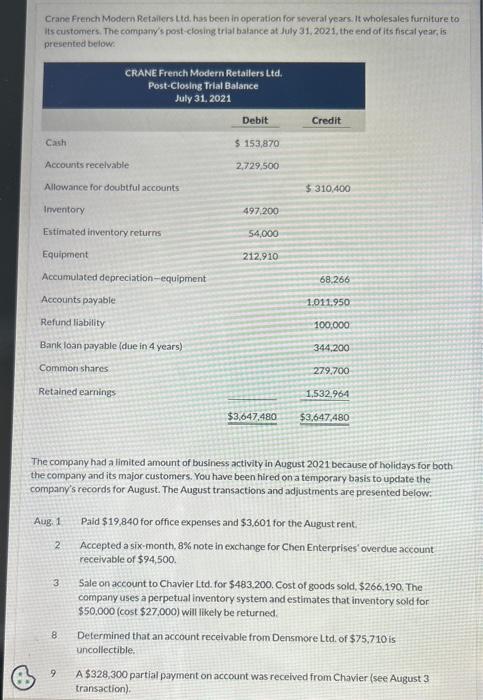

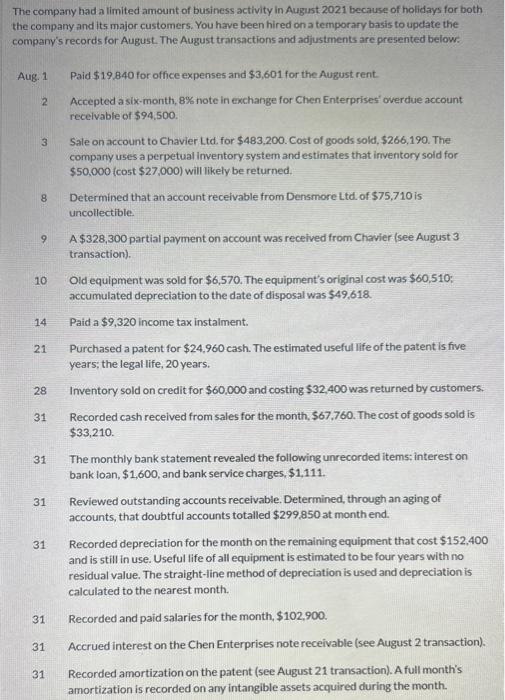

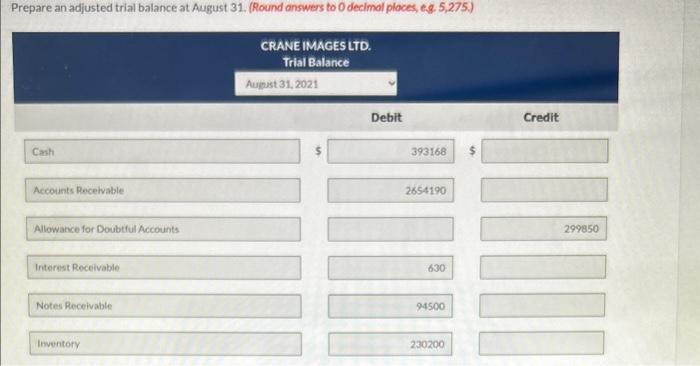

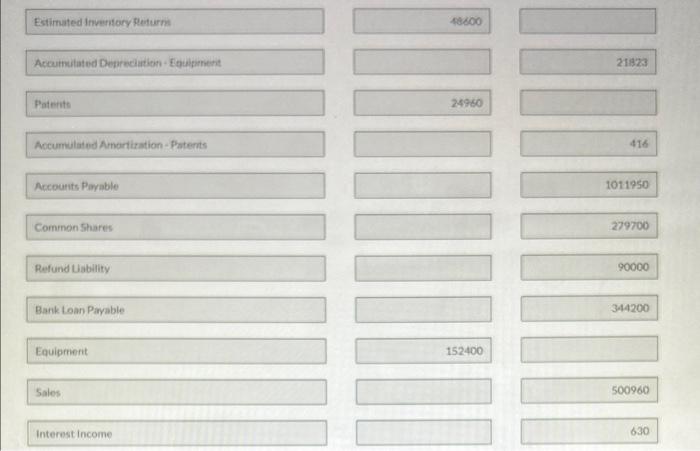

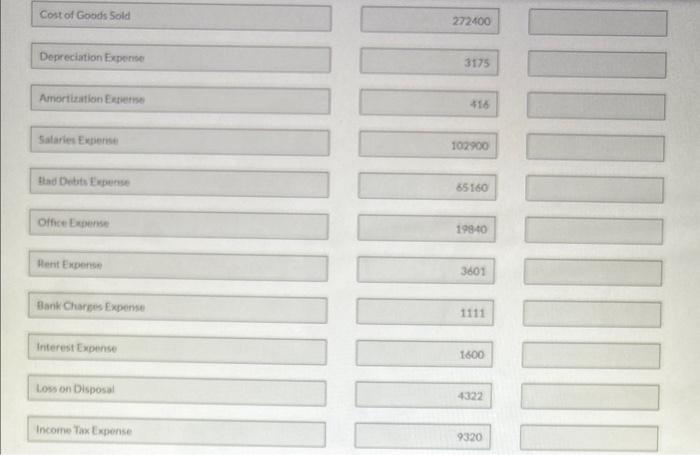

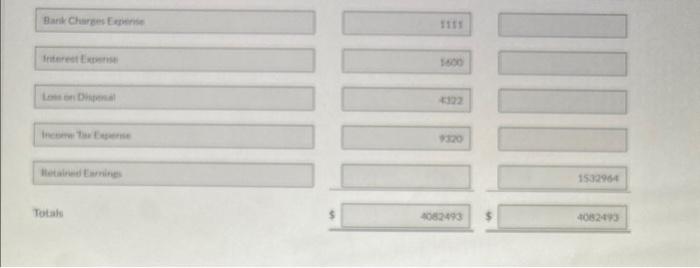

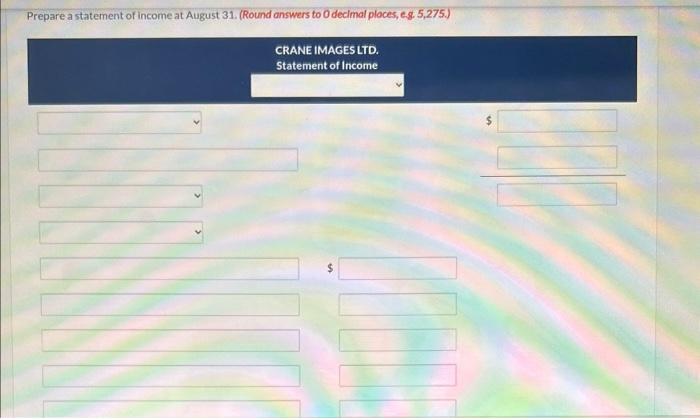

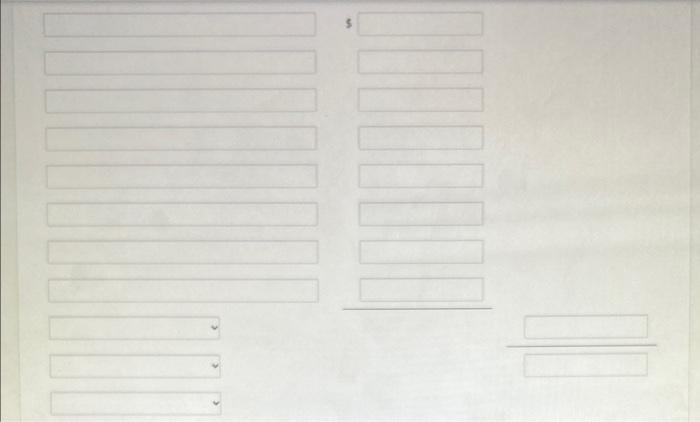

Crane French Modern Retailers Ldd, has been in operation for several years. It wholesales furniture to its customers. The compamy's post-ciosing trial balance at July 31, 2021, the end of its fiscal year, is presented below: The company had a limited amount of business activity in August 2021 because of holidays for both the company and its major customers. You have been hired on a temporary basis to update the company's records for August. The August transactions and adjustments are presented below: Aug.1 Paid $19,840 for office expenses and $3,601 for the August rent. 2. Accepted a six-month, 8\% note in exchange for Chen Enterprises' overdue account receivable of $94,500. 3. Sale on account to Chavier Ltd. for $483,200. Cost of goods sold, $266,190. The company uses a perpetual inventory system and estimates that inventory sold for $50.000(cost$27,000) will likely be returned. 8. Determined that an account receivable from Densmore Ltd. of $75.710 is uncollectible. 9 A $328,300 partial payment on account was received from Chavler (see August 3 transaction). The company bad a limited amount of business activity in August 2021 because of holidays for both the company and its major customers. You have been hired on a temporary basis to update the company's records for August. The August transactions and adjustments are presented below: Aug. 1 Paid $19,840 for office expenses and $3,601 for the August rent. 2 Accepted a six-month, 8\% note in exchange for Chen Enterprises' overdue account recelvable of $94,500 3 Sale on account to Chavier Ltd. for $483,200. Cost of goods sold, $266,190. The company uses a perpetual inventory system and estimates that inventory sold for $50,000(cost$27,000) will likely be returned. 8 Determined that an account receivable from Densmore Ltd. of $75,710 is uncollectible. 9 A $328,300 partial payment on account was recelved from Chavier (see August 3 transaction). 10 Old equipment was sold for $6,570. The equipment's original cost was $60,510 : accumulated depreciation to the date of disposal was $49,618. 14 Paid a $9,320 income tax instalment. 21 Purchased a patent for $24,960 cash. The estimated useful iife of the patent is five years; the legal life, 20 years. 28 Inventory sold on credit for $60,000 and costing $32,400 was returned by customers. 31 Recorded cash received from sales for the month, $67,760. The cost of goods sold is $33,210. 31 The monthly bank statement revealed the following unrecorded items; interest on bank loan, $1,600, and bank service charges, $1,111. 31 Reviewed outstanding accounts receivable. Determined, through an aging of accounts, that doubtful accounts totalled $299.850 at month end. 31 Recorded depreciation for the month on the remaining equipment that cost $152,400 and is still in use. Useful life of all equipment is estimated to be four years with no residual value. The straight-line method of depreciation is used and depreciation is calculated to the nearest month. 31 Recorded and paid salaries for the month, $102,900. 31 Accrued interest on the Chen Enterprises note receivable (see August 2 transaction). 31 Recorded amortization on the patent (see August 21 transaction). A full month's amortization is recorded on any intangible assets acquired during the month. Prepare an adjusted trial balance at August 31. (Round answers to 0 decimal ploces, e. \& 5,275.) Estimated Inveritory Reiurm Faterits Accumblated Amartiration - Paterits Accourits Payable Common Shares Refund Labitity Bank toan Paryable Equiprrerit Sales Interest income Cost of Goods Sold Depreciation Expense Amortization Extietise Salaries Exberise thad Detits Erperse Office Exomse Hent Enperse Bank Charges Expense 1111 Interest Exownse L.os on Disposal 4322 Income Tax Expense Barik Charese E wienise Ifitered fxtieni likecunt tue fogerse lietairied timnities Totale Prepare a statement of income at August 31. (Round answers to 0 decimal ploces, e.g 5,275.)