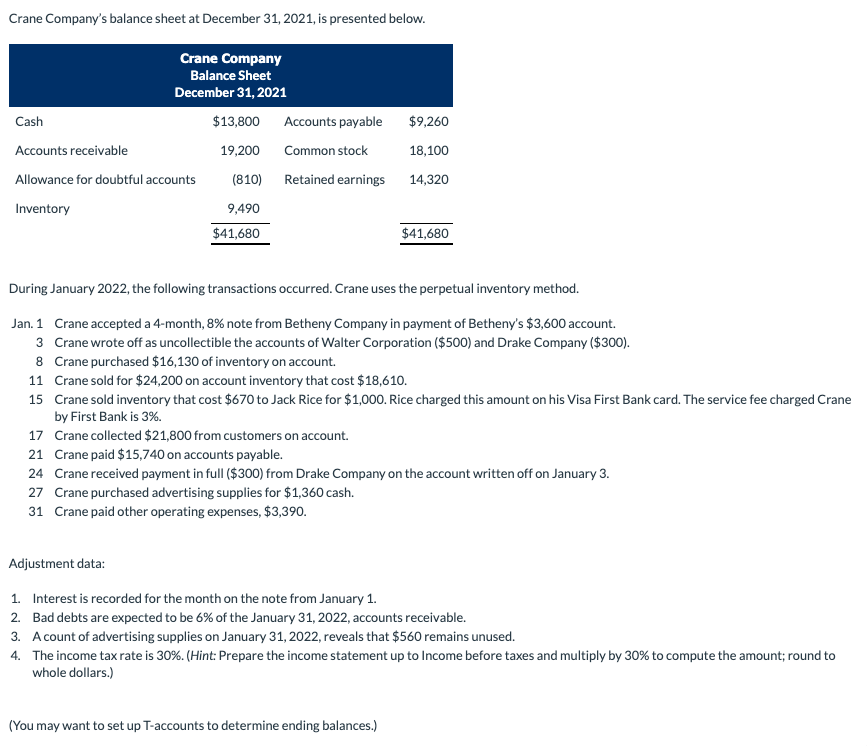

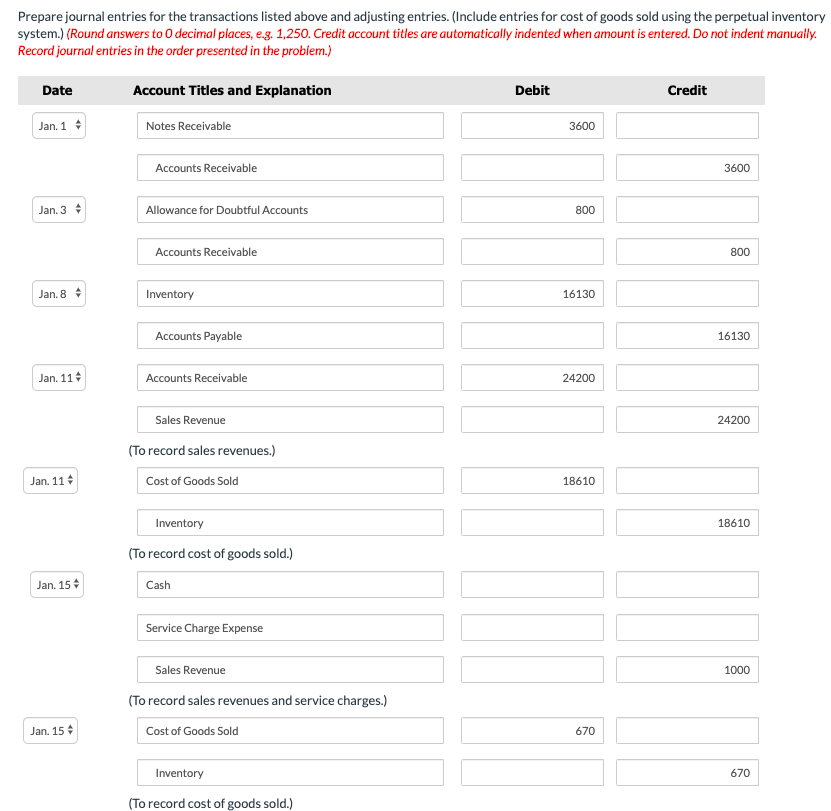

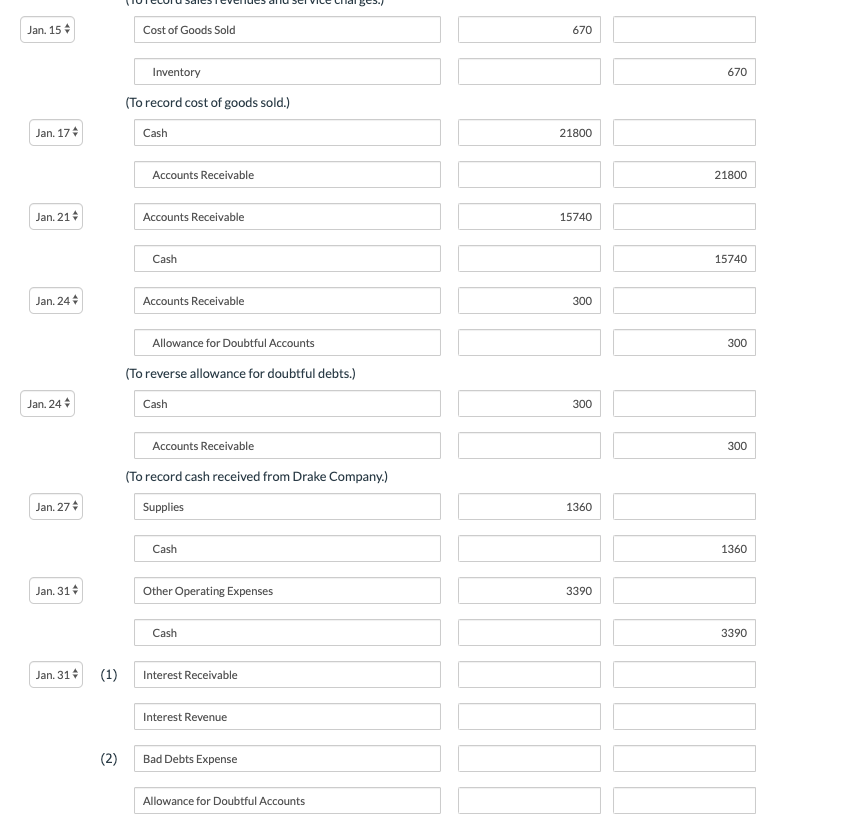

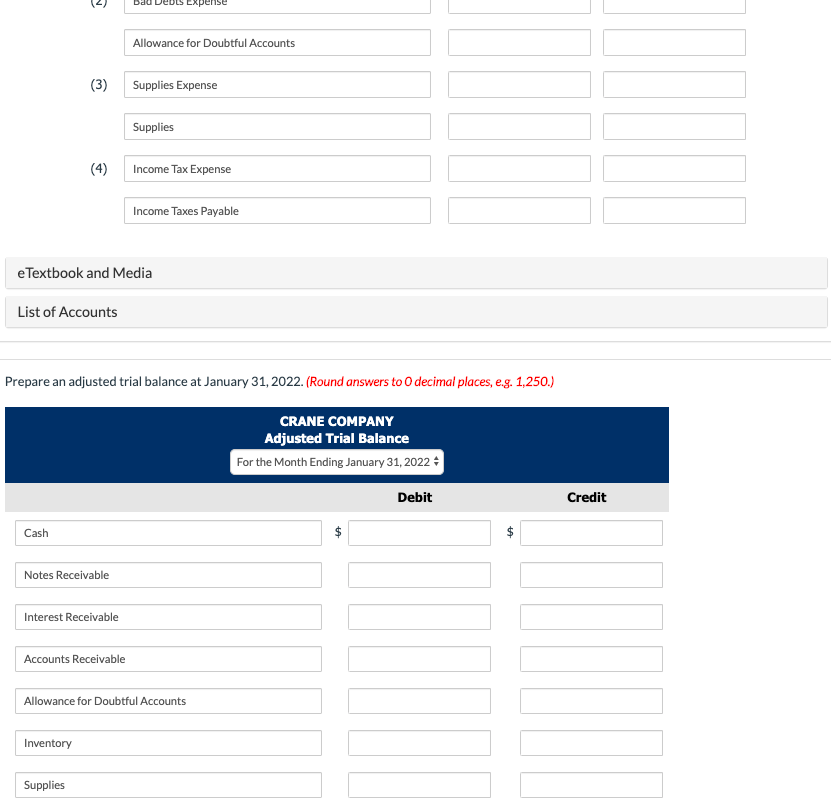

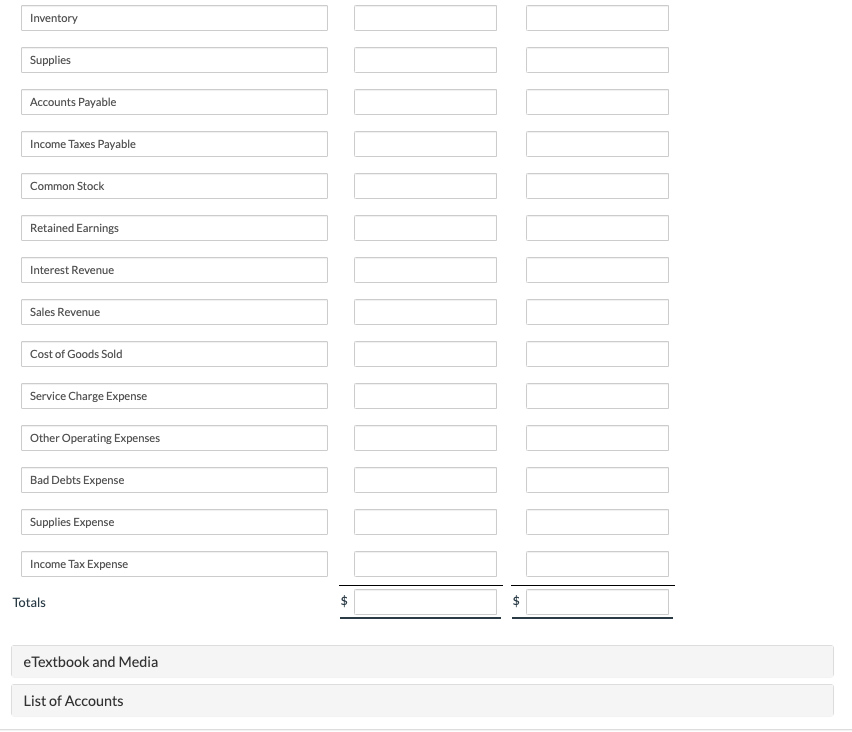

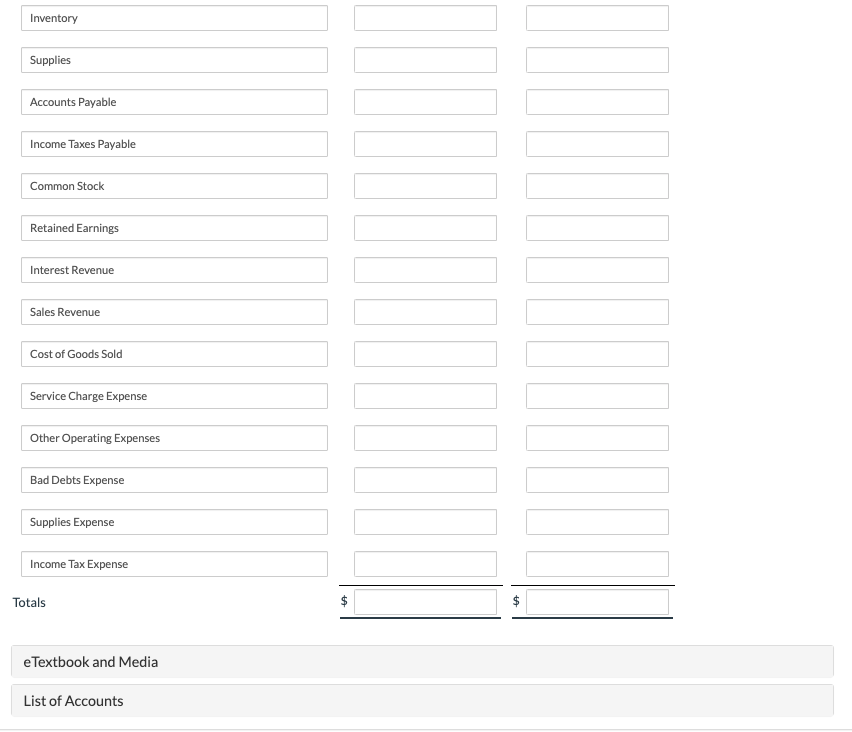

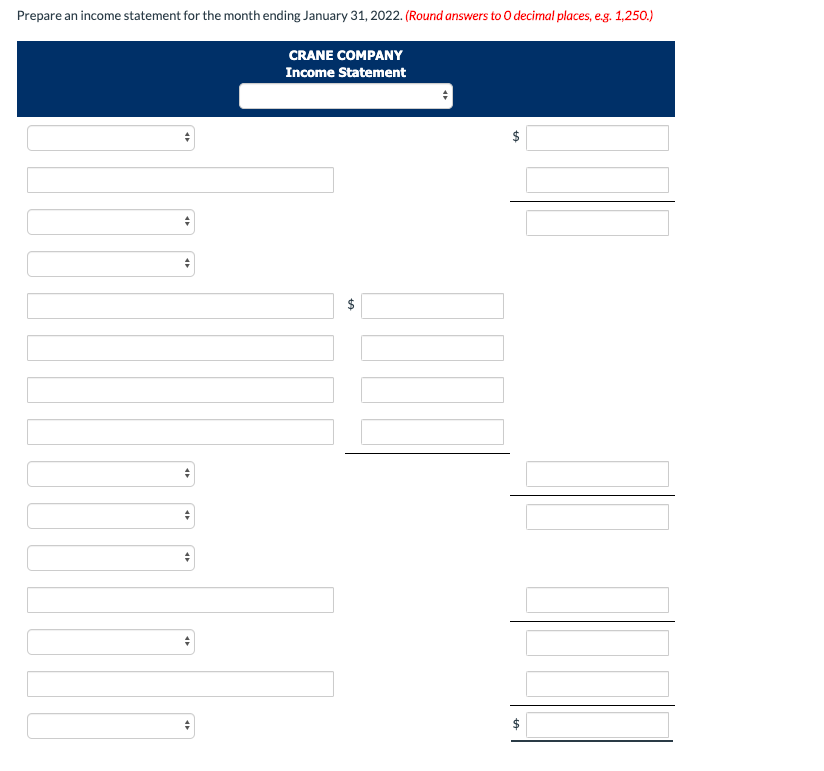

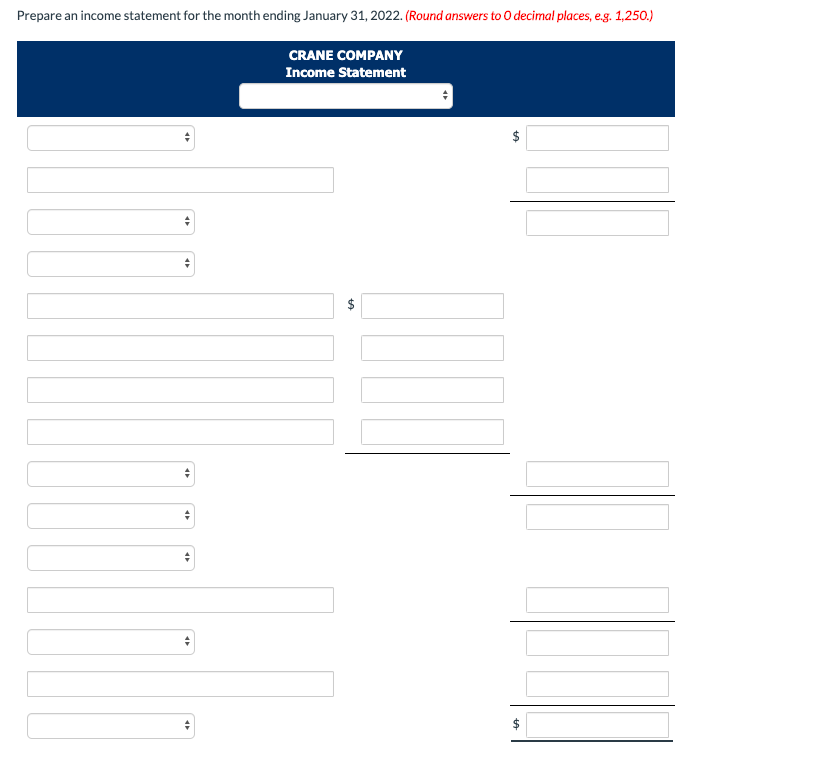

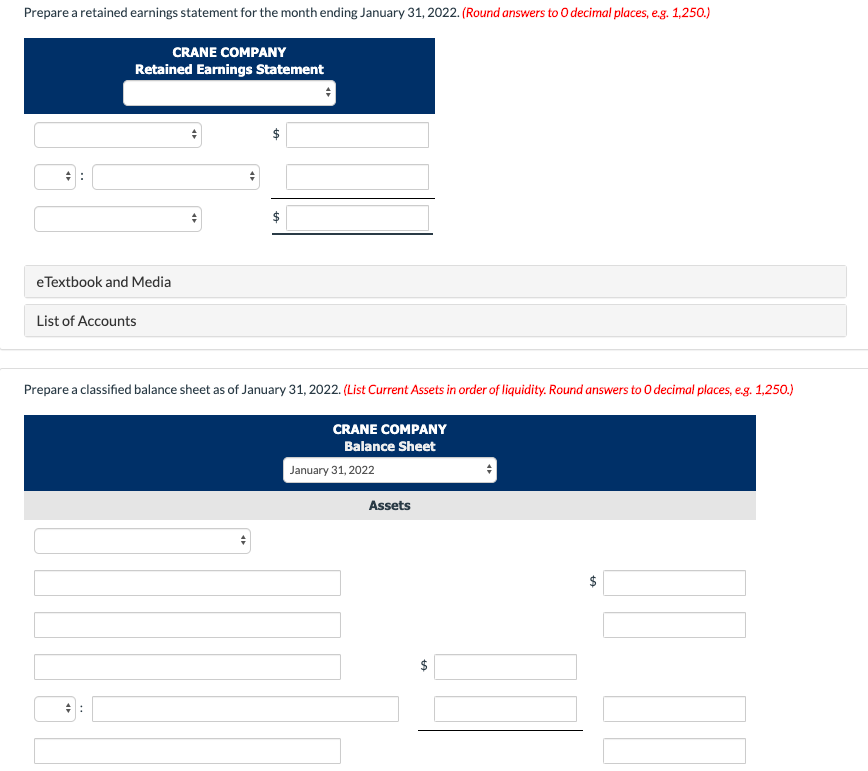

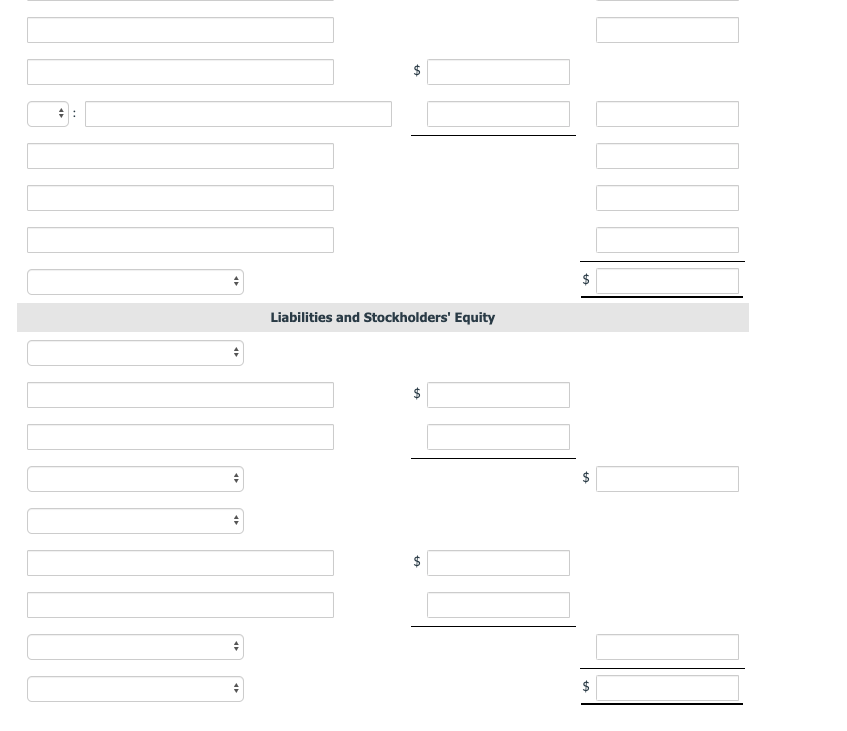

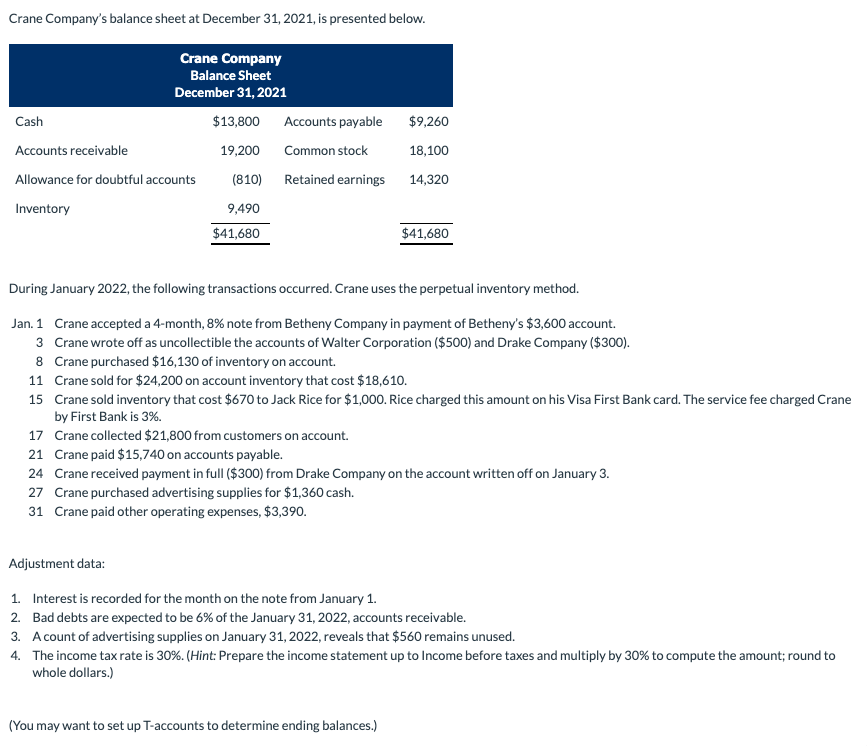

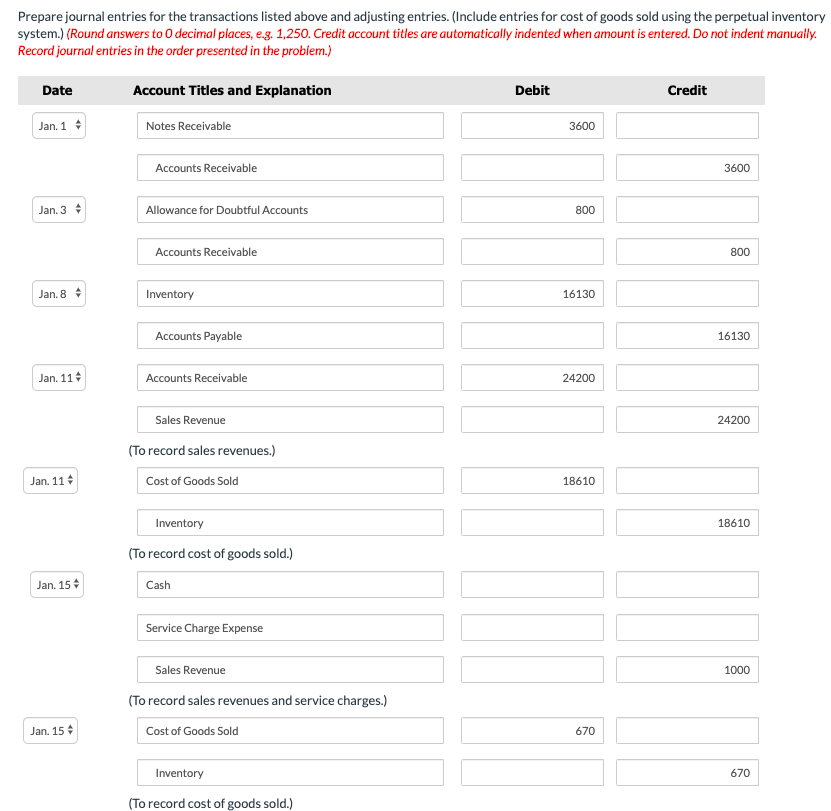

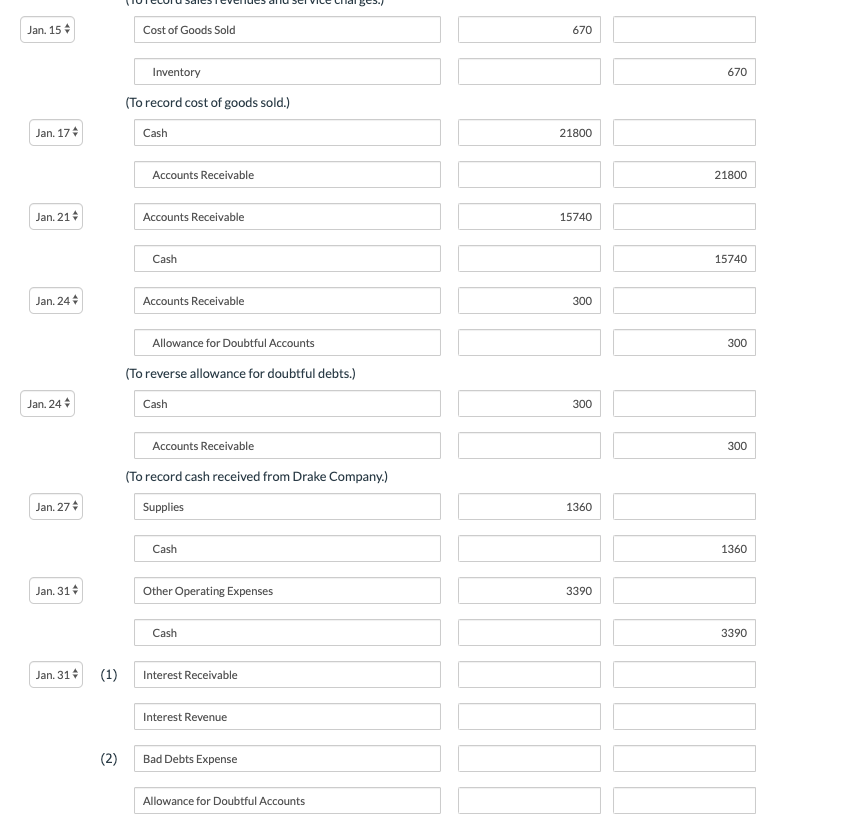

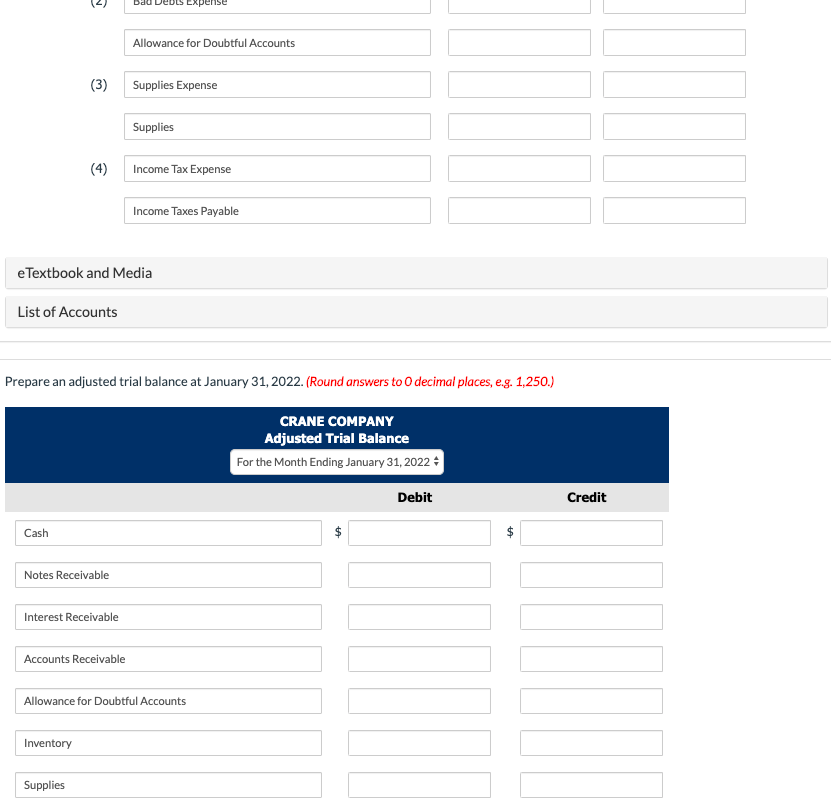

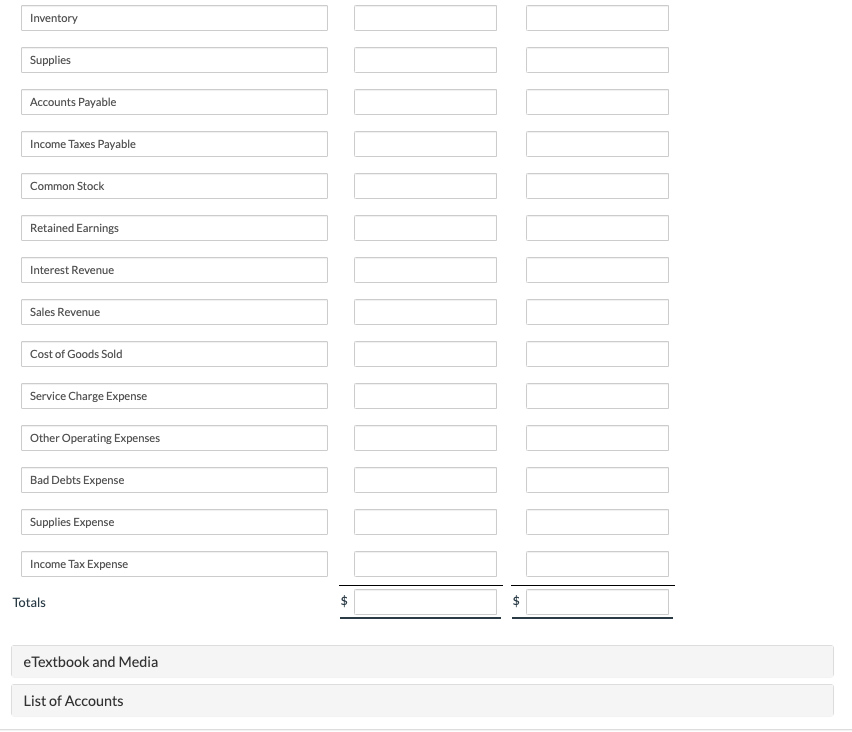

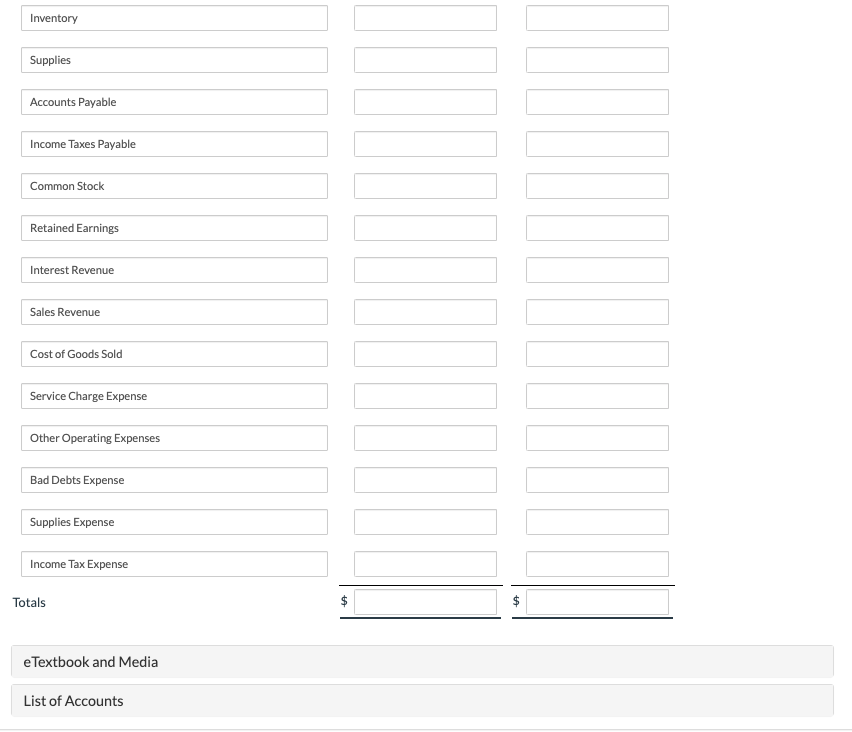

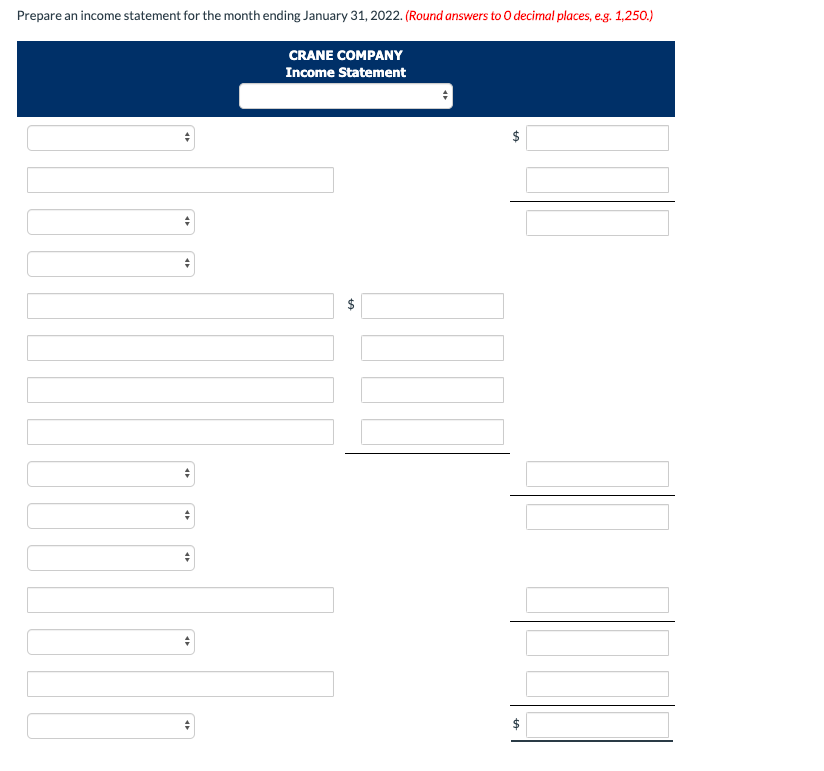

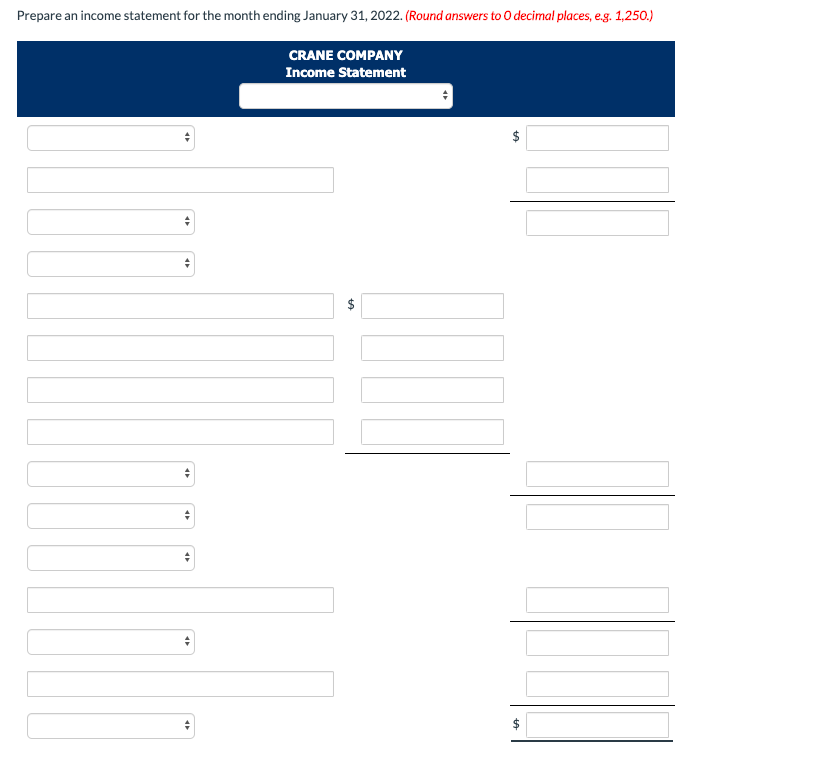

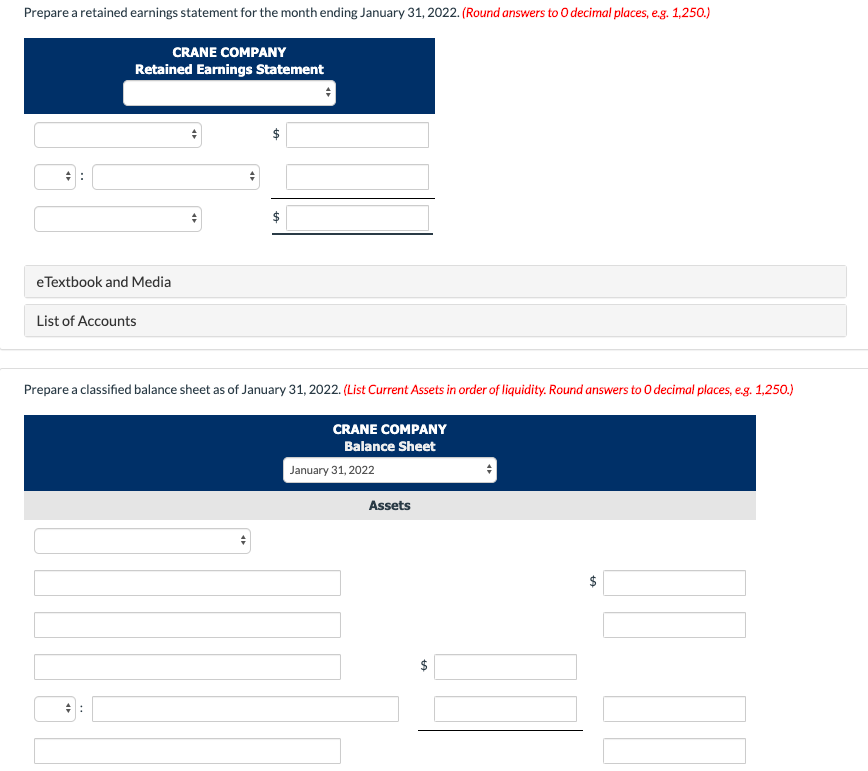

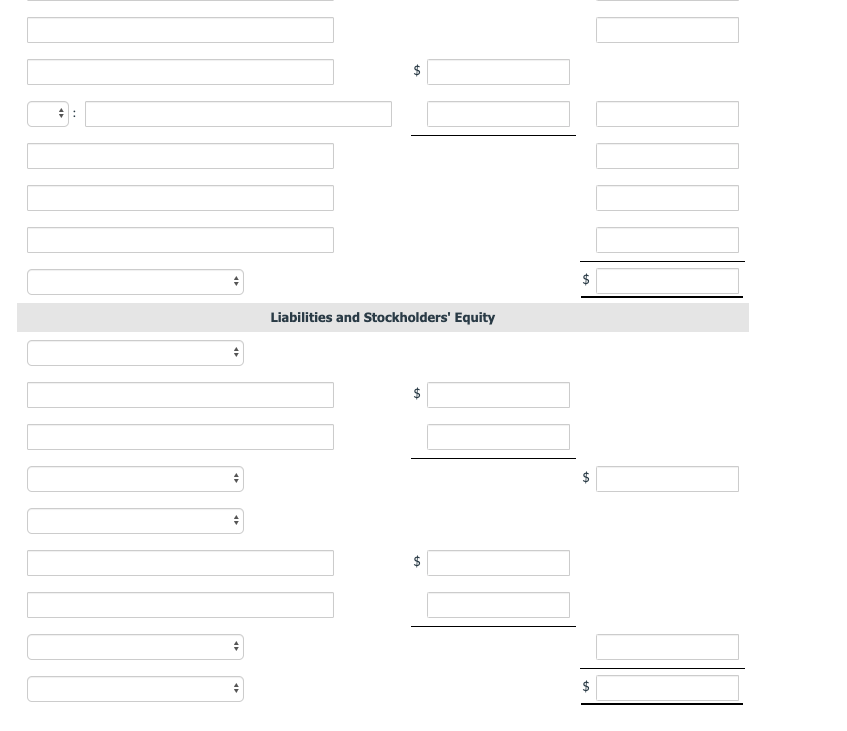

Crane Company's balance sheet at December 31, 2021, is presented below. Crane Company Balance Sheet December 31, 2021 Cash $13,800 Accounts payable $9,260 Accounts receivable 19,200 Common stock 18,100 Allowance for doubtful accounts (810) Retained earnings 14,320 Inventory 9,490 $41,680 $41,680 During January 2022, the following transactions occurred. Crane uses the perpetual inventory method. Jan. 1 Crane accepted a 4-month, 8% note from Betheny Company in payment of Betheny's $3,600 account. 3 Crane wrote off as uncollectible the accounts of Walter Corporation ($500) and Drake Company ($300). 8 Crane purchased $16,130 of inventory on account. 11 Crane sold for $24,200 on account inventory that cost $18,610. 15 Crane sold inventory that cost $670 to Jack Rice for $1,000. Rice charged this amount on his Visa First Bank card. The service fee charged Crane by First Bank is 3%. 17 Crane collected $21,800 from customers on account. 21 Crane paid $15,740 on accounts payable. 24 Crane received payment in full ($300) from Drake Company on the account written off on January 3. 27 Crane purchased advertising supplies for $1,360 cash. 31 Crane paid other operating expenses, $3,390. Adjustment data: 1. Interest is recorded for the month on the note from January 1. 2. Bad debts are expected to be 6% of the January 31, 2022, accounts receivable. 3. A count of advertising supplies on January 31, 2022, reveals that $560 remains unused. 4. The income tax rate is 30%. (Hint: Prepare the income statement up to Income before taxes and multiply by 30% to compute the amount; round to whole dollars.) (You may want to set up T-accounts to determine ending balances.) Prepare journal entries for the transactions listed above and adjusting entries. (Include entries for cost of goods sold using the perpetual inventory system.) (Round answers to O decimal places, e.g. 1,250. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit Jan. 1 Notes Receivable 3600 Accounts Receivable 3600 Jan. 3 Allowance for Doubtful Accounts 800 Accounts Receivable 800 Jan. 8 Inventory 16130 Accounts Payable 16130 Jan. 11 Accounts Receivable 24200 Sales Revenue 24200 (To record sales revenues.) Jan. 114 Cost of Goods Sold 18610 Inventory 18610 (To record cost of goods sold.) Jan. 15 Cash Service Charge Expense Sales Revenue 1000 (To record sales revenues and service charges.) Jan. 15 Cost of Goods Sold Inventory 670 (To record cost of goods sold.) (ITCLUIU Salesievenue allu Sel Vice Cilal ges.) Jan. 15 Cost of Goods Sold 670 Inventory (To record cost of goods sold.) Jan. 17 Cash 21800 Accounts Receivable 21800 Jan. 214 Accounts Receivable 15740 Cash 15740 Jan. 24+ Accounts Receivable 300 Allowance for Doubtful Accounts 300 (To reverse allowance for doubtful debts.) Jan. 24 Cash 300 Accounts Receivable 300 (To record cash received from Drake Company.) Jan. 274 Supplies 1360 Cash 1360 Jan. 31 Other Operating Expenses 3390 Cash 3390 Jan. 31 (1) Interest Receivable Interest Revenue (2) Bad Debts Expense Allowance for Doubtful Accounts (2) Dau Devis expense Allowance for Doubtful Accounts Supplies Expense Supplies (4) Income Tax Expense Income Taxes Payable e Textbook and Media List of Accounts Prepare an adjusted trial balance at January 31, 2022. (Round answers to decimal places, e.g. 1,250.) CRANE COMPANY Adjusted Trial Balance For the Month Ending January 31, 2022 Debit Credit Cash Notes Receivable Interest Receivable Accounts Receivable Allowance for Doubtful Accounts Inventory Supplies Inventory Supplies Accounts Payable Income Taxes Payable Common Stock Retained Earnings Interest Revenue Sales Revenue Cost of Goods Sold Service Charge Expense Other Operating Expenses Bad Debts Expense Supplies Expense Income Tax Expense Totals e Textbook and Media List of Accounts Prepare an income statement for the month ending January 31, 2022. (Round answers to O decimal places, eg. 1,250.) CRANE COMPANY Income Statement Prepare an income statement for the month ending January 31, 2022. (Round answers to O decimal places, eg. 1,250.) CRANE COMPANY Income Statement Prepare a retained earnings statement for the month ending January 31, 2022. (Round answers to decimal places, eg. 1,250.) CRANE COMPANY Retained Earnings Statement e Textbook and Media List of Accounts Prepare a classified balance sheet as of January 31, 2022. (List Current Assets in order of liquidity. Round answers to O decimal places, eg. 1,250.) CRANE COMPANY Balance Sheet January 31, 2022 Assets Liabilities and Stockholders' Equity Crane Company's balance sheet at December 31, 2021, is presented below. Crane Company Balance Sheet December 31, 2021 Cash $13,800 Accounts payable $9,260 Accounts receivable 19,200 Common stock 18,100 Allowance for doubtful accounts (810) Retained earnings 14,320 Inventory 9,490 $41,680 $41,680 During January 2022, the following transactions occurred. Crane uses the perpetual inventory method. Jan. 1 Crane accepted a 4-month, 8% note from Betheny Company in payment of Betheny's $3,600 account. 3 Crane wrote off as uncollectible the accounts of Walter Corporation ($500) and Drake Company ($300). 8 Crane purchased $16,130 of inventory on account. 11 Crane sold for $24,200 on account inventory that cost $18,610. 15 Crane sold inventory that cost $670 to Jack Rice for $1,000. Rice charged this amount on his Visa First Bank card. The service fee charged Crane by First Bank is 3%. 17 Crane collected $21,800 from customers on account. 21 Crane paid $15,740 on accounts payable. 24 Crane received payment in full ($300) from Drake Company on the account written off on January 3. 27 Crane purchased advertising supplies for $1,360 cash. 31 Crane paid other operating expenses, $3,390. Adjustment data: 1. Interest is recorded for the month on the note from January 1. 2. Bad debts are expected to be 6% of the January 31, 2022, accounts receivable. 3. A count of advertising supplies on January 31, 2022, reveals that $560 remains unused. 4. The income tax rate is 30%. (Hint: Prepare the income statement up to Income before taxes and multiply by 30% to compute the amount; round to whole dollars.) (You may want to set up T-accounts to determine ending balances.) Prepare journal entries for the transactions listed above and adjusting entries. (Include entries for cost of goods sold using the perpetual inventory system.) (Round answers to O decimal places, e.g. 1,250. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit Jan. 1 Notes Receivable 3600 Accounts Receivable 3600 Jan. 3 Allowance for Doubtful Accounts 800 Accounts Receivable 800 Jan. 8 Inventory 16130 Accounts Payable 16130 Jan. 11 Accounts Receivable 24200 Sales Revenue 24200 (To record sales revenues.) Jan. 114 Cost of Goods Sold 18610 Inventory 18610 (To record cost of goods sold.) Jan. 15 Cash Service Charge Expense Sales Revenue 1000 (To record sales revenues and service charges.) Jan. 15 Cost of Goods Sold Inventory 670 (To record cost of goods sold.) (ITCLUIU Salesievenue allu Sel Vice Cilal ges.) Jan. 15 Cost of Goods Sold 670 Inventory (To record cost of goods sold.) Jan. 17 Cash 21800 Accounts Receivable 21800 Jan. 214 Accounts Receivable 15740 Cash 15740 Jan. 24+ Accounts Receivable 300 Allowance for Doubtful Accounts 300 (To reverse allowance for doubtful debts.) Jan. 24 Cash 300 Accounts Receivable 300 (To record cash received from Drake Company.) Jan. 274 Supplies 1360 Cash 1360 Jan. 31 Other Operating Expenses 3390 Cash 3390 Jan. 31 (1) Interest Receivable Interest Revenue (2) Bad Debts Expense Allowance for Doubtful Accounts (2) Dau Devis expense Allowance for Doubtful Accounts Supplies Expense Supplies (4) Income Tax Expense Income Taxes Payable e Textbook and Media List of Accounts Prepare an adjusted trial balance at January 31, 2022. (Round answers to decimal places, e.g. 1,250.) CRANE COMPANY Adjusted Trial Balance For the Month Ending January 31, 2022 Debit Credit Cash Notes Receivable Interest Receivable Accounts Receivable Allowance for Doubtful Accounts Inventory Supplies Inventory Supplies Accounts Payable Income Taxes Payable Common Stock Retained Earnings Interest Revenue Sales Revenue Cost of Goods Sold Service Charge Expense Other Operating Expenses Bad Debts Expense Supplies Expense Income Tax Expense Totals e Textbook and Media List of Accounts Prepare an income statement for the month ending January 31, 2022. (Round answers to O decimal places, eg. 1,250.) CRANE COMPANY Income Statement Prepare an income statement for the month ending January 31, 2022. (Round answers to O decimal places, eg. 1,250.) CRANE COMPANY Income Statement Prepare a retained earnings statement for the month ending January 31, 2022. (Round answers to decimal places, eg. 1,250.) CRANE COMPANY Retained Earnings Statement e Textbook and Media List of Accounts Prepare a classified balance sheet as of January 31, 2022. (List Current Assets in order of liquidity. Round answers to O decimal places, eg. 1,250.) CRANE COMPANY Balance Sheet January 31, 2022 Assets Liabilities and Stockholders' Equity