Answered step by step

Verified Expert Solution

Question

1 Approved Answer

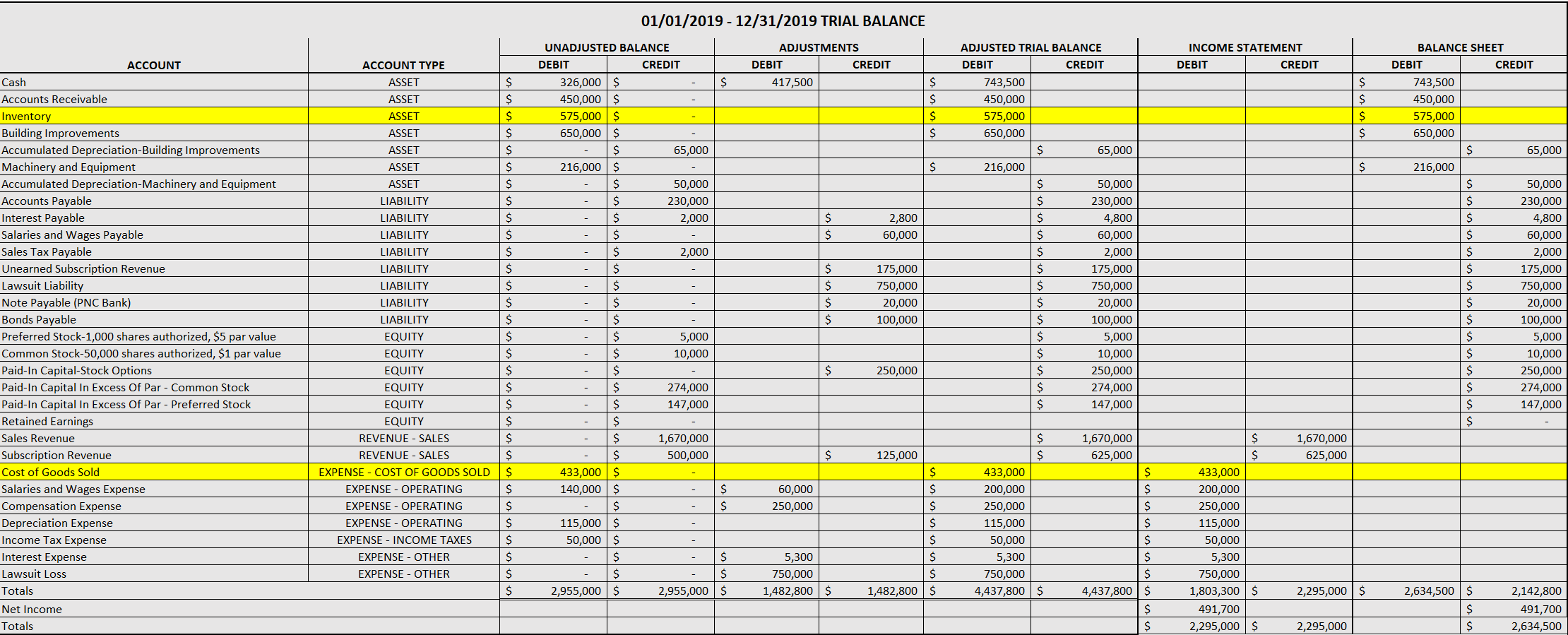

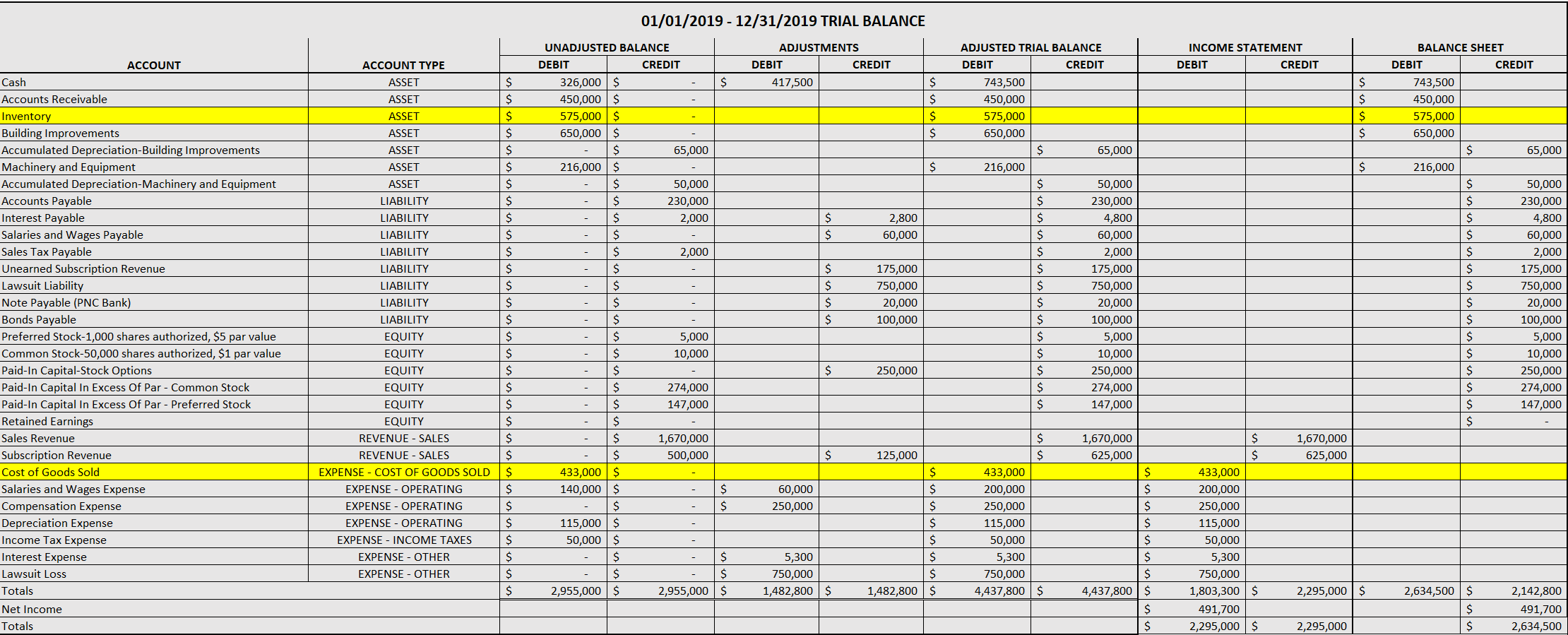

Create a Balance Sheet. 01/01/2019 - 12/31/2019 TRIAL BALANCE ADJUSTMENTS DEBIT CREDIT 417,500 INCOME STATEMENT DEBIT CREDIT ACCOUNT TYPE ASSET $ $ $ $ ASSET

Create a Balance Sheet.

01/01/2019 - 12/31/2019 TRIAL BALANCE ADJUSTMENTS DEBIT CREDIT 417,500 INCOME STATEMENT DEBIT CREDIT ACCOUNT TYPE ASSET $ $ $ $ ASSET $ $ $ $ ASSET ASSET $ $ $ $ ASSET ASSET $ $ $ $ $ ASSET LIABILITY $ $ $ $ 2,800 60,000 $ $ ADJUSTED TRIAL BALANCE DEBIT CREDIT 743,500 450,000 575,000 650,000 $ 65,000 216,000 $ 50,000 $ 230,000 $ 4,800 $ 60,000 $ 2,000 $ 175,000 $ 750,000 $ 20,000 $ 100,000 $ 5,000 $ 10,000 $ 250,000 $ 274,000 $ 147,000 - $ $ BALANCE SHEET DEBIT CREDIT 743,500 450,000 575,000 650,000 $ 65,000 216,000 $ 50,000 $ 230,000 $ 4,800 $ 60,000 $ 2,000 $ 175,000 $ 750,000 $ 20,000 $ 100,000 $ 5,000 $ 10,000 $ 250,000 $ 274,000 $ 147,000 $ $ $ $ $ ACCOUNT Cash Accounts Receivable Inventory Building Improvements Accumulated Depreciation-Building Improvements Machinery and Equipment Accumulated Depreciation Machinery and Equipment Accounts Payable Interest Payable Salaries and Wages Payable Sales Tax Payable Unearned Subscription Revenue Lawsuit Liability Note Payable (PNC Bank) Bonds Payable Preferred Stock-1,000 shares authorized, $5 par value Common Stock-50,000 shares authorized, $1 par value Paid-In Capital-Stock Options Paid-In Capital In Excess Of Par - Common Stock Paid-In Capital In Excess Of Par - Preferred Stock Retained Earnings Sales Revenue Subscription Revenue Cost of Goods Sold Salaries and Wages Expense Compensation Expense Depreciation Expense Income Tax Expense Interest Expense Lawsuit Loss Totals Net Income Totals 175,000 750,000 20,000 100,000 $ UNADJUSTED BALANCE DEBIT CREDIT 326,000 $ $ 450,000 $ 575,000 $ 650,000 $ $ 65,000 216,000 $ $ 50,000 $ 230,000 $ 2,000 $ $ 2,000 $ $ $ $ $ 5,000 $ 10,000 $ $ 274,000 $ 147,000 $ $ 1,670,000 $ 500,000 433,000 $ 140,000 $ $ $ $ 115,000 $ 50,000 $ $ $ $ 2,955,000 $ 2,955,000 $ - LIABILITY LIABILITY LIABILITY LIABILITY LIABILITY LIABILITY LIABILITY EQUITY EQUITY EQUITY EQUITY EQUITY EQUITY REVENUE - SALES REVENUE - SALES EXPENSE - COST OF GOODS SOLD EXPENSE - OPERATING EXPENSE - OPERATING EXPENSE - OPERATING EXPENSE - INCOME TAXES EXPENSE - OTHER EXPENSE - OTHER $ 250,000 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 1,670,000 625,000 $ 60,000 250,000 125,000 $ $ $ $ $ $ $ 1,482,800 $ 433,000 200,000 250,000 115,000 50,000 1,670,000 625,000 $ $ $ $ $ $ $ 4,437,800 $ $ $ $ $ 433,000 200,000 250,000 115,000 50,000 5,300 750,000 1,803,300 $ 491,700 2,295,000 $ 5,300 5,300 750,000 1,482,800 $ 750,000 4,437,800 $ 2,295,000 $ 2,634,500 $ $ $ 2,142,800 491,700 2,634,500 2,295,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started