Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Craxton Engineering will either purchase or lease a new $758,000 fabricator. If purchased, the fabricator will be depreciated on a straight-line basis over 7 years.

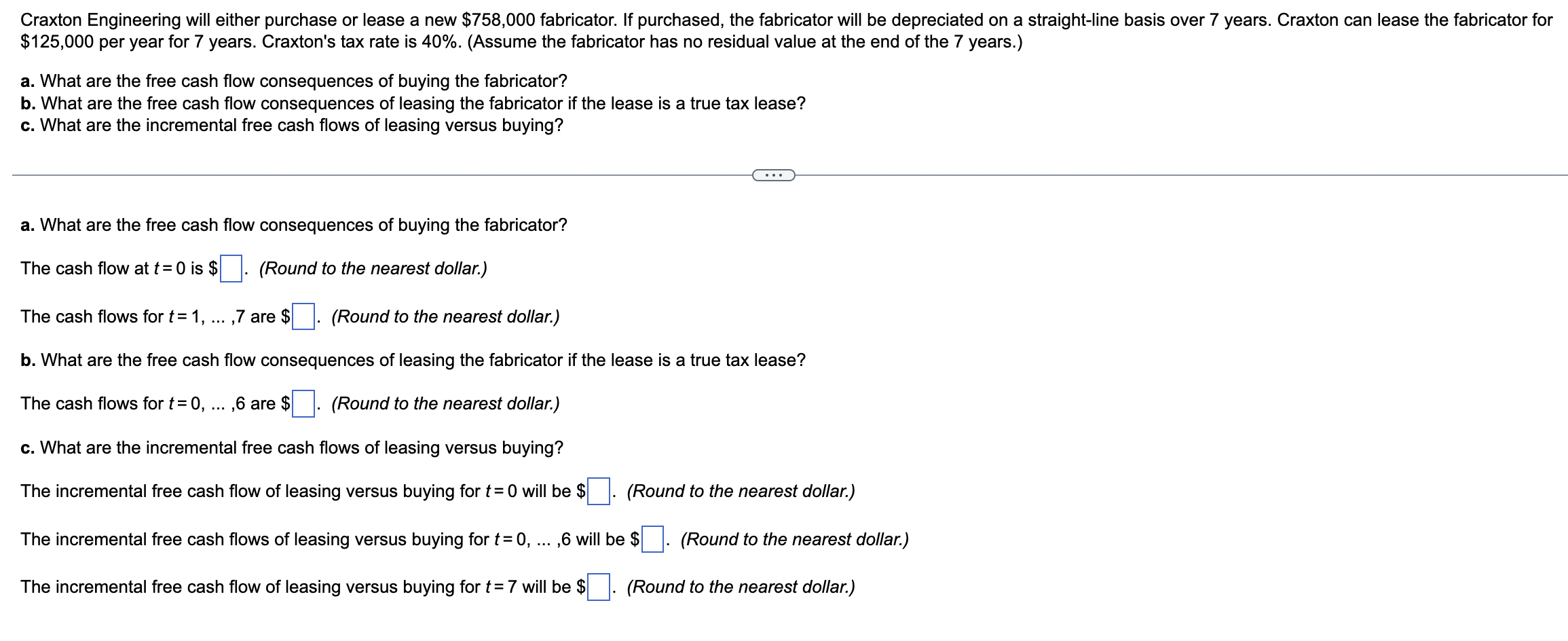

Craxton Engineering will either purchase or lease a new $758,000 fabricator. If purchased, the fabricator will be depreciated on a straight-line basis over 7 years. Craxton can lease the fabricator for $125,000 per year for 7 years. Craxton's tax rate is 40%. (Assume the fabricator has no residual value at the end of the 7 years.) a. What are the free cash flow consequences of buying the fabricator? b. What are the free cash flow consequences of leasing the fabricator if the lease is a true tax lease? c. What are the incremental free cash flows of leasing versus buying? a. What are the free cash flow consequences of buying the fabricator? The cash flow at t=0 is $. (Round to the nearest dollar.) The cash flows for t=1,,7 are $ (Round to the nearest dollar.) b. What are the free cash flow consequences of leasing the fabricator if the lease is a true tax lease? The cash flows for t=0,,6 are $ (Round to the nearest dollar.) c. What are the incremental free cash flows of leasing versus buying? The incremental free cash flow of leasing versus buying for t=0 will be . (Round to the nearest dollar.) The incremental free cash flows of leasing versus buying for t=0,,6 will be $. (Round to the nearest dollar.) The incremental free cash flow of leasing versus buying for t=7 will be $ (Round to the nearest dollar.) Craxton Engineering will either purchase or lease a new $758,000 fabricator. If purchased, the fabricator will be depreciated on a straight-line basis over 7 years. Craxton can lease the fabricator for $125,000 per year for 7 years. Craxton's tax rate is 40%. (Assume the fabricator has no residual value at the end of the 7 years.) a. What are the free cash flow consequences of buying the fabricator? b. What are the free cash flow consequences of leasing the fabricator if the lease is a true tax lease? c. What are the incremental free cash flows of leasing versus buying? a. What are the free cash flow consequences of buying the fabricator? The cash flow at t=0 is $. (Round to the nearest dollar.) The cash flows for t=1,,7 are $ (Round to the nearest dollar.) b. What are the free cash flow consequences of leasing the fabricator if the lease is a true tax lease? The cash flows for t=0,,6 are $ (Round to the nearest dollar.) c. What are the incremental free cash flows of leasing versus buying? The incremental free cash flow of leasing versus buying for t=0 will be . (Round to the nearest dollar.) The incremental free cash flows of leasing versus buying for t=0,,6 will be $. (Round to the nearest dollar.) The incremental free cash flow of leasing versus buying for t=7 will be $ (Round to the nearest dollar.)

Craxton Engineering will either purchase or lease a new $758,000 fabricator. If purchased, the fabricator will be depreciated on a straight-line basis over 7 years. Craxton can lease the fabricator for $125,000 per year for 7 years. Craxton's tax rate is 40%. (Assume the fabricator has no residual value at the end of the 7 years.) a. What are the free cash flow consequences of buying the fabricator? b. What are the free cash flow consequences of leasing the fabricator if the lease is a true tax lease? c. What are the incremental free cash flows of leasing versus buying? a. What are the free cash flow consequences of buying the fabricator? The cash flow at t=0 is $. (Round to the nearest dollar.) The cash flows for t=1,,7 are $ (Round to the nearest dollar.) b. What are the free cash flow consequences of leasing the fabricator if the lease is a true tax lease? The cash flows for t=0,,6 are $ (Round to the nearest dollar.) c. What are the incremental free cash flows of leasing versus buying? The incremental free cash flow of leasing versus buying for t=0 will be . (Round to the nearest dollar.) The incremental free cash flows of leasing versus buying for t=0,,6 will be $. (Round to the nearest dollar.) The incremental free cash flow of leasing versus buying for t=7 will be $ (Round to the nearest dollar.) Craxton Engineering will either purchase or lease a new $758,000 fabricator. If purchased, the fabricator will be depreciated on a straight-line basis over 7 years. Craxton can lease the fabricator for $125,000 per year for 7 years. Craxton's tax rate is 40%. (Assume the fabricator has no residual value at the end of the 7 years.) a. What are the free cash flow consequences of buying the fabricator? b. What are the free cash flow consequences of leasing the fabricator if the lease is a true tax lease? c. What are the incremental free cash flows of leasing versus buying? a. What are the free cash flow consequences of buying the fabricator? The cash flow at t=0 is $. (Round to the nearest dollar.) The cash flows for t=1,,7 are $ (Round to the nearest dollar.) b. What are the free cash flow consequences of leasing the fabricator if the lease is a true tax lease? The cash flows for t=0,,6 are $ (Round to the nearest dollar.) c. What are the incremental free cash flows of leasing versus buying? The incremental free cash flow of leasing versus buying for t=0 will be . (Round to the nearest dollar.) The incremental free cash flows of leasing versus buying for t=0,,6 will be $. (Round to the nearest dollar.) The incremental free cash flow of leasing versus buying for t=7 will be $ (Round to the nearest dollar.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started