Question

Create a Balance Sheet from the Information provided below for the company Wok City, Inc. as of March 31, 2017 In March 2017, Wok City

Create a Balance Sheet from the Information provided below for the company Wok City, Inc. as of March 31, 2017

In March 2017, Wok City, Inc. was formed by contributing (1)$10,000 in cash in exchange for all of the company's 1,000 shares of stock. Owner 1 convinced his parents to loan the new venture (2)$120,000 in cash, with principal payable at the rate of $12,000 per year over ten years and interest payable at a rate of 7.5 percent on the outstanding balance as of the beginning of the loan's year. The loan agreement was signed on March 31, 2017, and provided that both principal and interest would be paid only once a year on March 31.

During March, the Owners searched for a suitable spot for the business to be located. Owner 1 negotiated a lease for approximately 2,000 square feet of retail space at a rate of $1,400 per month. The lease agreement ran for ten years. The landlord agreed to give the owners three months of reduced rent on the front end of the lease in order to help the new business survive the critical start-up period, so rent was only $800 for the first three months.

Also during the month of March, Owner 1 arranged to buy a commercial refrigerator, range, and grill for (3)$26,000 in cash, to be delivered and installed on March 31. Discussions with the seller indicated that the kitchen equipment should last for six years. Owner 1 and owner 2 also purchased a computer system, with restaurant-specific software already installed, at a (4)cost of $12,000 cash. While the system could last indefinitely, owner 2 suggested that it be depreciated over three years. Other purchases included food preparation equipment at a cost of (5)$1,200 cash and various restaurant furniture and fixtures at a cost of (5)$2,700 in cash; the equipment, furniture, and fixtures were expected to have a useful life of four years.

To enable the restaurant to be fully operational on April 1, the landlord allowed the owners carpenter, electrician, painters, and plumbers to begin renovations to the leased store on March 30 and 31. Working round-the-clock, the workers completed all necessary improvements and renovations to the leased space at a (6) cost of $68,000 in cash (leasehold improvement to be depreciation over the 10-year life of the lease). On March 31, the purchased kitchen equipment was delivered and Woks Have a Good Time opened forbusiness as planned on April 1, 2017.

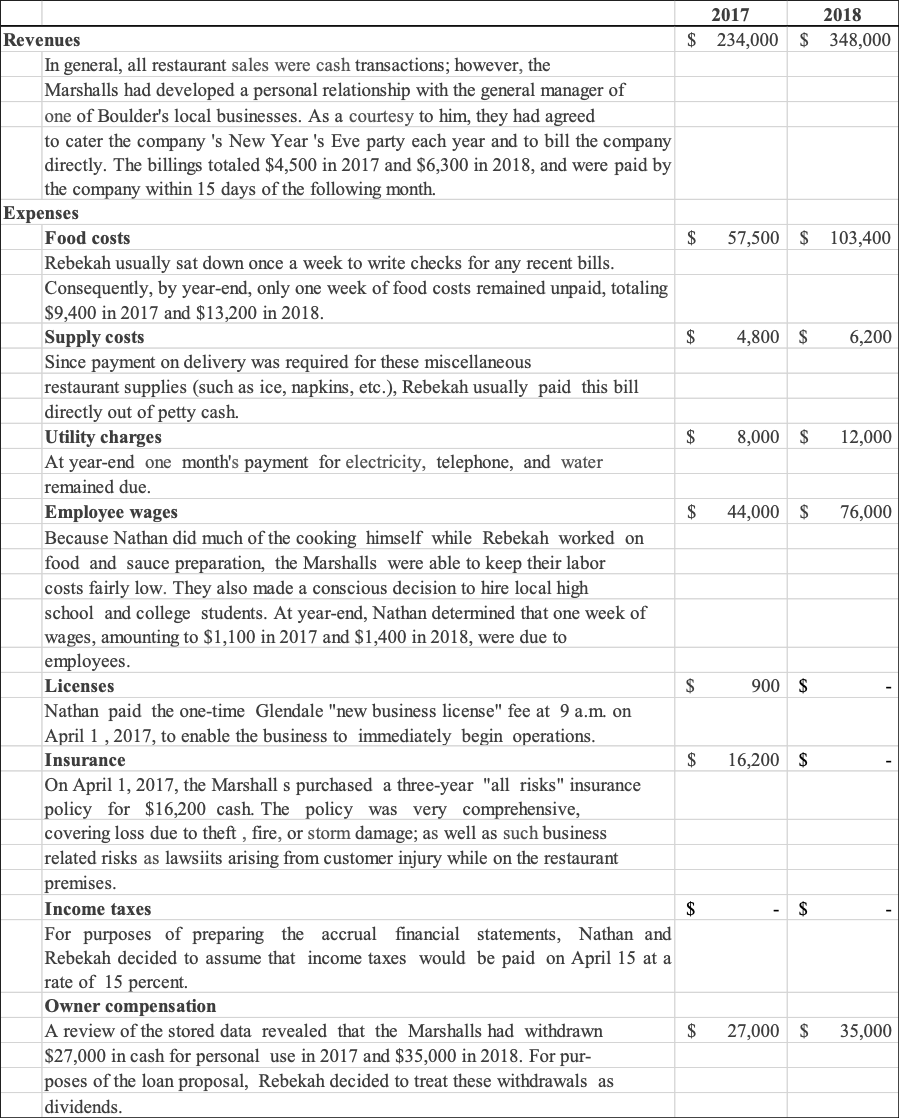

2017 2018 $ 234,000 $ 348,000 $ 57,500 $ 103,400 $ 4,800 $ 6,200 $ 8,000 $ 12,000 $ 44,000 $ 76,000 Revenues In general, all restaurant sales were cash transactions; however, the Marshalls had developed a personal relationship with the general manager of one of Boulder's local businesses. As a courtesy to him, they had agreed to cater the company's New Year's Eve party each year and to bill the company directly. The billings totaled $4,500 in 2017 and $6,300 in 2018, and were paid by the company within 15 days of the following month. Expenses Food costs Rebekah usually sat down once a week to write checks for any recent bills. Consequently, by year-end, only one week of food costs remained unpaid, totaling $9,400 in 2017 and $13,200 in 2018. Supply costs Since payment on delivery was required for these miscellaneous restaurant supplies (such as ice, napkins, etc.), Rebekah usually paid this bill directly out of petty cash. Utility charges At year-end one month's payment for electricity, telephone, and water remained due. Employee wages Because Nathan did much of the cooking himself while Rebekah worked on food and sauce preparation, the Marshalls were able to keep their labor costs fairly low. They also made a conscious decision to hire local high school and college students. At year-end, Nathan determined that one week of wages, amounting to $1,100 in 2017 and $1,400 in 2018, were due to employees. Licenses Nathan paid the one-time Glendale "new business license" fee at 9 a.m. on April 1, 2017, to enable the business to immediately begin operations. Insurance On April 1, 2017, the Marshall s purchased a three-year "all risks" insurance policy for $16,200 cash. The policy was very comprehensive, covering loss due to theft , fire, or storm damage; as well as such business related risks as lawsiits arising from customer injury while on the restaurant premises. Income taxes For purposes of preparing the accrual financial statements, Nathan and Rebekah decided to assume that income taxes would be paid on April 15 at a rate of 15 percent. Owner compensation A review of the stored data revealed that the Marshalls had withdrawn $27,000 in cash for personal use in 2017 and $35,000 in 2018. For pur- poses of the loan proposal, Rebekah decided to treat these withdrawals as dividends. $ 900 $ $ 16,200 $ $ $ $ 27,000 $ 35,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started