Question

Crane Inc. owns assets to which it applies the revaluation model (asset-adjustment method). The following additional information is available: 1. The depreciation expense for

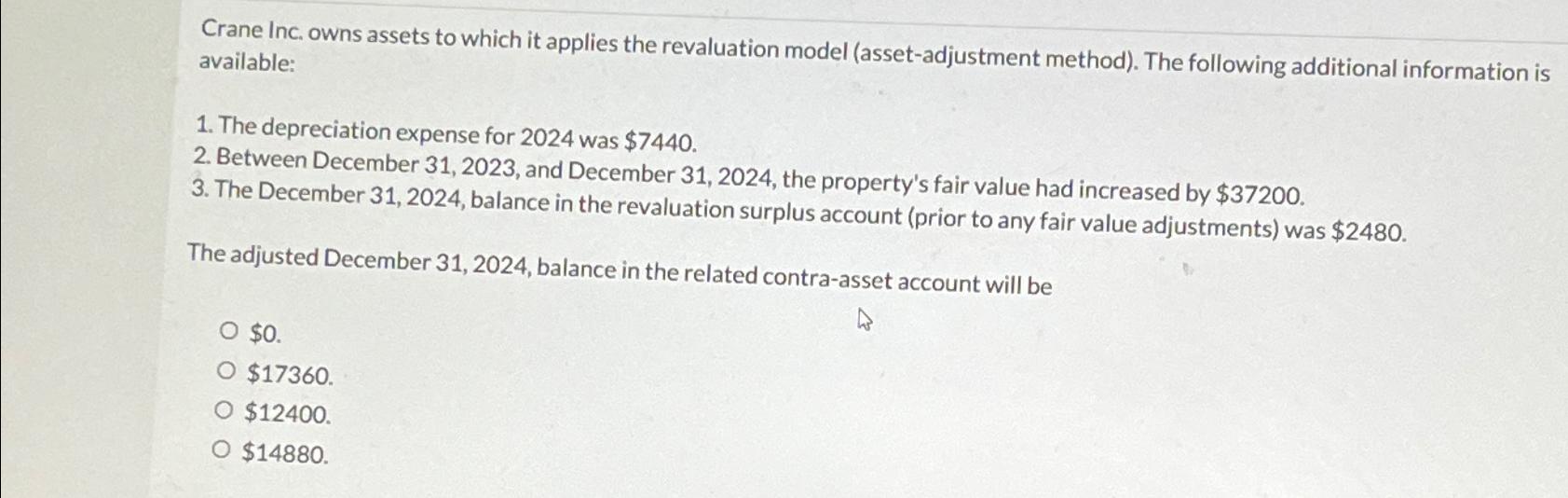

Crane Inc. owns assets to which it applies the revaluation model (asset-adjustment method). The following additional information is available: 1. The depreciation expense for 2024 was $7440. 2. Between December 31, 2023, and December 31, 2024, the property's fair value had increased by $37200. 3. The December 31, 2024, balance in the revaluation surplus account (prior to any fair value adjustments) was $2480. The adjusted December 31, 2024, balance in the related contra-asset account will be O $0. O $17360. O $12400. O $14880.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Depreciation expense for 2024 was 7440 Fair value increased by 37200 be...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Discrete and Combinatorial Mathematics An Applied Introduction

Authors: Ralph P. Grimaldi

5th edition

201726343, 978-0201726343

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App