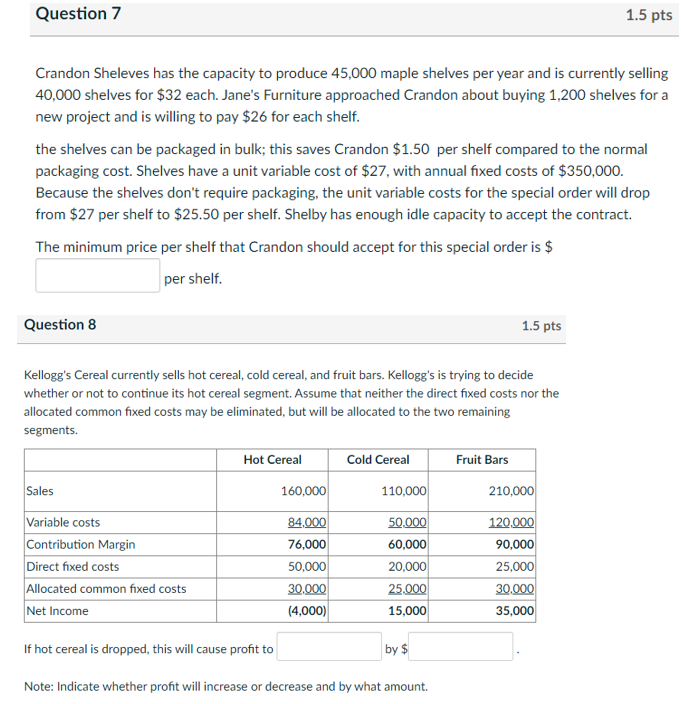

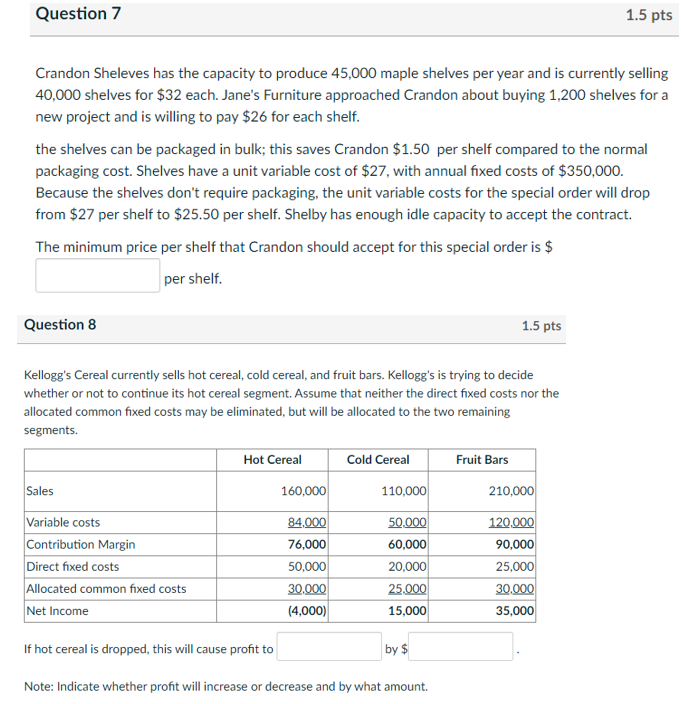

Crandon Sheleves has the capacity to produce 45,000 maple shelves per year and is currently selling 40,000 shelves for $32 each. Jane's Furniture approached Crandon about buying 1,200 shelves for a new project and is willing to pay $26 for each shelf. the shelves can be packaged in bulk; this saves Crandon $1.50 per shelf compared to the normal packaging cost. Shelves have a unit variable cost of $27, with annual fixed costs of $350,000. Because the shelves don't require packaging, the unit variable costs for the special order will drop from $27 per shelf to $25.50 per shelf. Shelby has enough idle capacity to accept the contract. The minimum price per shelf that Crandon should accept for this special order is $ per shelf. Question 8 Kellogg's Cereal currently sells hot cereal, cold cereal, and fruit bars. Kellogg's is trying to decide whether or not to continue its hot cereal segment. Assume that neither the direct fixed costs nor the allocated common fixed costs may be eliminated, but will be allocated to the two remaining segments. If hot cereal is dropped, this will cause profit to by $ Note: Indicate whether profit will increase or decrease and by what amount. Crandon Sheleves has the capacity to produce 45,000 maple shelves per year and is currently selling 40,000 shelves for $32 each. Jane's Furniture approached Crandon about buying 1,200 shelves for a new project and is willing to pay $26 for each shelf. the shelves can be packaged in bulk; this saves Crandon $1.50 per shelf compared to the normal packaging cost. Shelves have a unit variable cost of $27, with annual fixed costs of $350,000. Because the shelves don't require packaging, the unit variable costs for the special order will drop from $27 per shelf to $25.50 per shelf. Shelby has enough idle capacity to accept the contract. The minimum price per shelf that Crandon should accept for this special order is $ per shelf. Question 8 Kellogg's Cereal currently sells hot cereal, cold cereal, and fruit bars. Kellogg's is trying to decide whether or not to continue its hot cereal segment. Assume that neither the direct fixed costs nor the allocated common fixed costs may be eliminated, but will be allocated to the two remaining segments. If hot cereal is dropped, this will cause profit to by $ Note: Indicate whether profit will increase or decrease and by what amount