Create a income statement, SOE, and balance sheet.

Create a income statement, SOE, and balance sheet.

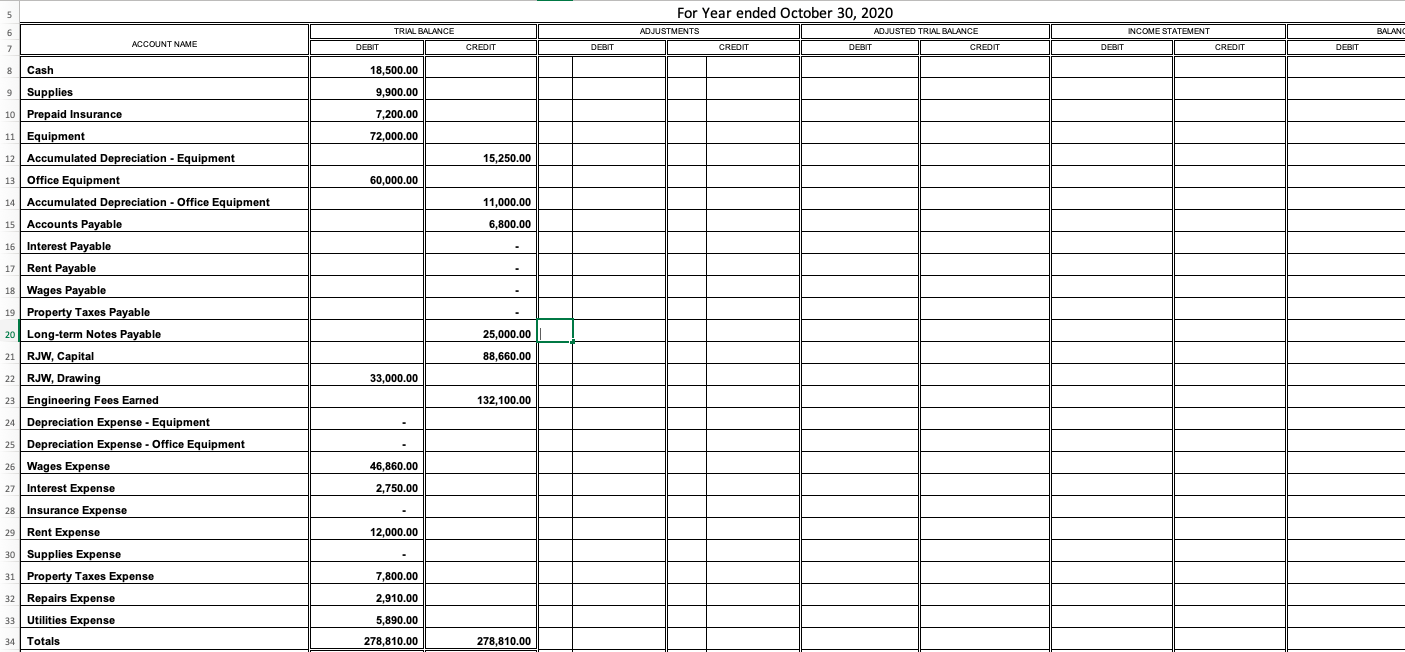

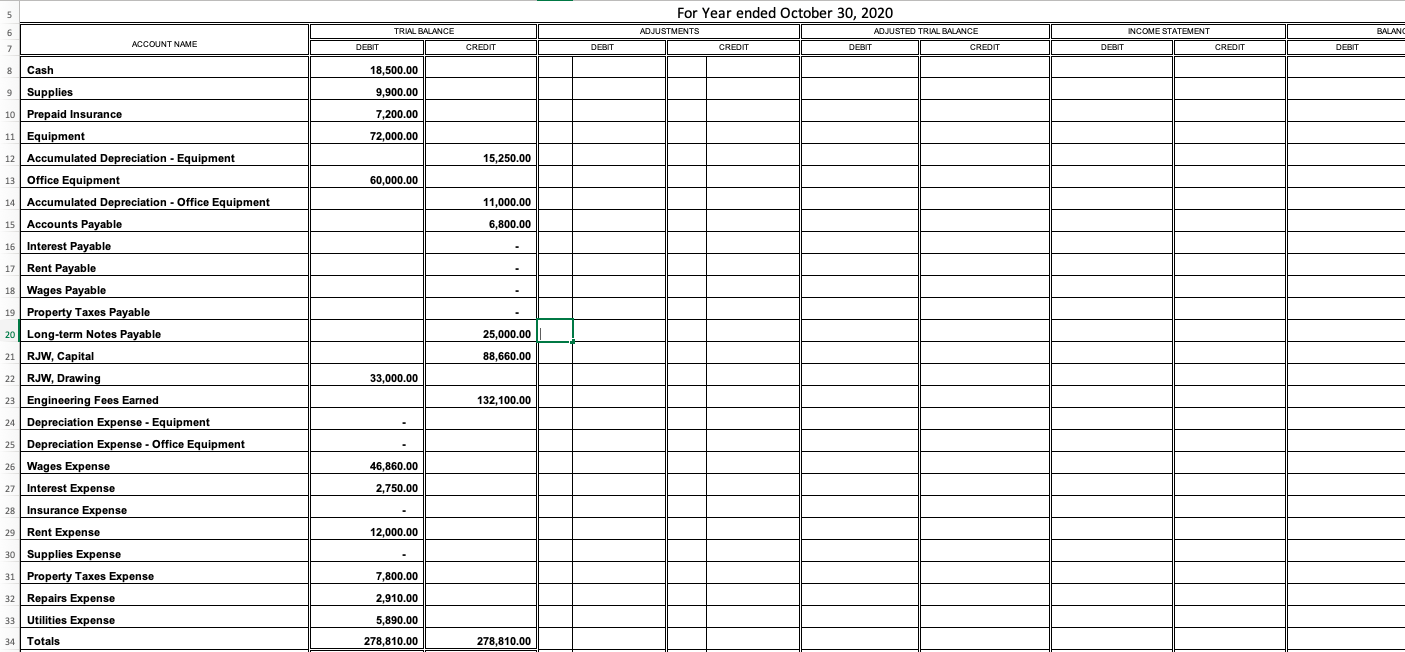

For Year ended October 30, 2020 TRIAL BALANCE ADJUSTMENTS INCOME STATEMENT BALANC 6 7 ACCOUNT NAME ADJUSTED TRIAL BALANCE DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT 8 Cash 18,500.00 9,900.00 7,200.00 72,000.00 15,250.00 60,000.00 11,000.00 6,800.00 25,000.00 88,660.00 9 Supplies 10 Prepaid Insurance 11 Equipment 12 Accumulated Depreciation - Equipment 13 Office Equipment 14 Accumulated Depreciation - Office Equipment 15 Accounts Payable 16 Interest Payable 17 Rent Payable 18 Wages Payable 19 Property Taxes Payable 20 Long-term Notes Payable 21 RJW, Capital , 22 RJW, Drawing 23 Engineering Fees Earned 24 Depreciation Expense - Equipment 25 Depreciation Expense - Office Equipment 26 Wages Expense 27 | Interest Expense 28 Insurance Expense 29 Rent Expense 30 Supplies Expense 31 Property Taxes Expense 32 Repairs Expense 33 Utilities Expense 34 Totals 33,000.00 132,100.00 46,860.00 2,750.00 12,000.00 7,800.00 2,910.00 5,890.00 278,810.00 278,810.00 1. Complete the worksheet for the year ended October 31,2020 for RJW Engineering Co. on the Worksheet. The trial balance includes the current balances of each account. Below are the details for the adjusting entries. Make sure to use the letters to identify each adjustment. a. The supplies available on Oct. 31st, 2020 had a cost of $2,300. b. The cost of expired insurance for the fiscal year is $4,000. C. Annual depreciation on the equipment is $5,400. d. Annual depreciation on the office equipment is $2,300. e. The October utilities expense of $650 is not included in the unadjusted trial balance because the bill arrived after the trial balance was prepared. This amount is currently owed. f. The company's employees have earned $2,600 of accrued wages at the fiscal year end. g. The rent expense incurred and not yet paid or recorded at the fiscal year end is $600. h. Additional property taxes of $1,000 haave assessed for this fiscal year but have not been paid or recorded. i. The long-term note payable bears interest at 12% per year. The unadjusted Interest Expense account equals the amount paid for the first 11 months of the fiscal year. The $250 accrued interest for October has not yet been paid or recorded. The company must also make a $5,000 payment toward the note payable during the next fiscal year. 2. Record all adjusting entries in the journals provided using page numbers 56 & 57. 3. Prepare the Income Statement. 4. Prepare the Statement of Owner's Equity. 5. Prepare the Classified (currenton-current) Balance Sheet for October 31, 2020. For Year ended October 30, 2020 TRIAL BALANCE ADJUSTMENTS INCOME STATEMENT BALANC 6 7 ACCOUNT NAME ADJUSTED TRIAL BALANCE DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT 8 Cash 18,500.00 9,900.00 7,200.00 72,000.00 15,250.00 60,000.00 11,000.00 6,800.00 25,000.00 88,660.00 9 Supplies 10 Prepaid Insurance 11 Equipment 12 Accumulated Depreciation - Equipment 13 Office Equipment 14 Accumulated Depreciation - Office Equipment 15 Accounts Payable 16 Interest Payable 17 Rent Payable 18 Wages Payable 19 Property Taxes Payable 20 Long-term Notes Payable 21 RJW, Capital , 22 RJW, Drawing 23 Engineering Fees Earned 24 Depreciation Expense - Equipment 25 Depreciation Expense - Office Equipment 26 Wages Expense 27 | Interest Expense 28 Insurance Expense 29 Rent Expense 30 Supplies Expense 31 Property Taxes Expense 32 Repairs Expense 33 Utilities Expense 34 Totals 33,000.00 132,100.00 46,860.00 2,750.00 12,000.00 7,800.00 2,910.00 5,890.00 278,810.00 278,810.00 1. Complete the worksheet for the year ended October 31,2020 for RJW Engineering Co. on the Worksheet. The trial balance includes the current balances of each account. Below are the details for the adjusting entries. Make sure to use the letters to identify each adjustment. a. The supplies available on Oct. 31st, 2020 had a cost of $2,300. b. The cost of expired insurance for the fiscal year is $4,000. C. Annual depreciation on the equipment is $5,400. d. Annual depreciation on the office equipment is $2,300. e. The October utilities expense of $650 is not included in the unadjusted trial balance because the bill arrived after the trial balance was prepared. This amount is currently owed. f. The company's employees have earned $2,600 of accrued wages at the fiscal year end. g. The rent expense incurred and not yet paid or recorded at the fiscal year end is $600. h. Additional property taxes of $1,000 haave assessed for this fiscal year but have not been paid or recorded. i. The long-term note payable bears interest at 12% per year. The unadjusted Interest Expense account equals the amount paid for the first 11 months of the fiscal year. The $250 accrued interest for October has not yet been paid or recorded. The company must also make a $5,000 payment toward the note payable during the next fiscal year. 2. Record all adjusting entries in the journals provided using page numbers 56 & 57. 3. Prepare the Income Statement. 4. Prepare the Statement of Owner's Equity. 5. Prepare the Classified (currenton-current) Balance Sheet for October 31, 2020

Create a income statement, SOE, and balance sheet.

Create a income statement, SOE, and balance sheet.