Question

Craig is a business owner, and has a universal life policy with a level face death benefit of $100,000 . He has named his brother

Craig is a business owner, and has a universal life policy with a level face death benefit of

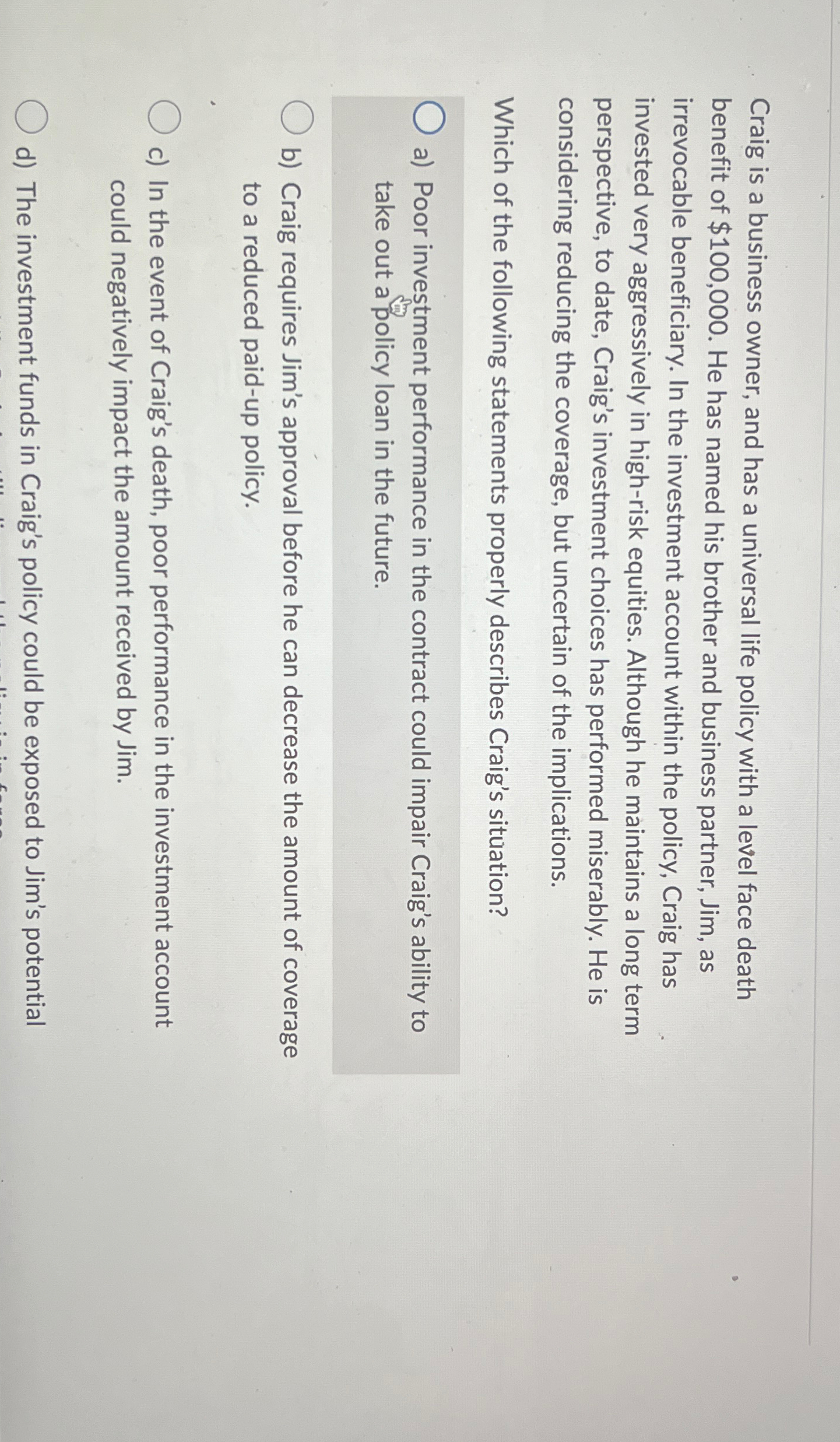

$100,000. He has named his brother and business partner, Jim, as irrevocable beneficiary. In the investment account within the policy, Craig has invested very aggressively in high-risk equities. Although he maintains a long term perspective, to date, Craig's investment choices has performed miserably. He is considering reducing the coverage, but uncertain of the implications.\ Which of the following statements properly describes Craig's situation?\ a) Poor investment performance in the contract could impair Craig's ability to take out a policy loan in the future.\ b) Craig requires Jim's approval before he can decrease the amount of coverage to a reduced paid-up policy.\ c) In the event of Craig's death, poor performance in the investment account could negatively impact the amount received by Jim.\ d) The investment funds in Craig's policy could be exposed to Jim's potential

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started