Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Create a horizontal and vertical analysis of the following balance sheets please. I think I was able to complete mine correctly but I want to

Create a horizontal and vertical analysis of the following balance sheets please. I think I was able to complete mine correctly but I want to double check I did the right calculations.

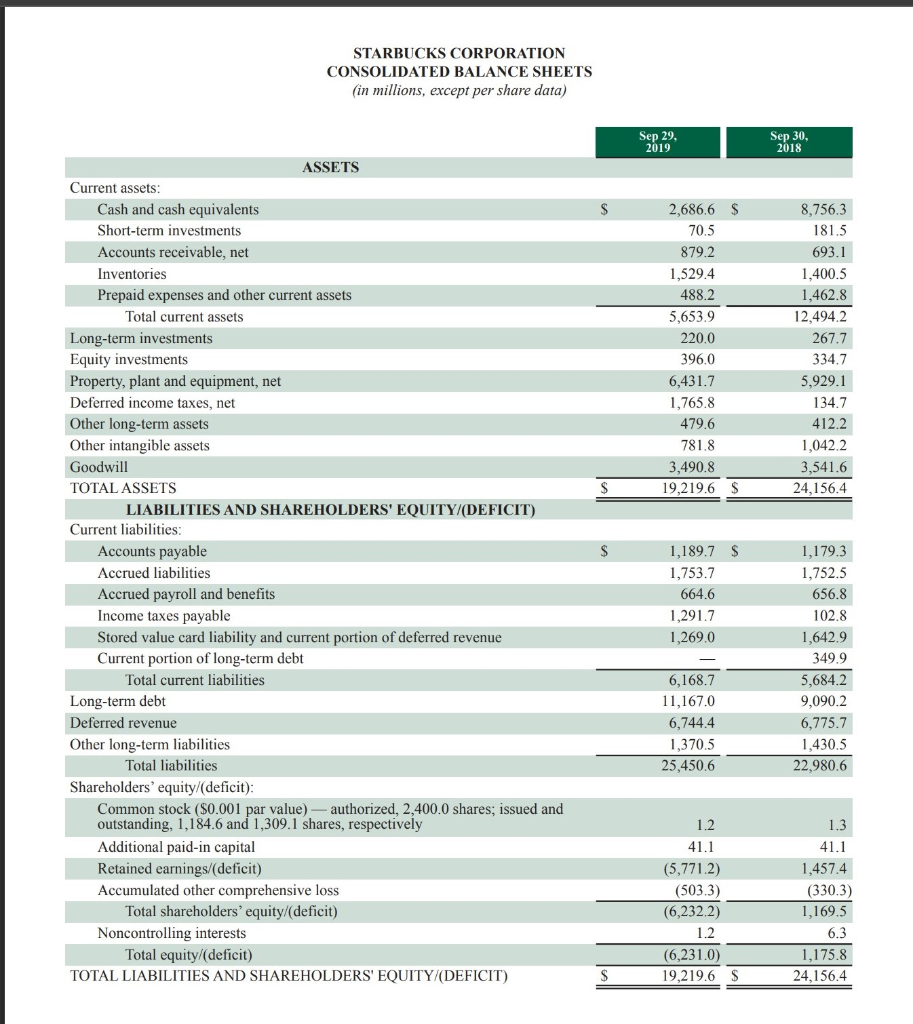

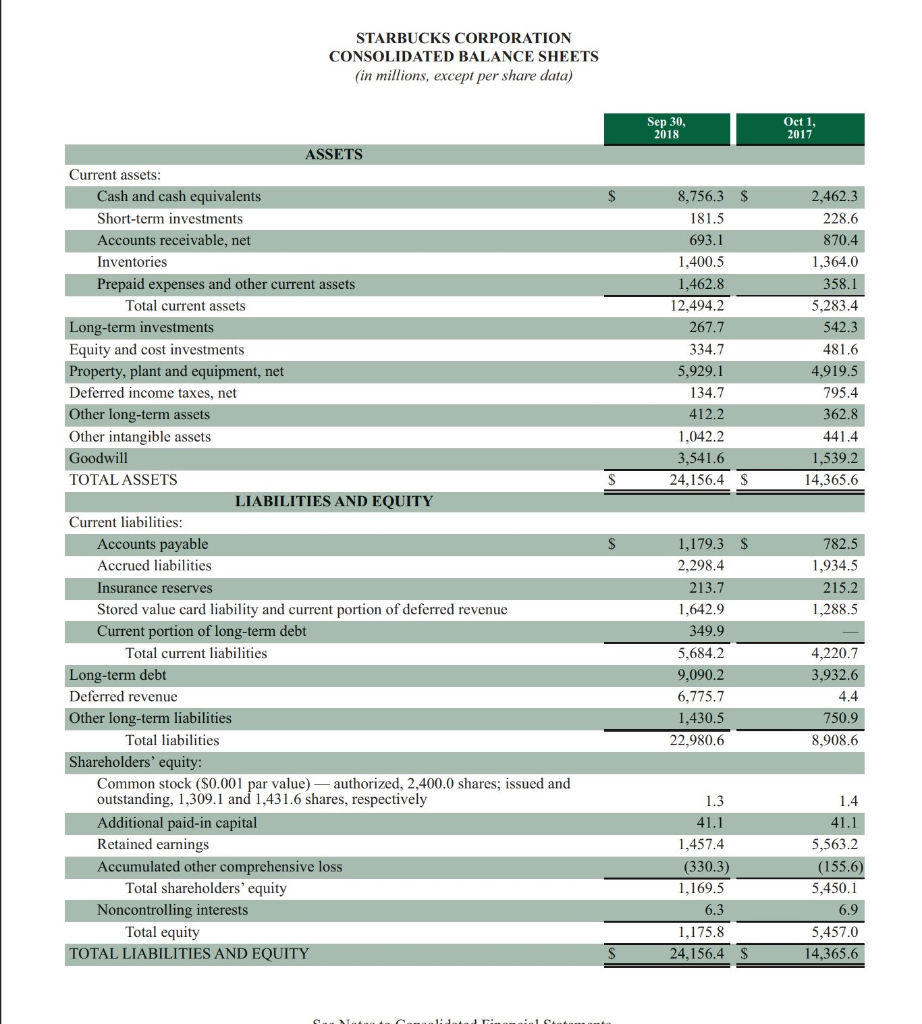

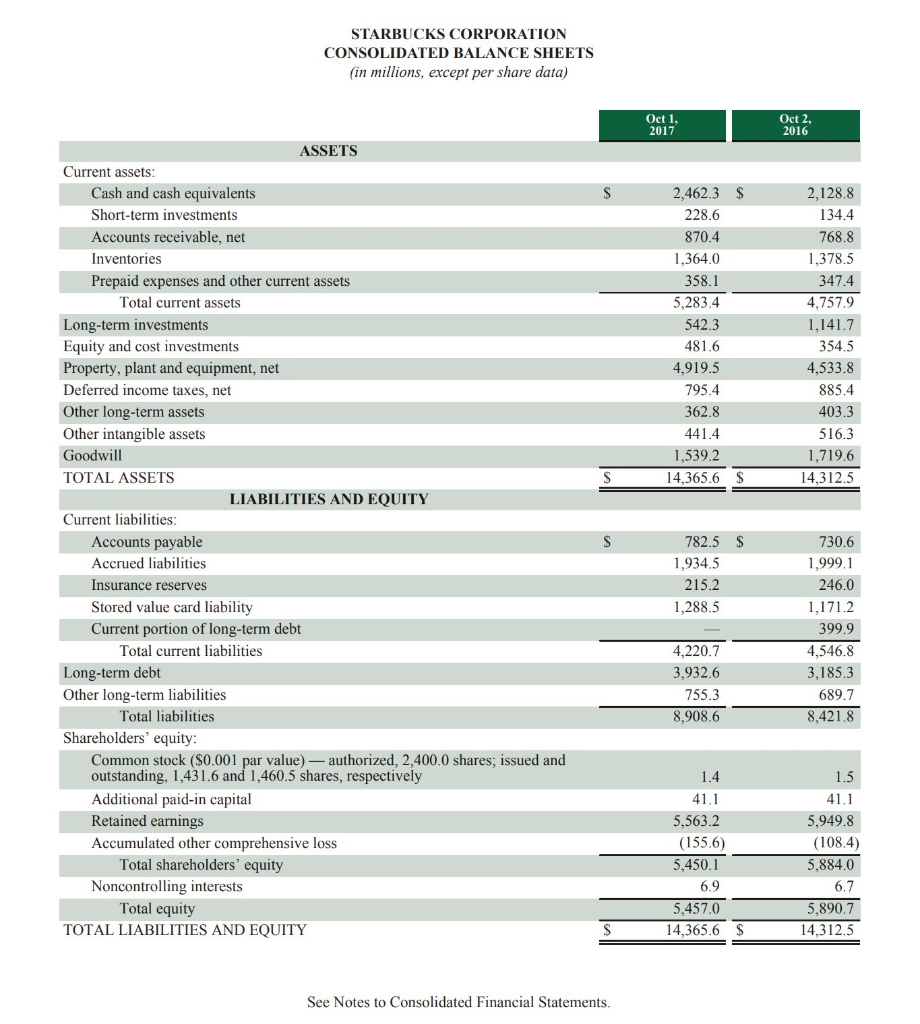

STARBUCKS CORPORATION CONSOLIDATED BALANCE SHEETS (in millions, except per share data) Sep 29, 2019 Sep 30, 2018 2,686.6 $ 70.5 879.2 1,529.4 488.2 5,653.9 220,0 396,0 6,431.7 1,765.8 479,6 781.8 3,490.8 19,219.6 $ 8,756,3 181.5 693.1 1,400.5 1,462.8 12,494.2 267.7 334.7 5,929.1 134.7 412.2 1,042.2 3,541.6 24,156.4 S ASSETS Current assets: Cash and cash equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Long-term investments Equity investments Property, plant and equipment, net Deferred income taxes, net Other long-term assets Other intangible assets Goodwill TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY/(DEFICIT) Current liabilities: Accounts payable Accrued liabilities Accrued payroll and benefits Income taxes payable Stored value card liability and current portion of deferred revenue Current portion of long-term debt Total current liabilities Long-term debt Deferred revenue Other long-term liabilities Total liabilities Shareholders' equity/(deficit): Common stock ($0.001 par value) - authorized, 2,400.0 shares; issued and outstanding, 1,184.6 and 1,309.1 shares, respectively Additional paid-in capital Retained earnings/(deficit) Accumulated other comprehensive loss Total shareholders' equity/(deficit) Noncontrolling interests Total equity/(deficit) TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY/(DEFICIT) 1,189.7 $ 1,753.7 664.6 1,291.7 1,269.0 1,179.3 1,752.5 656.8 102.8 1,642.9 349.9 5,684.2 9,090.2 6,775.7 1,430.5 22,980.6 6,168.7 11,167.0 6,744.4 1,370.5 25,450.6 1.3 1.2 41.1 (5,771.2) (503.3) (6,232.2) 1.2. (6,231.0) 19,219.6 $ 41.1 1,457.4 (330.3) 1,169.5 6.3 1,175.8 24,156.4 $ STARBUCKS CORPORATION CONSOLIDATED BALANCE SHEETS (in millions, except per share data) Sep 30, 2018 Oct 1, 2017 8,756.3 $ 181.5 693.1 1,400.5 1,462.8 12,494.2 267.7 334.7 5,929.1 134.7 412.2 1,042.2 3,541.6 24,156.4 S 2,462.3 228.6 870.4 1,364.0 358.1 5,283.4 542.3 481.6 4,919.5 795.4 362.8 441.4 1,539.2 14,365.6 $ ASSETS Current assets: Cash and cash equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Long-term investments Equity and cost investments Property, plant and equipment, net Deferred income taxes, net Other long-term assets Other intangible assets Goodwill TOTAL ASSETS LIABILITIES AND EQUITY Current liabilities: Accounts payable Accrued liabilities Insurance reserves Stored value card liability and current portion of deferred revenue Current portion of long-term debt Total current liabilities Long-term debt Deferred revenue Other long-term liabilities Total liabilities Shareholders' equity: Common stock ($0.001 par value) - authorized, 2,400.0 shares; issued and outstanding, 1,309.1 and 1,431.6 shares, respectively Additional paid-in capital Retained earnings Accumulated other comprehensive loss Total shareholders' equity Noncontrolling interests Total equity TOTAL LIABILITIES AND EQUITY 782.5 1,934.5 215.2 1,288.5 1,179.3 $ 2,298.4 213.7 1,642.9 349,9 5,684.2 9,090.2 6,775.7 1,430.5 22,980.6 4,220.7 3,932.6 4.4 750.9 8,908.6 1.3 41.1 1,457.4 (330.3) 1,169.5 6.3 1,175.8 24,156.4 1.4 41.1 5,563.2 (155.6) 5,450.1 6.9 5,457.0 14,365.6 STARBUCKS CORPORATION CONSOLIDATED BALANCE SHEETS (in millions, except per share data) Oct 1. 2017 Oct 2, 2016 2,462.3 $ 228.6 870.4 1,364.0 358.1 5,283.4 542.3 481.6 4,919.5 795.4 362.8 441.4 1,539.2 14,365.6 $ 2,128.8 134.4 768.8 1,378.5 347.4 4,757.9 1,141.7 354.5 4,533.8 885.4 403.3 516.3 1,719.6 14,312.5 ASSETS Current assets: Cash and cash equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Long-term investments Equity and cost investments Property, plant and equipment, net Deferred income taxes, net Other long-term assets Other intangible assets Goodwill TOTAL ASSETS LIABILITIES AND EQUITY Current liabilities: Accounts payable Accrued liabilities Insurance reserves Stored value card liability Current portion of long-term debt Total current liabilities Long-term debt Other long-term liabilities Total liabilities Shareholders' equity: Common stock ($0.001 par value) authorized, 2,400.0 shares; issued and outstanding, 1,431.6 and 1,460.5 shares, respectively Additional paid-in capital Retained earnings Accumulated other comprehensive loss Total shareholders' equity Noncontrolling interests Total equity TOTAL LIABILITIES AND EQUITY 782.5 $ 1,934.5 215.2 1,288.5 730.6 1,999.1 246.0 1,171.2 399.9 4,546.8 3,185.3 689.7 8,421.8 4.220.7 3,932.6 755.3 8,908.6 1.4 41.1 5,563.2 (155.6) 5,450.1 6.9 5,457.0 14,365.6 $ 1.5 41.1 5,949.8 (108.4) 5,884.0 6.7 5,890.7 14,312.5 See Notes to Consolidated Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started