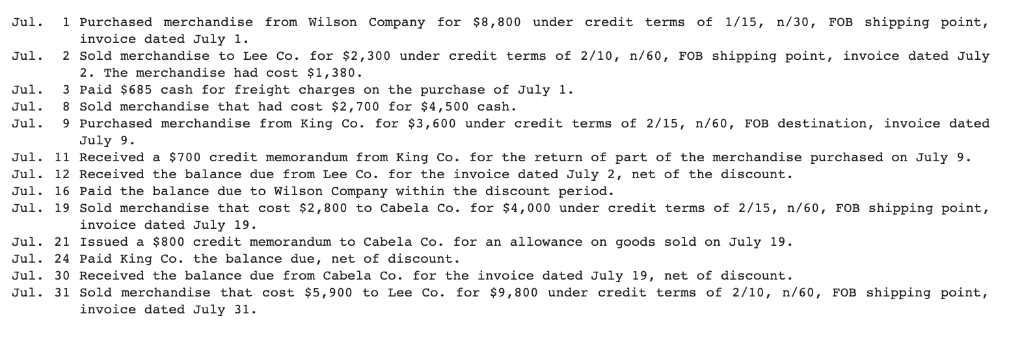

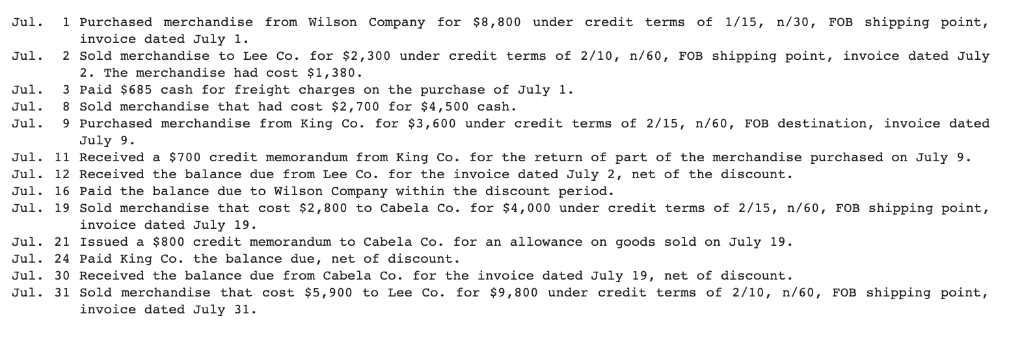

Create a General Ledger for the following

Jul. Purchased merchandise from Wilson Company for $8,800 under credit terms of 1/15, n/30, FOB shipping point, invoice dated July 1. Jul. 2 Sold merchandise to Lee Co. for $2,300 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 2. The merchandise had cost $1,380 Jul. 3 Paid $685 cash for freight charges on the purchase of July 1 Jul 8 Sold merchandise that had cost $2,700 for $4,500 cash Jul. 9 Purchased merchandise from King Co. for $3,600 under credit terms of 2/15, n/60, FOB destination, invoice dated July 9. Jul. 11 Received a $700 credit memorandum from King Co. for the return of part of the merchandise purchased on July 9. Jul. 12 Received the balance due from Lee Co. for the invoice dated July 2, net of the discount. Jul. 16 Paid the balance due to Wilson Company within the discount period. Jul. 19 Sold merchandise that cost $2,800 to Cabela Co. for $4,000 under credit terms of 2/15, n/60, FOB shipping point, invoice dated July 19. Jul. 21 Issued a $800 credit memorandum to Cabela Co. for an allowance on goods sold on July 19. Jul. 24 Paid King Co. the balance due, net of discount. Jul. 30 Received the balance due from Cabela Co. for the invoice dated July 19, net of discount. Jul. 31 Sold merchandise that cost $5,900 to Lee Co. for $9,800 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 31. Jul. Purchased merchandise from Wilson Company for $8,800 under credit terms of 1/15, n/30, FOB shipping point, invoice dated July 1. Jul. 2 Sold merchandise to Lee Co. for $2,300 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 2. The merchandise had cost $1,380 Jul. 3 Paid $685 cash for freight charges on the purchase of July 1 Jul 8 Sold merchandise that had cost $2,700 for $4,500 cash Jul. 9 Purchased merchandise from King Co. for $3,600 under credit terms of 2/15, n/60, FOB destination, invoice dated July 9. Jul. 11 Received a $700 credit memorandum from King Co. for the return of part of the merchandise purchased on July 9. Jul. 12 Received the balance due from Lee Co. for the invoice dated July 2, net of the discount. Jul. 16 Paid the balance due to Wilson Company within the discount period. Jul. 19 Sold merchandise that cost $2,800 to Cabela Co. for $4,000 under credit terms of 2/15, n/60, FOB shipping point, invoice dated July 19. Jul. 21 Issued a $800 credit memorandum to Cabela Co. for an allowance on goods sold on July 19. Jul. 24 Paid King Co. the balance due, net of discount. Jul. 30 Received the balance due from Cabela Co. for the invoice dated July 19, net of discount. Jul. 31 Sold merchandise that cost $5,900 to Lee Co. for $9,800 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 31