Question

Crane Inc. manufactures wood poles. Crane Inc. has two responsibility centres, harvesting and sawing, which are both evaluated as profit centres. The harvesting division

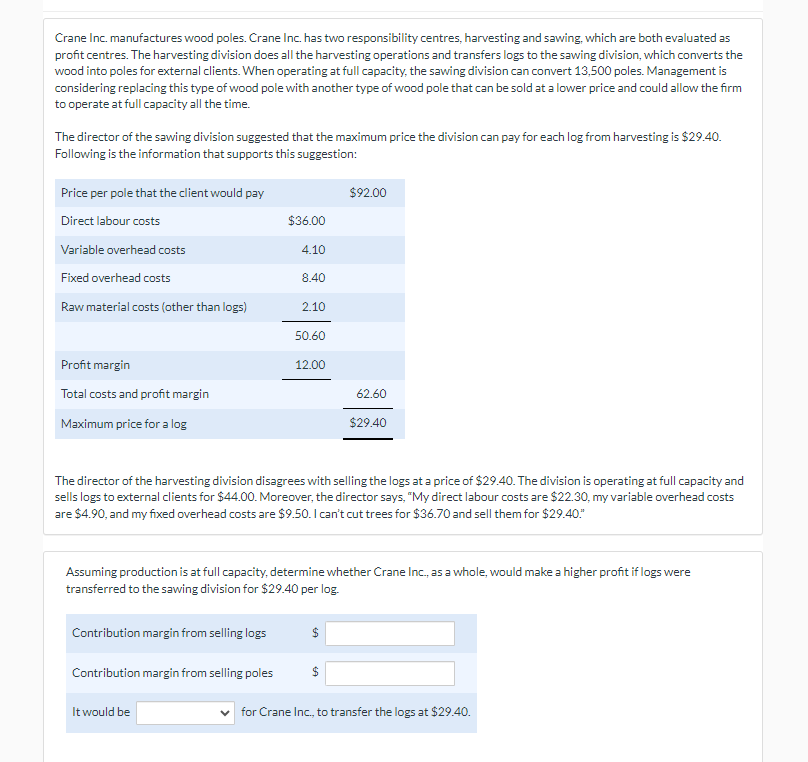

Crane Inc. manufactures wood poles. Crane Inc. has two responsibility centres, harvesting and sawing, which are both evaluated as profit centres. The harvesting division does all the harvesting operations and transfers logs to the sawing division, which converts the wood into poles for external clients. When operating at full capacity, the sawing division can convert 13,500 poles. Management is considering replacing this type of wood pole with another type of wood pole that can be sold at a lower price and could allow the firm to operate at full capacity all the time. The director of the sawing division suggested that the maximum price the division can pay for each log from harvesting is $29.40. Following is the information that supports this suggestion: Price per pole that the client would pay $92.00 Direct labour costs $36.00 Variable overhead costs 4.10 Fixed overhead costs 8.40 Raw material costs (other than logs) 2.10 50.60 Profit margin 12.00 Total costs and profit margin 62.60 Maximum price for a log $29.40 The director of the harvesting division disagrees with selling the logs at a price of $29.40. The division is operating at full capacity and sells logs to external clients for $44.00. Moreover, the director says, "My direct labour costs are $22.30, my variable overhead costs are $4.90, and my fixed overhead costs are $9.50. I can't cut trees for $36.70 and sell them for $29.40." Assuming production is at full capacity, determine whether Crane Inc., as a whole, would make a higher profit if logs were transferred to the sawing division for $29.40 per log. Contribution margin from selling logs Contribution margin from selling poles It would be for Crane Inc., to transfer the logs at $29.40.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started