Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Crane SA manufactures an X-ray machine with an estimated life of 12 years and leases it to Chambers Medical Center for a period of 10

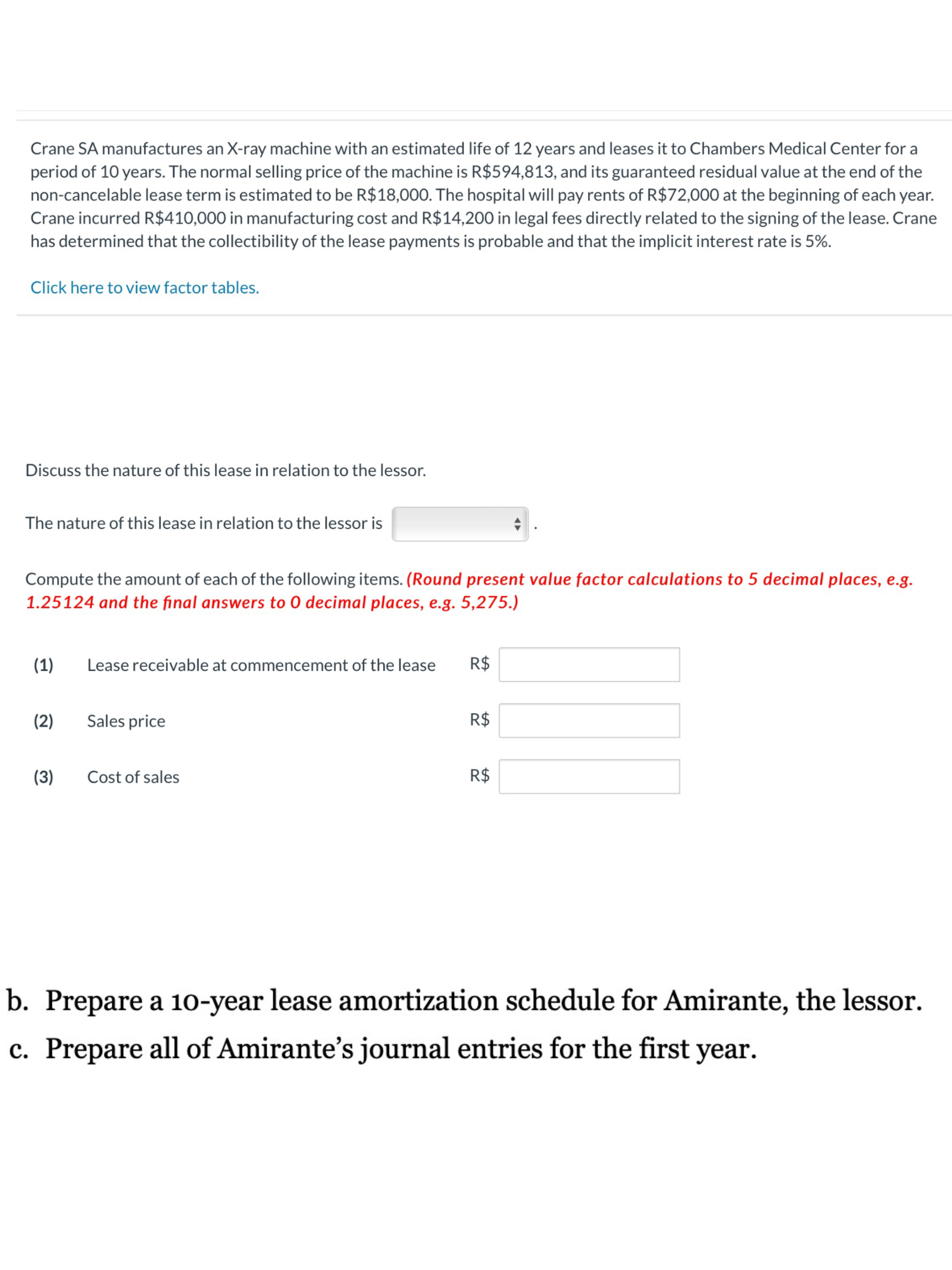

Crane SA manufactures an X-ray machine with an estimated life of 12 years and leases it to Chambers Medical Center for a period of 10 years. The normal selling price of the machine is R$594,813, and its guaranteed residual value at the end of the non-cancelable lease term is estimated to be R$18,000. The hospital will pay rents of R$72,000 at the beginning of each year. Crane incurred R$410,000 in manufacturing cost and R$14,200 in legal fees directly related to the signing of the lease. Crane has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 5%. Click here to view factor tables. Discuss the nature of this lease in relation to the lessor. The nature of this lease in relation to the lessor is Compute the amount of each of the following items. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answers to 0 decimal places, e.g. 5,275.) (1) Lease receivable at commencement of the lease R$ (2) Sales price R$ (3) Cost of sales R$ b. Prepare a 10-year lease amortization schedule for Amirante, the lessor. c. Prepare all of Amirante's journal entries for the first year

Crane SA manufactures an X-ray machine with an estimated life of 12 years and leases it to Chambers Medical Center for a period of 10 years. The normal selling price of the machine is R$594,813, and its guaranteed residual value at the end of the non-cancelable lease term is estimated to be R$18,000. The hospital will pay rents of R$72,000 at the beginning of each year. Crane incurred R$410,000 in manufacturing cost and R$14,200 in legal fees directly related to the signing of the lease. Crane has determined that the collectibility of the lease payments is probable and that the implicit interest rate is 5%. Click here to view factor tables. Discuss the nature of this lease in relation to the lessor. The nature of this lease in relation to the lessor is Compute the amount of each of the following items. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answers to 0 decimal places, e.g. 5,275.) (1) Lease receivable at commencement of the lease R$ (2) Sales price R$ (3) Cost of sales R$ b. Prepare a 10-year lease amortization schedule for Amirante, the lessor. c. Prepare all of Amirante's journal entries for the first year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started