Answered step by step

Verified Expert Solution

Question

1 Approved Answer

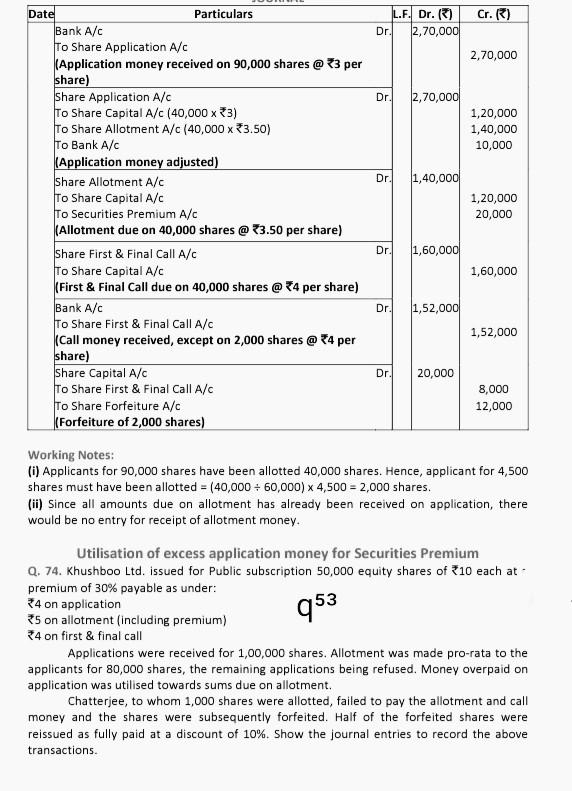

Cr.) L.F. Dr. (3) Dr. 2,70,000 2,70,000 Dr. 2,70,000 1,20,000 1,40,000 10,000 Dr. 1,40,000 Date Particulars Bank A/C To Share Application A/c (Application money received

Cr.) L.F. Dr. (3) Dr. 2,70,000 2,70,000 Dr. 2,70,000 1,20,000 1,40,000 10,000 Dr. 1,40,000 Date Particulars Bank A/C To Share Application A/c (Application money received on 90,000 shares @ 83 per share) Share Application A/C To Share Capital A/c (40,000 x 33) To Share Allotment A/c (40,000 x 33.50) To Bank A/c (Application money adjusted) Share Allotment A/c To Share Capital A/C To Securities Premium A/c (Allotment due on 40,000 shares @ 73.50 per share) Share First & Final Call A/c To Share Capital Alc (First & Final Call due on 40,000 shares @ 84 per share) Bank A/C To Share First & Final Call A/C (Call money received, except on 2,000 shares @ 4 per share) Share Capital A/C To Share First & Final Call A/C To Share Forfeiture A/C (Forfeiture of 2,000 shares) 1,20,000 20,000 Dr. 1,60,000 1,60,000 Dr. 1,52,000 1,52,000 Dr. 20,000 8,000 12,000 Working Notes: (i) Applicants for 90,000 shares have been allotted 40,000 shares. Hence, applicant for 4,500 shares must have been allotted = (40,000 + 60,000) * 4,500 = 2,000 shares. (ii) Since all amounts due on allotment has already been received on application, there would be no entry for receipt of allotment money. Utilisation of excess application money for Securities Premium Q. 74. Khushboo Ltd. issued for Public subscription 50,000 equity shares of 10 each at premium of 30% payable as under: 34 on application q53 35 on allotment (including premium) 34 on first & final call Applications were received for 1,00,000 shares. Allotment was made pro-rata to the applicants for 80,000 shares, the remaining applications being refused. Money overpaid on application was utilised towards sums due on allotment Chatterjee, to whom 1,000 shares were allotted, failed to pay the allotment and call money and the shares were subsequently forfeited. Half of the forfeited shares were reissued as fully paid at a discount of 10%. Show the journal entries to record the above transactions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started