Question

Creat an Investment Policy Statement for yourhypothetical investor Your first client is Jim and Karla Sanders who are 25 and 22, resectively. Jim and Karla

Creat an Investment Policy Statement for yourhypothetical investor

Your first client is Jim and Karla Sanders who are 25 and 22, resectively. Jim and Karla have been married for two years and have a one year old son. They plan on adding another baby and dog to their family within the next two years. Jim is an accountant and his salary is $45,000 a year. Karla works part-time and earns $25,000 a year. In two years, Jim expects to be making $70,000 a year and Karla is planning on staying at home with the growing family. They do not expect to have more than two children, but they may add a cat. They recently inherited $100,000 from Karla's grandmother and would like you to invest it all in equities for them. They would like to buy a house in two years, but they do not expect to need any funds from this $100,000 portfolio for that. They would like to use this portfolio to fund the college eduations of their two children and supplement thier retirement. Jim currently is very happy with his job and doesn't expect to retire for at least 40 years. Jim also has a 401k retirement plan from work, that he may need further help managing but it is very small at this point in time and they did not share the details of that account with you. They both took the same risk tolerance survey that you just took and they both had an average risk tolerance level.

NOTE: We are assuming that your client is saving for long term goals such as retirement (10 years or longer) thus you are only concerned about capital appreciation or growth NOT income. In the strategic asset allocation example for George it was important that we set up a portfolio that met his income needs after tax as well as his long term needs. YOU do NOT need to make any assumptions about dividend yields or income for current year IF you have only long term objectives in your client's IPS. For long term investments you can assume that your portfolio asset classes will be in line with long run historical averages. For example, we are benchmarking the S&P 500. Therefore, the $100,000 equity portfolio you are managing should have an expected return equal or close to the long run historical average of the S&P 500. IF you are assuming the client has other assets that you are not managing then you should assume reasonable expected rates that are again based on long run averages that could be adjusted for future performance. IF your client only has $100,000 of investment, then you simply use the S&P 500 expected return.

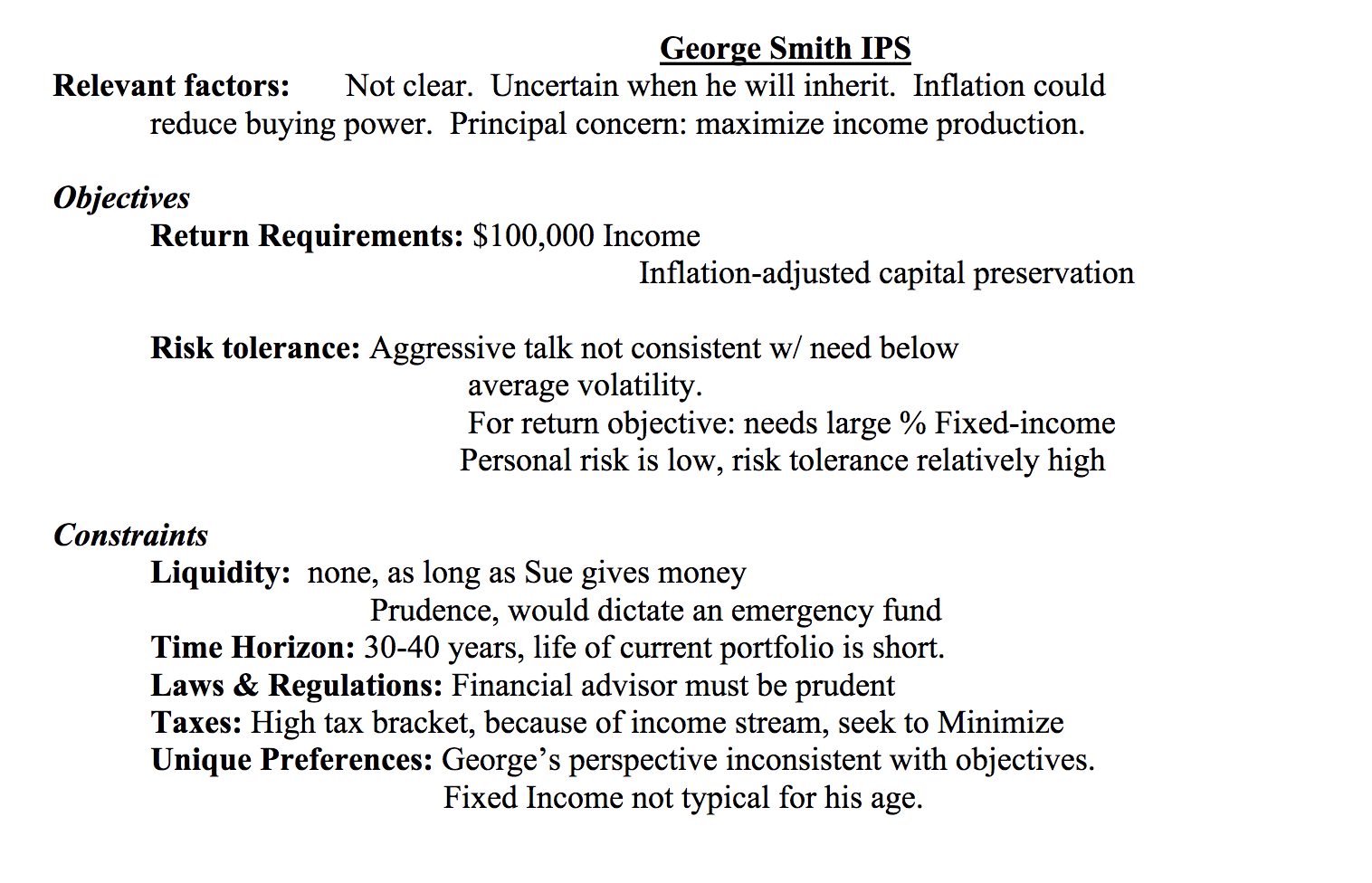

EXAMPLE:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started