nd Quarter n/a n/a n/a n/a n/a 1st Quarter n/a 3,796.00 n/a n/a n/a n/a 3rd Quarter $3,796.00 n/a n/a n/a $ 150.00 $70.00 n/a 3,032.40 4th Quarter 2,920.00 n/a Pay Period Ending Regular Hours Worked Regular Pay Rate Regular Wages vertime Hours Worked Overtie Pay Rate Overtime Wages Gross Pay Federal Withholding Tax $ State Withholding Tax Social Security Tax Medicare Tax Retirement Contribution ife Insurance Charitable Contribution Additional Withholding Check Number Employee Earnings Record David Alexander Marital Status Name Single Fed. Withholding Allow. Address 1 Freedom Blvd. 1 Durham, NC 27701 State Withholding Allow 1 SS# 454-54-5454 Earnings Deductions $ 260.00 $ $260.00 $ 260.00 $- 200.00 $ n/a n/a n/a n/a n/a $ $ . $ - $ 52,650.00 S 9,621.30 S 2,316.60 S3,264.30 S 763.49 S 6,318.00S $52,650.00 $ 9,621.30 $ 2,316.60 3,264.30 763.49 6,318.00 $ 52,650.00 $ 9,621.30 $ 2,316.60 1,432.20 763.49 6,318.00 $ 40,500.00 $ 7,401.00 $ 1,782.00 $ 1st Quarter n/a 52,650.00 n/a n/a 30,106.31 2nd Quarter n/a n/a n/a n/a 40,500.00 52,650.00 $52,650.00 30,106.31 3rd Quarter n/a n/a 31,938.41 n/a 4th Quarter n/a 587.30 4,860.00 $ $ 25,669.70 Period Ending Regular Hours Worked Regular Pay Rate Regular Wages OvertimeHours Worked OvertimePay Rate Overtime Wages Gross Pay Federal Withholding Ta Social Security Tax $ Medicare Tax Retirement Contribution Life Insurance Charitable Contribution Additional Withholding Check Number Employee Earnings Record Michael Sierra Marital Status Name Married Address 200 Mississippi Road Fed. Withholding Allow. 4 Durham, NC 27701 State Withholding Allow. SS# 232-32-3232 Earnings Deductions 1st Quarter n/a $ 31,850.00 $ 260.00 65.00 $650.00 260.00 65.00 650.00 260.00 65.00 650.00 $ 200.00 $50.00 $500.00 31,850.00 $ 3,428.36 1,560.00 1,934.40 452.40 $ 31,850.00 $ 3,428.36 $1,560.00 $1,934.40 $452.40 $ 31,850.00 $ 3,428.36 $1,560.00 $1,934.40 $452.40 $ $ 24,500.00 $ 2,637.20 1,200.00 $1,488.00 348.00 $ n/a n/a n/a $ n/a $23,499.84 23,499.84 2nd Quarter n/a 3rd Quarter n/a n/a $31,850.00 n/a n/a n/a $31,850.00 n/a n/a n/a 23,499.84 4th Quarter n/a $ 24,500.00 n/a $18,076.80 ay Period Ending Regular Hours Worked Regular Pay Rate Regular Wages ertime Pay Rate vertime Wages Gross Pay ederal Withholding Tax State Withholding Tax ial Security Tax Medicare Tax Retirement Contribution Life Insurance haritable Contribution heck Number Social Security FWT Medicare Fox Bell $1,488.00 $60.60 $2,637.20 Alexander $7,401.00 $587.30 Sierra $1,488.00 $348.00 S2,637.20 $ CPP 6-1 (#1) Complete 4th Quarter and Year-End Payroll Reporting Calculate total federal income tax, Social Security tax, and Medicare tax for the 4th quarter. Assume that Zachary Fox earns the same amount for each of the final three weeks of the year (the only weeks in 2018 during which he worked) and that Calvin Bell earned the same amount during each of the 52 weeks of the year. Further assume that no changes to voluntary deductions were requested by any employee during 2018. Note that the final week of the year (beginning on December 24, 2018) is a full workweek (the 52nd workweek of 2018). Notes: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. Payroll Register 12/16/2018 Pay Period 12/20/2018 Pay Date Earnings Deductions Regular Regular Vol. With Net Pay Employee Overtime Regular Overtime Overtime Total FWT SWT Social Medicare Check Security Name Hours Rate Earnings Hours Rate Earnings Earnings Number $1,162.00 $67.00 Fox, Z 40 $1,120.00 092 $28.00 1 $42.00 $42.00 $32.00 $16.85 $916.01 $58.10 $72.04 40 $7.30 093 $6.06 $303.24 Bell, C 11.5 $19.64 $47.08 $292.00 $10.95 $125.93 $417.93 $16,00 $25.91 Alexander, D n/a $4,050.00 S740.10 $178.20 $506.00 $81.23 n/a $4,050.00 n/a n/a 094 $2,544.47 $2,450.00 $252.72 $120.00 $75.00 Sierra, M n/a n/a 095 $2.450.00 n/a n/a $148.80 $34.80 $1.818.68 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $7,912.00 $167.93 $8,079.93$1,075.82 $375.94 $138.94 Totals: $660.08 S5,582.40 $246.75 These employee eamings records display year-to-date earnings prior to the current pay period. Therefore the "4th Quarter" row excludes the final three weeks of the year (the current pay period, and the subsequent two pay periods). Note that the current pay period is the first pay period for Zachary Fox (SSN 121-21-2121, address: 1483 Independence Road, Durham, NC 27701); therefore, his employee earnings record is not provided, as it contains no previous earnings information. Employee Earnings Record Marital Status Name Zachary Fox Married Fed. Withholding Allow. Address 1483 Independence Road Durham, NC 27701 State Withholding Allow. 4 sS# I 121-21-2121 Earnings Deductions $42.00 S1,162.00 s67.00 s58.10 S72.04 $16.85 S15.00 $10.00 40 $28.00 S1,120.00 S7.00 092 $42.00 $916.01 2/16/2018 Pay Period Ending Regular Hours Worked 8 Regular Pay Rate Regular Wages Overtime Hours Worked Overtime Pay Rate 8 Overtime Wages Gross Pay Federal Withh olding Tax State Withholding Tax Social Security Tax Medicare Tax Retirement Contribution Life Insurance Charitable Additional Withholding Check Number Net Pay Employee Earnings Record Marital Status Name Calvin Bell Single Address 2222 Sacker Place Fed. Withholding Allow. Durham, NC 27701 1 State Withholding Allow. sS# 500-00-0000 Earning Deductions $125.93 $417.93 11.5 $19.64 $25.91$6.06 12/16/2018 $7.3 $16.00 $25.08 S303.24 $10.95 Pay Period Ending Regular Hours Worked Regular Pay Rate 8 Regular Wages Overtime Hours Worked Overtime Pay Rate Overtime Wages Gross Pay 8Federal Withh olding Tax State Withholding Tax Social Security Tax Medicare Tax Retirement Contribution Life Insurance Charitable Contribution 8Additional Withholding Check Number Net Pay Employee Earnings Record Marital Status Name Michael Sierra Married Fed. Withholding Allow. Address 200 Mississippi Road Durham, NC 27701 State Withholding Allow. 3 SS# 232-32-3232 Deductions Earning: |$2,450.00 S316.65 $2,450.00 n/a $1,818.6 8 $120.00 252.72 20.00 Pay Period Ending Regular Hours Worked Regular Pay Rate Regular Wages Overtime Hours Worked Overtime Pay Rate Overtime Wages Gross Pay Federal Withholding Tax State Withholding Tax Social Security Tax Medicare Tax Retirement Contribution 520 Life Insurance Charitable Con trib ution 8Additional Withholding Check Number Net Pay Employee Earnings Record Marital Status Name David Alexander Single Address Fed. Withholding Allow. 1 Freedom Boulevard Durham. NC 27701 State Withholding Allow. 1 454-54-5454 Earnings Deductions $81.23 S486.00 $2,544,47 12/16/2018 $4,050.00 n/a S4,050.00 $740.10 S178.20 Pay Period Ending co Regular Hours Worked Regular Pay Rate Regular Wages Overtime Hours Worked Overtime Pay Rate Overtime Wages Gross Pay Federal Withh olding Tax State Withholding Tax Social Security Tax Medicare Tax Retirement Contribution Life Insurance 8Charitabl Additional Withholding 9 Check Number Net Pay Employee Earnings Record Calvin Bell Marital Status Single Name Address 2222 Sacker Place Fed. Withholding Allow. 2 Durham, NC 27701 State Withholding Allow. 1 SS# 500-00-0000 Earnings Deductions $ 3,796.00 $ 195.00 $ 91.00 $ 195.00 $ 91.00 $ 195.00 $ 91.00 $1,637.09 $ 5,433.09 $ 208.00 255.32 $336.83 78.78 326.04 $1,637.09 $ 5,433.09 $ 208.00 255.32 $336.83| $ 78.78 326.04 $ 1,637.09 $ 5,433.09 $208.00 255.32 336.83 $ 78.78 326.04 $ $ 1,259.30 $ 4,179.30 $160.00 196.40 259.10 $60.60 250.80 $ $ 3,942.12 $ 3,942.12 3,942.12 n/a 2nd Quarter n/a n/a n/a n/a n/a 1st Quarter n/a 3,796.00 n/a n/a n/a n/a 3rd Quarter $3,796.00 n/a n/a n/a $ 150.00 $70.00 n/a 3,032.40 4th Quarter 2,920.00 n/a Pay Period Ending Regular Hours Worked Regular Pay Rate Regular Wages vertime Hours Worked Overtie Pay Rate Overtime Wages Gross Pay Federal Withholding Tax $ State Withholding Tax Social Security Tax Medicare Tax Retirement Contribution ife Insurance Charitable Contribution Additional Withholding Check Number Employee Earnings Record David Alexander Marital Status Name Single Fed. Withholding Allow. Address 1 Freedom Blvd. 1 Durham, NC 27701 State Withholding Allow 1 SS# 454-54-5454 Earnings Deductions $ 260.00 $ $260.00 $ 260.00 $- 200.00 $ n/a n/a n/a n/a n/a $ $ . $ - $ 52,650.00 S 9,621.30 S 2,316.60 S3,264.30 S 763.49 S 6,318.00S $52,650.00 $ 9,621.30 $ 2,316.60 3,264.30 763.49 6,318.00 $ 52,650.00 $ 9,621.30 $ 2,316.60 1,432.20 763.49 6,318.00 $ 40,500.00 $ 7,401.00 $ 1,782.00 $ 1st Quarter n/a 52,650.00 n/a n/a 30,106.31 2nd Quarter n/a n/a n/a n/a 40,500.00 52,650.00 $52,650.00 30,106.31 3rd Quarter n/a n/a 31,938.41 n/a 4th Quarter n/a 587.30 4,860.00 $ $ 25,669.70 Period Ending Regular Hours Worked Regular Pay Rate Regular Wages OvertimeHours Worked OvertimePay Rate Overtime Wages Gross Pay Federal Withholding Ta Social Security Tax $ Medicare Tax Retirement Contribution Life Insurance Charitable Contribution Additional Withholding Check Number Employee Earnings Record Michael Sierra Marital Status Name Married Address 200 Mississippi Road Fed. Withholding Allow. 4 Durham, NC 27701 State Withholding Allow. SS# 232-32-3232 Earnings Deductions 1st Quarter n/a $ 31,850.00 $ 260.00 65.00 $650.00 260.00 65.00 650.00 260.00 65.00 650.00 $ 200.00 $50.00 $500.00 31,850.00 $ 3,428.36 1,560.00 1,934.40 452.40 $ 31,850.00 $ 3,428.36 $1,560.00 $1,934.40 $452.40 $ 31,850.00 $ 3,428.36 $1,560.00 $1,934.40 $452.40 $ $ 24,500.00 $ 2,637.20 1,200.00 $1,488.00 348.00 $ n/a n/a n/a $ n/a $23,499.84 23,499.84 2nd Quarter n/a 3rd Quarter n/a n/a $31,850.00 n/a n/a n/a $31,850.00 n/a n/a n/a 23,499.84 4th Quarter n/a $ 24,500.00 n/a $18,076.80 ay Period Ending Regular Hours Worked Regular Pay Rate Regular Wages ertime Pay Rate vertime Wages Gross Pay ederal Withholding Tax State Withholding Tax ial Security Tax Medicare Tax Retirement Contribution Life Insurance haritable Contribution heck Number Social Security FWT Medicare Fox Bell $1,488.00 $60.60 $2,637.20 Alexander $7,401.00 $587.30 Sierra $1,488.00 $348.00 S2,637.20 $