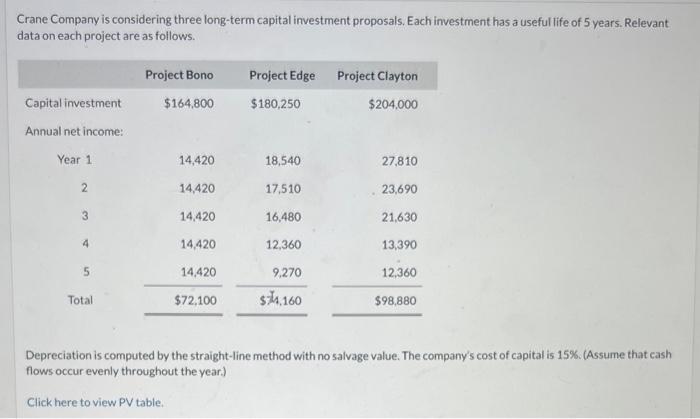

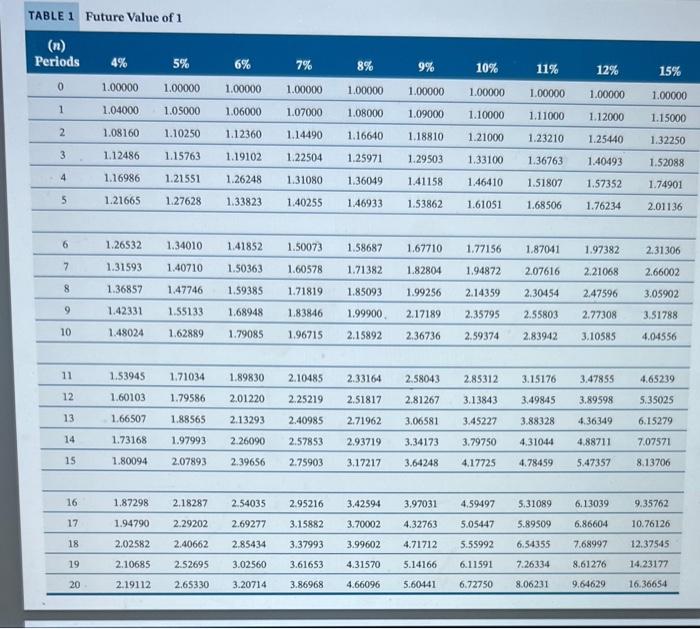

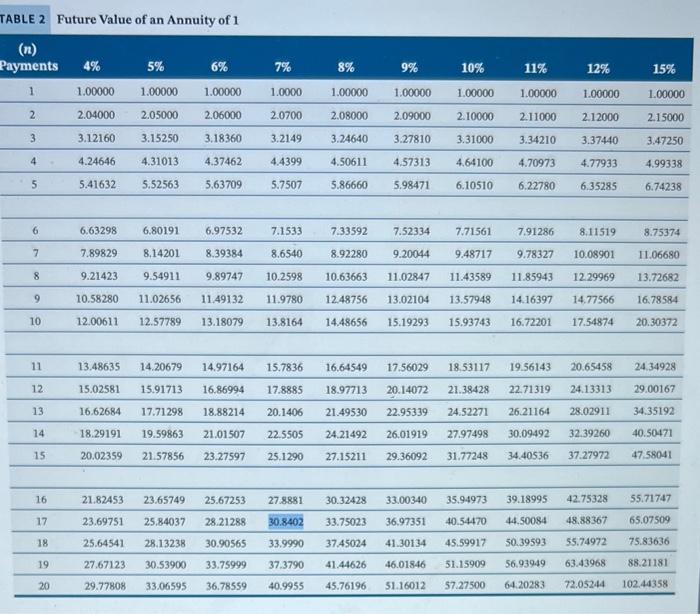

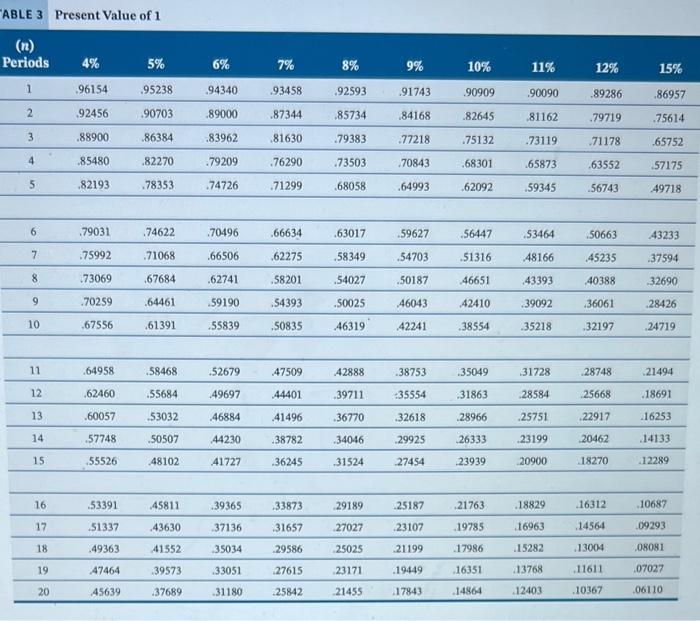

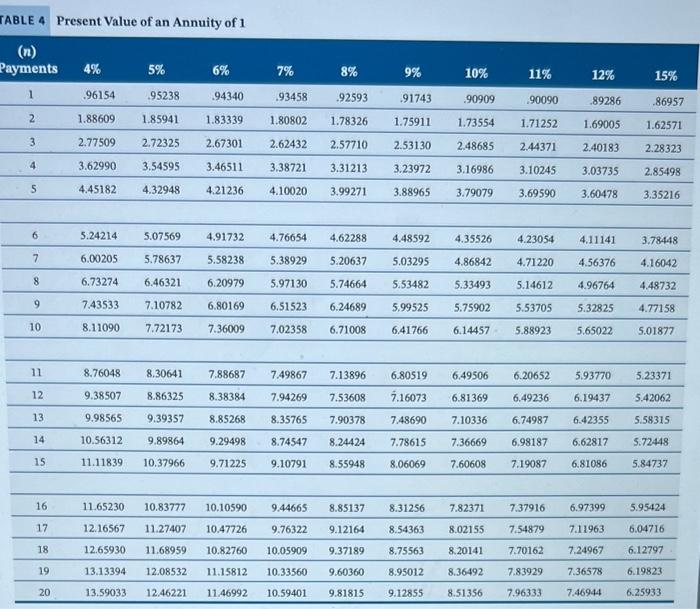

Crane Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows. Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.) Click here to view PV table. TABLE 1 Future Value of 1 \begin{tabular}{lllllllllll} \hline 6 & 1.26532 & 1.34010 & 1.41852 & 1.50073 & 1.58687 & 1.67710 & 1.77156 & 1.87041 & 1.97382 & 2.31306 \\ \hline 7 & 1.31593 & 1.40710 & 1.50363 & 1.60578 & 1.71382 & 1.82804 & 1.94872 & 2.07616 & 2.21068 & 2.66002 \\ \hline 8 & 1.36857 & 1.47746 & 1.59385 & 1.71819 & 1.85093 & 1.99256 & 2.14359 & 2.30454 & 2.47596 & 3.05902 \\ \hline 9 & 1.42331 & 1.55133 & 1.68948 & 1.83846 & 1.99900 & 2.17189 & 2.35795 & 2.55803 & 2.77308 & 3.51788 \\ \hline 10 & 1.48024 & 1.62889 & 1.79085 & 1.96715 & 2.15892 & 2.36736 & 2.59374 & 2.83942 & 3.10585 & 4.04556 \\ \hline \end{tabular} \begin{tabular}{rllllllllll} \hline 11 & 1.53945 & 1.71034 & 1.89830 & 2.10485 & 2.33164 & 2.58043 & 2.85312 & 3.15176 & 3.47855 & 4.65239 \\ \hline 12 & 1.60103 & 1.79586 & 2.01220 & 2.25219 & 2.51817 & 2.81267 & 3.13843 & 3.49845 & 3.89598 & 5.35025 \\ \hline 13 & 1.66507 & 1.88565 & 2.13293 & 2.40985 & 2.71962 & 3.06581 & 3.45227 & 3.88328 & 4.36349 & 6.15279 \\ \hline 14 & 1.73168 & 1.97993 & 2.26090 & 2.57853 & 2.93719 & 3.34173 & 3.79750 & 4.31044 & 4.88711 & 7.07571 \\ \hline 15 & 1.80094 & 2.07893 & 2.39656 & 2.75903 & 3.17217 & 3.64248 & 4.17725 & 4.78459 & 5.47357 & 8.13706 \\ \hline & & & & & & & & & & \\ \hline 16 & 1.87298 & 2.18287 & 2.54035 & 2.95216 & 3.42594 & 3.97031 & 4.59497 & 5.31089 & 6.13039 & 9.35762 \\ \hline 17 & 1.94790 & 2.29202 & 2.69277 & 3.15882 & 3.70002 & 4.32763 & 5.05447 & 5.89509 & 6.86604 & 10.76126 \\ \hline 18 & 2.02582 & 2.40662 & 2.85434 & 3.37993 & 3.99602 & 4.71712 & 5.55992 & 6.54355 & 7.68997 & 12.37545 \\ \hline 19 & 2.10685 & 2.52695 & 3.02560 & 3.61653 & 4.31570 & 5.14166 & 6.11591 & 7.26334 & 8.61276 & 14.23177 \\ \hline 20 & 2.19112 & 2.65330 & 3.20714 & 3.86968 & 4.66096 & 5.60441 & 6.72750 & 8.06231 & 9.64629 & 16.36654 \\ \hline \end{tabular} E 2. Future Value of an Annuity of 1 ABLE 3 Present Value of 1 \begin{tabular}{ccccccccccc} \hline (n) & & & & & & & & & & \\ Periods & 4% & 5% & 6% & 7% & 8% & 9% & 10% & 11% & 12% & 15% \\ \hline 1 & .96154 & .95238 & .94340 & .93458 & .92593 & .91743 & .90909 & .90090 & .89286 \\ \hline 2 & .92456 & .90703 & .89000 & .87344 & .85734 & .84168 & .82645 & .81162 & .79719 & .75614 \\ \hline 3 & .88900 & .86384 & .83962 & .81630 & .79383 & .77218 & .75132 & .73119 & .71178 & .65752 \\ \hline 4 & .85480 & .82270 & .79209 & .76290 & .73503 & .70843 & .68301 & .65873 & .63552 & .57175 \\ \hline 5 & .82193 & .78353 & .74726 & .71299 & .68058 & .64993 & .62092 & .59345 & .56743 & .49718 \\ \hline \end{tabular} \begin{tabular}{rrrrrrrrrrr} \hline 6 & .79031 & .74622 & .70496 & .66634 & .63017 & .59627 & .56447 & .53464 & .50663 & .43233 \\ \hline 7 & .75992 & .71068 & .66506 & .62275 & .58349 & .54703 & .51316 & .48166 & .45235 & .37594 \\ \hline 8 & .73069 & .67684 & .62741 & .58201 & .54027 & .50187 & .46651 & .43393 & .40388 & .32690 \\ \hline 9 & .70259 & .64461 & .59190 & .54393 & .50025 & .46043 & .42410 & .39092 & .36061 & .28426 \\ \hline 10 & .67556 & .61391 & .55839 & .50835 & .46319 & .42241 & .38554 & .35218 & .32197 & .24719 \\ \hline \end{tabular} \begin{tabular}{rrrrrrrrrrrr} \hline 11 & .64958 & .58468 & .52679 & .47509 & .42888 & .38753 & .35049 & .31728 & .28748 & .21494 \\ \hline 12 & .62460 & .55684 & .49697 & .44401 & .39711 & .35554 & .31863 & .28584 & .25668 & .18691 \\ \hline 13 & .60057 & .53032 & .46884 & .41496 & .36770 & .32618 & .28966 & .25751 & .22917 & .16253 \\ \hline 14 & .57748 & .50507 & .44230 & .38782 & .34046 & .29925 & .26333 & .23199 & .20462 & .14133 \\ \hline 15 & .55526 & .48102 & .41727 & .36245 & .31524 & .27454 & .23939 & .20900 & .18270 & .12289 \\ \hline & & & & & & & & \\ \hline 16 & .53391 & .45811 & .39365 & .33873 & .29189 & .25187 & .21763 & .18829 & .16312 & .10687 \\ \hline 17 & .51337 & .43630 & .37136 & .31657 & .27027 & .23107 & .19785 & 16963 & .14564 & .09293 \\ \hline 18 & .49363 & .41552 & .35034 & .29586 & .25025 & .21199 & .17986 & .15282 & .13004 & .08081 \\ \hline 19 & .47464 & .39573 & .33051 & .27615 & .23171 & .19449 & .16351 & .13768 & .11611 & .07027 \\ \hline 20 & .45639 & .37689 & .31180 & .25842 & .21455 & .17843 & .14864 & .12403 & .10367 & .06110 \\ \hline \end{tabular} E 4 Present Value of an Annuitu af 1 Compute the cash payback period for each project. (Round answers to 2 decimal places, e.g. 10.50.) Project Bono years Project Edge years Project Clayton years