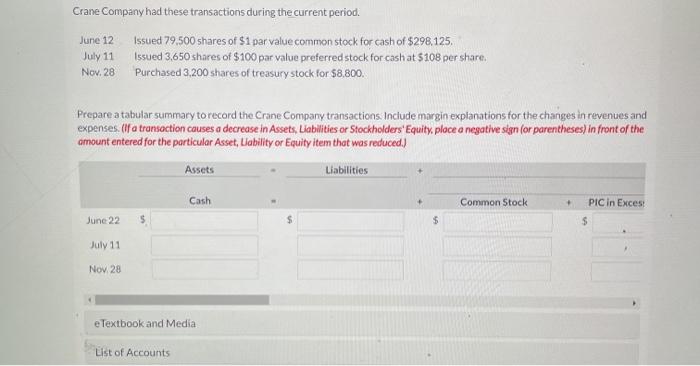

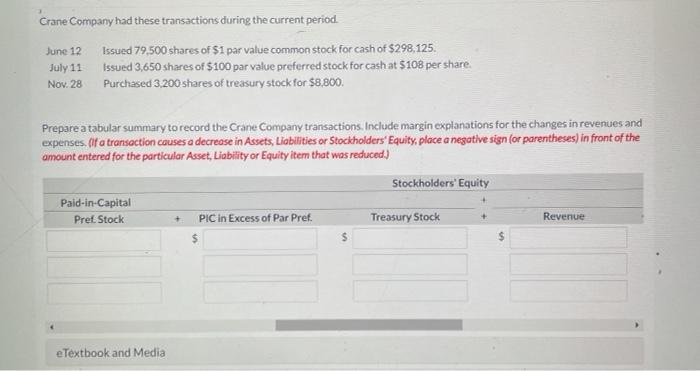

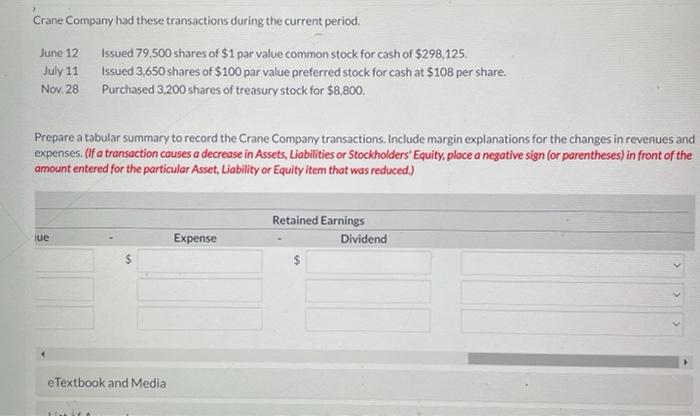

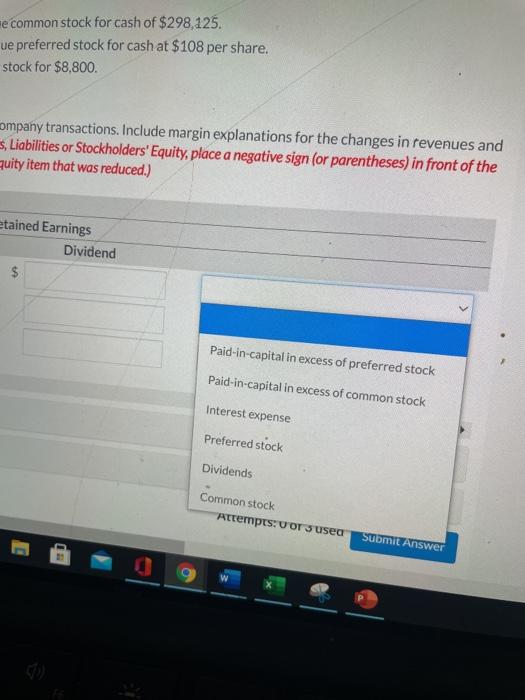

Crane Company had these transactions during the current period. June 12 issued 79,500 shares of $1 par value common stock for cash of $298,125, July 11 Issued 3,650 shares of $100 par value preferred stock for cash at $108 per share. Nov. 28 Purchased 3.200 shares of treasury stock for $8,800. Prepare a tabular summary to record the Crane Company transactions. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign for parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Assets Liabilities Cash Common Stock PIC in Excest June 22 $ $ July 11 Nov 28 e Textbook and Media List of Accounts Crane Company had these transactions during the current period. June 12 Issued 79.500 shares of $1 par value common stock for cash of $298,125. July 11 Issued 3,650 shares of $100 par value preferred stock for cash at $108 per share Nov. 28 Purchased 3.200 shares of treasury stock for $8,800. Prepare a tabular summary to record the Crane Company transactions. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Stockholders' Equity Paid-in-Capital Pret Stock PIC in Excess of Par Pref. Treasury Stock Revenue $ + $ e Textbook and Media Crane Company had these transactions during the current period. June 12 Issued 79,500 shares of $1 par value common stock for cash of $298,125, July 11 Issued 3,650 shares of $100 par value preferred stock for cash at $108 per share. Nov. 28 Purchased 3.200 shares of treasury stock for $8.800. Prepare a tabular summary to record the Crane Company transactions. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Retained Earnings Dividend jue Expense e Textbook and Media e common stock for cash of $298,125. ue preferred stock for cash at $108 per share. stock for $8,800. company transactions. Include margin explanations for the changes in revenues and s, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the quity item that was reduced.) etained Earnings Dividend $ Paid-in-capital in excess of preferred stock Paid-in-capital in excess of common stock Interest expense Preferred stock Dividends Common stock Attempts vor s used Submit