Answered step by step

Verified Expert Solution

Question

1 Approved Answer

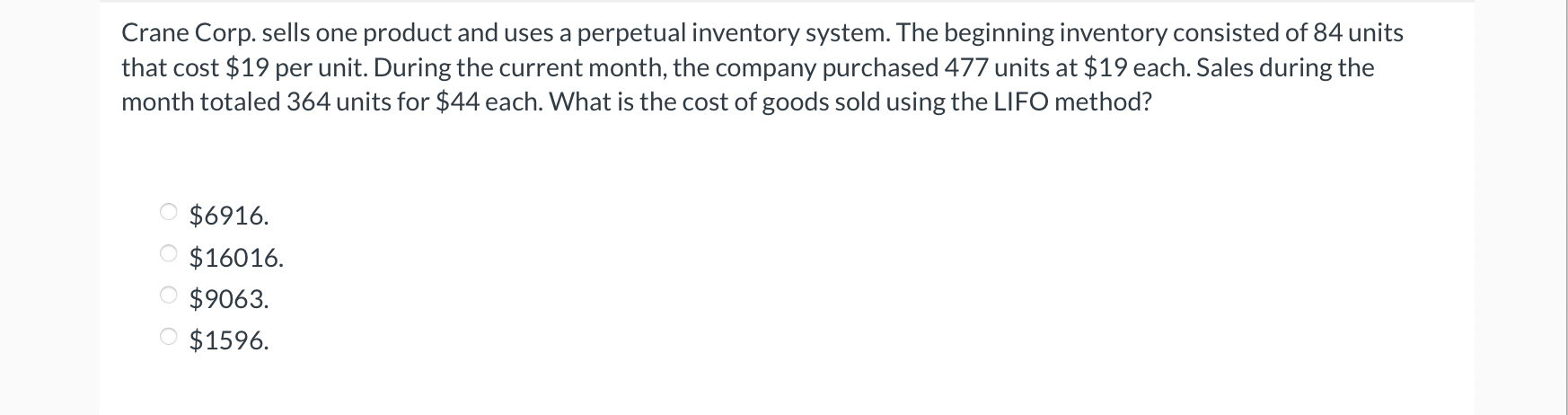

Crane Corp. sells one product and uses a perpetual inventory system. The beginning inventory consisted of 84 units that cost $19 per unit. During the

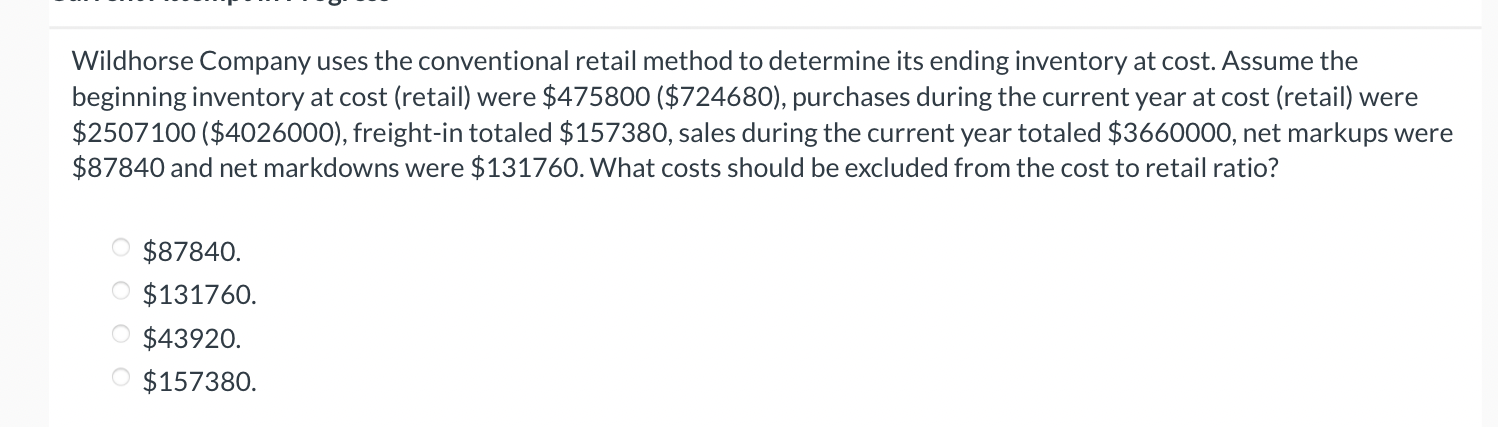

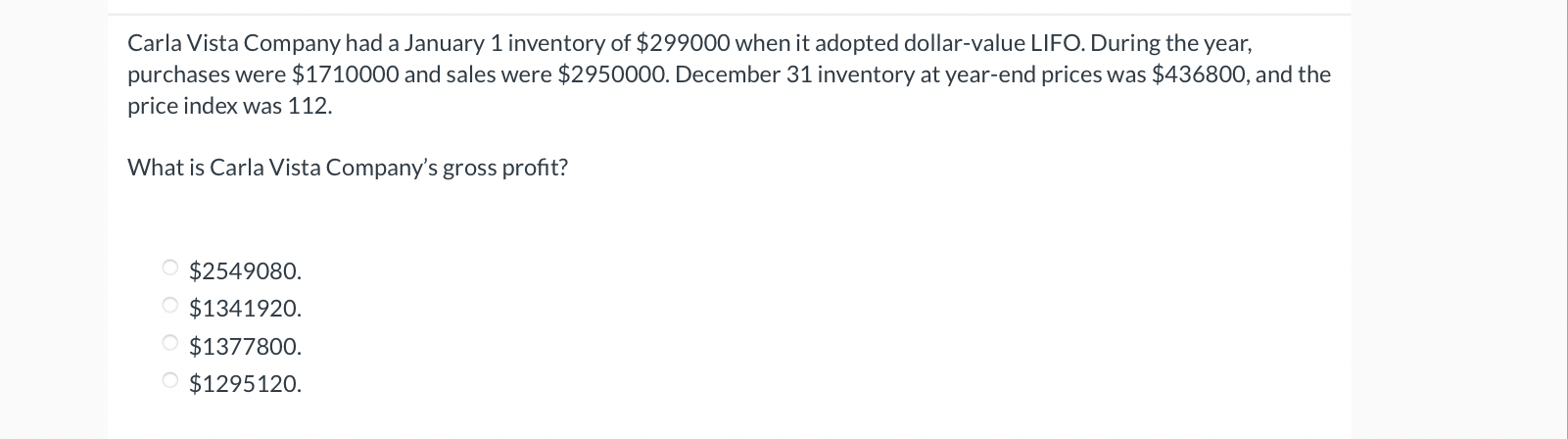

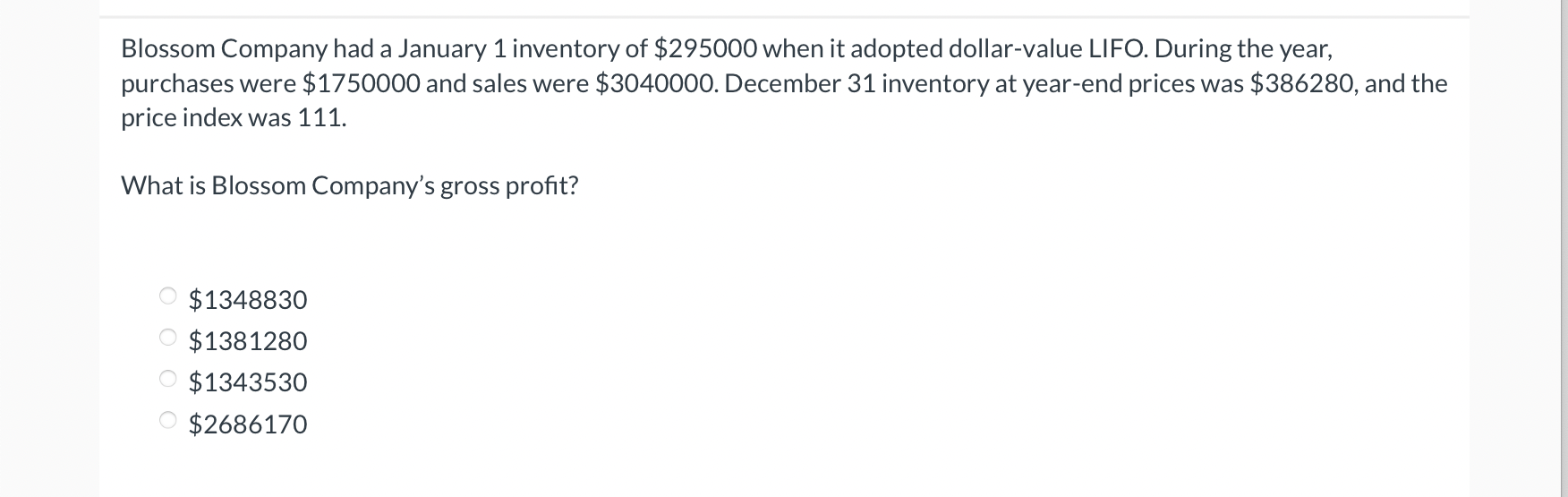

Crane Corp. sells one product and uses a perpetual inventory system. The beginning inventory consisted of 84 units that cost $19 per unit. During the current month, the company purchased 477 units at $19 each. Sales during the month totaled 364 units for $44 each. What is the cost of goods sold using the LIFO method? $6916.$16016.$9063.$1596. Wildhorse Company uses the conventional retail method to determine its ending inventory at cost. Assume the beginning inventory at cost (retail) were $475800 ( $724680) ), purchases during the current year at cost (retail) were $2507100 ( $4026000 ), freight-in totaled $157380, sales during the current year totaled $3660000, net markups were $87840 and net markdowns were $131760. What costs should be excluded from the cost to retail ratio? $87840.$131760.$43920.$157380. Carla Vista Company had a January 1 inventory of $299000 when it adopted dollar-value LIFO. During the year, purchases were $1710000 and sales were $2950000. December 31 inventory at year-end prices was $436800, and the price index was 112 . What is Carla Vista Company's gross profit? $2549080.$1341920.$1377800.$1295120. Blossom Company had a January 1 inventory of $295000 when it adopted dollar-value LIFO. During the year, purchases were $1750000 and sales were $3040000. December 31 inventory at year-end prices was $386280, and the price index was 111. What is Blossom Company's gross profit? $1348830$1381280$1343530$2686170

Crane Corp. sells one product and uses a perpetual inventory system. The beginning inventory consisted of 84 units that cost $19 per unit. During the current month, the company purchased 477 units at $19 each. Sales during the month totaled 364 units for $44 each. What is the cost of goods sold using the LIFO method? $6916.$16016.$9063.$1596. Wildhorse Company uses the conventional retail method to determine its ending inventory at cost. Assume the beginning inventory at cost (retail) were $475800 ( $724680) ), purchases during the current year at cost (retail) were $2507100 ( $4026000 ), freight-in totaled $157380, sales during the current year totaled $3660000, net markups were $87840 and net markdowns were $131760. What costs should be excluded from the cost to retail ratio? $87840.$131760.$43920.$157380. Carla Vista Company had a January 1 inventory of $299000 when it adopted dollar-value LIFO. During the year, purchases were $1710000 and sales were $2950000. December 31 inventory at year-end prices was $436800, and the price index was 112 . What is Carla Vista Company's gross profit? $2549080.$1341920.$1377800.$1295120. Blossom Company had a January 1 inventory of $295000 when it adopted dollar-value LIFO. During the year, purchases were $1750000 and sales were $3040000. December 31 inventory at year-end prices was $386280, and the price index was 111. What is Blossom Company's gross profit? $1348830$1381280$1343530$2686170 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started