Answered step by step

Verified Expert Solution

Question

1 Approved Answer

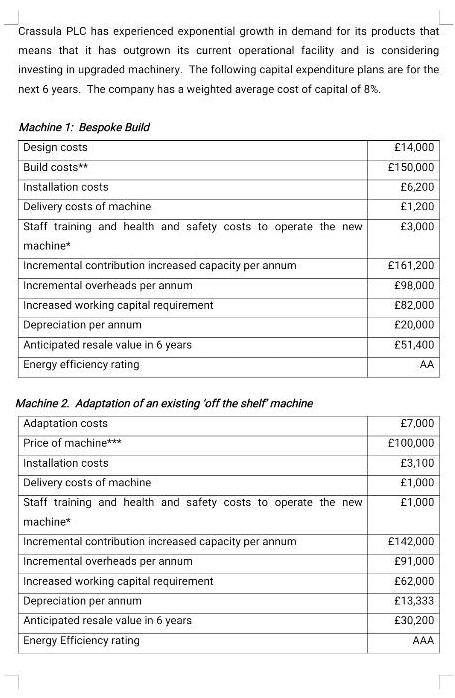

Crassula PLC has experienced exponential growth in demand for its products that means that it has outgrown its current operational facility and is considering

Crassula PLC has experienced exponential growth in demand for its products that means that it has outgrown its current operational facility and is considering investing in upgraded machinery. The following capital expenditure plans are for the next 6 years. The company has a weighted average cost of capital of 8%. Machine 1: Bespoke Build Design costs Build costs** Installation costs Delivery costs of machine Staff training and health and safety costs to operate the new machine* Incremental contribution increased capacity per annum Incremental overheads per annum Increased working capital requirement Depreciation per annum Anticipated resale value in 6 years Energy efficiency rating Machine 2. Adaptation of an existing off the shelf machine Adaptation costs Price of machine*** Installation costs Delivery costs of machine Staff training and health and safety costs to operate the new machine* Incremental contribution increased capacity per annum Incremental overheads per annum Increased working capital requirement Depreciation per annum Anticipated resale value in 6 years Energy Efficiency rating 14,000 150,000 6,200 1,200 3,000 161,200 98,000 82,000 20,000 51,400 AA 7,000 100,000 3,100 1,000 1,000 142,000 91,000 62,000 13,333 30,200 AAA The staff training and health and safety costs are a one off cost required before the machines are operational. ** The bespoke machine figures for build and installation are estimates provided by the contractors but are subject to potential cost increases. ***The price of the off the shelf machine is guaranteed for 6 months. Due to government growth strategies for industry Crassula PLC will pay no corporation tax on profits for the next 10 years. Required (show your workings for each answer): [14 marks] Write a report for Crassula PLC, clearly advising which proposal should be undertaken. Indicate any reservations regarding the methods used in your evaluation and discuss other strategic factors that Crassula PLC should consider. [10 marks] Explain why the NPV is considered the most theoretically superior of the four capex appraisal techniques used to evaluate this investment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

In order to advise Crassula PLC on which proposal to undertake we need to calculate the Net Present Value NPV for each machine and then compare these values The NPV is calculated by finding the presen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started