Answered step by step

Verified Expert Solution

Question

1 Approved Answer

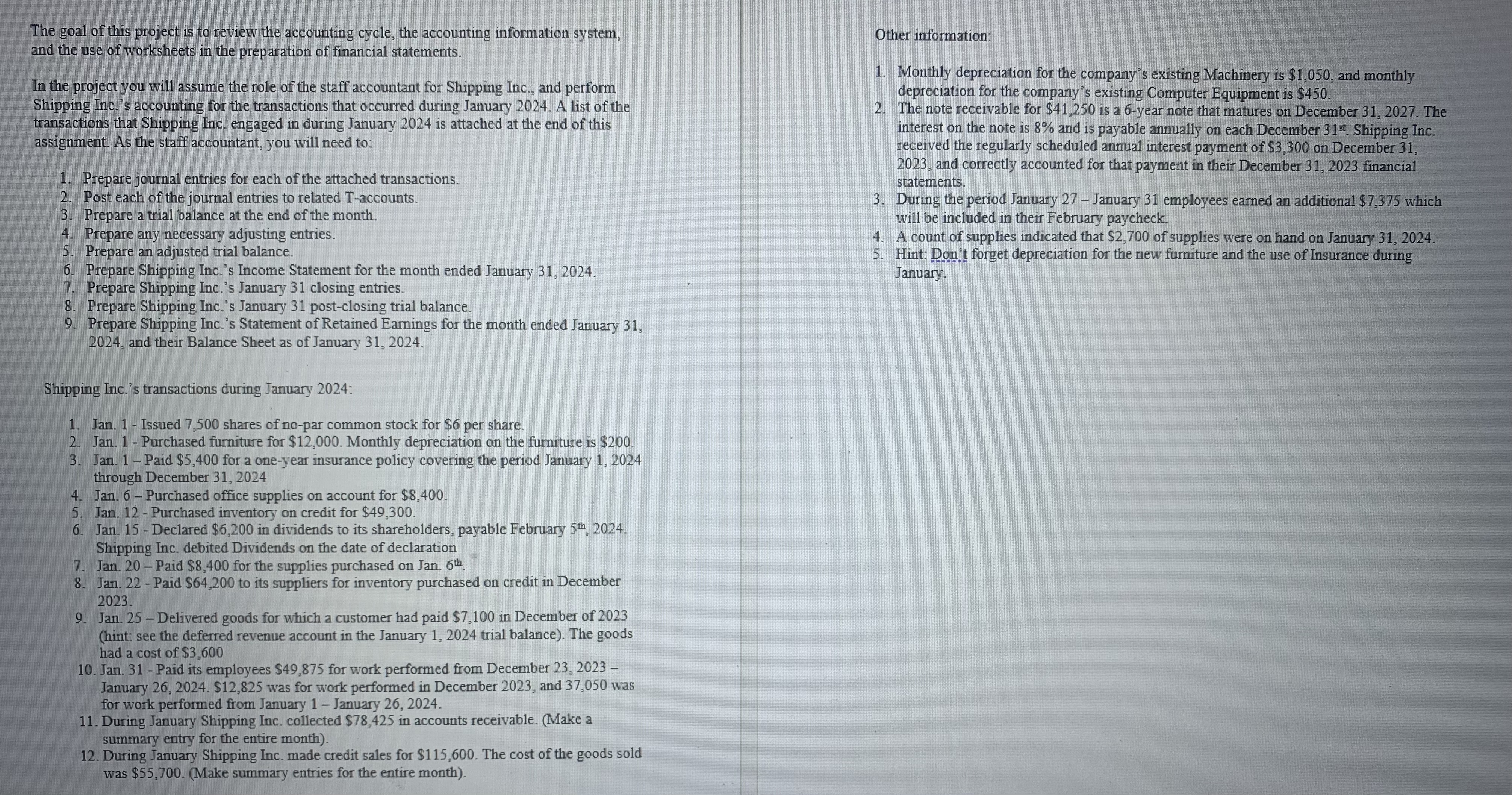

In the project you will assume the role of the staff accountant for Shipping Inc., and perform Shipping Inc. s accounting for the transactions that

In the project you will assume the role of the staff accountant for Shipping Inc., and perform Shipping Inc.s accounting for the transactions that occurred during January A list of the transactions that Shipping Inc. engaged in during January is attached at the end of this assignment. As the staff accountant, you will need to:

Prepare journal entries for each of the attached transactions.

Post each of the journal entries to related Taccounts.

Prepare a trial balance at the end of the month.

Prepare any necessary adjusting entries.

Prepare an adjusted trial balance.

Prepare Shipping Inc.s Income Statement for the month ended January

Prepare Shipping Inc.s January closing entries.

Prepare Shipping Inc.s January postclosing trial balance.

Prepare Shipping Inc.s Statement of Retained Earnings for the month ended January and their Balance Sheet as of January

Shipping Inc.s transactions during January :

Jan. Purchased inventory costing $ on credit.

Jan. Purchased a delivery van for $ in cash. Monthly depreciation for the van is $

Jan. Paid $ for a oneyear insurance policy covering the period January through December

Jan. Purchased $ of supplies using cash.

Jan. Paid $ to its suppliers for inventory purchased on credit in December

Jan. Issued shares of nopar common stock for $ per share.

Jan. Performed repairs and maintenance on their equipment costing $paid in cash

Jan. Declared and paid $ in dividends to its shareholders. Shipping Inc. elected to debit Retained Earnings for the dividend.

Jan. Delivered goods for which a customer had prepaid $the full sales price in December of hint: see the Deferred Revenue account in the January trial balance

Jan. Paid its employees $ for work performed from December January $ was for work performed in December and was for work performed from January January

During January Shipping Inc. collected $ in accounts receivable. Make a summary entry for the entire month

During January Shipping Inc. made credit sales for $ The cost of the goods sold was $Make summary entries for the entire month

Other information:

At the end of January Shipping Inc. had $ of supplies on hand.

Monthly depreciation for the Furniture & Fixtures is $ and monthly depreciation for the equipment is $

The note payable for $ is an year note that matures on December The interest on the note is and is payable annually on each December st Shipping Inc. made their regularly scheduled interest payment of $ on December

During the period January January employees earned an additional $ which will be included in their February paycheck.

At the end of January Shipping Inc. had months of prepaid insurance remaining.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To answer all parts of the question in tabular form Ill use a format that will help organize the journal entries Taccounts trial balances and financial statements effectively Heres a detailed stepbyst...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started