Answered step by step

Verified Expert Solution

Question

1 Approved Answer

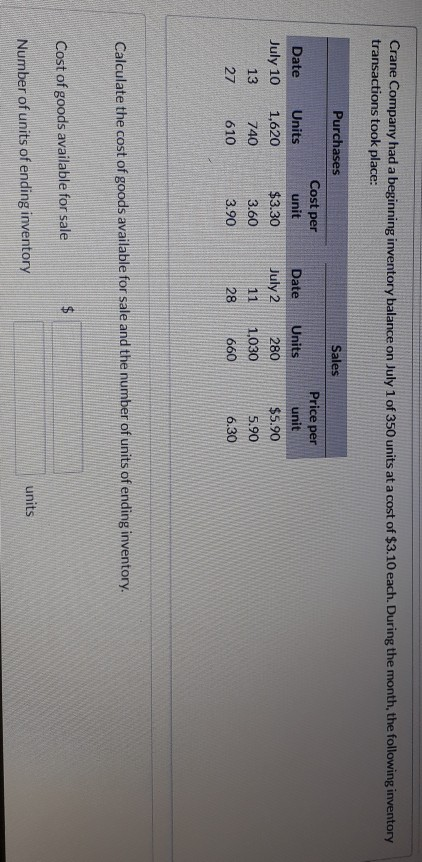

Crane Company had a beginning inventory balance on July 1 of 350 units at a cost of $3.10 each. During the month, the following inventory

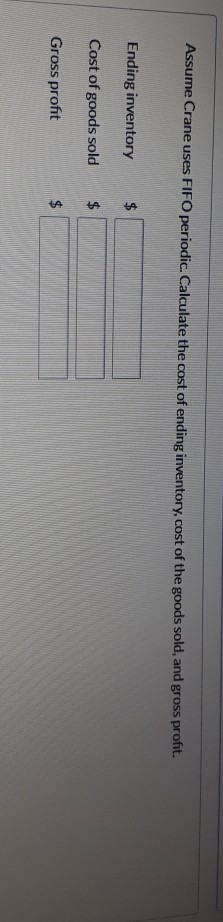

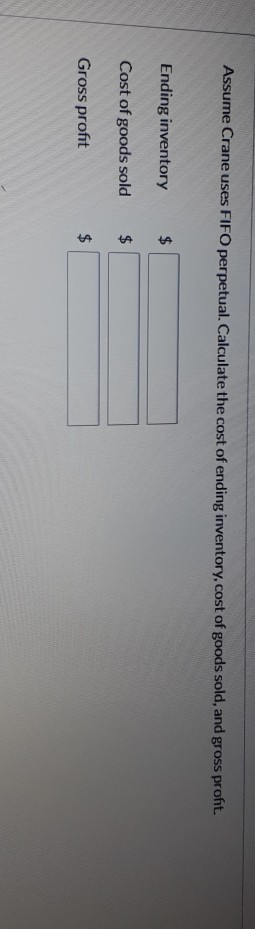

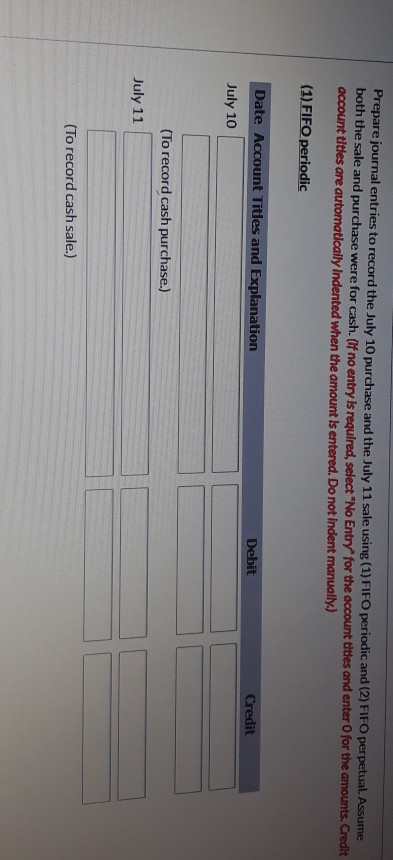

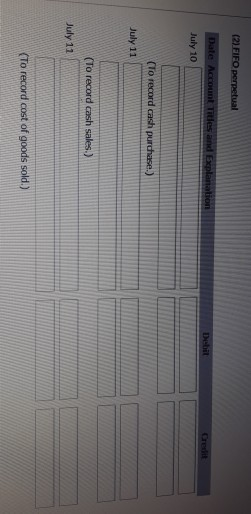

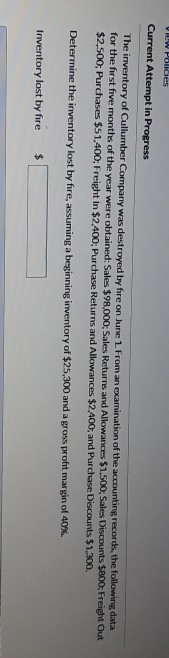

Crane Company had a beginning inventory balance on July 1 of 350 units at a cost of $3.10 each. During the month, the following inventory transactions took place: Purchases Sales Cost per Price per unit unit Units Date July 10 13 Units 1,620 740 Date July 2 11 $3.30 3.60 280 $5.90 5.90 1,030 27 610 3.90 28 660 6.30 Calculate the cost of goods available for sale and the number of units of ending inventory. Cost of goods available for sale $ units Number of units of ending inventory Assume Crane uses FIFO periodic. Calculate the cost of ending inventory, cost of the goods sold, and gross profit. Ending inventory $ Cost of goods sold $ Gross profit Assume Crane uses FIFO perpetual. Calculate the cost of ending inventory, cost of goods sold, and gross profit. Ending inventory $ Cost of goods sold $ Gross profit $ Prepare journal entries to record the July 10 purchase and the July 11 sale using (1) FIFO periodic and (2) FIFO perpetual. Assume both the sale and purchase were for cash. (If no entry is required, select "No Entry" for the account titles and enter for the amounts. Credit account titles are automatically Indented when the amount is entered. Do not Indent manually.) (1) FIFO periodic Date Account Titles and Explanation Debit Credit July 10 (To record cash purchase.) July 11 (To record cash sale.) (2) FIFO perpetual Date Account Titles and Explanation July 10 Credit (to record cash purchase.) July 11 (To record cash sales.) July 11 (To record cost of goods sold.) VIUW Policies Current Attempt in Progress The inventory of Cullumber Company was destroyed by fire on June 1. From an examination of the accounting records, the following data for the first five months of the year were obtained: Sales $98,000, Sales Returns and Allowances $1.500, Sales Discounts $800: Freight Out $2,500, Purchases $51,400, Freight in $2,400; Purchase Returns and Allowances $2.400, and Purchase Discounts $1,300. Determine the inventory lost by fire, assuming a beginning inventory of $25,300 and a gross profit margin of 40% Inventory lost by fire $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started