Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have decided to make some extra cash to pay for college. You had the bright idea to open up a Cheap Crap Pawn

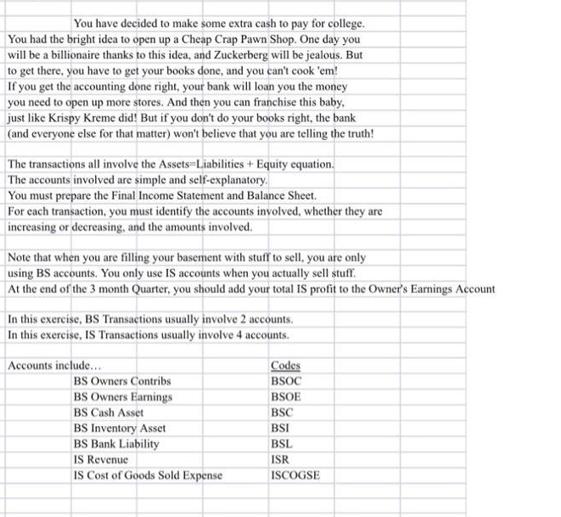

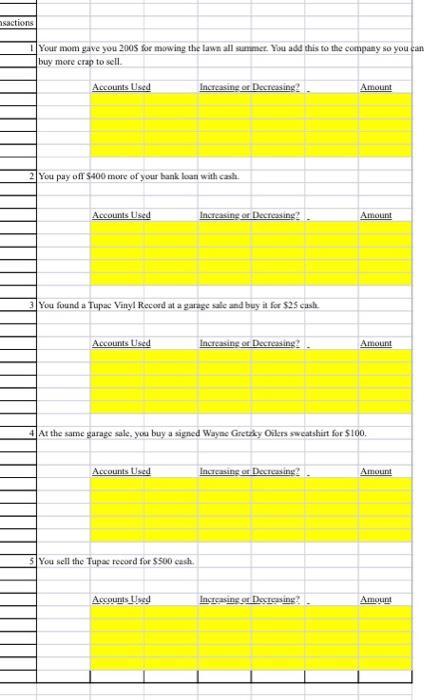

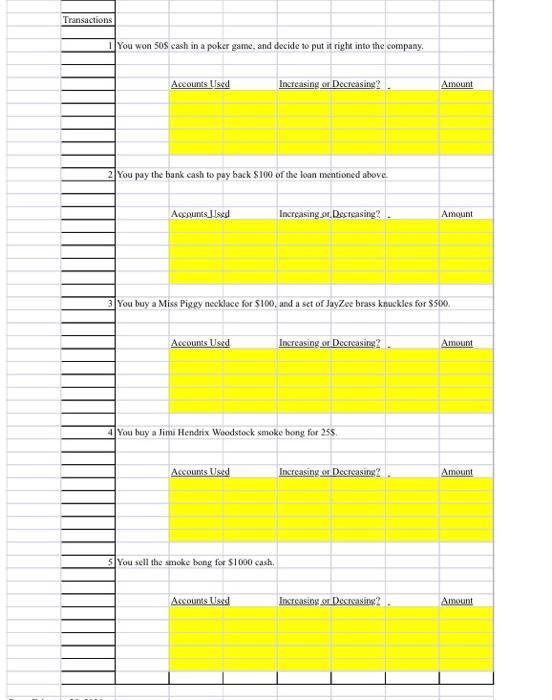

You have decided to make some extra cash to pay for college. You had the bright idea to open up a Cheap Crap Pawn Shop. One day you will be a billionaire thanks to this idea, and Zuckerberg will be jealous. But to get there, you have to get your books done, and you can't cook 'em! If you get the accounting done right, your bank will loan you the money you need to open up more stores. And then you can franchise this baby, just like Krispy Kreme did! But if you don't do your books right, the bank (and everyone else for that matter) won't believe that you are telling the truth! The transactions all involve the Assets-Liabilities + Equity equation. The accounts involved are simple and self-explanatory. You must prepare the Final Income Statement and Balance Sheet. For each transaction, you must identify the accounts involved, whether they are increasing or decreasing, and the amounts involved. Note that when you are filling your basement with stuff to sell, you are only using BS accounts. You only use IS accounts when you actually sell stuff. At the end of the 3 month Quarter, you should add your total IS profit to the Owner's Earnings Account In this exercise, BS Transactions usually involve 2 accounts. In this exercise, IS Transactions usually involve 4 accounts. Accounts include... BS Owners Contribs BS Owners Earnings BS Cash Asset BS Inventory Asset BS Bank Liability IS Revenue IS Cost of Goods Sold Expense Codes BSOC BSOE BSC BSI BSL ISR ISCOGSE sactions Your mom gave you 2005 for mowing the lawn all summer. You add this to the company so you can buy more crap to sell. Accounts Used You pay off $400 more of your bank loan with cash. Accounts Used Accounts Used 3 You found a Tupac Vinyl Record at a garage sale and buy it for $25 cash. Increasing or Decreasing? Accounts Used 5 You sell the Tupac record for $500 cash. Increasing or Decreasing? Accounts Used Increasing or Decreasing? 4 At the same garage sale, you buy a signed Wayne Gretzky Oilers sweatshirt for $100. Increasing or Decreasing? Amount Increasing or Decreasing? Amount Amount Amount Amount Transactions You won 50S cash in a poker game, and decide to put it right into the company. Accounts Used 2 You pay the bank cash to pay back $100 of the loan mentioned above. Accounts Lised Accounts Used Increasing or Decreasing? Accounts Used 3 You buy a Miss Piggy necklace for $100, and a set of JayZee brass knuckles for $500. 5 You sell the smoke bong for $1000 cash. Increasing or Decreasing? 4 You buy a Jimi Hendrix Woodstock smoke bong for 255. Accounts Used Increasing or Decreasing? Increasing or Decreasing? Amount Increasing or Decreasing? Amount Amount Amount Amount

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To properly record the transactions and prepare the Final Income Statement and Balance Sheet for your Cheap Crap Pawn Shop we need to identif...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started