Answered step by step

Verified Expert Solution

Question

1 Approved Answer

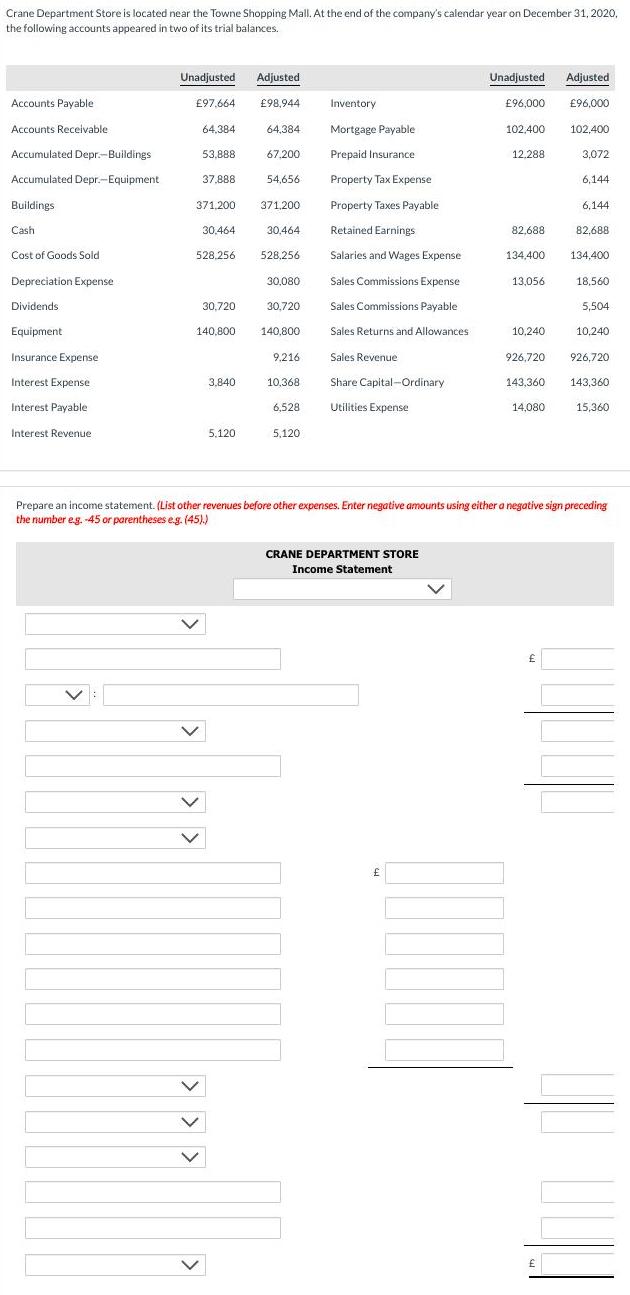

Crane Department Store is located near the Towne Shopping Mall. At the end of the company's calendar year on December 31, 2020, the following

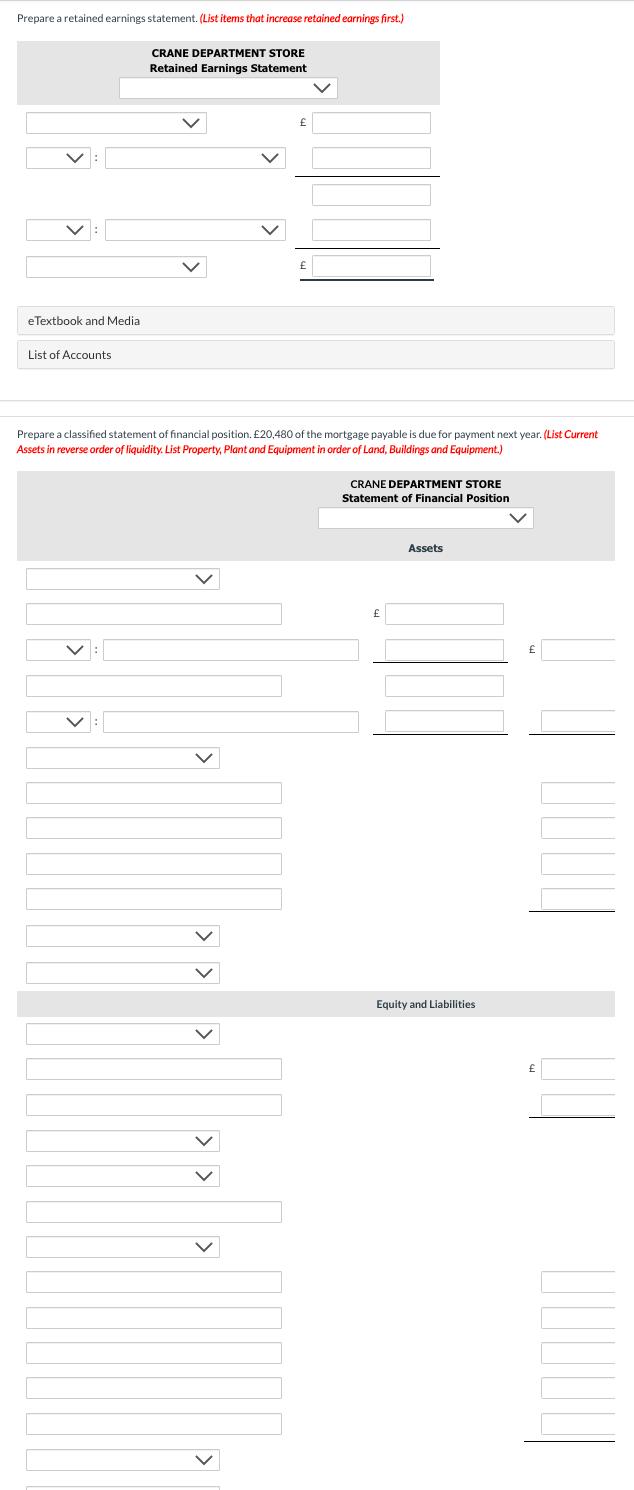

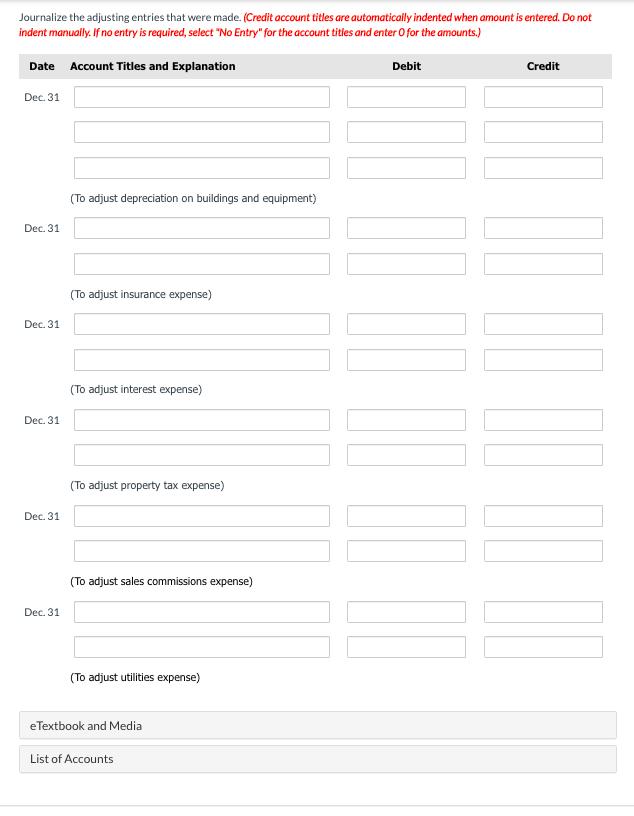

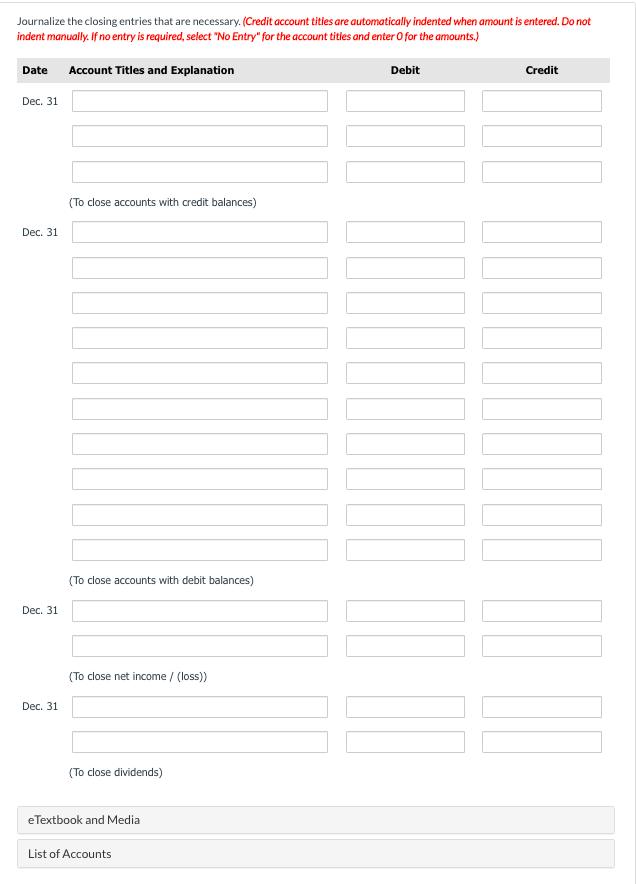

Crane Department Store is located near the Towne Shopping Mall. At the end of the company's calendar year on December 31, 2020, the following accounts appeared in two of its trial balances. Accounts Payable Accounts Receivable Accumulated Depr.-Buildings Accumulated Depr.-Equipment Buildings Cash Cost of Goods Sold Depreciation Expense Dividends Equipment. Insurance Expense Interest Expense Interest Payable Interest Revenue Unadjusted 97,664 64,384 53,888 37.888 371,200 30.464 528,256 > > > 30,720 140,800 3,840 5.120 Adjusted 98,944 64,384 67,200 54,656 371,200 30,464 528,256 30,080 30,720 140,800 9,216 10,368 6,528 5,120 Inventory. Mortgage Payable Prepaid Insurance Property Tax Expense Property Taxes Payable Retained Earnings Salaries and Wages Expense Sales Commissions Expense Sales Commissions Payable Sales Returns and Allowances Sales Revenue Share Capital-Ordinary Utilities Expense CRANE DEPARTMENT STORE Income Statement Unadjusted Adjusted 96,000 102,400 12.288 82,688 134,400 13,056 10,240 926,720 143,360 14,080 96,000 102,400 3,072 6,144 Prepare an income statement. (List other revenues before other expenses. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) 6,144 82,688 134,400 18,560 5,504 10,240 926,720 143,360 15,360 Prepare a retained earnings statement. (List items that increase retained earnings first.) eTextbook and Media List of Accounts CRANE DEPARTMENT STORE Retained Earnings Statement Prepare a classified statement of financial position. 20,480 of the mortgage payable is due for payment next year. (List Current Assets in reverse order of liquidity. List Property, Plant and Equipment in order of Land, Buildings and Equipment.) CRANE DEPARTMENT STORE Statement of Financial Position Assets Equity and Liabilities Journalize the adjusting entries that were made. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Dec. 31 Dec. 31 Dec. 31 Dec. 31 Dec. 31 Dec. 31 (To adjust depreciation on buildings and equipment) (To adjust insurance expense) (To adjust interest expense) (To adjust property tax expense) (To adjust sales commissions expense) (To adjust utilities expense) eTextbook and Media List of Accounts Debit Credit Journalize the closing entries that are necessary. (Credit account tities are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Dec. 31 Dec. 31 Dec. 31 Dec. 31 (To close accounts with credit balances) (To close accounts with debit balances) (To close net income / (loss)) (To close dividends) eTextbook and Media List of Accounts Debit Credit

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started