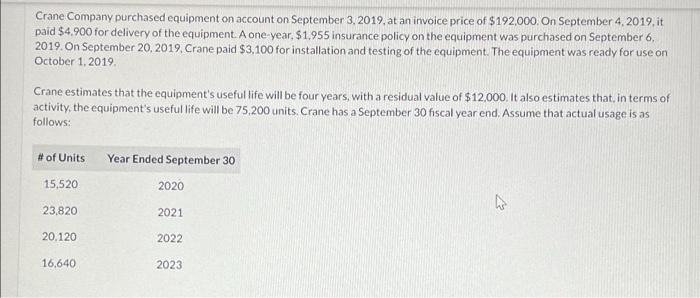

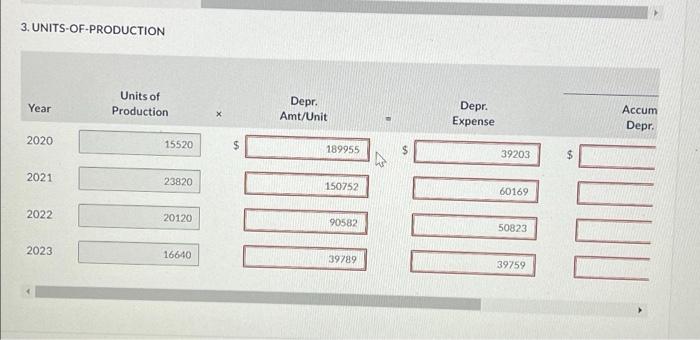

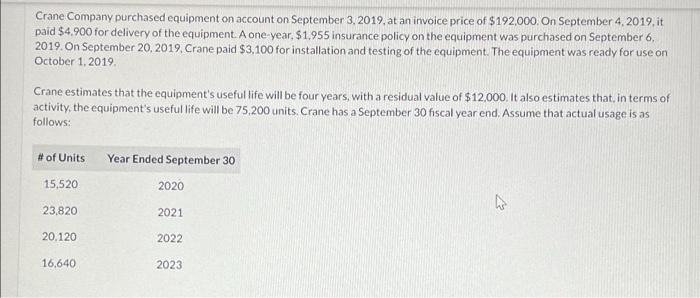

Crane estimates that the equipment's useful life will be four years, with a residual value of $12,000. It also estimates that, in terms of

activity, the equipment's useful life will be 75,200 units. Crane has a September 30 fiscal year end. Assume that actual usage is as

follows:

PLEASE ANSWER ALL THE PARTS!!

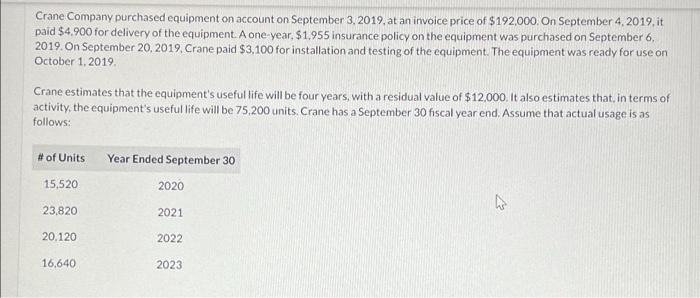

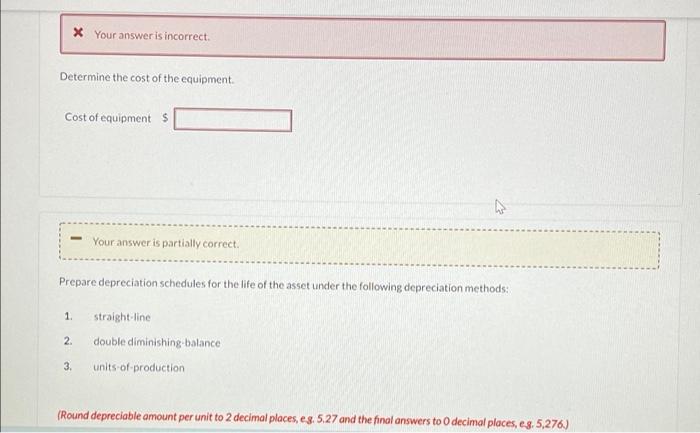

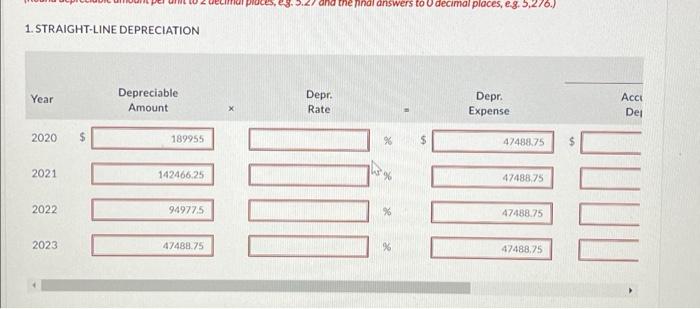

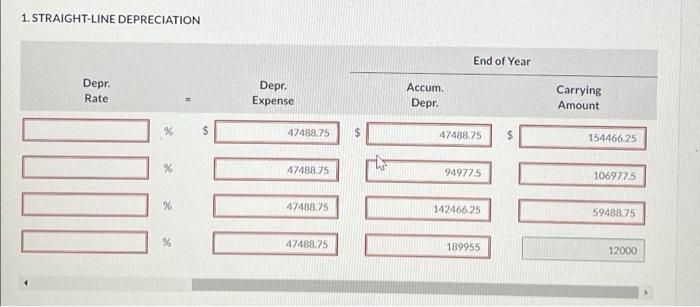

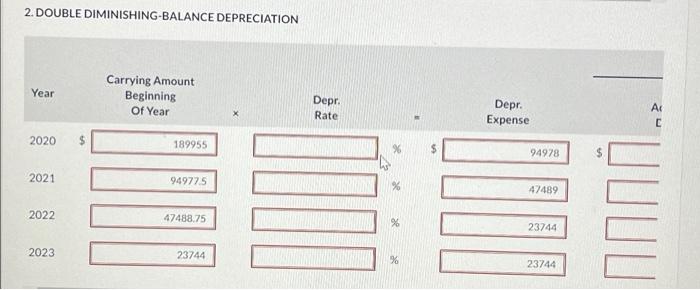

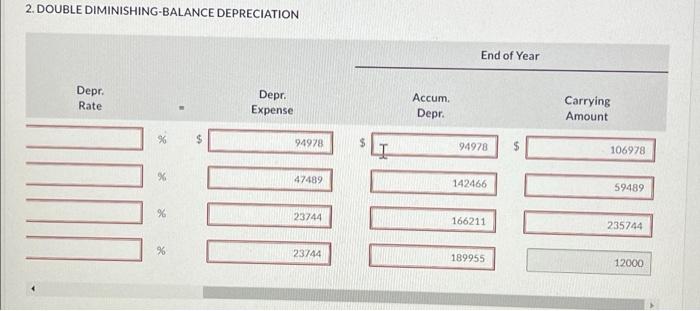

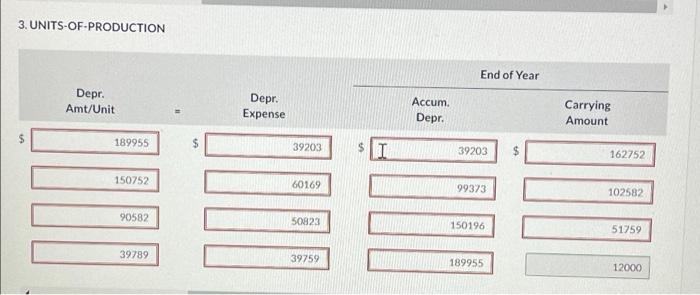

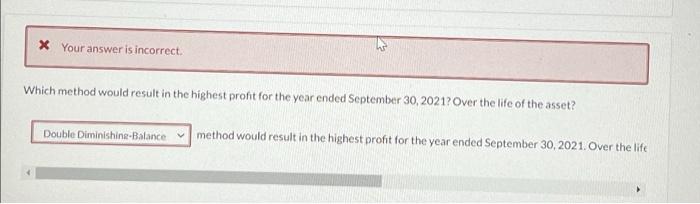

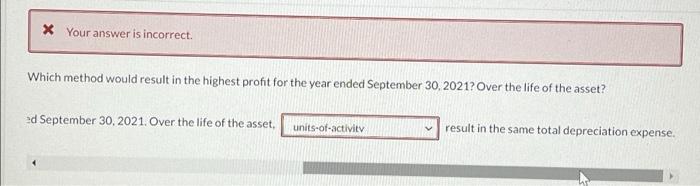

Crane Company purchased equipment on account on September 3, 2019 at an invoice price of $192.000. On September 4, 2019.it paid $4.900 for delivery of the equipment. A one-year $1.955 insurance policy on the equipment was purchased on September 6, 2019. on September 20, 2019. Crane paid $3,100 for installation and testing of the equipment. The equipment was ready for use on October 1, 2019 Crane estimates that the equipment's useful life will be four years, with a residual value of $12,000. It also estimates that in terms of activity, the equipment's useful life will be 75,200 units Crane has a September 30 fiscal year end. Assume that actual usage is as follows: # of Units Year Ended September 30 15,520 2020 W 23,820 2021 20.120 2022 16,640 2023 * Your answer is incorrect. Determine the cost of the equipment Cost of equipments Your answer is partially correct. Prepare depreciation schedules for the life of the asset under the following depreciation methods: 1. 2. straight line double diminishing balance units of production 3. (Round depreciable amount per unit to 2 decimal places, es. 5.27 and the final answers to decimal places, eg,5,276) proces and the nnal answers to decimal places, e g. 5,276.) 1. STRAIGHT-LINE DEPRECIATION Year Depreciable Amount Depr. Rate Depr Expense Acci Dei 2020 189955 % 47488.75 $ 2021 142466.25 47488.75 2022 949775 %6 47488.75 2023 47488.75 47488.75 1. STRAIGHT-LINE DEPRECIATION End of Year Depr. Rate Depr. Expense Accum. Depr. Carrying Amount 9 $ 47488.75 $ 47488.75 $ 154466.25 % 47488.75 949775 106977.5 %% 47488.75 142466.25 5948825 47488.75 189955 12000 2. DOUBLE DIMINISHING-BALANCE DEPRECIATION Year Carrying Amount Beginning Of Year Depr. Rate Depr. Expense AL C 2020 189955 2 94978 $ 2021 949775 % 47489 M 2022 47488.75 23744 2023 23744 %. 23744 2. DOUBLE DIMINISHING-BALANCE DEPRECIATION End of Year Depr. Rate Depr. Expense Accum. Depr. Carrying Amount 94978 UR 94978 $ 106978 47489 142466 59489 % 23744 166211 235744 23744 189955 12000 3. UNITS-OF-PRODUCTION Year Units of Production Depr. Amt/Unit Depr. Expense Accum Depr. 2020 15520 $ 189955 A 39203 $ 2021 23820 150752 60169 2022 20120 90582 50823 2023 16640 39789 39759 3. UNITS-OF-PRODUCTION End of Year Depr. Amt/Unit Depr. Expense Accum. Depr. Carrying Amount 189955 39203 $ I 39203 162752 150752 60169 99373 102582 90582 50923 150196 51759 39789 39759 189955 12000 X Your answer is incorrect. Which method would result in the highest profit for the year ended September 30, 2021? Over the life of the asset? Double Diminishine-Balance method would result in the highest profit for the year ended September 30, 2021. Over the life * Your answer is incorrect. Which method would result in the highest profit for the year ended September 30, 2021? Over the life of the asset? 20 September 30, 2021. Over the life of the asset, units of activity result in the same total depreciation expense