Answered step by step

Verified Expert Solution

Question

1 Approved Answer

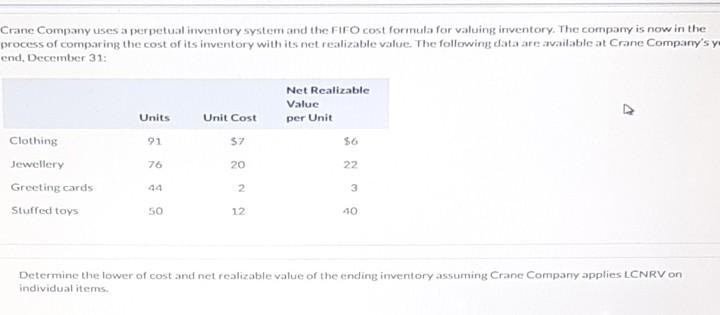

Crane Company uses a perpetual inventory system and the FIFO cost formula for valuing inventory. The company is now in the process of comparing the

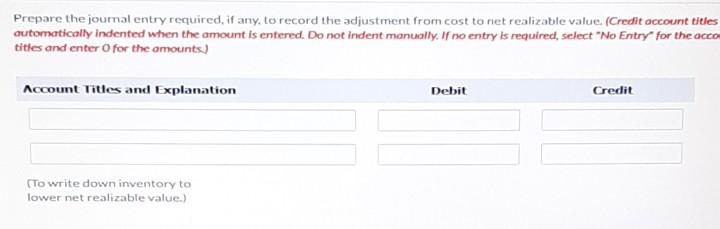

Crane Company uses a perpetual inventory system and the FIFO cost formula for valuing inventory. The company is now in the process of comparing the cost of its inventory with its net realizable value. The following data are available at Crane Company's y end, December 31: Net Realizable Value per Unit Units Unit Cost 91 $7 $6 76 20 22 Clothing Jewellery Greeting cards Stuffed toys 44 2 3 50 12 40 Determine the lower of cost and net realizable value of the ending inventory assuming Crane Company applies LCNRV on individual items. Determine the lower of cost and net realizable value of the ending inventory assuming Crane Company applies LCNR individual items. Lower of cost and net realizable value $ Prepare the journal entry required, if any, to record the adjustment from cost to net realizable value. (Credit occount titles automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the accom tities and enter for the amounts) Account Titles and Explanation Debit Credit (To write down inventory to lower net realizable value)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started