Answered step by step

Verified Expert Solution

Question

1 Approved Answer

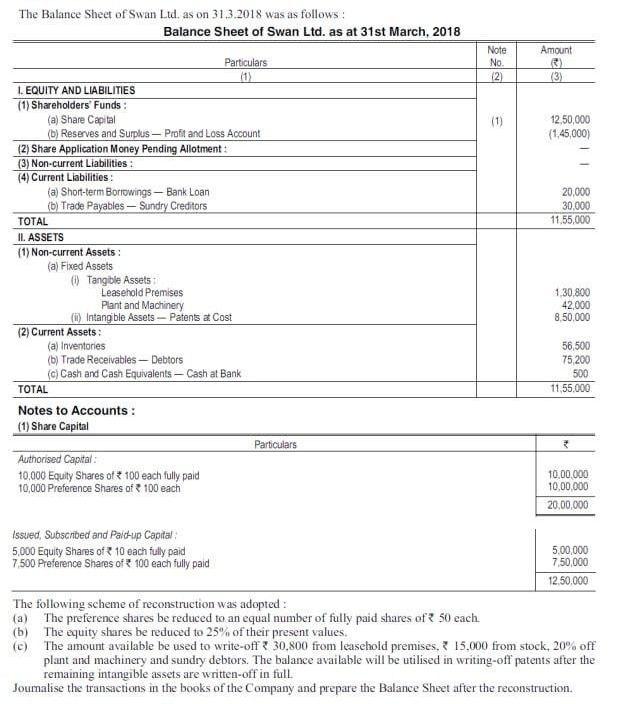

The Balance Sheet of Swan Ltd. as on 31.3.2018 was as follows: 1. EQUITY AND LIABILITIES (1) Shareholders Funds: (a) Share Capital (b) Reserves

The Balance Sheet of Swan Ltd. as on 31.3.2018 was as follows: 1. EQUITY AND LIABILITIES (1) Shareholders Funds: (a) Share Capital (b) Reserves and Surplus-Profit and Loss Account Balance Sheet of Swan Ltd. as at 31st March, 2018 (2) Share Application Money Pending Allotment: (3) Non-current Liabilities: (4) Current Liabilities: (a) Short-term Borrowings - Bank Loan (b) Trade Payables - Sundry Creditors TOTAL II. ASSETS (1) Non-current Assets: (a) Fixed Assets (i) Tangible Assets: Particulars (1) Leasehold Premises Plant and Machinery (ii) Intangible Assets-Patents at Cost TOTAL Notes to Accounts: (1) Share Capital (2) Current Assets: (a) Inventories (b) Trade Receivables - Debtors (c) Cash and Cash Equivalents-Cash at Bank Authorised Capital: 10,000 Equity Shares of * 100 each fully paid 10,000 Preference Shares of 100 each Issued, Subscribed and Paid-up Capital: 5,000 Equity Shares of 10 each fully paid 7,500 Preference Shares of 100 each fully paid Particulars The following scheme of reconstruction was adopted: (a) The preference shares be reduced to an equal number of fully paid shares of 50 each. Note No. (2) (1) Amount (3) (3) 12,50,000 (1,45,000) 20,000 30,000 11,55,000 1,30,800 42,000 8,50.000 56,500 75,200 500 11,55.000 10,00,000 10,00,000 20,00,000 5,00,000 7,50,000 12,50.000 (b) The equity shares be reduced to 25% of their present values. (c) The amount available be used to write-off 30.800 from leasehold premises. 15,000 from stock, 20% off plant and machinery and sundry debtors. The balance available will be utilised in writing-off patents after the remaining intangible assets are written-off in full. Journalise the transactions in the books of the Company and prepare the Balance Sheet after the reconstruction.

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started