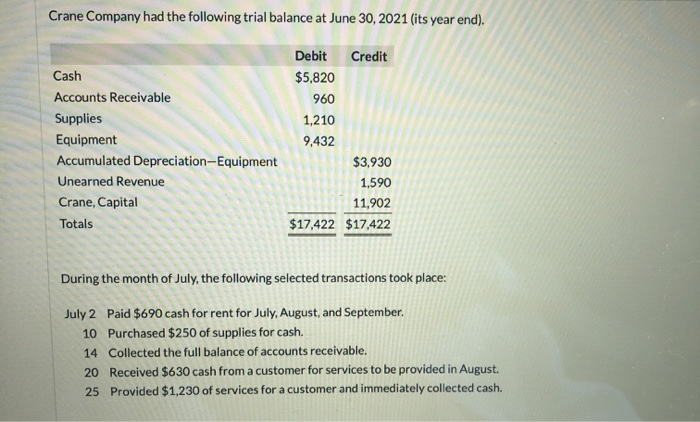

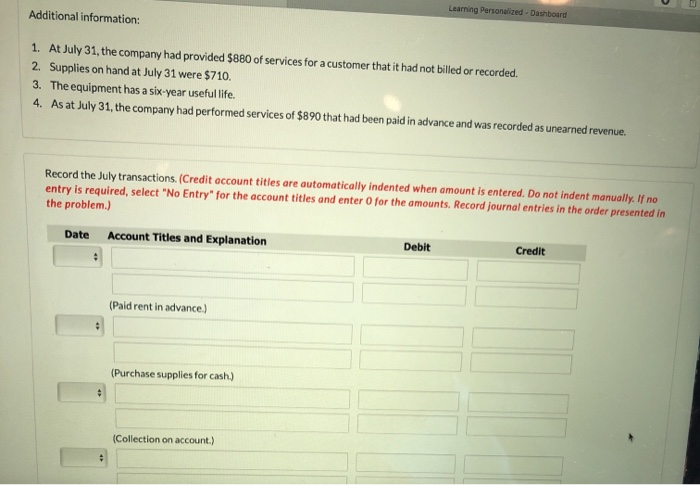

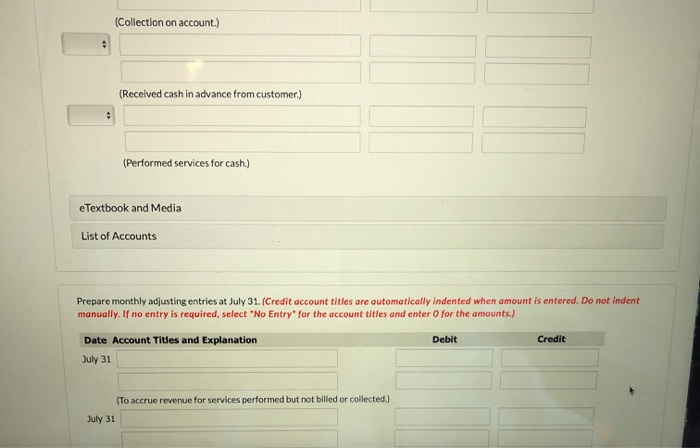

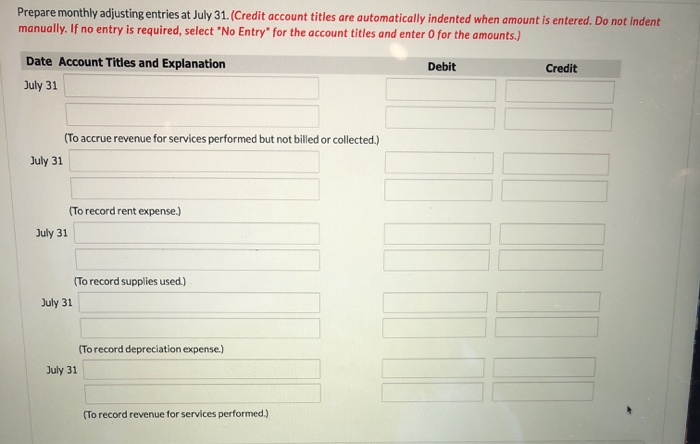

Crane Company had the following trial balance at June 30, 2021 (its year end). Cash Accounts Receivable Supplies Equipment Accumulated Depreciation-Equipment Unearned Revenue Crane, Capital Totals Debit Credit $5,820 960 1,210 9,432 $3,930 1,590 11,902 $17,422 $17,422 During the month of July, the following selected transactions took place: July 2 Paid $690 cash for rent for July, August, and September 10 Purchased $250 of supplies for cash. 14 Collected the full balance of accounts receivable. 20 Received $630 cash from a customer for services to be provided in August. 25 Provided $1,230 of services for a customer and immediately collected cash. Learning Personalized - Dashboard Additional information: 1. At July 31, the company had provided 5880 of services for a customer that it had not billed or recorded. 2. Supplies on hand at July 31 were $710. 3. The equipment has a six-year useful life. 4. As at July 31, the company had performed services of $890 that had been paid in advance and was recorded as unearned revenue. Record the July transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit (Paid rent in advance (Purchase supplies for cash) (Collection on account.) (Collection on account.) (Received cash in advance from customer.) (Performed services for cash.) eTextbook and Media List of Accounts Prepare monthly adjusting entries at July 31. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter o for the amounts.) Debit Credit Date Account Titles and Explanation July 31 (To accrue revenue for services performed but not billed or collected.) July 31 Prepare monthly adjusting entries at July 31. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation July 31 (To accrue revenue for services performed but not billed or collected.) July 31 (To record rent expense.) July 31 (To record supplies used.) July 31 (To record depreciation expense.) July 31 (To record revenue for services performed.)