Answered step by step

Verified Expert Solution

Question

1 Approved Answer

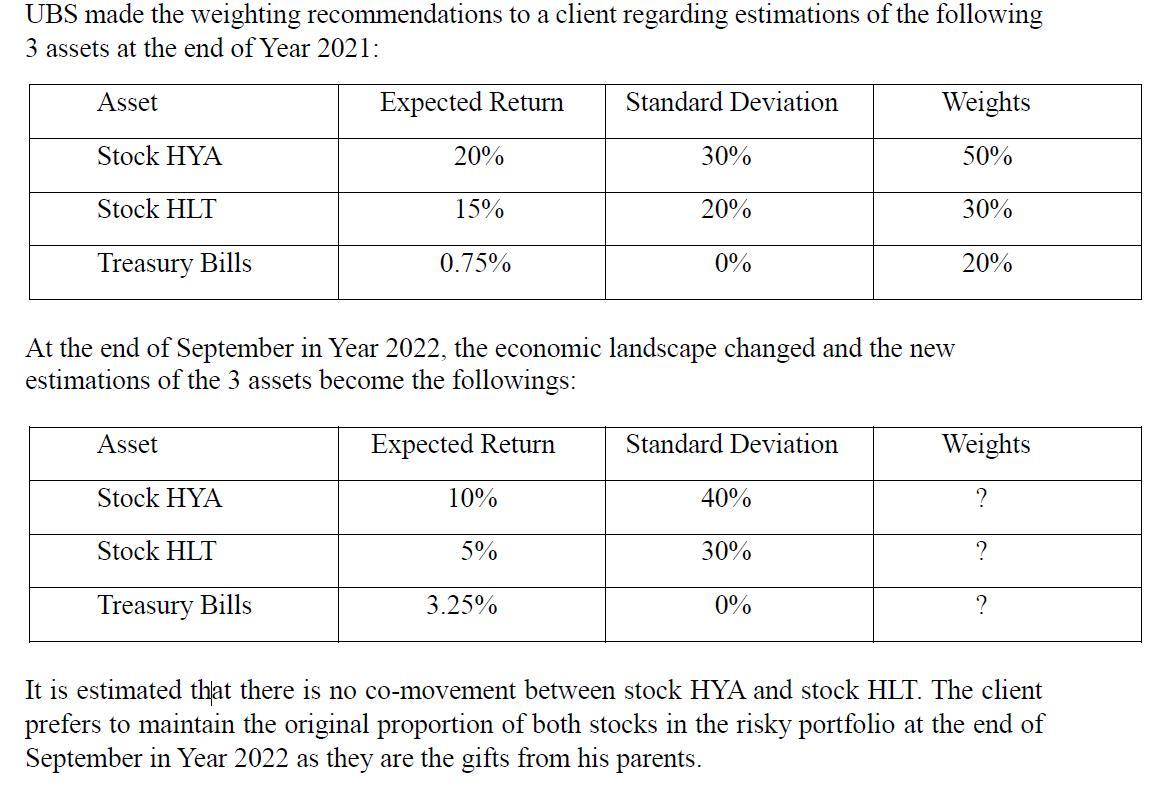

UBS made the weighting recommendations to a client regarding estimations of the following 3 assets at the end of Year 2021: Asset Stock HYA

UBS made the weighting recommendations to a client regarding estimations of the following 3 assets at the end of Year 2021: Asset Stock HYA Stock HLT Treasury Bills Asset Stock HYA Stock HLT Expected Return Treasury Bills 20% 15% 0.75% At the end of September in Year 2022, the economic landscape changed and the new estimations of the 3 assets become the followings: Expected Return 10% 5% Standard Deviation 3.25% 30% 20% 0% Standard Deviation 40% 30% Weights 50% 30% 20% 0% Weights ? ? ? It is estimated that there is no co-movement between stock HYA and stock HLT. The client prefers to maintain the original proportion of both stocks in the risky portfolio at the end of September in Year 2022 as they are the gifts from his parents.

Step by Step Solution

★★★★★

3.41 Rating (167 Votes )

There are 3 Steps involved in it

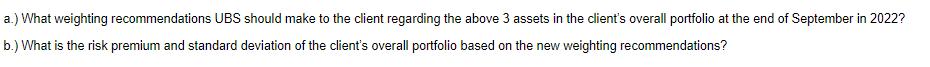

Step: 1

a UBS should recommend the following weights for the clients overall portfolio at the end of Septemb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started